Learning objectives

After you have completed this topic, you should have knowledge of:

- Bank Reconciliation procedure

- Reconciling cash payments and cash receipts

- Petty Cash Imprest System

- Opening a petty cash fund

- Processing petty cash transactions

- Balancing the petty cash book

- Preparing a reimbursement cheque

Bank Reconciliations

A bank statement is a ledger account maintained by a financial institution listing deposits and withdrawal transactions occurring within a given period for a bank account held by the business with a financial institution. Companies keep a similar general ledger account called 'Bank' or 'Cash at Bank', which is updated monthly by posting transactions from the cash receipts and cash payments journal.

Periodically, usually monthly but can be more or less often, bank reconciliation is done comparing the cash records of the business with the financial institution's records. Because the financial institution and the company prepare the same records independently, any differences between the two records are identified.

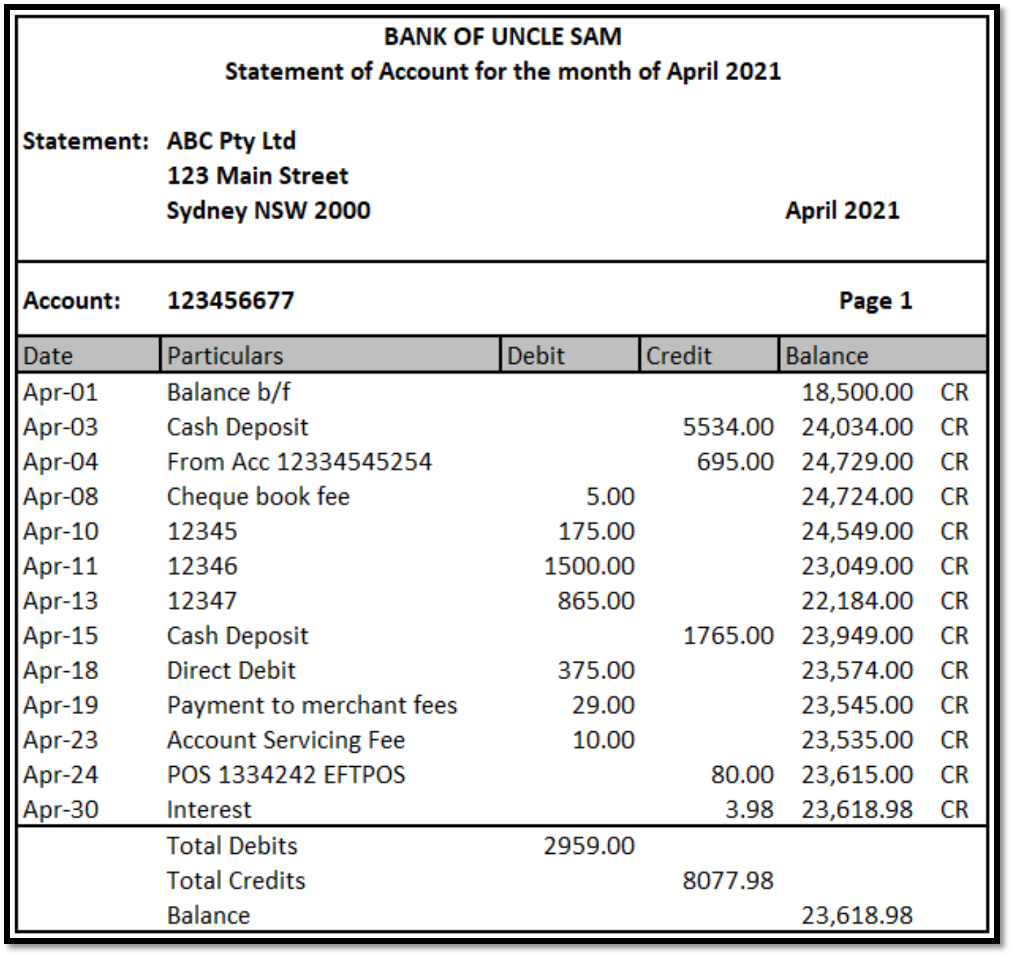

Below is a copy of the bank statement and Bank ledger of ABC Pty Ltd for the month of April 2021. You may expect that the bank statement balance and ABC's Bank ledger account match; however, this is not the case.

The bank statement balance of ABC Pty Ltd shows a credit closing balance of $23618.98. This amount is a liability to the bank as it is the amount the bank owes the business. ABC's Bank ledger account will have a debit balance as the cash held in the Bank of Uncle Sam is an asset for ABC Pty Ltd.

Some items in the bank's records do not appear in the business' records and vice versa. This is often due to a timing difference or fees and charges. It is the purpose of the bank reconciliation to pick up these differences.

Differences that may be picked up off the bank statement include:

- Bank Charges that are automatically deducted each month from the bank account.

- Interest received that is automatically deposited each month into the bank account.

- Bank transfers and direct deposits that the business may have instructed the bank to pay automatically: e.g. power bill, rent, credit card.

Differences that may appear in the business' records but not on the bank statement include:

- Represented cheques – Cheques that have been recorded in the business accounts but have not been presented at the bank for payment during the statement period

- Deposits not credited – Deposits that have been recorded in the cash receipts journal but do not appear on the bank statement yet.

A business usually does not record these transactions until it receives its bank statement and does a reconciliation. Consequently, the cash payments and cash receipts journal are not balanced and posted to the ledger until the bank statement has been checked, missing items identified and recorded in the journals.

Bank reconciliation procedure

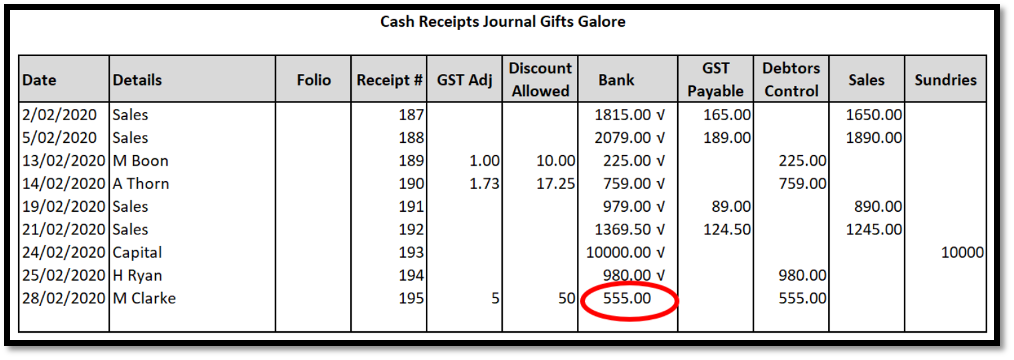

Compare the credit column of the bank statement with the bank column in the cash receipts journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records

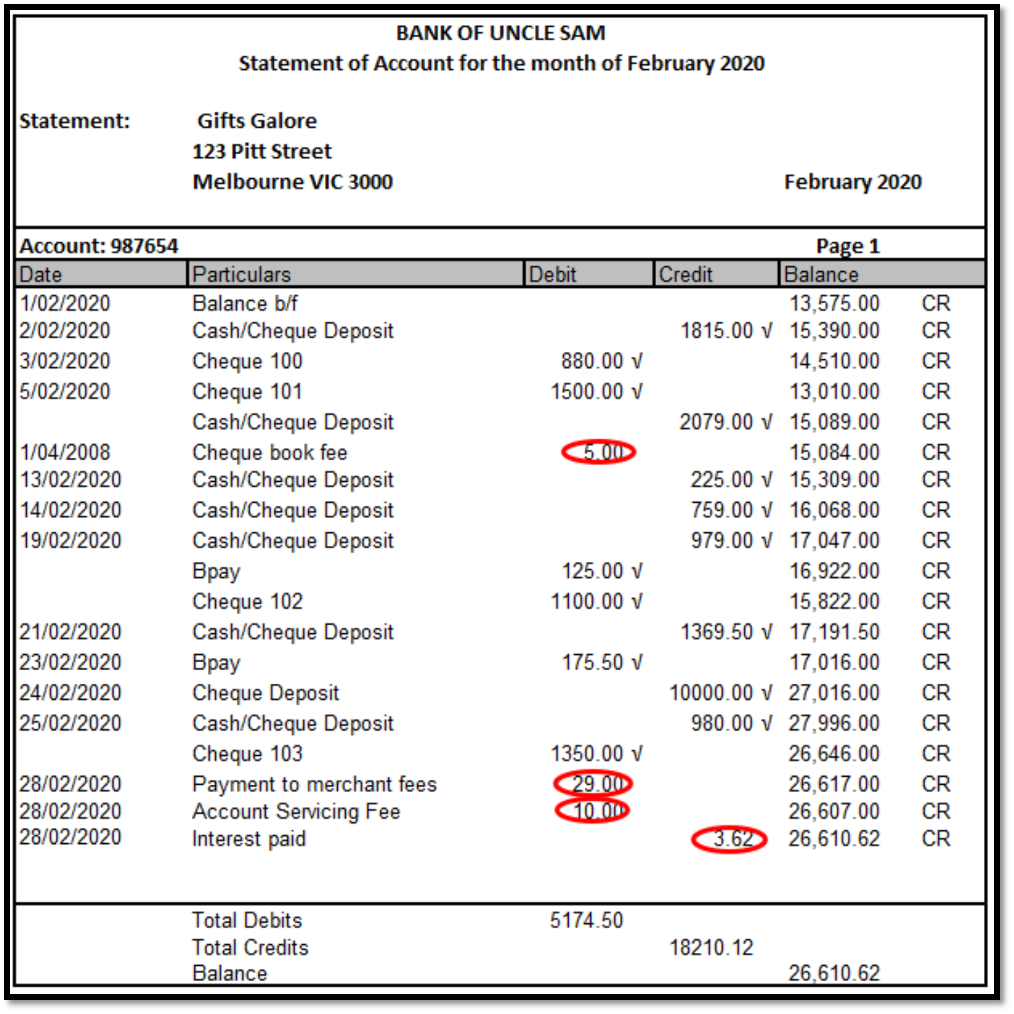

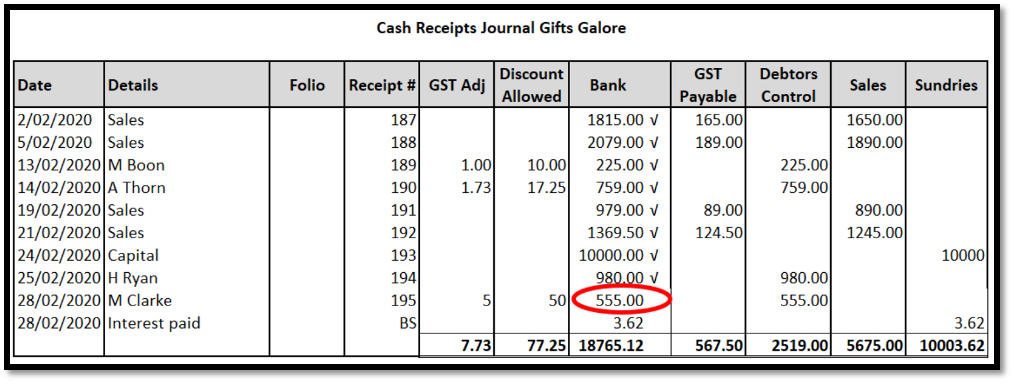

Cash Receipts Journal Gifts Galore

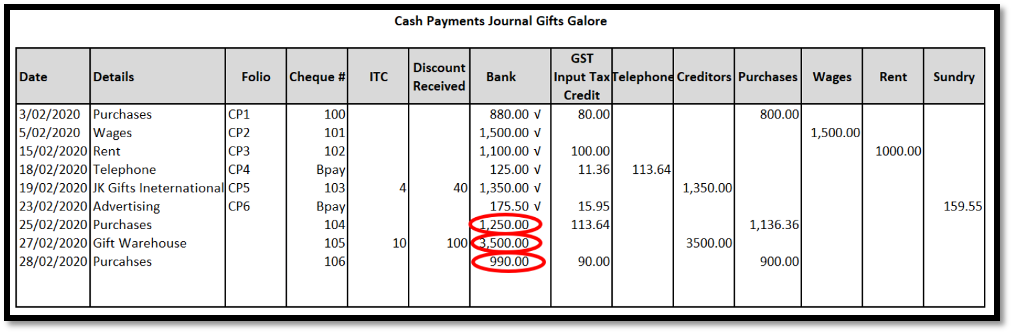

Compare the debit column in the bank statement with the bank column in the cash payments journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records.

Cash Payments Journal Gifts Galore

Update the cash payments and cash receipts journal by recording any items that appear only on the bank statement and total the journals.

Cash Receipts Journal Gifts Galore

Post the cash receipts and cash payment journals to the ledgers.

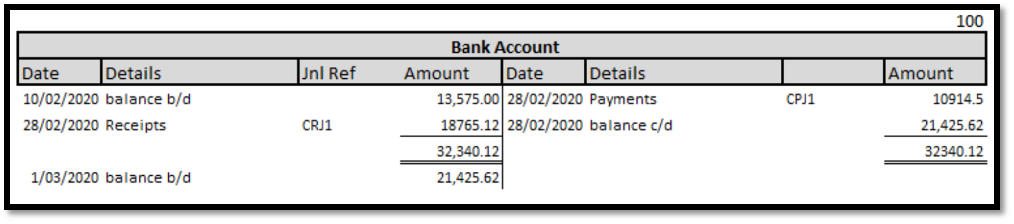

Extract from General Ledger Account

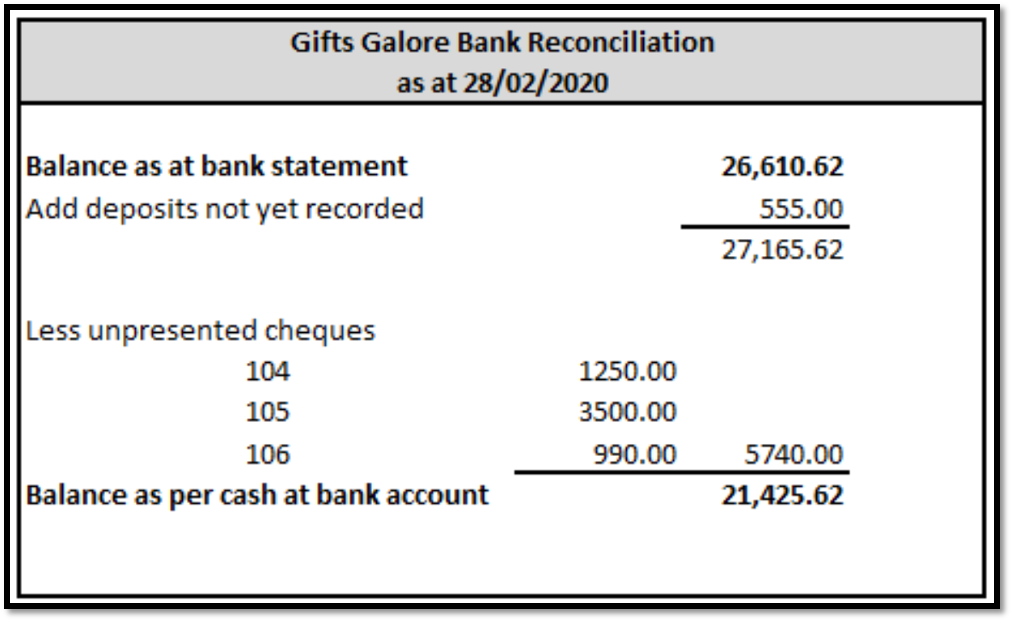

Prepare the bank reconciliation statement listing any transactions in the business records that do not appear on the bank statement.

Where minor payments need to be made for such things as taxi fares, postage, coffee etc. It is sometimes more convenient to pay these small expenses from a small reserve of cash the business has on hand. This reserve of cash is referred to as petty cash. Without adequate controls, petty cash can become a problem. Often petty cash is the area where money is lost, and usually, not a lot of attention is paid to accurately recording transactions.

For security purposes and to comply with auditing and tax requirements, it is important that a receipt or docket is provided for every petty cash withdrawal made.

The petty cash Imprest system is the accounting system most used to control petty cash. The petty cash starts at a fixed balance at the beginning of the month and is reduced during the month due to expenses being paid. At the end of the month, the balance is replenished back to the float limit. Someone with the business is designated to manage the petty cash system often, this role is assigned to a bookkeeper or accountant. The designated person is responsible for disbursing small amounts of cash and for documenting each payment with a petty cash receipt.

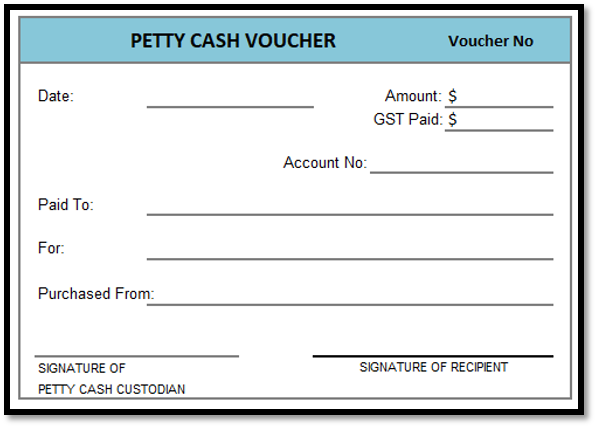

Petty cash vouchers

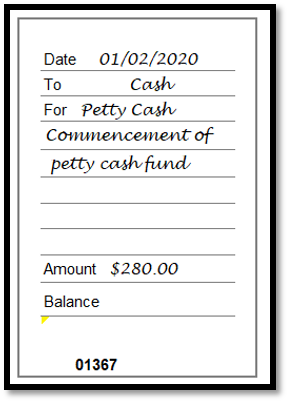

To obtain money from petty cash, members of staff may need to sign a petty cash voucher and provide receipts that support the expenditure. Before processing any petty cash claims, the custodian of the petty cash must check the petty cash voucher and receipt to ensure the claim is legitimate and the supporting documentation has been completed accurately. Below is an example of a petty cash voucher.

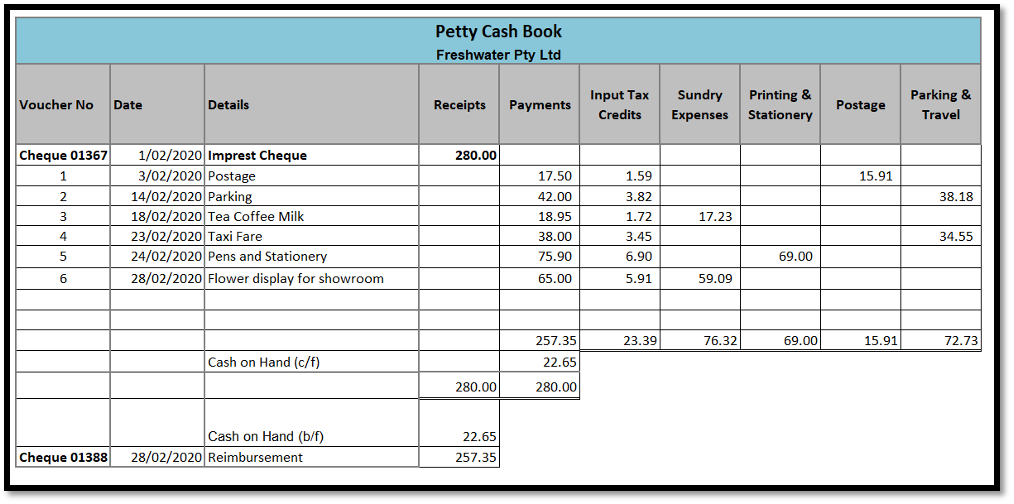

Petty cash book

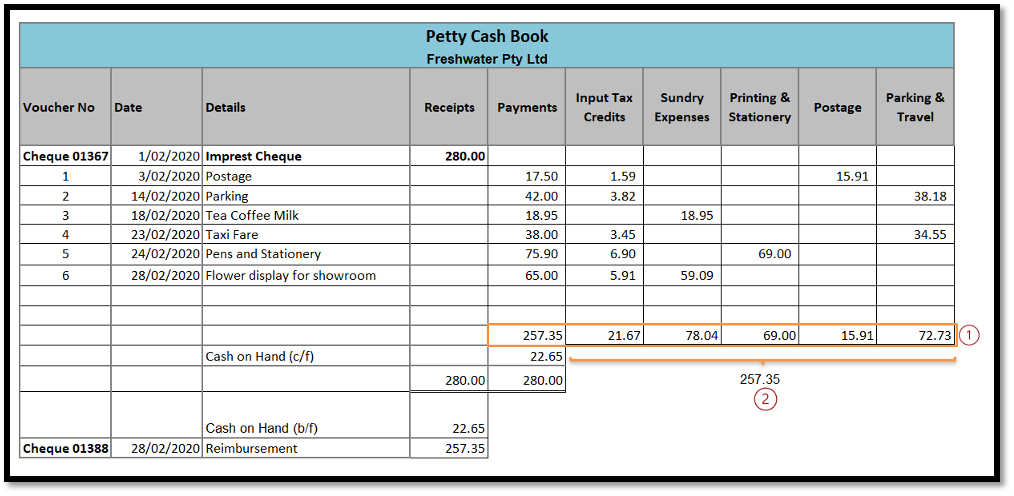

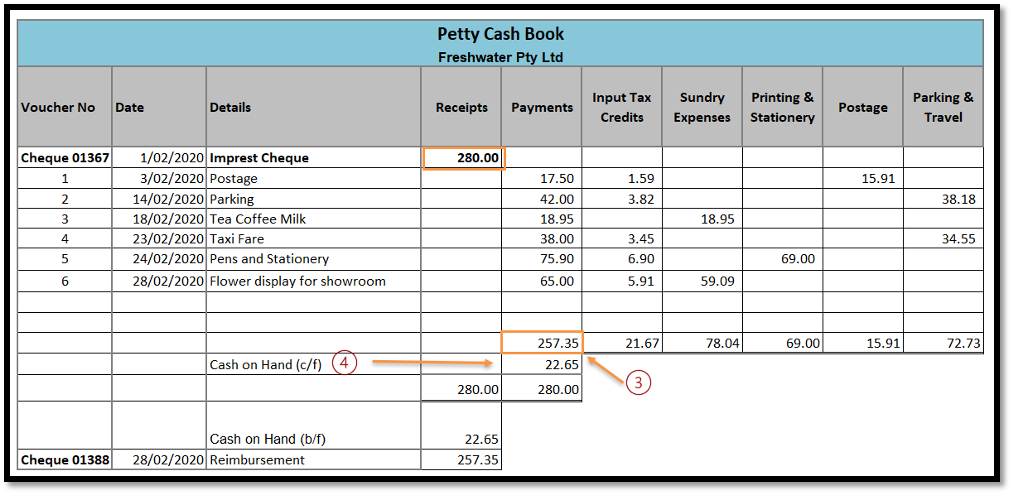

The petty cash book is used to record details of all petty cash vouchers prepared by the petty cash custodian. Below is an example of the petty cash book for Freshwater Pty Ltd.

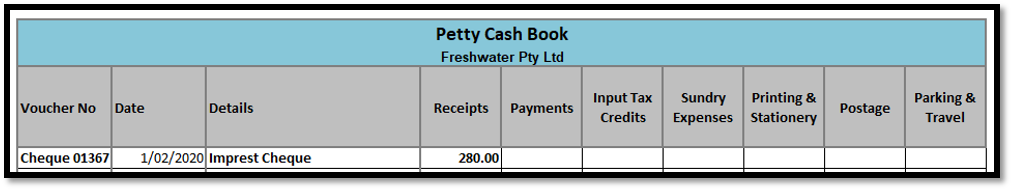

A petty cash fund is established when the imprest cheque is cashed, and the money is placed in the petty cash tin.

Cheque butt for cheque drawn for Freshwater Pty Ltd petty cash fund.

The amount and cheque number are recorded in the petty cash book.

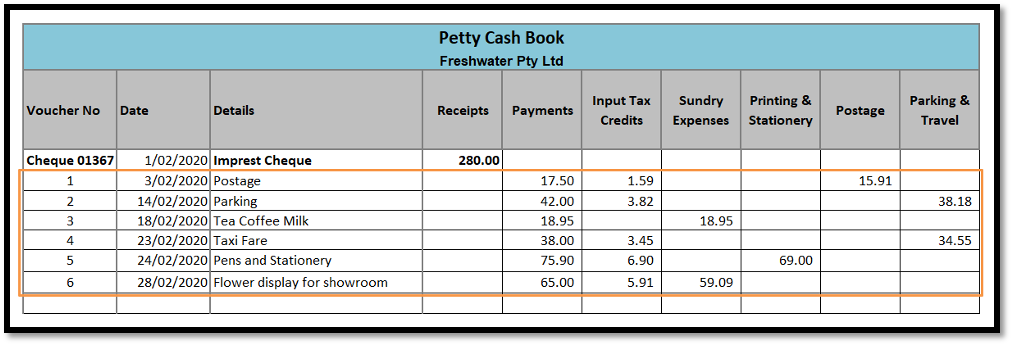

Processing petty cash transactions:

- A voucher is completed for all purchases made from the petty cash fund.

- All vouchers are recorded in the petty cash book.

Balancing the petty cash book at the end of the period:

1. Total the Payments, Input Tax Credits and Expense columns.

2. Verify the total of the payments column by adding together the totals from each expense column and the total of the Input Tax Credits column.

3. Subtract the total of the Payments column from the amount in the Receipts column and record this amount under the total of the payments. This is the carried forward (c/f) cash amount.

4. Physically count the amount of cash in the petty cash fund. The amount should equal the c/f amount.

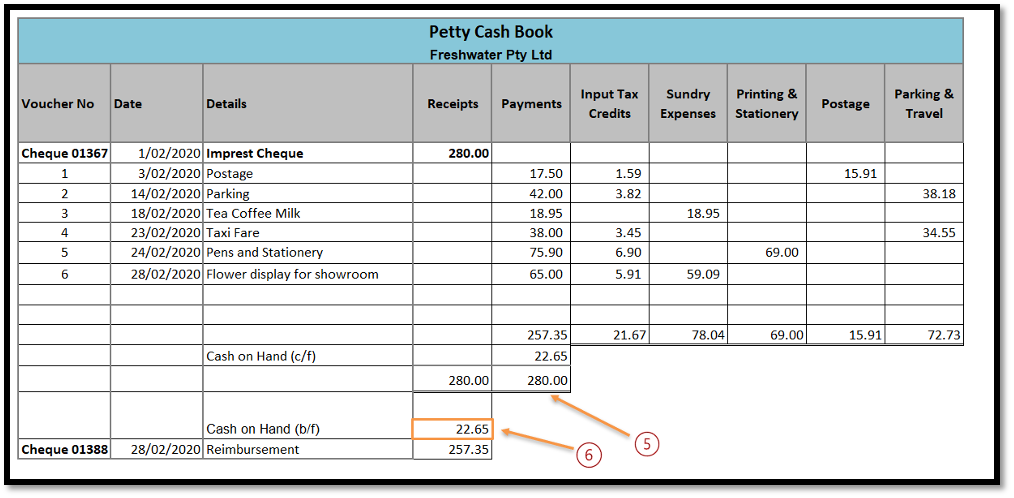

5. Rule off the Receipts column and the Payments column below the Cash on Hand amount. Total and rule off with a double line. The Receipts and Payments columns should equal each other.

6. Transfer the Cash on Hand amount to the receipts column.

Reimbursing the petty cash fund:

- Request a cheque for the amount that needs to be reimbursed.

- The cheque will need to be made out to cash and not crossed so that it can be taken to the bank and cashed.

- The cheque butt will record the amount of the cheque, the total of each of the expense columns and the GST paid.

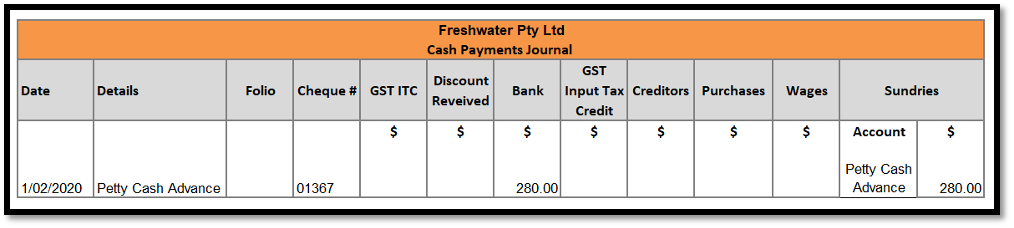

For petty cash, there are two journal entries required.

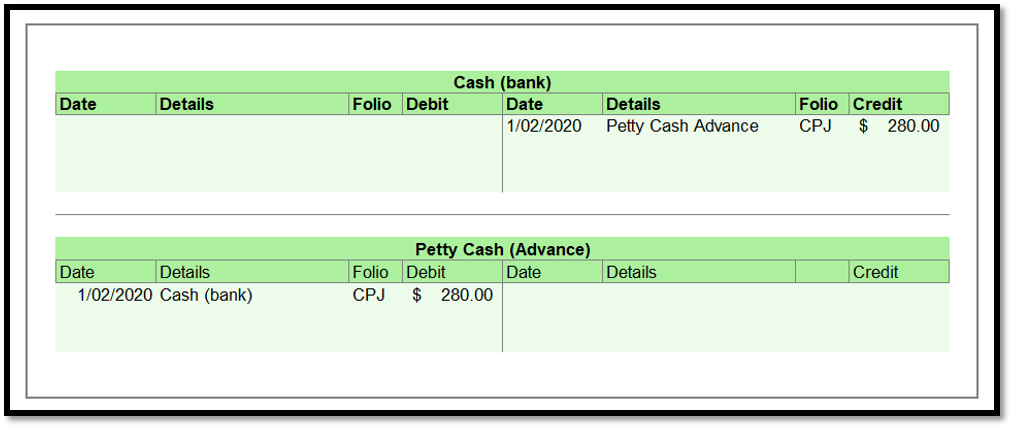

1. Cash Payments Journal - A journal entry to record the cheque drawn for the establishment of the petty cash fund.

The General Ledger entries result from the Cash Payments Journal.

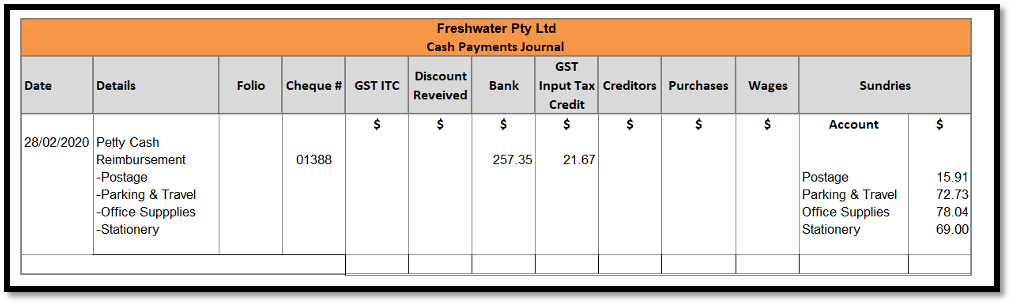

2. Cash Payments Journal - A journal entry to record the cheque drawn to reimburse the petty cash fund.

The individual items recorded in the Sundries column are the totals of the individual analysis columns of the Petty Cash Book, representing the various expenses paid from petty cash. The GST paid has been shown as a total in the Cash Payments Journal, being the amount of GST paid on all expenses subject to GST, rather than showing GST individually on each item.

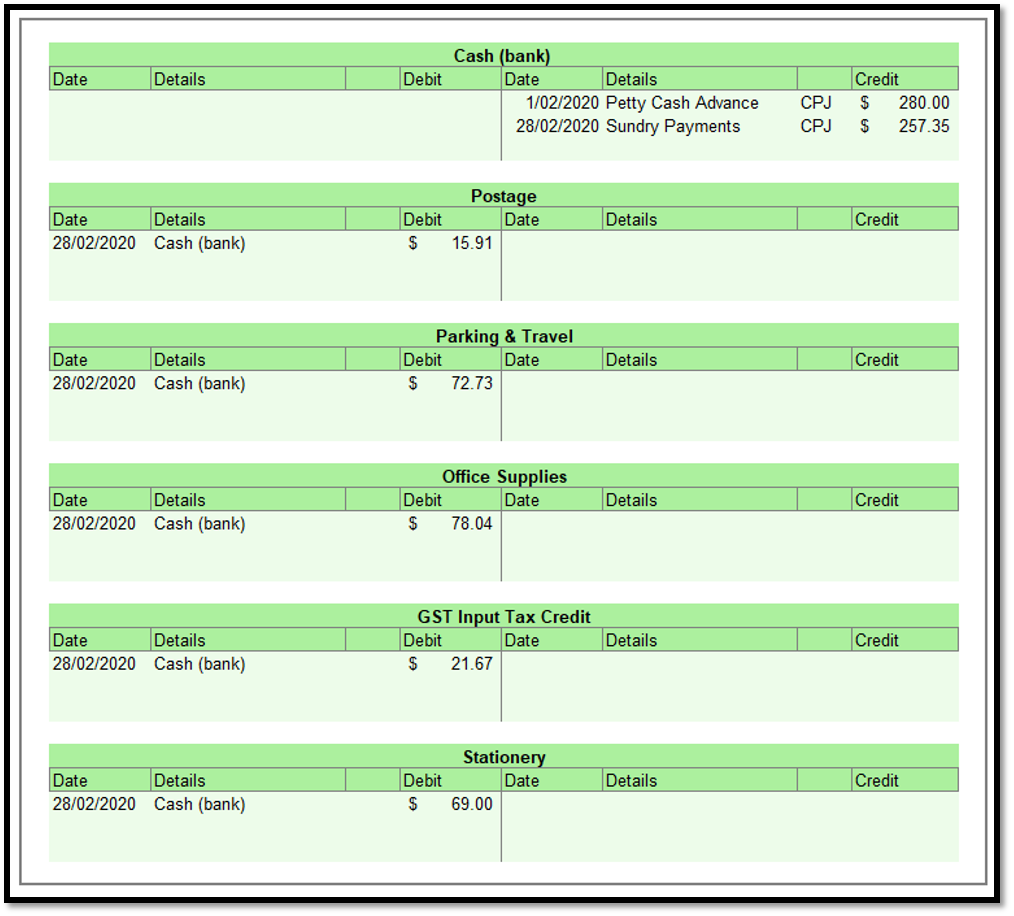

The General Ledger entries recorded resulting from the Cash Payment Journal of Freshwater Pty Ltd are:

The petty cash must be kept secure, preferably in a locked cash tin, to prevent any thief of cash. Some suggested control methods include:

- Having a maximum amount that can be paid out of petty cash for a single transaction

- Always ensure that a petty cash voucher is completed for each item of expenditure before making payment.

- Sequentially number petty cash vouchers

- Occasional random surprise audits of the petty cash fund should be conducted

- Keep petty cash in a secure place

- Keep petty cash vouchers and receipts in the petty cash tin until balancing at the end of the month

- Maintain a detailed description of what money is spent on

- When the cheque is prepared to reimburse the petty cash fund, the cheque signatories should review the petty cash vouchers for the money expended from the fund. Any discrepancies should be followed up.

Test your understanding

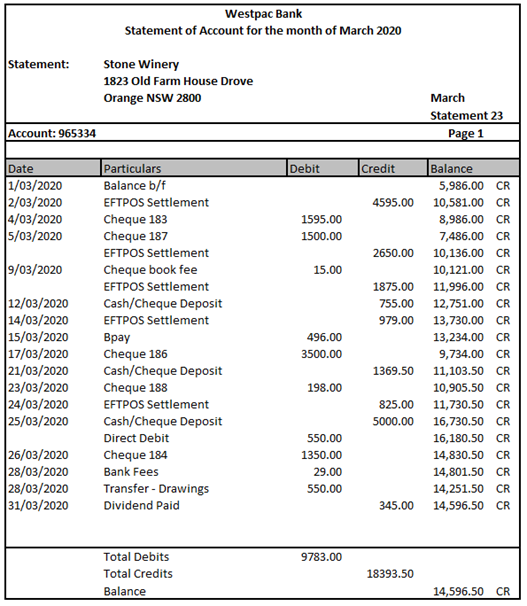

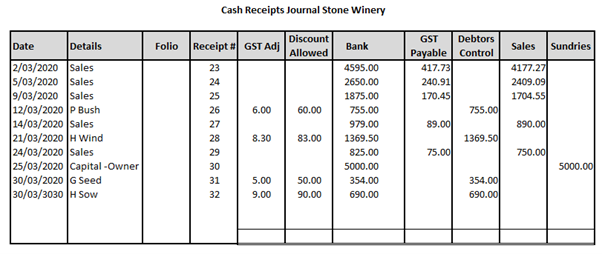

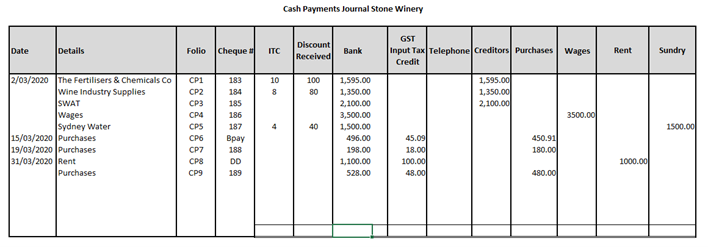

Using the following documents provided by Stone Winery, in the attached excel workbook:

• Complete the cash journals

• Post to the Bank general ledger account

• Prepare the bank reconciliation statement as at 31/03/2020

Test your understanding.

On 01/02/2020 a petty cash fund was established using cheque # 01367 for the amount of $280.00.

Using the attached excel workbook:

- Record the establishment of the petty cash fund.

- Create a petty cash vouchers for each of the February petty cash transactions in the table below.

- Total and balance the petty cash book as at 28/02/2020.

- Prepare the cheque for the reimbursement amount. (cheque # 01388)

- Record the reimbursement in the petty cash book.