This is Andrew Lee from ACE Finance.

In this module, you will learn the skills and knowledge that enable Andrew to perform his role, namely how and when to:

- Review of existing technology used by the business

- Identify opportunities to implement digital technologies for workplace collaboration

- Implement and use digital technologies to collaborate in the workplace.

We will be following Andrew as he studies, assesses and implements these new technologies at ACE Finance. Before we begin, let us find out more about his role and the type of projects he is involved in.

Andrew is the Information Technology Officer at ACE Finance. He provides technical support to the company by introducing new tools and applications when there is an operational need.

His duties include:

- Review Ace Finance's current digital technology set-up to determine possible solutions for a collaborative remote working set-up

- Research and assess new available collaborative technologies that can be implemented

- Prepare a business case for the company leaders to approve

- Develop a plan to introduce these new collaborative technologies to the company

- Implement these collaborative tools in the company while providing support through training and communication to employees.

Andrew's current project:

Since everybody at ACE Finance is still operating from home due to the pandemic, Andrew was recently asked to introduce a new collaboration framework into the workplace to help enhance virtual communication. He was in charge of a short-term project from start to finish. In order to run this project effectively and in line with the organisational strategies and goals, he will reference a variety of the company's policies through this process, such as:

- Corporate Marketing Plan

- Storage of Information Policy

- Internet Access and Computer Usage Policy

- Technology and Collaboration and Communication Policy and Procedure

- On-job Training Plan and template

- SWOT template

- Style Guide (for creating a business case)

- Business Case template.

Let us begin by considering his role by asking Andrew the following three questions.

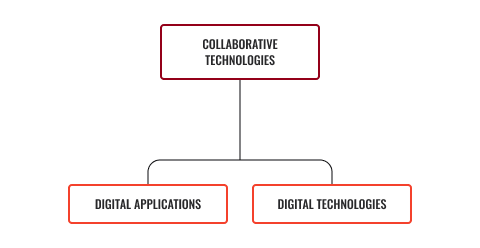

Collaborative technology refers to the tools and systems designed to better facilitate group work, both in-office and remote. These tools and systems are web applications that allow users to create, analyse, exchange and share information in a collaborative and interactive manner, regardless of their location. These are also known as groupware.

Digital applications: this term refers to any software application or program which can be used through mobile, computer or tablet device. For example, Asana, Skype, Zoom (for real-time online communication) and Slack (for team collaboration).

Digital technologies: this term refers to electric tools, systems or devices, and resources which store, processes and or generate data. For example, mobile games, online games or social media.

Here is a video I have often used when explaining to colleagues.

There are a number of reasons why ACE Finance will put so much into the collaboration tools. These are:

- Sharing of Ideas: When teams are brought together, the work they create is greater than their individual effort. Cooperation is enhanced among team members and the opportunity to learn from each other is present.

- Better Ideation: Brainstorming becomes more productive when dialogue is present between team members, this allows for a better view of different perspectives.

- Engaged Employees: When employees are engaged, they are satisfied. When they are satisfied, they are more productive. Working together creates a sense of belonging and fosters a bond between employees.

- Flexibility: Collaboration through groupware allows members to be more adaptive and flexible to the needs of the business.

- Attracts Top Talent: According to a Gallup poll, strong teams attract the best talent. We can create these strong teams because we have the right technology that enables our members to collaborate.

There really is no one way to choose the right collaboration tool for any organisation, but some of the considerations that I think of are:

- What is the kind of work that we do? Will the tool fit?

- What are the working styles of our employees? Will it make things easier or complicate them?

- Can I easily integrate it with what we currently have?

- Is it found in the cloud or does it have to be site-based?

- How secure is the tool?

- How easy is it to learn? Will our employees quickly learn how to use it?

- What does it cost in terms of purchase, implementation, training, and maintenance?

Now we have met Andrew and discussed aspects of his role at ACE finance, let us now dive further into collaborative technology.