In the previous topic, we looked at the transactions that affected the balance sheet. We will now look at the way owner’s equity can change when the business makes a profit or loss during the normal course of business.

The profit and loss statement is a financial statement that summarises the Income earned, Expenses incurred and profit or loss achieved by a business over a specific accounting period. Usually a month, quarter or financial year. It is also known as the Income Statement and the Statement of Financial Performance.

The AASB defines Income in the Framework for the Preparation and Presentation of Financial Statements as ‘Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.’

Applying this definition, a coffee shop will earn income when it sells coffee, IT consultants will earn income when they provide consultancy services to clients, and a business will also earn income when it receives interest on money it has invested in a term deposit.

The AASB defines Expenses in the Framework for the Preparation and Presentation of Financial Statements as decreases in economic benefits during the accounting period in the form of outflows or depletion of assets or incurrences of liabilities that result in decreases in equity other than those relating to distributions to equity participants.

Watch this video for an overview of the profit & loss statement.

Main components of a profit and loss Statement

This is the money coming into the business from selling goods or services

These are the direct costs of supplying the goods or services and can include wages, buying raw materials to make the products, packaging costs and energy costs such as gas and electricity.

This is the Income minus the COGS.

These are the costs that do not change as production increases or decreases. This includes, rent, interest paid on loans, insurance, salaries and maintenance costs.

This is calculated by taking the expenses away from the gross profit. This is the final part of the profit and loss account. If the net profit figure is negative, the business has made a loss.

The equation for working out gross profit is:

Income – Cost of Goods Sold = Gross Profit

The equation for working out net profit is:

Gross Profit – Expenses = Net Profit

Stakeholders interested in profit and loss accounts

There are many stakeholders that are interested in the profit and loss statement of a business. This includes

- Managers will use the profit and loss statement to help them make decisions.

- Shareholders will use the profit and loss statement to help them decide whether or not to invest money into the business or whether to sell their shares.

- Employees could use a profit and loss statement to support a demand for a wage rise or to see how secure their job is.

- The government will use the profit and loss account to calculate how much tax the business needs to pay.

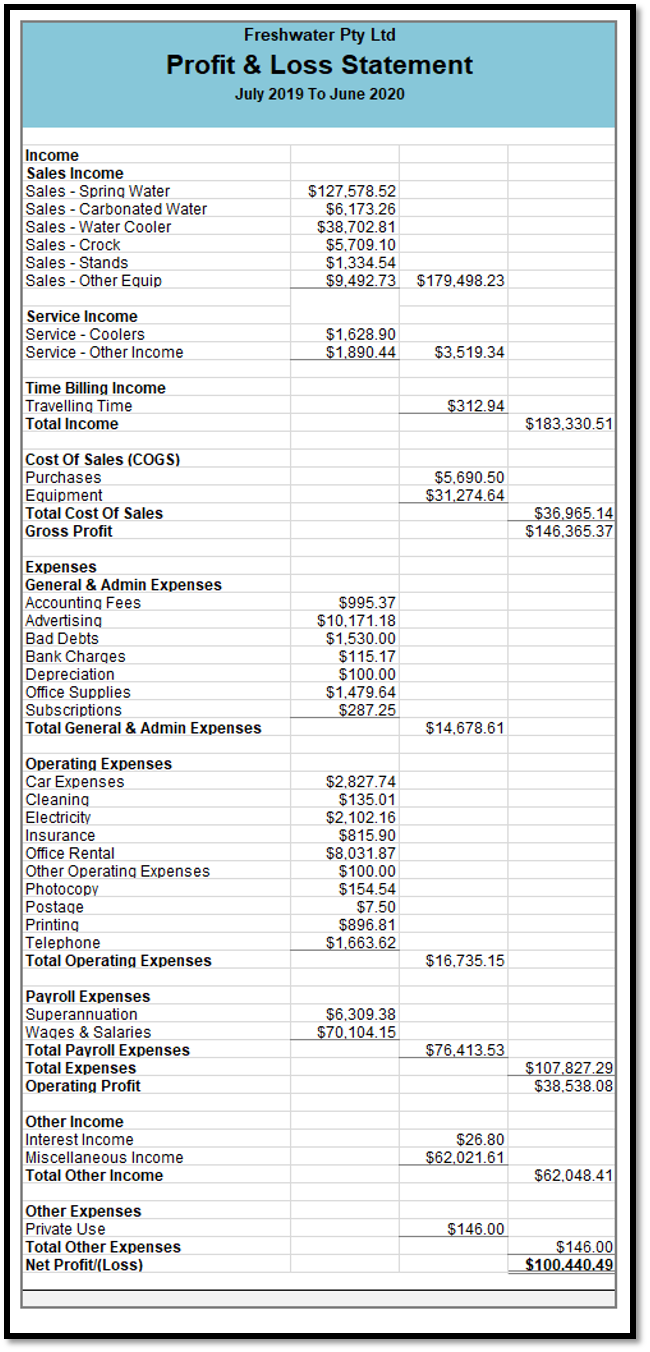

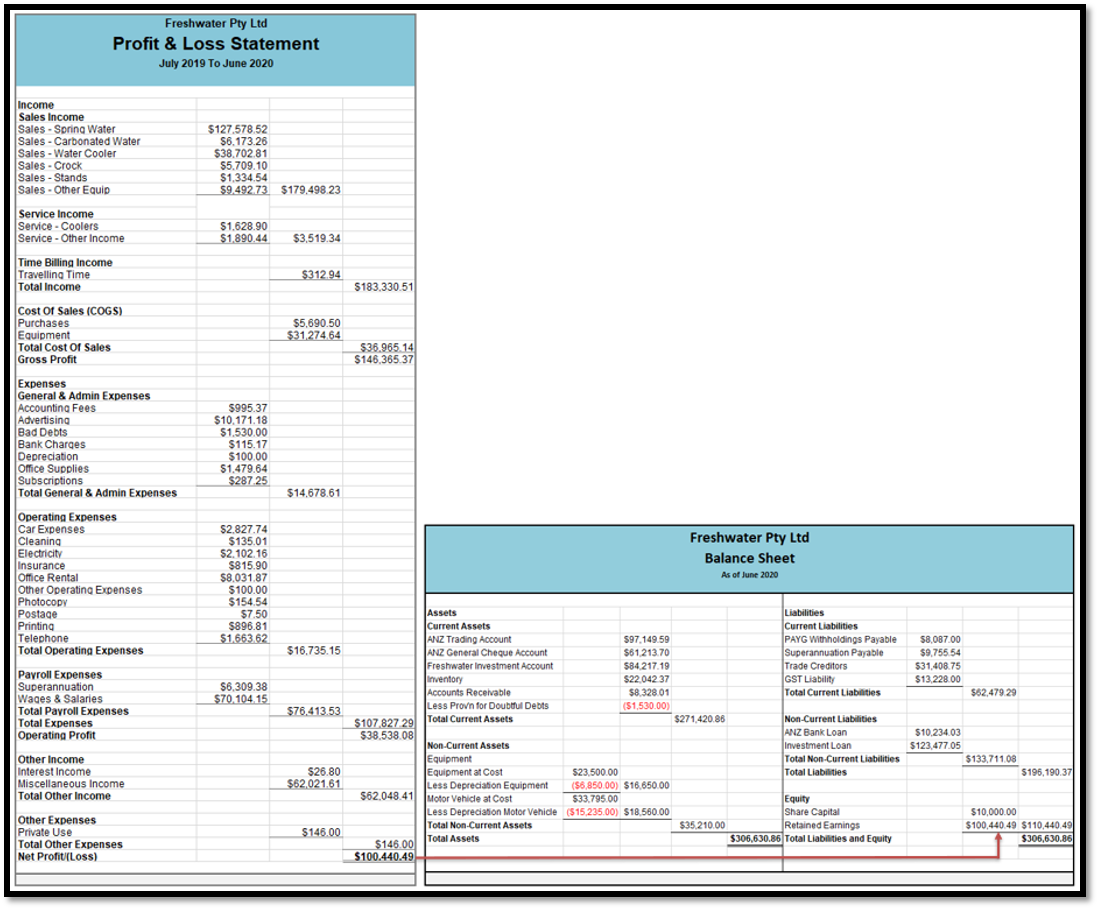

Example Profit & Loss Statement for Freshwater Pty Ltd

Let’s examine each section of the profit and Loss statement.

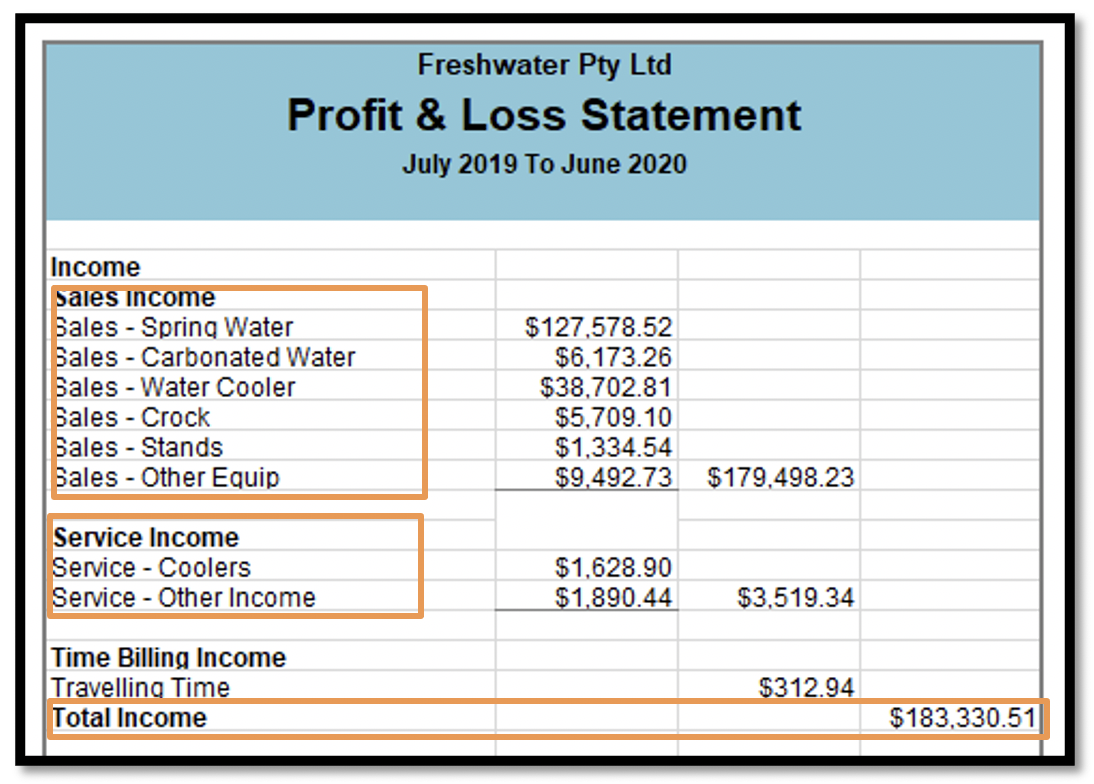

Revenue/Sales/Income

Sales Revenue/Income is a company’s revenue from sales or services. It is displayed at the very top of the profit & loss statement. This value will be the gross cost associated with creating the goods sold or in providing a service. Some companies have multiple income streams that add up to total Income.

Revenue Example

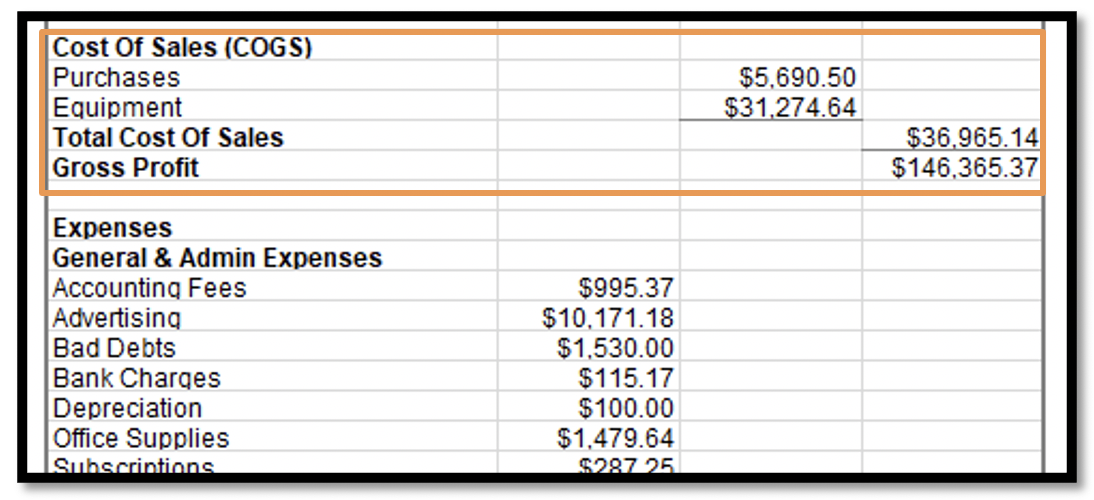

Cost of Sales or Cost of Goods Sold (COGS)

Cost of Sales, also known as Cost of Goods Sold (COGS), is the direct cost associated with selling products to generate revenue. This line item can also be called Cost of Sales if the company is a service business. COGS can include labour, parts, materials, and an allocation of other expenses such as depreciation.

COGS Example

Gross profit is calculated by subtracting the Cost of Sales (or Cost of Goods Sold) from Sales Revenue/Income.

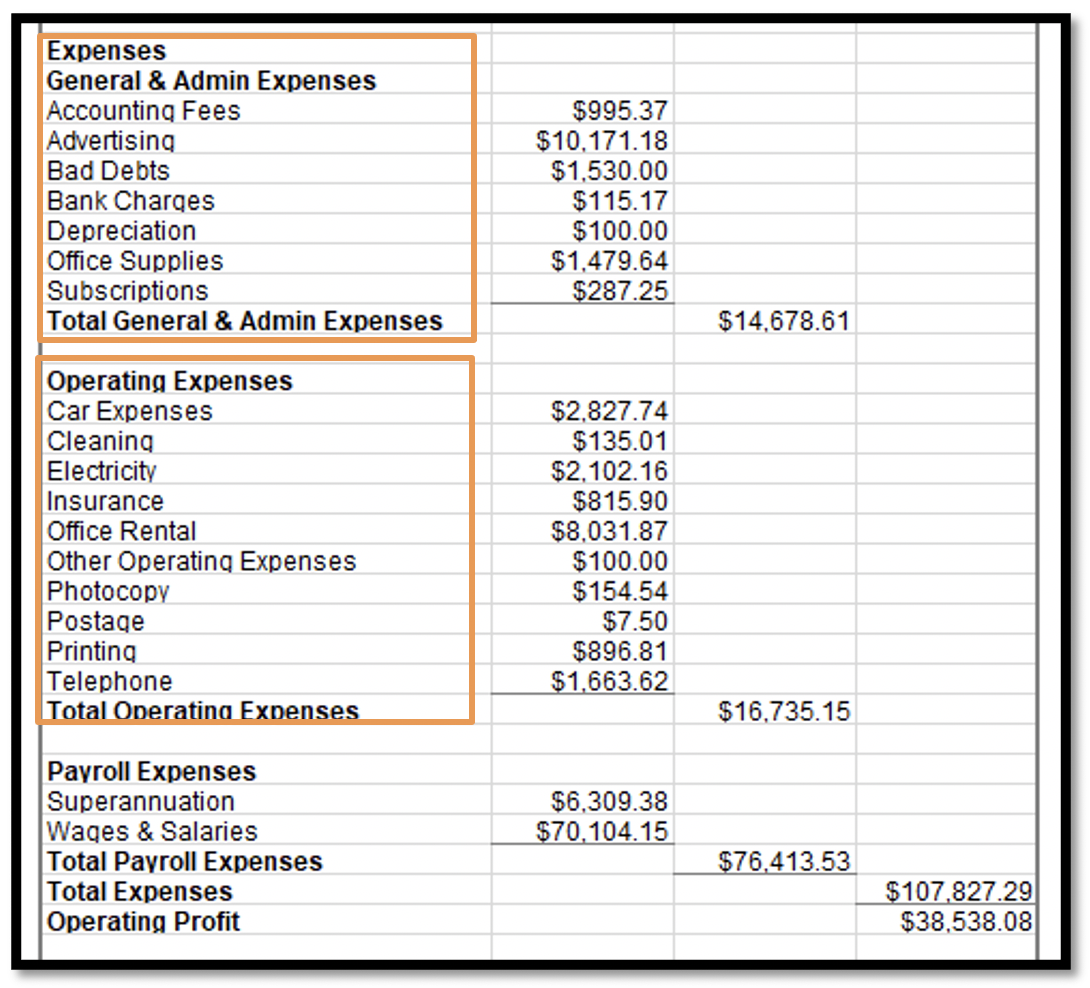

Expenses

The expense section of the profit and loss statement includes all the operating expenses of the business. Depending on the business, they may be grouped into different expenses, for example, general and admin expenses, operating expenses, and payroll expenses.

Expenses Example

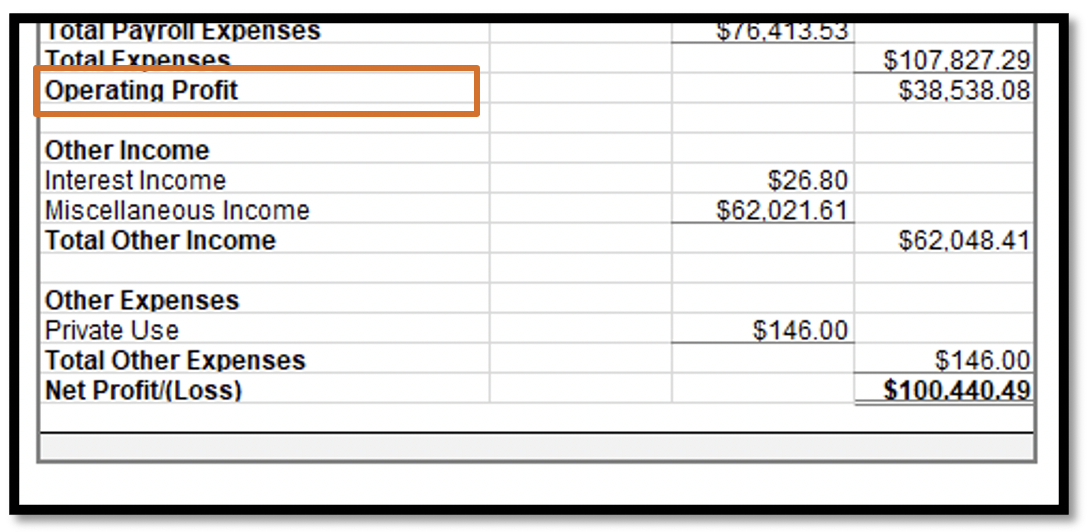

Operating Profit

Operating profit represents what has been earned from regular business operations. It is the profit before any non-operating income, non-operating expenses, interest, or taxes are subtracted from revenues. It is often referred to as EBIT and stands for Earnings Before Interest and Taxes.

Operating Profit Example

Interest

Interest Income. It is common for companies to split out interest income and interest expense as a separate line item in the income statement. This is done to reconcile the difference between EBIT and Earnings before tax (EBT).

Other Expenses

Businesses often have other expenses that are unique to their industry. Other expenses may include technology, research and development (R&D), gains/losses on the sale of investments, foreign exchange impacts, and many other expenses that are industry or company-specific. Other expenses also include expenses for private use.

Net Profit

After the net profit has been calculated, it is added to equity in the Balance Sheet. Net Profit is added to the owner’s capital because the owner is entitled to all profits made by the business. The relationship between Profit and Loss and the Balance Sheet is illustrated below.

Adding Net Profit to the Balance Sheet Example

The profit and loss statement components have the following effects on the owner's equity:

- Revenues and gains cause the owner's (or stockholders') equity to increase

- Expenses and losses cause the owner's (or stockholders') equity to decrease

The Extended Accounting Equation

The expanded accounting equation is a longer version of the basic accounting equation that shows the accounts that makeup equity.

Assets = Liabilities + Share Capital + Beginning Retained Earnings - Dividends + Revenue - Expenses

The expanded equation is used to compare a company's assets with greater granularity than provided by the basic equation.

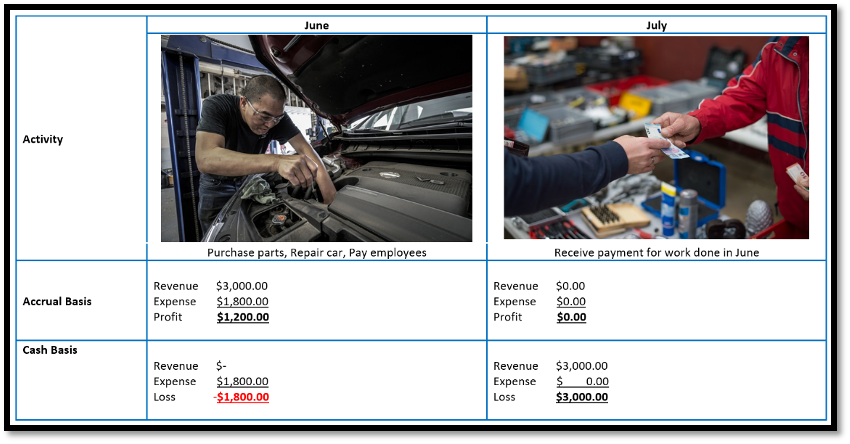

Accrual concept: Income and expense must be recognised in the accounting periods to which they relate rather than on cash basis.

Matching concept: This principle dictates that for every entry of revenue recorded in a given accounting period, an equal expense entry has to be recorded for correctly calculating profit or loss in a given period.

Revenue and expenses can be recorded on either a cash or accrual basis. With cash accounting:

- Revenue is recorded when the cash is received from the customer

- Expenses are recorded when the cash is paid

With accrual accounting

- Revenue is recognised in the period it is which the revenue is earned

- Expenses are recognised in the period they are incurred

The cash basis of accounting is often used by sole traders or small businesses. To further understand cash basis accounting how it works and why watch the videos.

The accrual basis of accounting is used by larger businesses. To further understand the cash basis and accrual basis of accounting watch the videos.

It is now time to test your understanding of Income and Expenses.

Cam's Cars sells new and used cars. The company's policy is to prepare a profit and loss statement at the end of every month.

Download this Excel workbook and use the information provided below to prepare a profit and loss statement for the month ending 31/05/2022.

We encourage you to attempt the task before checking the answer provided in the workbook.

| Account | Amount |

|---|---|

| Superannuation | $12,400.00 |

| Sales New Cars | $1,000,000.00 |

| Electricity | $3,750.00 |

| Interest Income | $345.00 |

| Rent | $55,000.00 |

| Sales Used Cars | $500,000.00 |

| Wages | $124,000.00 |

| Telephone | $1,200.00 |

| Cost of Goods Sold | $600,000.00 |

| Depreciation | $4,500.00 |