Businesses must have an accounting system to help them manage financial resources and business activities. An accounting system refers to an organised set of accounting methods, procedures, and controls used by a business organisation to collect, store, analyse, process, and report any financial transactions conducted by the business.

List of topics in this module:

- Accounting Systems

- MYOB Cloud Accounting

- Managing Assets

- Ledgers, Journals, Accounts

- Purchasing

- Sales

- Banking

- Reporting

Taking the leap beyond pen, paper, and three-ring binders are two systems of computerised accounting. One that requires a downloadable app, and the other uses a web-based approach that can be accessed via any browser at any time.

Download or Online

Desktop-based computerised Accounting System

Once installed, the computerised accounting system is the primary tool for recording, organising, and generating reports on the business's various financial transactions. These systems require software downloaded and installed onto a desktop computer. Collaboration is limited to those that have access to a shared network that can house the data file.

Cloud-Based Accounting System

A cloud-based accounting system is a computerised accounting system that stores financial data in the cloud on a remote server. These systems only require a current browser, such as Chrome or Edge in order to to access the accounting data and use the system, as opposed to downloadable software that must be installed. Collaboration with advisors, tax accountants, executives, data entry, bookkeepers and others are managed via specified roles and permissions.

This unit will provide instruction using the cloud-based provider, MYOB Business™.

MYOB is pitched and designed for a business owner to manage much of the financial activities of their business. Mind Your Own Business, to MYOB, means that you spend more time doing activities that relate to the business enterprise and not doing the books. All of the MYOB Help articles are written as if you are the business owner and often suggest you refer to your accountant or advisor. As an accounting student, you will simply need to put yourself in the shoes of the retained or in-house bookkeeper of a business. Think ahead...someday that may be you.

There are three major players in Australia. In addition to MYOB and its broad array of products, there is also:

- Xero - A fully functional online, cloud-based popular solution.

- QuickBooks - They have two product channels, Small Business and Self Employed.

Accounting systems have the following basic functions:

- collect and store data relevant to the business activities and financial transactions of the organisation

- ensure that transactions and financial data are accurately recorded for processing reports

- provide information for decision-making through financial statements and reports generated.

Accounting systems are typically composed of the following parts:

- People: refers to accounting system users such as bookkeepers, accountants, managers, business analysts, and auditors

- Procedure: refers to instructions within an organisation on how data will be collected, stored, retrieved, and processed

- Data: includes all information such as transactions and source documents which are encoded into the computerised accounting system

- Software: a computer program where the accounting system is created or setup (e.g. MYOB, QuickBooks, Sage, Xero, etc.)

- Internal controls: security measures used to maintain and protect the data

To implement an integrated accounting system, source documents of financial statements, including the general ledger, chart of accounts, and subsidiary accounts, must be encoded into the system you are using.

One of the benefits of using a computerised accounting system that we have explained is that the vendor, in our case, MYOB, helps its users stay compliant with current legislation. People in the privileged position of being authorised to view and store financial and personal information have a legal obligation to respect and protect the privacy of the business and its employees.

Computerised System Policies and Procedures

However sophisticated, computerised accounting systems are still vulnerable to hacks, attacks, and database loss. Business organisations must establish policies and procedures referring to security measures to be applied when using these accounting systems. The following features must be considered when writing policies and procedures for computerised accounting systems:

Security setting

The computerised accounting system should be password protected so that only authorised personnel can access the system and the information stored in the system. The security setting should directly relate to staff responsibility in the business. Additional security measures should be installed on computer systems to minimise risks from computer viruses and hackers.

Authentication

The accounting system in your organisation must require login IDs and passwords from users to confirm permission to access the computer. Passwords must be kept personal and private and should not be shared across users. Some organisations allow limited access to users to avoid damage or unauthorised access to confidential information in the system.

Virus protection

Computer systems must use anti-virus software and firewalls to minimise or prevent the risk of viruses, malware, and other threats entering the system. Such threats could increase the possibility of the system’s files and database being hacked or experiencing a system loss.

Backup

If the system is not cloud-based, then a backup of the computer file needs to be done periodically. To do this, create a policy and process to take a backup copy of the file and store it in a secure and remote location. This way, the data can be accessed in case of a natural disaster, or other emergency and restored if necessary — at least up to the latest backup. Large businesses may do this nightly.

The following are key requirements when setting up a computerised accounting system and preparing for accounting and bookkeeping work securely and safely:

Storing data securely

- Shred unwanted printed material after they are entered into the system, which may contain personal or financial information

- If your system is not cloud-based, you will need to ensure your data backup is stored away from the workplace

- Lock all printed source materials in a secure location

- Additional details are below under "Privacy and confidentiality"

Log on and authorisation levels

- Ensure only those with the correct authority and credentials have access to the system and data

- Change passwords for login regularly

- Educate users to store passwords securely

- Set alerts for unauthorised access to the system

Workplace Health and Safety (WHS)

- Ensure workstations are ergonomically set up

- Set time for breaks when working at a computer (e.g. 10 minutes every hour)

- When taking a break, turn off work notifications

- Manage cords to remove any tripping hazards

- Regularly test and tag electrical equipment

- Ensure correct office lighting

The following are key requirements when maintaining a computerised accounting system:

Lodgement and reporting

- Financial reporting

- Balance sheet

- Payroll records PAYG

- BAS and IAS

- Lodgement schedule:

- GST

- Income tax

- Company tax

- PAYG

- Superannuation

Privacy legislation must inform policy

Key features of a privacy and confidentiality policy will reflect the requirements and principles under the Privacy Act 1988 such as:

- how the business protects personal information

- how the business uses personal information

- process for using and disclosing clients' information.

- specifying types of information needed to perform specific tasks

- maintaining record keeping to meet privacy requirements such as:

- the information is required

- the person responsible for collecting information

- the procedure used to collect the information

- where and for how long the information is stored

- how records are disposed.

The Privacy Act 1988

Under this legislation, the following are the Australian Privacy Principles that must be adhered to when accessing, using, and storing personal information and data in a computerised accounting system.

- APP 1 — Open and transparent management of personal information

- APP 2 — Anonymity and pseudonymity

- APP 3 — Collection of solicited personal information

- APP 4 — Dealing with unsolicited personal information

- APP 5 — Notification of the collection of personal information

- APP 6 — Use or disclosure of personal information

- APP 7 — Direct marketing

- APP 8 — Cross-border disclosure of personal information

- APP 9 — Adoption, use or disclosure of government related identifiers

- APP 10 — Quality of personal information

- APP 11 — Security of personal information

- APP 12 — Access to personal information

- APP 13 — Correction of personal information

Accounts Receivable Policy

There are several risks associated with a business carrying a large accounts receivable balance:

- Uncollectable debt – When customers who purchase on credit go bankrupt or do not pay their invoices, the business is left with having high accounts receivables and often result in bad debt that is written off.

- Cash flow deficiencies – Businesses that sell on credit may show a boost in revenue and income, but it offers no actual cash inflow until the debt is paid. Carrying long-term debt and a large accounts receivable balance can cause a business to get caught without enough cash on hand, and have to take on other liabilities to fund operations.

These risks can be mitigated by having a well-documented accounts receivable policy.

Example Accounts Receivable Policy

Accounts Payable Policy

The Accounts Payable System is part of a company’s accounting system. Similar to accounts receivable, there are risks associated when paying invoices. These include:

- unauthorised purchase

- duplicate payment of invoices

- fraudulent payments

- late processing resulting in late fees or forfeiting a discount.

A policy with proper internal controls that is communicated to the right people can effectively and efficiently minimise the incidences of fraud and costly errors.

Example of an Accounts Payable Policy

As a reminder, an audit trail is generated every time a business transaction occurs. This audit trail can be generated in paper or electronic format and is known in bookkeeping as a source document. Source documents are important to the bookkeeping process because they serve as physical evidence that a financial transaction has occurred. Let’s look at some of the source documents you will encounter through the accounts receivable process.

Tax Invoices

Whenever a seller provides goods or services on credit, a tax invoice is prepared and sent to the buyer requesting payment. A tax invoice is needed by the buyer to claim an input tax credit from the Australian Taxation Office (ATO). The purchase order and sales invoice act as accounting source documents for the transaction.

Once issued, a tax invoice becomes a legally binding contract that creates an obligation for the buyer to pay. Because of this, it cannot be cancelled or removed from sales records.

Specific details must be included on a valid tax invoice:

- Tax invoices for sales less than $1,000.00 must include:

- that the document is intended to be a tax invoice

- the identity of the seller

- the Australian Business Number (ABN) of the seller

- the date the invoice was issued

- a description of the goods or services sold, including quantity and price

- the GST amount (if any) payable

- the extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST)

- Tax invoices for sales over $1000.00 must also include:

- The buyer's identity or ABN

If a tax invoice is missing or contains incorrect information, it is not considered a valid tax invoice and needs to be replaced with a correct and valid tax invoice.

Where there is more than one taxable sale on a tax invoice, two rules must be applied, the total invoice rule and the taxable supply rule. The ATO has more information about these rules and requirements of tax invoices.1

In addition to tax invoices, select the (+) sign to see the characteristics of other source documents.

A purchase order is a document sent from a buyer to order goods or services from a seller. It includes the following information:

- identity of the buyer

- ABN of the buyer

- date

- a purchase order number

- identity of the seller

- description of the goods or services to be supplied

- how and when the goods or service will be delivered

- price from the supplier’s price list or agreed with the supplier

- signature of the authorised person

A credit note is a document issued by the seller to acknowledge goods have been returned by the buyer and the amount owing by the seller has been reduced. The goods may have been returned because they were faulty, damaged, did not meet the buyers’ expectations or did not match what was ordered.

Credit notes include the following information:

- document type - Credit Note

- the identity of the seller

- the ABN of the seller

- the date the credit note was issued

- a description of the goods or services being returned

- credit note number

- the amount of the adjustment

- details of any GST included in the credit note

- the identity of the buyer

An adjustment note is similar to a credit note. It is issued by the seller to acknowledge an agreed reduction in the amount still owing by the buyer. The reduction may be due to an incorrect price, incorrect invoice details or an order being short delivered.

A statement of account is a document issued by the seller to the buyer. It lists all the financial transactions between the buyer and the seller within a specified time period, usually a month and includes:

- the balance owing at the beginning of the month

- invoices, credit notes and adjustments notes issued by the seller during the month

- the payment date and amount of each payment received from the buyer during the month

- the balance owing at the end of the month

- a payment slip that can be remitted back to the seller with payment.

Often a Statement of Account will include a section that lists ‘time buckets’ highlighting how overdue a particular amount is. For example:

- Current: $85.00

- 0-30 days: $92.00

- 31-60 days: $0.00

- 61-90 days: $0.00

- 90 days+: $0.00

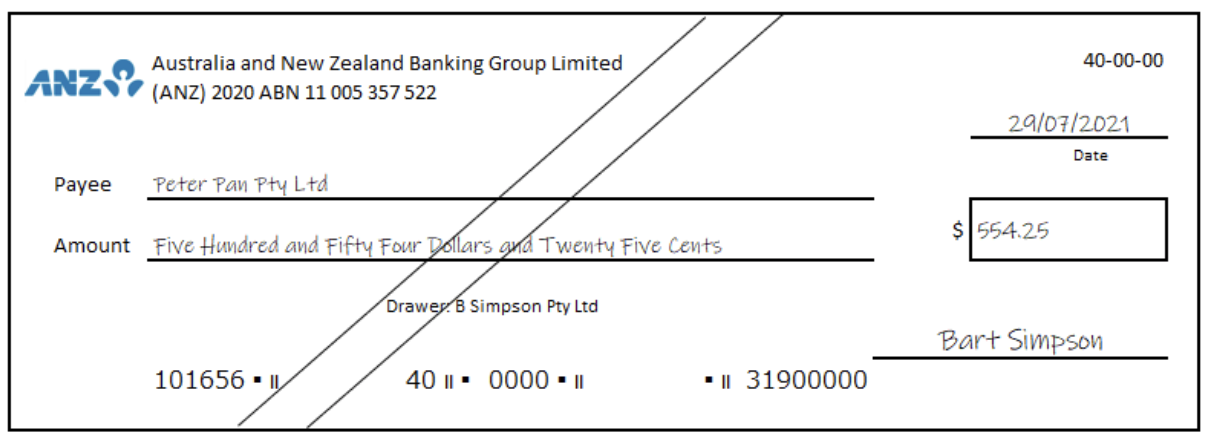

A cheque is a form of payment that authorises the bank to transfer money from one account to another. The cheque butt remains in the cheque book as a record of:

- who the payment was made to

- the amount of the payment

- the date of the payment

- what the payment was for.

A cheque may be sent to a seller by a buyer as payment for the amount outstanding on a Statement of Account. Adding crossed lines to a cheque increases its security. It means that the cheque cannot be cashed by a bank teller but must be paid into an account of the payee.

A remittance advice is documents sent by the buyer to the seller that advises the payment is being prepared and will be remitted by a certain date. Sometimes the payment will accompany the remittance advice.

A receipt is a document sent to the buyer from the seller acknowledging payment has been received.

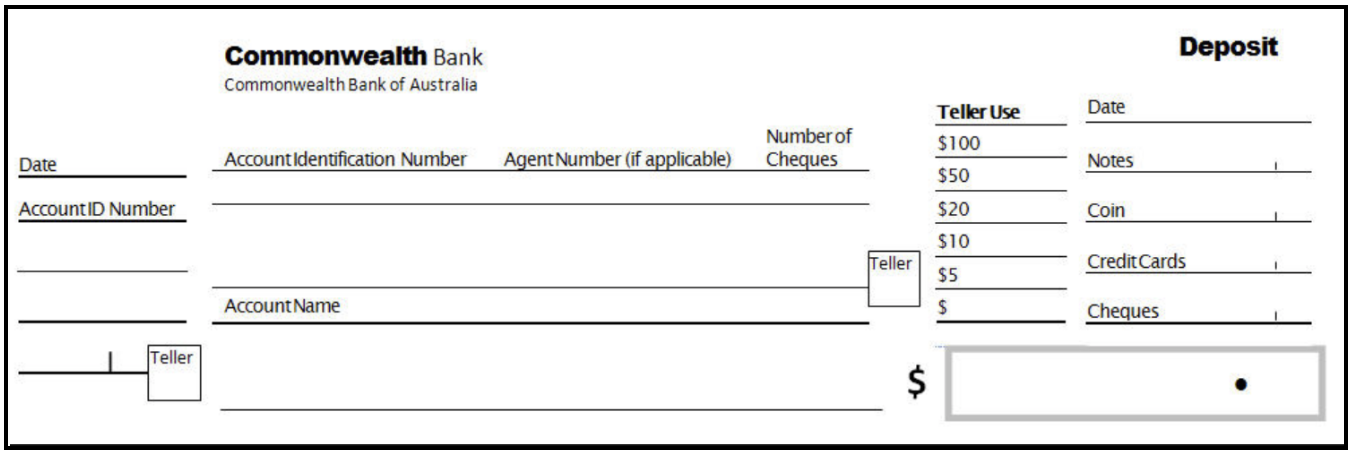

If a business accepts cash or cheques as a form of payment, someone within the business has to physically bank the cash and cheques into the business bank account. A bank deposit slip is evidence money has been deposited into a bank account. The deposit slip includes the number and dollar amount of coins and notes and lists the cheques included in the total deposit. The bank teller counts the cash and cheques and confirms the totals agree with the amounts recorded on the deposit slip before entering the deposit into the bank's system.

Computerised accounting systems, are designed around modules, e.g. general ledger, accounts receivable, inventory, sales. Once a transaction is entered, it is automatically updated in all the accounts and modules to which it relates. For example, when a sale is entered into MYOB, the system has linked accounts that automatically update the accounts receivable account. This change is then carried through to all of the reprting, such as the balance sheet and the profit & loss statement.

A payroll system is only as good as the information entered, so collecting current information and relevant materials from the employee is essential to setting them up in the system and ensuring all legal compliance issues are satisfied.

This includes not only personal identifying information and wages but also TFN declaration, super choice form, apprenticeship and traineeship agreements, etc.

There are three forms that your employee needs to complete or sign:

Letter of offer

A letter of offer or employment contract informs new employees about the terms and conditions of their employment with your business, including:

- start date

- position

- hours of work

- pay

- any other entitlements.

TFN declaration form

The TFN declaration form determines the amount of tax to be withheld from your employee's payments. It's completed by the employee for you to then enter the answers into your software. You can download this form from the ATO website.

Superannuation choice form

You will need to provide new employees with a superannuation choice form to complete so they can advise you of their choice of super fund and you configure MYOB to make contributions to their nominated fund. The details of your nominated (default) super fund must be filled in before providing it to your employee for them to complete. You can view more information about the form at the ATO website.

Most of these terms will not be new to you. Take a look at them just to ensure you have a clear understanding of each term in the list, as it will provide the background knowledge you need to understand in order to set up a computerised accounting system.

Scroll through them all, then you can jump to the term later if you need a reminder.

- Account

- Accounting equation

- Assets

- Asset Register

- Balance day adjustments

- Cash vs Accrual based accounting

- Double-entry Bookkeeping system

- Financial statements

- Journals

- Ledgers

- Liabilities

Account

An account is the summary record of all transactions relating to a particular item in a business.2

Accounting equation

The accounting equation shows us how much of the assets are owned by the owner (equity) and how much is owed to others (liabilities).

ASSETS = LIABILITIES + EQUITY

This is the equation or formula used to prepare a balance sheet. All accounting entries are derived from it.

James Hearle, an accountant from the UK, now based out of Sydney, Australia, operates a YouTube channel called Accounting Stuff. He does a great job of breaking down complex ideas into easier notions to understand. We'll use James's videos throughout this module to offer support for learning accounting concepts related to reporting.

Assets

Assets are possessions the business that add befit and value to its management and operations.

Examples include:

- furniture

- machinery

- vehicles

- computers

- stationery

- cash.

According to the IFRS (International Financial Reporting Standards) definition, “an asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.3 IFRS defines a number of assets with different characteristics (nature):

- Inventory

- Property

- Plant and equipment

- Intangibles

- Investment property

- Financial assets.

Financial Training Australia adds to the definition the notion of ‘current’ and ‘non-current assets’:

- Current – assets that are expected to be converted to cash within a year, such as cash, money in the bank, accounts receivable (debtors), inventory, stock, etc.

- Non-current – considered long-term, their full value won't be recognised for at least a year, such as equipment, buildings, plant, vehicles, etc.

Fixed Assets

Fixed assets are non-current assets with a useful life of more than one year and appear on a company’s balance sheet as property, plant, and equipment.4

Examples of Fixed Assets:

- land

- buildings and facilities

- machinery

- tools

- vehicles (company cars, trucks, forklifts, etc.)

- furniture

- computer equipment.

Asset Register

A fixed asset register is a system used to compile and hold the details of each fixed asset a business owns.

Balance day adjustments

For the double-entry accounting system, adjustments to assets and liability accounts (and corresponding revenues or expenses) are recorded to reflect the impact of accounting periods on underlying transactions. They commonly result in accruals and prepayments, depreciation and inventory adjustments.

Cash vs accrual based accounting

Revenue and expenses can be recorded on either a cash or accrual basis and the difference between them focuses on when transactions are recorded vs occurred in real life.

With cash accounting:

- Revenue is recorded when the cash is received from the customer

- Expenses are recorded when the cash is paid

With accrual accounting:

- Revenue is recognised in the period the revenue is earned

- Expenses are recognised in the period they are incurred

| June | July | |||||

|---|---|---|---|---|---|---|

| Activity | Purchase parts, repair car, pay employees, receive payment for work done in June and July. | |||||

| Accrual Basis | Revenue | $3,000.00 | Revenue | $0.00 | ||

| Expense | $1,800.00 | Expense | $0.00 | |||

| Profit | $1200.00 | Profit | $0.00 | |||

| Cash Basis | Revenue | $0.00 | Revenue | $3,000.00 | ||

| Expense | $1,800.00 | Expense | $0.00 | |||

| Profit | -$1,800 | Profit | $3,000.00 | |||

If you struggle with the concepts, the following two videos, from James at Accounting Stuff, offer an engaging way to understand cash vs accrual. If you haven't watched them already, and you are still a bit murky about these concepts, take the time to watch them now.

We'll start with cash accounting:

And now watch this one about accrual. James certainly has a specific and strong opinion, but after watching both videos, you can make up your own mind about which system is best for meeting the business goals.

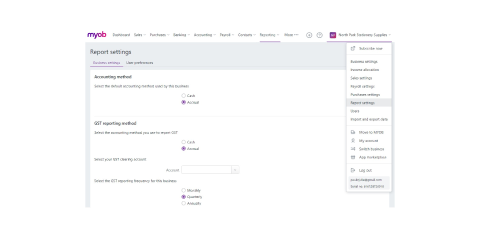

When setting up a computerised accounting system, you will need to specify your Accounting method (Cash or Accrual), GST reporting method (Cash or Accrual) and how frequently you will be reporting (Monthly, Quarterly, or Annually) as shown in this MYOB example:

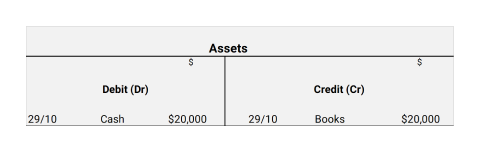

Double-entry bookkeeping system

Double-entry bookkeeping is an accounting method that keeps a company's accounts balanced and provides an accurate financial picture of a company's finances. In double-entry bookkeeping, for every debit, there must be a corresponding credit.

The double-entry method of bookkeeping records transactions based on the principle of duality; that is, for each debit entry in the ledger, there is a corresponding credit entry. It fully records the effects of every transaction in the accounts in the chart of accounts, making reconciliation possible, and agrees with Generally Accepted Accounting Principles (GAAP). It is the method most businesses adopt.

Double-entry bookkeeping relies on the accounting equation to ensure that the accounts are always balanced.

Assets = Liabilities + Equity

As a reminder:

- Assets are the resources a business owns.

- Liabilities are money owed by the business.

- The owners equity is the share the owner has on these assets.

The accounting equation is a condensed version of the balance sheet.

There is an extended version of the accounting equation that breaks down owners equity.

Assets = Liabilities + Owners Capital + Income - Expenses

- Asset accounts increase when debited and decrease when credited.

- Liabilities and equity accounts increase when credited and decrease when debited.

If an asset increases with a debit, then the credit side of the entry will either affect another asset by decreasing it or affect a liability or equity account, increasing it, keeping the assets = liabilities + equity equation in balance.5

This video provides an excellent explanation of what debits and credits are and what they are not.

This is a great takeaway from the video:

| Debits | Credits |

|---|---|

| Debits increase these balances and credits decrease them. | Credits increase these accounts and debits decrease them. |

| Dividends | Liabilities |

| Expenses | Equity |

| Assets | Revenue |

Let’s work through a few examples of how the accounting equation works in a double-entry bookkeeping system.

James invests $10,000 in his company, Tall Timbers.

This transaction will result in an:

- an increase of $10,000 in the cash asset account

- an increase of $10,000 in the owners equity capital

Tall Timbers purchase a new piece of equipment for $3,000.

This transaction will result in an:

- a decrease of $3,000 in the cash asset account

- an increase of $3,000 in the equipment asset account

Tall Timbers purchase $1,300 of supplies on credit from Nicks Nails.

This transaction will result in:

- An increase of $1,300 in the asset supplies account

- An increase of $1,300 in the liability accounts payable account

How to create a journal transaction using the double-entry system

There are three steps involved when you create a journal transaction. We will use Craig to demonstrate the steps.

Craig started a computer retail business on the 1st of March 2021. He deposited $500,000 into his business bank account.

- Identify that a business transaction has occurred. Using our example, Craig started a new business and deposited $500,000 into his business bank account. This means a new asset (cash) must be added to the accounting equation

- After identifying that an event impacting the accounting equation has occurred, the business must analyse how the event changed the accounting equation. When Craig contributed funds to start his new business, the business bank account increased and Craig's capital increased. The bank account is an asset (an increase in an asset is a debit). Craig's capital account is Owners Equity (an increase in owners equity is a credit). Each side of the accounting equation has increased by $500.000 — keeping the accounting equation balanced.

- After identifying that a transaction occurred and analysing the impact on the business, we can record the journal entry. The format of journal entries is to record the debit entry before the credit entry. Here is an example of how the journal entry would be recorded.

| Date | Account name | Debit | Credit |

|---|---|---|---|

| 1/03/2021 | Cash | 500,000 | |

| Capital - Craig | 500,000 | ||

| Capital contributed to start business by owner Craig | |||

Debits and credits

Debits and credits have the following roles in accounting systems:

| Type of Account | By Default | Increase | Decrease |

|---|---|---|---|

| Asset | Debit | Debit | Credit |

| Liability | Credit | Credit | Debit |

| Revenue | Credit | Credit | Debit |

| Expense | Debit | Debit | Credit |

| Owners Equity | Credit | Credit | Debit |

The following are some key features of debits and credits:

Debit

- Debits are always entered on the left side of the ledger

- Commonly abbreviated as Dr.

Credit

- Credits are entered on the right side of the ledger

- Commonly abbreviated as Cr.

Knowledge Check

Start with this question and then move on to the activity below.

Debits and Credits Activity

On a notepad, quickly sketch out the following table and put a checkmark in the correct column to indicate whether you would debit or credit the account to increase the balance. Check your work at the bottom of this activity.

| To increase the balance in the following accounts, would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Cash | ||

| Accounts Payable | ||

| Inventory | ||

| Telephone Charges | ||

| Drawings | ||

| Consulting Revenue | ||

Do the same thing again, but this time, the checkmarks indicate which account would be credited or debited if you were to decrease the balance in the following accounts.

| To decrease the balance in the following accounts, would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Accounts Receivable | ||

| Stock | ||

| Bank Loan | ||

| Land & Buildings | ||

| Discount Received | ||

| GST collected | ||

Check your answers here.

| Increase: Review your answers against these checkmarks | ||

|---|---|---|

| Debit | Credit | |

| Cash | ✓ | |

| Accounts Payable | ✓ | |

| Inventory | ✓ | |

| Telephone Charges | ✓ | |

| Drawings | ✓ | |

| Consulting Revenue | ✓ | |

| To decrease: Review your answers against these checkmarks | ||

|---|---|---|

| Debit | Credit | |

| Accounts Receivable | ✓ | |

| Stock | ✓ | |

| Bank Loan | ✓ | |

| Land & Buildings | ✓ | |

| Discount Received | ✓ | |

| GST collected | ✓ | |

Financial statements

Financial statements are written records that convey a company's business activities and financial performance. Financial statements are often audited by government agencies, accountants, firms, etc., to ensure accuracy and for tax, financing, or investing purposes.6

Financial statements are usually considered to be the:

- balance sheet

- income statement

- cash flow statement.

Journals

In accounting, a journal records financial transactions ordered by date. Historically, the journal was referred to as the book of original entry. The definition was coined when transactions were recorded in a journal before manually posting them to the accounts in the general ledger or subsidiary ledger.

Examples of Journals in a Manual Accounting System

- Sales and sales return journals

- Purchases and purchased returns journal

- Cash receipts journal

- Cash payment journal

- General journal

Computerised Accounting Systems

With today's computerised accounting systems, the recording and posting of most transactions will occur automatically when sales and vendor invoice information is entered, payroll is processed, etc. In other words, accounting software such as MYOB Business has eliminated the need to first record routine transactions into a journal. However, even with computerised accounting systems, it is necessary to have a general journal in which adjusting entries and unique financial transactions are recorded.7

Ledgers

Essentially, ledgers are T-accounts that are grouped. Virtually all T-accounts in a business fall under the general ledger.

A T-account refers to an account using the double-entry system and is represented visually by a graph that looks like a T to show both sides of the double-entry equation. The information gained from this view of accounts provides the information accountants use to make entries into a ledger to get an adjusting balance so that revenues equal expenses.

The main ledger is the general ledger.

There are also subsidiary (supporting) ledgers such as:

Debtors (or Receivables) Ledger: This ledger only contains T accounts for each person/business that owes money to the business (each debtor).

Creditors (or Payables) Ledger: This ledger only contains T-accounts for each person/business that the business owes money to (each creditor).

Liabilities

Liabilities are essentially debts.

The amount of liabilities represents the value of the business assets owed to others. In other words, it is the value of the assets that people outside the business can lay claim.

Examples include:

- Business loans

- Bank overdrafts

- Money owed to suppliers and vendors

The balance sheet shows the liabilities, indicating accounts with a credit balance.

Activity 1

Compare and contrast the big three Cloud-based accounting services in Australia.

- Xero

- QuickBooks

- MYOB Business (similar to MYOB Essentials, but only available in AU currently.)

Answer these questions about them:

- What features does each have?

- Are there any gaps in the features that would require you to work with more than one system to complete a task?

- Are any of the systems better suited to certain industries? Why?

- How do the cost of each compare?

- Do they have phone support? Weekends? Nights?

- How easily can you create Financial Documents?

Please use the forum to discuss your answers with your classmates.

Activity 2

Policies are important to keep everyone in the know in clear and direct language. Answer the question below about your understanding of the benefits of having Accounts Receivable policy.

MYOB Help pages used in this topic: