This unit describes the skills and knowledge required to record general journal adjustment entries and to prepare end-of-period financial reports.

It applies to individuals in various work environments who are responsible for preparing financial reports. They may be individuals providing administrative support within an enterprise or be accountable for these tasks concerning their workgroup or role.1

The principles, terms, and ideas presented will help you understand financial reporting — whether it will be practised using paper and notebooks, a few well-crafted spreadsheets, or a full-blown accounting system.

List of topics in this module

- Accounting legislative requirements

- Asset register and depreciation

- Accounts and Journals

- General journal entries for balance day adjustments

- Prepare final general ledger accounts

- Prepare end-of-period financial reports

What do reports communicate?

Accounting reports come in various formats, and all provide different information. However, they all have one thing in common: they give the reader helpful information about a business (or an aspect of the company).2

The specific stated purpose of the financial statements is to show the reader the financial position, financial performance and cash flows of a business.

| Data | Report Type |

|---|---|

| Financial position | Balance Sheet |

| Financial performance | Income/Revenue/Profit & Loss Statement |

|

Cash Flows |

Cash Flow Statement |

The following diagram summarises the link between financial statements:

Download this Excel workbook as a template for all of your financial documents. Note the tabs along the bottom for each financial document included. The document contains complicated formulas and linked cells. To ensure you don’t accidentally lose them, save this document as a blank template that you never modify, and use SAVE AS to create new documents to complete the practice exercises.

Accounting systems used by businesses

As a reminder, here are the three options bookkeepers and accountants have to organise and manage their tasks and reporting.

Manual Accounting System

Manual accounting systems are paper-based accounting systems in which journal and ledger registers, vouchers, and accounts are recorded in binders and folders, collectively called ‘books’ to store, classify, and analyse the business's financial transactions. This system is usually used by small businesses, such as sole proprietors, e.g. shopkeepers. Some small business owners choose to use Excel to create their bookkeeping system.

Computerised Accounting System

A computerised accounting system is a software program that can either be stored locally on a computer or accessed remotely through the internet. Once installed, the computerised accounting system serves as the primary tool for recording, organising, and generating reports on the business's various financial transactions.

Cloud-Based Accounting System

A cloud-based accounting system is a computerised accounting system that stores financial data in the cloud. This software is hosted on a remote server that can be accessed via the internet or other networks provided by a cloud application service provider. This unit will provide instruction on Accounting reports using the cloud-based provider, MYOB Business™.

Understanding these terms will provide the background knowledge you need to understand about reporting for accounting. Use this section as a quick refresher of those terms.

Scroll through them all, then later you can jump to the term if you need a reminder.

- Account

- Accounting equation

- Assets

- Asset Register

- Balance day adjustments

- Cash vs Accrual based accounting

- Double-entry Bookkeeping system

- Equity

- Financial statements

- Journals

- Ledgers

- Liabilities

- Trial Balance

Account

An account is the summary record of all transactions relating to a particular item in a business.

Accounting equation

The accounting equation shows us how much of the assets are owned by the owner (equity) and how much is owed to others (liabilities).

ASSETS = LIABILITIES + EQUITY

This is the equation or formula used to prepare a balance sheet. All accounting entries are derived from it.

James Hearle, an accountant from the UK, now based out of Sydney, Australia operates a YouTube channel called Accounting Stuff and does a great job of breaking down complex ideas into easier notions to understand. We'll use James's videos throughout this module to offer support for learning accounting concepts related to reporting.

Assets

Assets are possessions of the business. They are things that add value to the business and will bring benefits in some form.

Examples include:

- furniture

- machinery

- vehicles

- computers

- stationery

- cash.

According to the IFRS (International Financial Reporting Standards) definition, “an asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity. IFRS defines a number of assets with different characteristics (nature):

- Inventory

- Property

- Plant and equipment

- Intangibles

- Investment property

- Financial assets.

Financial Training Australia adds to the definition the notion of ‘current’ and ‘non-current assets’:

- Current – assets that are expected to be converted to cash within a year, such as cash, money in the bank, accounts receivable (debtors), inventory, stock, etc.

- Non-current – considered long-term, their full value won't be recognised for at least a year such as equipment, buildings, plant, vehicles, etc.

Fixed Assets

Fixed assets are non-current assets with a useful life of more than one year and appear on a company’s balance sheet as property, plant, and equipment.

Examples of Fixed Assets:

- land

- buildings and facilities

- machinery

- tools

- vehicles (company cars, trucks, forklifts, etc.)

- furniture

- computer equipment.

Asset Register

A fixed asset register is a system used to compile and hold the details of each fixed asset a business owns.

Balance day adjustments

For the double-entry accounting system, adjustments to assets and liability accounts (and corresponding revenues or expenses) are recorded to reflect the impact of accounting periods on underlying transactions. They commonly result in accruals and prepayments, depreciation and inventory adjustments.

Cash vs Accrual based accounting

Revenue and expenses can be recorded on either a cash or accrual basis and the difference between them focuses on when transactions are recorded vs occurred in real life..

With cash accounting:

- Revenue is recorded when the cash is received from the customer

- Expenses are recorded when the cash is paid

With accrual accounting:

- Revenue is recognised in the period it is which the revenue is earned

- Expenses are recognised in the period they are incurred

| June | July | |||

|---|---|---|---|---|

| Activity | Purchase parts, repair car, pay employees, receive payment for work done in June. | |||

| Accrual Basis | Revenue | $3,000.00 | Revenue | $0.00 |

| Expense | $1,800.00 | Expense | $0.00 | |

| Profit | $1200.00 | Profit | $0.00 | |

| Cash Basis | Revenue | $ - | Revenue | $3,000.00 |

| Expense | $1,800.00 | Expense | $0.00 | |

| Profit | -$1,800 | Profit | $3,000.00 | |

If you struggle with the concepts, the following two videos offer an engaging way to understand cash vs accrual. If you haven't already watched them, and you still are a bit murky about these concepts, take the time to watch them now.

We'll start with cash accounting:

And now watch this one about accrual. He certainly has a specific and strong opinion, but after watching both videos you can make up your own mind about which system is best for meeting the business goals.

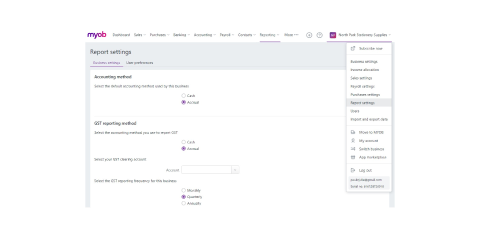

When setting up a computerised accounting system, you will need to specify your Accounting method (Cash or Accrual), GST reporting method (Cash or Accrual) and how frequently you will be reporting (Monthly, Quarterly, or Annually. This is demonstrated in the MYOB example.

Double-entry Bookkeeping system

Double-entry bookkeeping is an accounting method that keeps a company's accounts balanced and provides an accurate financial picture of a company's finances. In double-entry bookkeeping for every debit, there must be a corresponding credit.

The double-entry method of bookkeeping records transactions based on the principle of duality; that is, for each debit entry in the ledger, there is a corresponding credit entry. It fully records the effects of every transaction in the accounts in the chart of accounts, making reconciliation possible, and agrees with Generally Accepted Accounting Principles (GAAP). It is the method most businesses adopt.

Double-entry bookkeeping relies on the accounting equation to ensure that the accounts are always balanced.

Assets = Liabilities + Equity

As a reminder:

- Assets are the resources a business owns.

- Liabilities are money owed by the business.

- The owner’s equity is the share the owner has on these assets.

The accounting equation is a condensed version of the balance sheet.

There is an extended version of the accounting equation that breaks down owners equity.

Assets = Liabilities + Owners Capital + Income - Expenses

- Asset accounts increase when debited and decrease when credited.

- Liabilities and equity accounts increase when credited and decrease when debited.

If an asset increases with a debit, then the credit side of the entry will either affect another asset by decreasing it or affect a liability or equity account, increasing it, keeping the assets = liabilities + equity equation in balance.

This video provides an excellent explanation of what debits and credits are, and what they are not.

This is a great takeaway from the video:

| Debits | Credits |

|---|---|

| Debits increase these balances and credits decrease them. | Credits increase these accounts and debits decrease them. |

| Dividends | Liabilities |

| Expenses | Equity |

| Assets | Revenue |

Let’s work through a few examples of how the accounting equation works in a double-entry bookkeeping system.

James invests $10,000 in his company, Tall Timbers.

This transaction will result in an:

- an increase of $10,000 in the cash asset account

- an increase of $10,000 in the owner’s equity capital

Tall Timbers purchase a new piece of equipment for $3,000.

This transaction will result in an:

- a decrease of $3,000 in the cash asset account

- an increase of $3,000 in the equipment asset account

Tall Timbers purchase $1,300 of supplies on credit from Nicks Nails.

This transaction will result in:

- An increase of $1,300 in the asset supplies account

- An increase of $1,300 in the liability accounts payable account

How to create a journal transaction using the double-entry system

There are three steps involved when you create a journal transaction. We will use Craig to demonstrate the steps.

Craig started a computer retail business on the 1st of March 2021 He deposited $500,000 into his business bank account.

- Identify that a business transaction has occurred. Using our example, Craig started a new business and deposited $500,000 into his business bank account. This means a new asset (cash) must be added to the accounting equation

- After we have identified that an event that impacted the accounting equation has occurred the business must analyse how the event changed the accounting equation. When Craig contributed funds to start his new business, the business bank account increased and Craig's capital increased. The bank account is an asset (an increase in an asset is a debit). Craig's capital account is Owners Equity (an increase in owners equity is a credit). Each side of the accounting equation has increased by $500.000 keeping the accounting equation balanced.

- After we have identified a transaction has occurred and analysed the impact on the business we can record the journal entry. The format of journal entries is to record the debit entry before the credit entry. Here is an example of how the journal entry would be recorded.

| Date | Account name | Debit | Credit |

|---|---|---|---|

| 1/03/2021 | Cash | 500,000 | |

| Capital - Craig | 500,000 | ||

| Capital contributed to start business by owner Craig | |||

Debits and credits

Debits and credits have the following roles in accounting systems:

| Type of Account | By Default | Increase | Decrease |

|---|---|---|---|

| Asset | Debit | Debit | Credit |

| Liability | Credit | Credit | Debit |

| Revenue | Credit | Credit | Debit |

| Expense | Debit | Debit | Credit |

| Owners Equity | Credit | Credit | Debit |

The following are some key features of debits and credits:

Debit

- Debits are always entered on the left side of the ledger

- Commonly abbreviated as Dr.

Credit

- Credits are entered on the right side of the ledger

- Commonly abbreviated as Cr.

Knowledge Check

Start with this question and then move onto the activity below.

Debits and Credits Activity

On a notepad, quickly sketch out the following table and put a checkmark in the correct column to indicate if whether you would debit or credit the account to increase the balance. Check your work at the bottom of this activity.

| To increase the balance in the following accounts would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Cash | ||

| Accounts Payable | ||

| Inventory | ||

| Telephone Charges | ||

| Drawings | ||

| Consulting Revenue | ||

Do the same thing again, but this time, the checkmarks indicate which account would be credited or debited if you were to decrease the balance in the following accounts.

| To decrease the balance in the following accounts would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Accounts Receivable | ||

| Stock | ||

| Bank Loan | ||

| Land & Buildings | ||

| Discount Received | ||

| GST collected | ||

Check your answers here.

| Increase: Review your answers against these checkmarks | ||

|---|---|---|

| Debit | Credit | |

| Cash | ✓ | |

| Accounts Payable | ✓ | |

| Inventory | ✓ | |

| Telephone Charges | ✓ | |

| Drawings | ✓ | |

| Consulting Revenue | ✓ | |

| To decrease: Review your answers against these checkmarks | ||

|---|---|---|

| Debit | Credit | |

| Accounts Receivable | ✓ | |

| Stock | ✓ | |

| Bank Loan | ✓ | |

| Land & Buildings | ✓ | |

| Discount Received | ✓ | |

| GST collected | ✓ | |

Equity

Equity, or owner's equity, is the value of the owner's assets. The term is most commonly used to describe the funding of the business, which comes from shareholders — mainly represented by Contributed Equity (Share Capital), Retained Profits and Reserves. The term is also used for the business's value to the business's owner (which is the difference between the business’s assets and liabilities).

Financial statements

Financial statements are written records that convey a company's business activities and financial performance. Financial statements are often audited by government agencies, accountants, firms, etc., to ensure accuracy and for tax, financing, or investing purposes.

Financial statements consist of the:

- Balance sheet

- Income statement

- Cash flow statement.

Journals

In accounting, a journal records financial transactions ordered by date. Historically, the journal was referred to as the book of original entry. The definition was coined when transactions were recorded in a journal before manually posting them to the accounts in the general ledger or subsidiary ledger.

Examples of Journals in a Manual Accounting System

- Sales and sales return journals

- Purchases and purchased returns journal

- Cash receipts journal

- Cash paymentd journal

- General journal

Computerised Accounting Systems

With today's computerised accounting systems, the recording and posting of most transactions will occur automatically when sales and vendor invoice information is entered, payroll is processed, etc. In other words, accounting software such as MYOB Business has eliminated the need to first record routine transactions into a journal. However, even with computerised accounting systems, it is necessary to have a general journal in which adjusting entries and unique financial transactions are recorded.

Ledgers

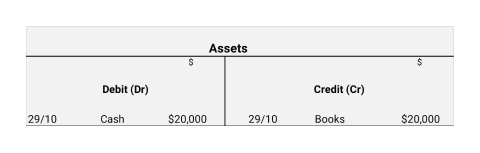

Essentially, ledgers are T-accounts that are grouped. Virtually all T-accounts in a business fall under the general ledger.

A T-account refers to an account using the double-entry system and is represented visually by a graph that looks like a T to show both sides of the double-entry equation. The information gained from this view of accounts provides the information accountants use to make entries into a ledger to get an adjusting balance so that revenues equal expenses.

The main ledger is the general ledger.

There are also subsidiary (supporting) ledgers such as:

Debtors (or Receivables) Ledger: This ledger only contains T accounts for each person/business that owes money to the business (each debtor).

Creditors (or Payables) Ledger: This ledger only contains T-accounts for each person/business that the business owes money to (each creditor).

Liabilities

Liabilities are essentially debts.

The amount of liabilities represents the value of the business assets owed to others. It is the value of the assets that people outside the business can lay claim to.

Examples include:

- Business loans

- Bank overdrafts

- Money owed to suppliers and vendors

The balance sheet shows the liabilities, indicating accounts with a credit balance.

Trial balance

A trial balance is made to root out errors before preparing financial statements. It lists the ending balance in each general ledger account and ensures the accounting equation balances — as in the business's assets are equal to the liabilities and equity.

In line with the record-keeping requirements for taxpayers, records must be kept for five years concerning:

- how you worked out your opening pool balance

- any change in how much you use the asset in your business

- any assets you dispose of.

The information on the ATO page, Record keeping for business is provided to help you understand the requirements for businesses to meet your tax, superannuation and employer obligations.

Responsibility for recording depreciation

Modern bookkeeping systems generally calculate depreciation but make sure you have chosen the right settings to apply the simplified depreciation rules. Depreciation will be discussed in further detail throughout the module.

Check out these videos to get an overview of MYOB Business and MYOB Reporting to see what an accountant does on a day-to-day basis. as well as what is expected of them come reporting time.

Video Practice:

Start with this fun video quiz about Debits and Credits that James made to provide insight into his success in passing his own Accounting exams.

MYOB Business

Accountants have a big job, and MYOB Business provides automation, security, organisation, and legislation compliance when appropriately used — with attention to detail, regular updates, and error-checking.

Day to day with MYOB - is a robust course that MYOB provides. Use it as an overview of the daily tasks of the bookkeeper or accountant.

This video tutorial describes how MYOB Business cloud-based software supports the people that keep the books and produce reports.

Now that you have a sense of the day-to-day operations of an accountant, watch this video, Reporting in MYOB Business to see how MYOB Business uses reports to help accountants fulfil legislative obligations and monitor the business's health.