Learning objectives

After you have completed this topic, you should have knowledge of:

- Preparing a Profit & Loss Statement

- Preparing a Balance Sheet

- Closing the accounts at the end of the accounting period

The life of a business is divided into accounting periods to allow owners, managers and interested parties to analyse the business’ performance. An accounting period maybe a week, month, three months or a year. Businesses choose their own accounting periods based on their business needs. Financial statements are reports that summarise important financial accounting information about a business. There are three main types of financial statements:

- Statement of Financial Performance, also known as the Profit and Loss

- Statement of Revenue Statement Statement of Financial Position, also known as the Balance Sheet

- Cash flow Statement.

Together they give owners, managers and interested parties a clear picture of a company’s financial position.

Interim reports

Interim reports are reports for a financial period shorter than a fiscal year. They are often produced by a bookkeeper and produced during three (3) quarters of each financial year. These reports include the following financial statements:

- Profit & Loss Statement

- Balance Sheet

- Statement of cash flows

In this module, we will only be looking at the Profit & Loss Statement and the Balance Sheet.

The Profit & Loss Statement (also known as the Statement of Financial Performance, Revenue Statement and Income Statement.

The Profit and Loss Statement (P&L) summarises the total revenues and expenses incurred by the business, showing the profitability (net income or net loss) over a specified period of time, usually a month, quarter or year.

Preparing a Profit & Loss Statement

The figures used to generate a profit and loss statement are accumulated year to date figures from the general ledger.

Steps in preparing a Profit and Loss Statement

- Identify the business’ revenue. Revenue can be defined as the money received from selling goods and services. Businesses may have more than one revenue source. Each revenue source has its own line. Revenue sources are totalled together to calculate total revenue.

- Identify the business’ cost of goods sold (COGS). COGS can be defined as the cost of making the goods that a business sells. Service businesses like accountants and lawyers don’t sell a physical product; therefore, they don’t have COGS.

- Calculate gross profit. Gross Profit. Gross Profit = Revenue – COGS. Gross Profit tells you how profitable the products the business sells are.

- Identify the business’ expenses. These will vary depending on the business type. Expenses can be broken up into:

- Administrative expenses - general expenses not specific to any division.

- Overheads- refer to the fixed costs of running a business that doesn’t vary from month to month (in contrast with operating costs, which can fluctuate)

- Selling, general, and administrative expenses - this encompasses everything except for COGS, direct costs, research and development expenses, and interest on business loans.

- Calculate Net Profit. Net profit = Gross profit – Expenses. Net Profit tells you how profitable the business is overall.

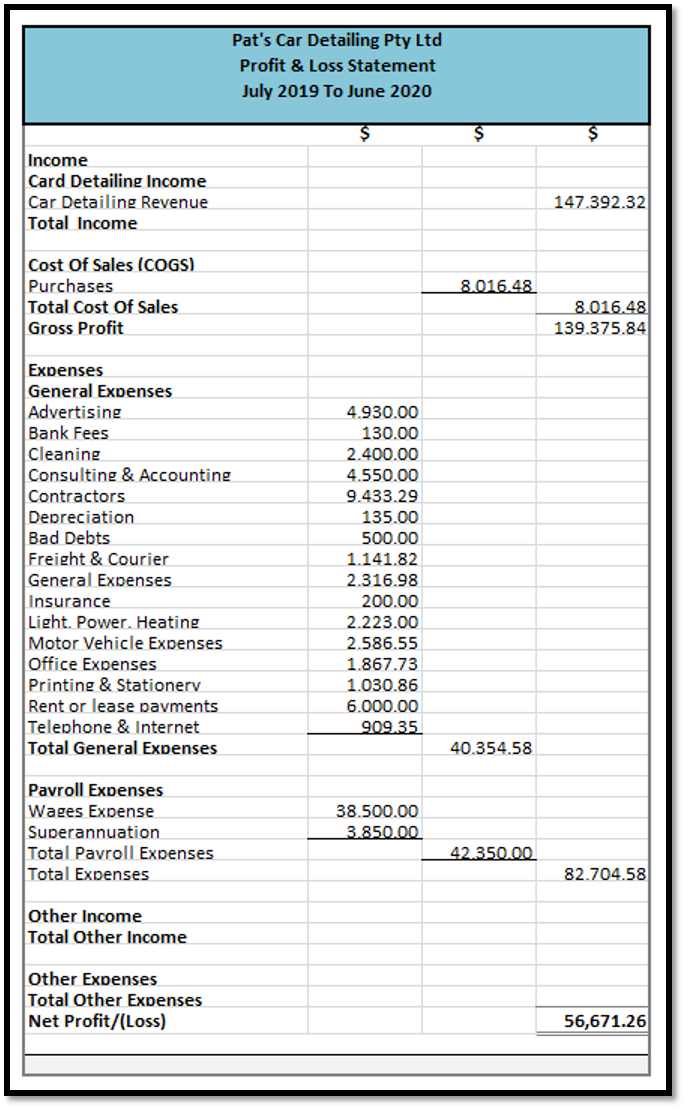

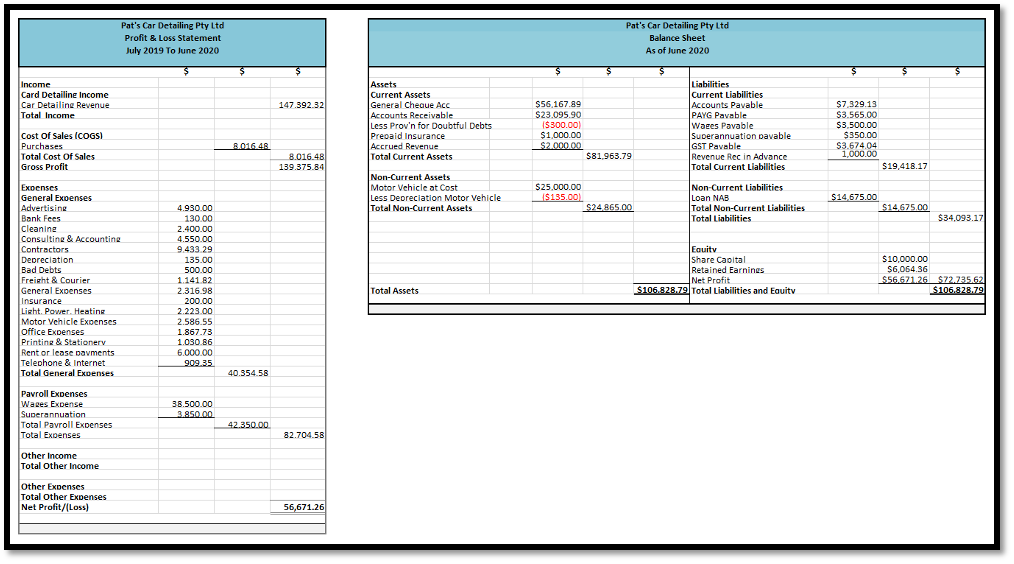

Below is an example of a Profit & Loss Statement for Pat’s Car Detailing

The profit & Loss statement tells us that Pat’s Car Detailing earned $147,392.32 in income from detailing cars. $8016.48 was spent on purchasing products to enable the business to earn revenue, and the business incurred a further $82,704.58 in indirect costs. The business made a Net Profit for the 2020 financial year of $56,671.26.

The video below demonstrates the process for producing a profit and loss statement.

The Balance Sheet is a financial statement that summarises a company’s total assets (current, non-current and intangible assets), liabilities (financial obligations), and equity (investments and retained earnings) at a specific point in time, usually at the end of an accounting period. It provides a snapshot of a company’s financial position, including the economic resources the company owns and the sources of financing for those resources.

Preparing a Balance Sheet

The Balance sheet is prepared from the adjusted trial balance. The financial position of a business is determined by comparing what the business owns against what the business owes. Prior to preparing a balance sheet, the asset, liability and equity accounts must be adjusted to reflect all transactions that have occurred during the period.

There are 3 different sections in a balance sheet, represented by the following formula: Assets – Liabilities = Equity, the accounting equation.

- Assets are items of value owned by or owed to the business

- Liabilities are amounts owed by the business.

- Equity is the net worth of the business.

Steps in preparing a Statement of Financial Position

- Determine the reporting date and period. Often, the reporting date is the final day of the reporting period

- Identify the business’ assets. Assets will often be split into the following line items:

Current Assets:- Cash and cash equivalents

- Accounts receivable

- Inventory

- Other current assets

- Non-current Assets:

- Property

- Equipment

- Other non-current assets

Current and non-current assets are subtotaled and then totalled together.

- Identify the business’ liabilities. Liabilities will often be split into the following line items:

Current Liabilities:- Accounts payable

- Accrued expenses

- Revenue received in advance

- Other current liabilities

- Non-Current Liabilities:

- Long-term lease obligations

- Long-term debt

- Other non-current liabilities

Current and non-current liabilities are subtotaled and then totalled together.

- Calculate the owners’ equity. Common line items found under equity include:

- Capital

- Retained earnings from previous periods

- Net Profit

Add total liabilities to total equity and compare to assets. If they are not equal, then there is an error, and you need to check your workings.

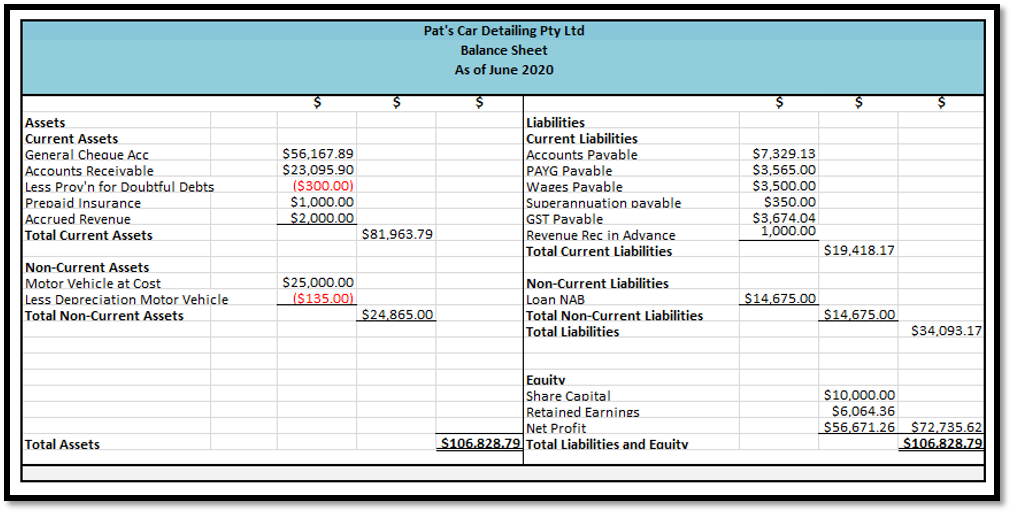

Below is an example of Pat’s Car Detailing Balance Sheet as of 30 June 2020.

The Balance sheet tells us that Pat’s Car Detailing Pty Ltd

The video below demonstrates the process of producing a balance sheet.

Test your understanding.

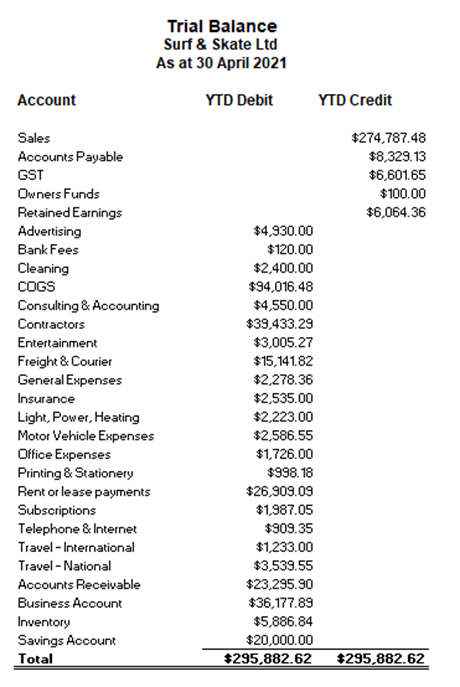

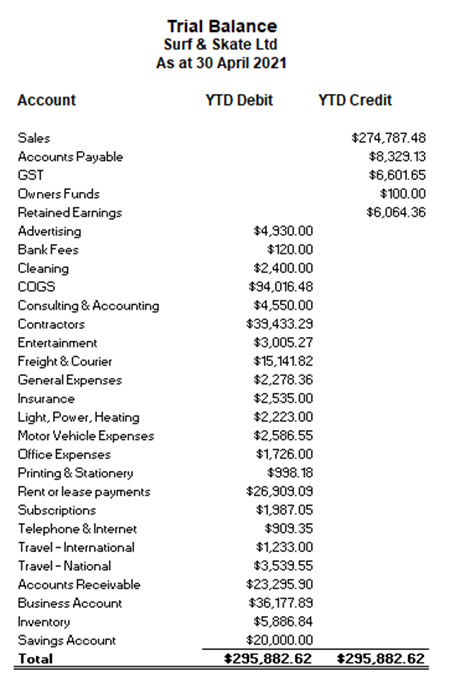

Using the following document provided by Surf & Skate, in the attached excel workbook:

• Prepare a Profit & Loss Report for the period 01/07/2020 – 30/04/2021

• Prepare a Balance Sheet as at 30/04/2021.

Closing the accounts is a process that is completed at the end of an accounting period and involves moving amounts from temporary accounts on the profit and loss statement to permanent accounts on the balance sheet in order to start the new financial year (FY) with a balance of zero.

Permanent Accounts are balance sheet accounts, including assets, liabilities, and most equity accounts. These account balances roll over into the next period. So, the ending balance of this period will be the beginning balance for the next period. There is no need to close these accounts.

Temporary are profit and loss accounts which include revenues, expenses, dividends (or withdrawals) account. These account balances do not roll over into the next period after closing. The closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero, so they are ready to receive data for the next accounting period.

The video below explains the closing process.

Test your understanding

Using the following document provided by Surf & Skate, in the attached excel workbook:

- Prepare a Profit & Loss Report for the period 01/07/2020 – 30/04/2021

- Prepare a Balance Sheet as at 30/04/2021. Table Description automatically generated

Excel Workbook