It is important to identify accounts that are frequently outside of agreed credit terms. These accounts represent a risk to the business. It might be necessary to close the account, reduce the amount allowed on credit, or reduce the credit period. Any customer flagged in breach of credit terms, should be easily identifiable and care should be taken by all relevant staff to ensure no additional credit is extended to the customer while the problem exists. It is vital that this information is provided to all possible staff members that may have the option to provide credit. In a computerised accounting systems this action can be flagged so that if the customer tries to place an order the person taking the order is notified of the account status.

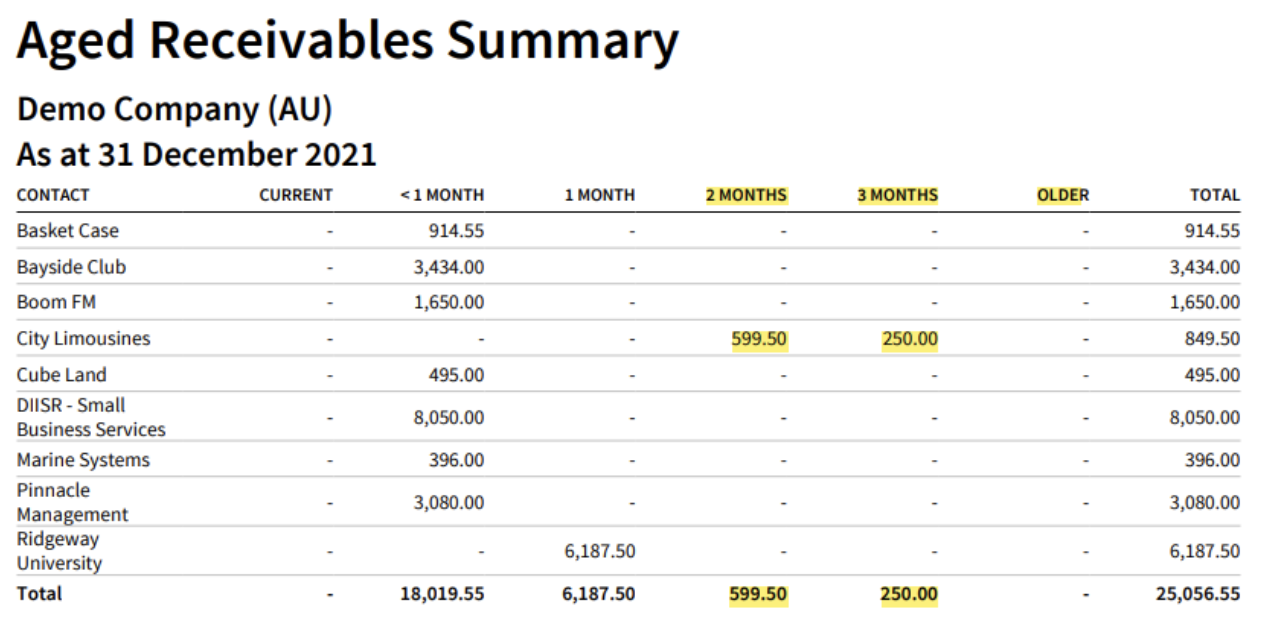

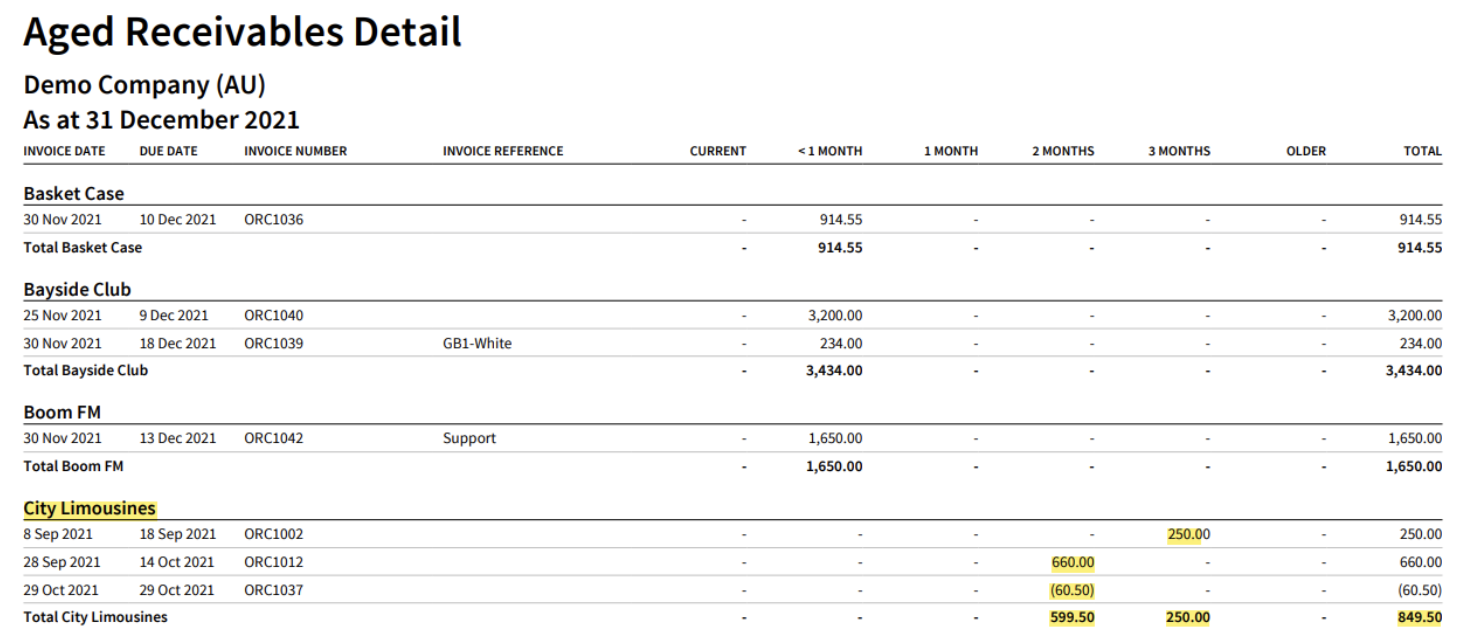

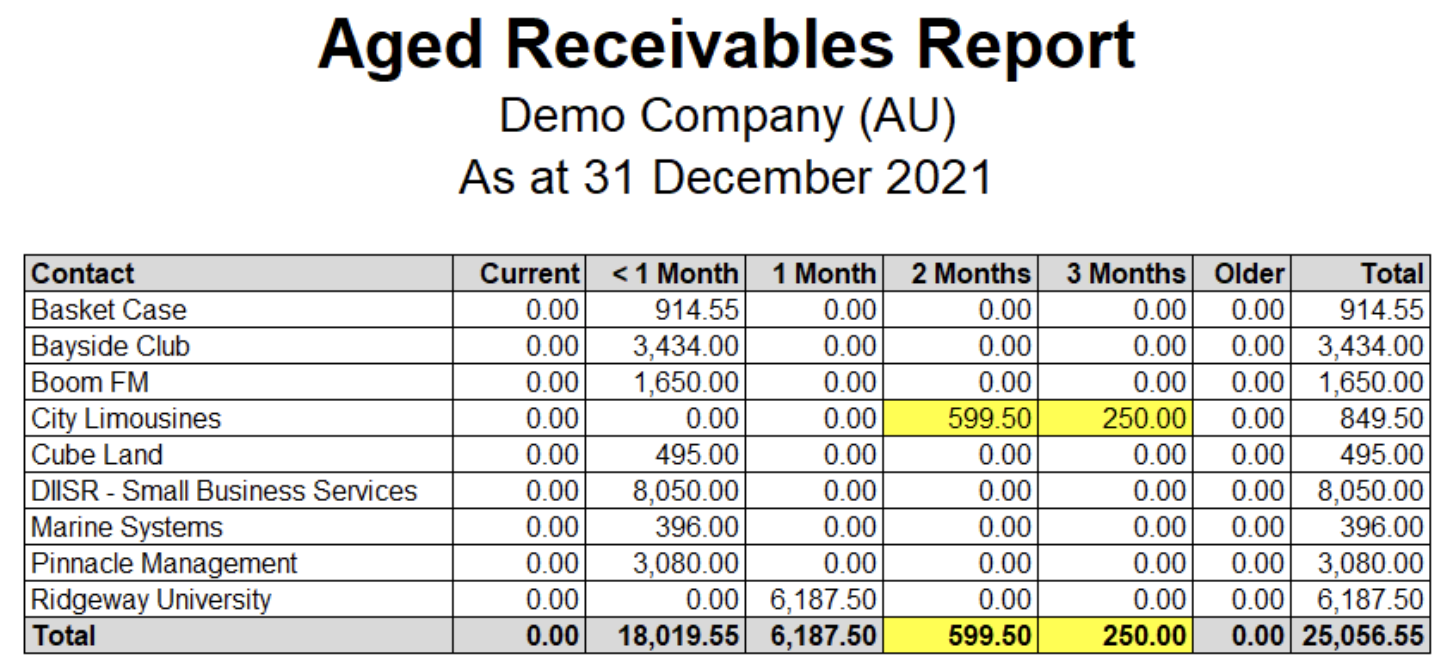

The aged receivables report (also known as customer aged balance report) will assist in monitoring accounts that are in breach of credit terms. Once a month the customer aged balance report should be examined in relation to the 2 months and in particular the 3 month and older columns for customers who might be a potential bad credit risk.

Example of Aged Receivable Detail report generated in Xero

Example of Aged Receivables Report using Excel

Using aging reports

The aging report is used to identify clients that are late in paying their invoices. If the bulk of the overdue amount is attributable to a single client, the business can take necessary steps to ensure that the customer’s account is collected promptly. If there are several customers with overdue amounts that extend beyond 2 months, it may signal the business needs to tighten its credit policy towards the existing and new clients.

The aging schedule also identifies recent changes and potential problems in accounts receivable. For example:

- it may identify a decline or increase in business from certain customers

- times during the year when customers are late in paying, for example December/January when business close.

This information can be used to protect the business from cash flow problems.

The accounts receivable aging report is also used to estimate the amount of uncollectable debts. This is used to record an allowance for doubtful accounts. While the percentage is different for each aging peropd and is based on the businesses past experience and current economic conditions, generally the longer an account receivable remains outstanding, the less chance of it being collected. When generating the accounts receivable aging report, it’s useful to include customer information, the status of collection, total amount outstanding and the financial history of each customer. The task is easier when using accounting software like Xero or MYOB as the software allows you to:

- drill down on customer information

- customise customer settings

- send automatic payment reminders

- specify the intervals to send the reminders

- include personalised messages to customers

- provides a complete audit trail of all communication with the customer.

Regardless of whether you use a computerised or manual system you will need to ensure you keep a record of all disputes that you deal with. These records will be used by supervisors and managers to solve problems, assess performance, contribute to planning and strategic management, and contribute toward continuous improvement processes.

Customer records can also be used to provide a trail of information to assist in checking that all action relevant to the outstanding debt has been taken before the account is haded over to a collection agency or mediation or legal action is commenced to recover debts.

The reports outlining your actions and the plan to recover the debt that was negotiated must be comprehensive and complete. The reports may be used as evidence in any legal action that your company might pursue. Therefore, when preparing reports ensure that the actions you have taken and what is in your document complies with the relevant legislation and codes of ethics, conduct, and practice.

Recording bad debt

When recording debt recovery you need to ensure:

- data you record aligns with your company's policies and procedures

- the nature of the outstanding debt is clearly stated

- any background to the outstanding debt is clearly described

- the details of the outstanding debt are specific, clear and true

- data is in a form which can be analysed

When generating accounts receivable reports you need to consider how the information will be consumed and by whom.

Distributing reports internally

The accounts receivable aging report should be distributed to employees whose responsibilities involve sales, and managing accounts receivable and overdue accounts. This may include accounts receivable officer, credit managers, accountants, and sales staff. Information contained in aging reports can be confidential and subject to the Privacy Act therefore reports should be delivered electronically or in a confidential manner.

It is also important for management to receive regular reports on accounts receivable because of the significance of these accounts. Problems of bad or doubtful debts should be highlighted and the success of collection efforts should be part of the reporting cycle. Management reports are generally provided on a monthly basis however this may vary depending on the size of the organisation.

Distributing repots externally

Your organisation should have company policies and procedures in regard to the forwarding of doubtful debts information and these procedures should be followed at all times. Your company procedures and training program should ensure you know when debt recovery is required, when and how information is forwarded to an external third party for action and the time frame in which this must be completed.

Always ensure you complete these reports in a timeframe that is in line with your organisational policies and procedures.

When preparing and forwarding reports:

- Ensure that the report is accurate

- Ensure that you know to whom it must be forwarded

- Forward it promptly

- Forward it with a clear identifier

- Do not forward it to unnecessary people

The Privacy Act

All customers have a right to privacy. This is a legal right covered by the Privacy and Personal Information Act 1998. This means keeping customer's personal and sensitive information confidential. This Act requires financial sector employees to behave in a careful manner with regards to personal information.

All financial records must be kept by all companies, irrespective of their size. Your company will have a documented Recordkeeping Policy and Procedure that provides a framework and assigns responsibilities for ensuring that full and accurate records are:

- created

- managed

- maintained

- made accessible

- stored

- disposed of

in a manner that ensures business and legislative requirements are met.

The ATO lists the record keeping obligations for businesses which includes information on debtor and creditor records.

Record keeping systems can be digital or manual. However the ATO recommends businesses use digital record keeping. Click here for more information on digital record.

If the ATO ask for copies of your business records you can provide them with either digital or printed copies. The ATO may also request documentation from your computer about your record-keeping system (for example, information about your regular back-up and record destruction procedures).

Five rules for record keeping

These five record-keeping rules developed by the ATO apply to most records your business is required to keep to meet reporting obligations:

- You need to keep all records related to starting, running, changing, and selling or closing your business that are relevant to your tax and super affairs.

- The relevant information in your records must not be changed and must be stored in a way that protects the information from being changed or the record from being damaged.

- You need to keep most records for five years.

- You need to be able to show us your records if we ask for them.

- Your records must be in English or able to be easily converted to English.