Welcome to gaining customer insights within market research. In this topic, you will learn about:

- Importance of gaining both marketplace and customer insights

- Defining the marketing information system

- Steps involved within the marketing research process

- How companies utilise marketing information

- Issues faced when conducting market research

In order to create value for customers and to build meaningful relationships with them, marketers must first gain fresh, deep insights into what customers need and want, this is not an easy task as customers’ needs and buying motives are often anything but obvious.

To aid this, companies must design effective marketing information systems (MIS) that give managers the right information, in the right form, at the right time. Modern marketers have ready access to plenty of marketing information, indeed, most marketing managers are overloaded with data and often overwhelmed by it. Marketers do not need more information; they need better information, and they need to make better use of the information they already have.

Marketing information and today’s ‘big data’

The term ‘Big data’ refers to the huge and complex data sets generated by today’s sophisticated information generation, collection, storage, and analysis technologies.

Opportunities and challenges

- Companies that use big data can gain rich, timely customer insights.

- Accessing and sifting through so much data is daunting.

Marketing analytics

Marketing analytics involves tools and technologies used in making sound marketing decisions that lead to effective outcomes and return on marketing investment.

Marketing analytics requires data collection and analysis from all channels in the physical and digital arenas, including big data, over a time span.

Managing marketing information

Customer insights provide fresh understandings of customers and the marketplace derived from marketing information that become the basis for creating customer value and relationships. With this in mind, many companies are now restructuring their marketing research functions and creating customer insights teams.

See the image below which shows an example of Competitive marketing intelligence: MasterCard’s digital intelligence command centre – called the Conversation Suite – monitors, analyses and responds in real-time to millions of brand-related conversations across 56 markets and 27 languages around the world.

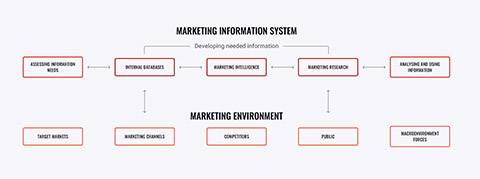

The following infographic illustrates to processes and stages within the marketing information system used by marketing managers and others who also require this information and how this links together with the marketing environment.

Marketing information needs

Marketing managers and other information users obtain customer and market insights from the marketing information system.

Questions to consider when assessing marketing information needs

- What types of decisions are you regularly called upon to make?

- What types of information do you need in order to make these decisions?

- What types of information do you regularly get?

- What types of special studies do you periodically request?

- What types of information would you like to get that you are now not getting?

- What information would you want daily, weekly, monthly, and annually?

- What magazine and trade reports would you like to see on a regular basis?

- What specific topics would you like to be get informed of?

- What types of data analysis programs would you like to see made available?

- What do you think would be the four most helpful improvements that could be made in the present marketing information system?

Developing marketing information

A sound marketing information system balances the information in regard to what the marketer would need and what they want in relation to what is feasible to offer, times at which this may be difficult would be if the MIS is systematically limited or the information simply not being available.

Let us now take a look at examples of these data sources below:

Internal data

Internal databases are electronic collections of consumer and market information obtained from data sources within the company’s network. These can provide powerful customer insights and a competitive advantage as well as providing access to data when in the field which allows salespeople to be more effective.

Competitive marketing intelligence

Competitive marketing intelligence is the systematic monitoring, collection and analysis of publicly available information about consumers, competitors and developments in the marketing environment. Companies such as LexisNexis, who provide general database services, put an incredible wealth of information at the fingertips of marketing decision-makers. This information helps marketers to gain insights into how consumers talk about and connect with their brands which provides early insights into competitor moves and strategies to prepare quick responses.

Marketing research

Marketing research is the systematic design, collection, analysis and reporting of data relevant to a specific marketing situation facing an organization which helps marketers to assess customer behaviour, market potential, market share, or to measure the effectiveness of pricing, product, distribution and promotion activities.

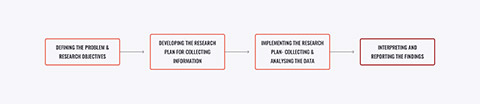

Defining the problem and research objectives

Let us now have a closer look at the stages that take place within the market research process

Let us look more into different forms of research.

Exploratory research

Marketing research used to explore and gather preliminary information that will help to define problems, and to suggest hypotheses.

Descriptive research

Marketing research used to better describe marketing problems, situations or markets.

Casual research

Marketing research used to test hypotheses about cause-and-effect relationships.

Managers often start with exploratory research and then follow later with descriptive or causal research.

Developing the research plan

Research objectives must be translated into specific information needs.

The research plan outlines:

- sources of existing data

- specific research approaches and contact methods

- sampling plans and instruments

To meet the manager’s information needs, the research plan may call for gathering primary data secondary data, or both.

- Primary data consists of information collected for the specific purpose at hand. For example, surveys, direct observations, focus group discussions, etc. to study customer preference.

- Secondary data consists of information that already exists somewhere, having been collected for another purpose. For example, information on the internet, existing market research results, information from agencies, etc. to get an initial understanding of the market.

Sources of secondary data

Company profit and loss statements, balance sheets, sales figures, sales call reports, invoices, inventory records and prior research reports.

Australian Bureau of Statistics:

e.g. Year Book Australia (Cat. No. 1301.0)

Household Expenditure Survey (Cat No.6530.0)

CDATA online from http://www.abs.gov.au

Other government departments:

e.g. Tourism Research Australia, ABARE, BTE, RIRC

Indexes: Business Periodicals Index

Business press: Australian Financial Review, Australian Business Monthly and BRW

Trade Press: AdNews, Marketing Magazine

Content Aggregation Services:

e.g. Ibis World, Datamonitor, Euromonitor

Market Research Services: e.g. AC Nielsen, Roy Morgan, AMR Quantum, Sweeney Research

Using commercial online databases, marketing researchers can conduct their own searches of secondary data sources. For example, ProQuest and LexisNexis, however, the researcher must evaluate secondary information carefully.

Criteria for evaluating secondary data

- Relevance: fits research project needs

- Accuracy: reliably collected and reported

- Currency: up-to-date enough for current decisions

- Impartiality: objectively collected and reported

Implementing the research plan, data collection and analysis

Now that we have explored the first two stages of the marketing process, let us now discuss how this information is collected and analyzed.

Primary data collection

| Research approaches | Contact methods | Sampling plan |

|---|---|---|

| Observation | Sampling unit | |

| Survey | Telephone | Sample size |

| Experiment | Personal Online | Sampling procedure |

A sample is a segment of the population selected for marketing research to represent the population as a whole. Marketing researchers use two main research instruments:

- Questionnaires

- The most common instrument

- Administered in person, by phone or online

- Include either closed-end questions or open-end questions

- Mechanical instruments

- Researchers use people meters or checkout scanners

- ‘Neuromarketing’ techniques can measure consumer involvement and emotional responses second by second

Look at the following table which illustrates the strengths and weaknesses of different contact methods

| Telephone | Personal | Online | ||

|---|---|---|---|---|

| Flexibility | Poor | Good | Excellent | Good |

| Quality of data that can be collected | Good | Fair | Excellent | Good |

| Control on interviewer effects | Excellent | Fair | Poor | Fair |

| Control of sample | Fair | Excellent | Good | Excellent |

| Speed of data collection | Poor | Excellent | Good | Excellent |

Let us look further into two of these contact methods

Personal marketing research

Individual interviewing: taking with people in their homes or offices, on the street or in shopping malls

Group interviewing: inviting a small group of people for discussion with a trained interviewer about a product, service or organisation

Focus group interviewing: the interviewer ‘focuses’ the group discussion on important issues

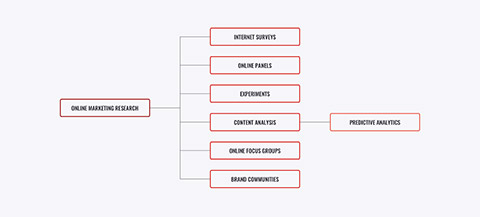

Online marketing research

The internet has had a dramatic impact on how marketing research is conducted and as a result, online research can take many forms.

Researchers are collecting primary data through online marketing research avenues such as:

- internet surveys: the use the internet or mobile technology as a survey medium. It can include a questionnaire on its website or social media sites or use email or mobile devices to invite people to answer questions.

- online panels: these can provide regular feedback or conduct live discussions or online focus groups.

- experiments: researchers can also conduct online experiments. They can experiment with different prices, headlines or product features on different websites or mobile sites or at different times, to learn the relative effectiveness of their offers. They can also set up virtual shopping environments and use them to test new products and marketing programs, or, a company can learn about the behaviour of online customers by following their clickstreams as they visit the online site and move to other sites.

- content analysis: the things that customers write about in different forms of social media can be captured and analysed by way of content analysis.

- online focus groups: internet-based survey research offers some real advantages over traditional telephone and mail approaches. By going online, researchers can quickly and easily distribute internet surveys to thousands of respondents simultaneously via email or by posting them on selected websites. Once the questionnaire is set up, there is little difference in cost between 10 respondents and 10 000 respondents on the internet, or between local or globally distant respondents. · brand communities: typically a community of individuals which has formed on the basis of an attachment to a particular product or brand (IGI Global, 2020).

Advantages of online marketing research

- Speed

- Low cost

- More interactive and engaging

- Higher response rates

- Able to reach ‘hard-to-reach’ consumers

Online behavioral targeting

This involves use of online data to target ads and offers to specific consumers which enables marketers to track consumer movements across online sites. For example, when you visit a product, the marketer may show a similar, but often more expensive, product.

The newest wave of web analytics and targeting moves from ‘behavioural targeting’ to ‘social targeting’ in which marketers track individual online social connections and conversations from social networking sites. For example, if your friend liked a brand’s page on Facebook, that brand’s products may appear on your Facebook page.

In summary, behavioural marketing involves marketers watching and analysing what consumers do online and then use the resulting insights to personalize online shopping experiences, is this sophisticated research or 'just creepy'?

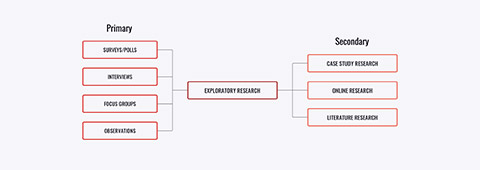

Exploratory research overview

Two main overall forms of exploratory research exist, primary and secondary, which can then be further subdivided into the individual components and each coming with pros and cons to consider.

Primary research: provides results specifically about your company and can take the form of focus groups, surveys and interviews however could become costly.

Secondary research: involves applying results of previously completed studies to your situation, often free or low cost however results are not specific to your business.

The following infographic identifies examples of each form of research.

Interpreting and reporting the findings

Let us now look through the final stage of the marketing research process in which the researcher should present relevant findings useful for managerial decision making. To do this effectively, both researchers and managers should interpret the findings jointly to tackle the problems at hand and making the best-informed decisions for the company.

Analysing and using marketing information 1

Customer relationship management

Customer relationship management (CRM) involves managing detailed information about individual customers and carefully managing customer touch points in order to maximise customer loyalty. This information integrates everything that a company’s sales, service and marketing teams know about individual customers, providing a 360-degree view of the customer relationship.

Uses and benefits of CRM

- Integrate customer information

- Database is easily interrogated

- Provide deep insights for marketing decisions

- Shopping rewards programs

- Pinpoint high-value customers and target them efficiently

- Cross-sell company’s products and services

- Create offers tailored to specific customers

International marketing research

International marketing researchers follow the same steps as domestic researchers, but often face more and different problems.

- Unavailability of good secondary data - even when available secondary data is often difficult to analyse.

- Difficulty in collecting primary data as people may not be willing to respond or not be able to respond.

Some of the largest research services firms operate on a worldwide scale. Nielsen has offices in more than 100 countries

Public policy and ethics in marketing research

As many issues of intrusion on consumer privacy and misuse of research findings are to be found around the globe, all organisations need to act responsibly in terms of the public policy and ethical issues surrounding marketing research. This includes issues of intrusions on consumer privacy and misuse of research findings with few advertisers which openly rig their research designs or blatantly misrepresent the findings.

To protect the privacy of consumers, researchers should ask only for the information they need, use it responsibly and avoid sharing information without the customer’s permission. The Australian Market and Social Research Society (AMSRS) maintains its code of practice in the light of strengthened privacy legislation and other factors.

For further information on this topic, read the following articles which discusses data breaches in further detail:

- Munro, K., 2018. The Cambridge Analytica Facebook Data Breach Explained. [online] SBS News. Retrieved 31 August 2020 from sbs.com.au

- Confessore, N. (2018). Cambridge Analytica and Facebook: The Scandal and the Fallout So Far. Retrieved 7 May 2020, fromh nytimes.com

- Roy Morgan Research

- Nielsen Research

- European Society Opinion and Market Research (ESOMAR)

- Mobile Marketing Association (MMA)

- Australian Bureau of Statistics (ABS)

- Pew Research Center

- Google Trends

Read the following article:

What is Big Data and Why is it Important?

Cambridge Analytica and Facebook: The Scandal and the Fallout So Far