Manage information

Efficient and effective information management is essential in the day-to-day operation of the financial services industry. Working in the financial services sector involves reading, understanding, analysing, checking and organising documents and reports to meet your business's and your clients' needs.

You must have systems and processes for your business and sustainable growth.

Introducing and developing systems into your small business has many benefits, including:

- Creating a consistent service for your clients

- Freeing up your time

- Allowing you to step away from being in the business and focus on working on the business – i.e. marketing, planning, strategy

- Less stress and more energy for you as a business owner when you know precisely how every process in your business operates.

- Keeping you on track to achieving your goals

- Documented processes allow you to quickly onboard new staff and train them.

Many bookkeeping businesses start as a team of one. Often, their processes are stored in their head rather than having them written down. The owner may know precisely how to sell, deliver and maintain relationships with their clients, but the business relies solely on them to succeed. With the strong demand for bookkeeping and BAS services, the business often grows quickly and requires more support and there comes a time when it is essential to have a written process on how things are done.

Anything done repeatedly or by more than one person in your business should be documented. You may have started by ‘having everything in your head’, but when you begin delegating to employees, you need to ensure that they can replicate your processes to provide the same level of service to your customers.

How to systemise your business

Firstly you should identify the areas of your business you need to systemise – i.e., sales process, marketing activities, client care, financial management etc.

Realising that you have one hundred processes to systemise in your business might seem overwhelming, so the best thing to do is to first identify the areas of business most important to systemise according to your business goals.

For example, if your main goal is to grow your business by efficiently onboarding new clients, you should focus on your client onboarding process. Ask yourself:

- What is our process for onboarding new clients?

- Do you have one?

- What does it look like?

For each area of business you want to systemise, you need to work out what you currently do first and document it. For example:

- Send a welcome email

- Ask clients to complete a new onboarding questionnaire

- Receive a signed agreement on the scope of work from the new client

- Assign a staff member to manage the new client account

- Set up the client in your project management software

- Introduce new client to an allocated staff member

- Outline the next steps with the client

- Monthly check-in call with client

Yours will be specific to your business, but this is the idea. Think of the process you take from start to finish, how you do it and record the variables. This is also a great way to identify if there are things you do that make your service unique and how you can market these to prospective clients.

Once you have documented your systems and are following them, you will see what works best for onboarding your new clients. You will be able to see areas that need improvement, such as gaps in your client care processes and potentially losing your clients. You will be able to know what you are doing well and ultimately have the basics you need to grow your business.

The most important part of having systems for your business after creating them, trialling them and tracking them is to revisit them. There is no point in creating or monitoring your processes if you do not review them to improve what you are doing.

The following video discusses how you can systemise your business.

Watch

Good automation helps humans deliver great support more effectively. It puts computers to use doing the things computers are good at repetitive tasks and analysing large amounts of data.

The majority of bookkeeping and accounting work often involves repetitive tasks that can get tedious and time-consuming. If done manually, accounting processes become more prone to human errors such as typos, miscalculations, and entry duplications.

Most accounting and bookkeeping tasks can be automated using basic technologies, such as:

- Optical character recognition (OCR): Scans and digitises physical documents like receipts and pulls numbers from them.

- Robotic process automation (RPA): Automates repetitive tasks by mimicking human actions.

Benefits of automating bookkeeping

Save time

The biggest benefit of using automation is the time it saves. Automation can cut down or completely remove the need for manual data entry. Tasks that used to take days or weeks can now be done much faster and more efficiently.

Greater productivity

Automation tools allow bookkeepers more time to focus on what really matters - helping clients improve their financial health. You can now do this more often and more effectively. For example, you can spend more time preparing your client's budgets and forecasts and provide insights on important cost areas and ways to save money.

Data accuracy

Everyone makes mistakes, even machines. However, machines make fewer small errors. Automation tools can handle thousands of entries in seconds, reducing the chance of data errors.

Visibility

Clients need to see when and where they are spending and earning money. Manually entering bills and invoices limits real-time visibility. The information might be days or weeks old because it takes time to collect and organise the data. Automation of these processes provides real-time updates, allowing clients to see their financial information instantly. This helps in making quicker and more accurate financial decisions, as the data is always current and easily accessible.

Secure file cloud storage and data retrieval

With cloud technology, every document is accessible to you since they’re stored securely in the cloud within the accounting system.

Automate Workflows in Xero

Automating repetitive tasks in Xero can lead to significant time savings and efficiency gains for bookkeepers.

Workflows in accounting refer to sequences of tasks or activities that need to be completed regularly, for example, reconciling bank transactions, processing invoices, or running payroll. Manually performing these repetitive tasks can be time-consuming for bookkeepers.

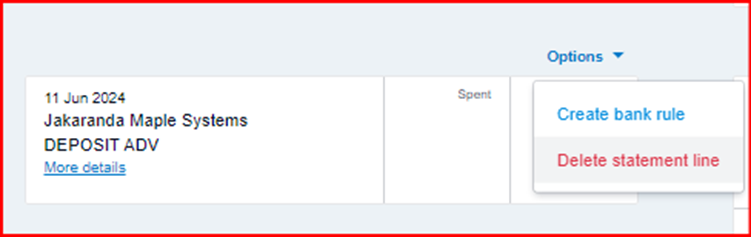

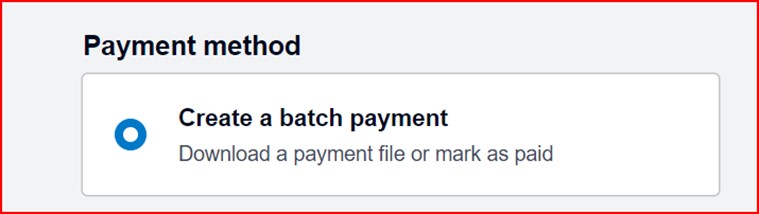

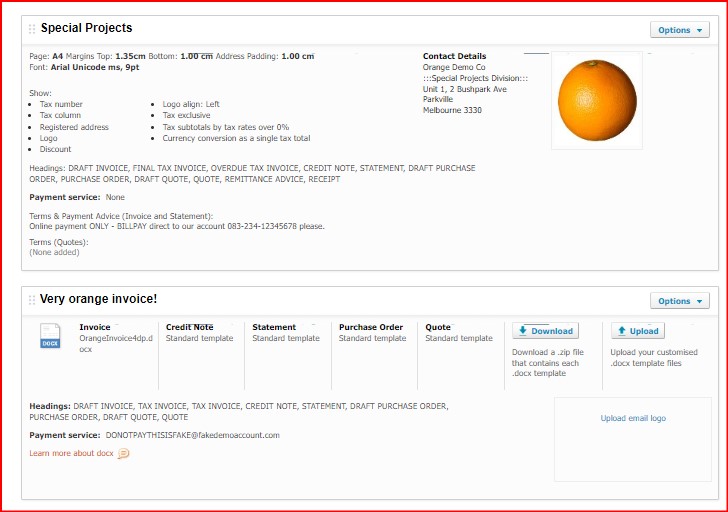

Automating these workflows in Xero allows the software to handle repetitive tasks automatically based on pre-defined rules and triggers.

Xero offers several features to help businesses automate workflows:

Businesses can also automate a wide range of processes by connecting Xero to hundreds of add-on apps available in the Xero App Marketplace.

So far in this module, we have examined various legislation and codes of practice that apply to the financial service industry. We also discussed the need to document anything done repeatedly or by more than one person in your business.

A well-drafted set of policies and procedures ensures that your company's rules, standards, values and processes are clearly outlined and documented. They provide your employees with regulations and guidelines on expected behaviours and performance standards while providing rules for the decision-making process across the business.

A policy is a guide that provides a clear and simple statement of how an organisation intends to conduct its business—for example, Internet Usage Policy.

A procedure is a series of steps that should be followed as a consistent approach to processes undertaken—Procedure: How to change a password.

Creating a policy

When creating a new policy, the following is an example of the key inclusions which need to be incorporated:

- Policy Title

Expresses the purpose and description of the policy - Basic Policy Information

Contains the policy type, responsible office, initial policy approved and current revision approval - Policy Statement and Purpose

Describes the policy's purpose, key requirements and expectations and includes reference to consequences of noncompliance, including disciplinary actions, when appropriate. It should reference any external regulations and clearly state the policy's objectives. Consider the following:- What are legal and regulatory requirements being addressed?

- What financial, operational or other needs is the policy addressing?

- What issues is the policy intending to address?

- Are there any significant conditions or restrictions?

- Are there any exclusions or special situations to address?

- What are the consequences of noncompliance?

- Who Should Know This Policy

State the primary audience – who needs to know and follow the policy? - Definitions

An alphabetical list of key terms and definitions that aid the user or reader’s understanding of the policy or procedure, for example:- New, uncommon and specialised terms.

- Terms that have different meanings in different contexts.

- Contacts

List the unit/department responsible for interpreting the policy and obtaining approval for revisions and the title/position of the person to contact to answer policy-related questions. - Policy Specifics and Procedures

Used to elaborate on the Policy Statement and Purpose section and to communicate the mandatory actions/operational processes/steps required to comply with the policy, support compliance with applicable laws and regulations, and mitigate risk. For consistency, staff must follow the same steps and process when performing a task. The procedures should:- Be listed in the order they should occur, and clearly detail who performs the procedure, what steps should be taken, and how the steps should be performed.

- Be consistent with the policy statement and related documents.

- Include implementation plans and dates for policies that require a phased implementation.

Creating a checklist can help guide you through the process of developing procedures. A sample checklist is provided for you below.

Checklist

1. Is the language simple, clear and precise? 2.Is the procedure free from misinterpretation and ambiguity? 3.Does the procedure describe what needs to be done in a logical and correct sequence? 4.Does it identify who is responsible? 5.Are time-frames included where appropriate? 6.Is the procedure relevant to the content of the policy? - Forms

List any forms applicable to the policy and the responsible officer accountable for maintaining the forms. - Related Documents

These are the documents and supplemental attachments that are critical to the development of the policy and procedures - Revision History

Lists the record of policy revisions and the date on which the modifications were approved.

CPA Australia has a resource that you can download from their website on Developing policies and procedures for your business.

Business Victoria has a free policy and procedure template that allows you to customise a suite of accounting and financial policies.

With everything you have to do in the normal course of a workday, it is easy for the policy review process to fall through the cracks. Policy review is most effective when it is done regularly and proactively, not reacting to an event.

The best way to proactively review your policies and procedures is to schedule time into your work calendar. Generally, you should review every policy between one and three years, but most policy management experts recommend that you review them annually.

Policy management software will let you set up workflows to collaborate on your policy review with your staff, gather feedback, and track approvals. It can automatically remind people to read and review policies, send signature reminders, and integrate with other software programs.

You should conduct additional policy and procedure reviews when:

- your business undergoes large-scale changes

- there are changes to laws or regulations

Questions to ask when reviewing policies and procedures.

A Customer Service Policy and Procedures outline the best practices for handling and processing positive and negative customer feedback and compiling and reporting this feedback. It assists in improving customer satisfaction and improves products and processes by encouraging complaints.

Customers will feel respected, listened to and taken seriously in organisations with customer service policies and procedures that are adhered to by all staff. When treated this way, customers are more likely to stay with their current bookkeeper.

Activity: Customer query procedure

Assume that you work in a small firm of bookkeepers. Customers are complaining that their queries are not being dealt with quick enough and, at times, feel that they are ‘fobbed off’. Create a procedure that could be used to deal with customer queries professionally and timely.

Sample Answer

Step 1: Establish a dedicated customer query handling process.

Designate a specific individual or team responsible for handling customer queries promptly. Ensure that everyone in the organisation is aware of the designated point of contact for customer queries.

Step 2: Train the customer query handling team.

Provide comprehensive training to the designated team members on effective communication skills, customer service principles, and the organisation's services. Familiarise the team with common customer queries and provide them with the necessary resources to address various types of inquiries.

Step 3: Implement a centralised query management system.

Set up a dedicated system (e.g., email, ticketing system, or customer relationship management software) to receive, track, and manage customer queries efficiently. Make sure the system allows for easy assignment, prioritisation, and monitoring of query status.

Step 4: Set clear response time targets.

Establish specific response time targets for different types of queries based on their urgency and complexity. Communicate these targets to the customers to manage their expectations.

Step 5: Acknowledge receipt of queries promptly.

As soon as a customer query is received, send an automated acknowledgment email or message to inform the customer that their query has been received. Include an estimated timeline for when they can expect a detailed response.

Step 6: Analyse and prioritise queries.

Assess the urgency and complexity of each query and prioritise them accordingly. Categorise queries based on their nature (e.g., billing, technical, general) to ensure appropriate handling.

Step 7: Thoroughly investigate and respond.

Assign queries to the appropriate team member based on their expertise and availability. Ensure that team members investigate queries thoroughly before responding, gathering all necessary information and consulting relevant resources if required.

Step 8: Provide timely and professional responses.

Respond to queries within the established response time targets. Craft personalised, clear, and concise responses that address all aspects of the customer's query. Use professional and empathetic language to ensure customers feel heard and valued.

Step 9: Review and quality control.

Establish a review process to ensure the quality and accuracy of responses. Conduct periodic assessments of the query handling team's performance and provide feedback for improvement.

Step 10: Continuous improvement.

Regularly evaluate the customer query handling process and seek feedback from both customers and the team. Identify areas for improvement and implement necessary changes to enhance the efficiency and effectiveness of the process.