Managing a successful payroll depends on the collection, storage and processing of a wide range of records and information. It may seem overwhelming but MYOB Business™ and Xero can help you to organise the payroll process and ensure that all records and requirements are accurate and up to date.

A Payroll system collects, calculates, stores, and provides information about employees' financial and non-financial compensation earned over the financial year.

A business can use a spreadsheet to track and calculate this information, but MYOB and Xero offer a more accessible and secure system to get the many tasks and activities done correctly.

The employee's hourly or salaried payroll details can be stored to record usual working hours, and a timesheet feature allows employees to submit their own hours. If their hours do not follow a consistent pattern or you pay them extras like overtime, allowances or bonuses, you can record this on their timesheets. Whether a business tracks time for employees depends on the employment contracts set up. You probably won't need to use this feature if your employees generally work fixed hours.

All things being usual, your employee's record (Salary and Wages tab) should show the correct number of hours for Base Hourly pay items considered the typical work week. The payroll administrator can record changes to that in the Hours field of the Standard Pay tab or while doing the pay run.

Timesheets

Timesheets record:

- all the hours worked by hourly employees

- extra hours worked by employees (in addition to their standard pay).

MYOB

Employees can submit their timesheets via the MYOB Team mobile app — a great way to save time and add efficiency in managing payroll tasks. Learn more about the app.

MYOB tracks time using an optional feature called Timesheets. The Timesheets feature must be switched on before it can be used.

Not all versions of MYOB Essentials have this feature. For more information about using Timesheets with the MYOB Team Mobile app to submit them, view this article at the MYOB help centre.

Xero provides time-tracking features similar to those available in MYOB, including timesheet submissions through the Xero Me mobile app. Here’s how Xero handles these features:

Xero

-

Time Tracking Feature:

- Xero uses an optional Timesheets feature that allows employees to enter their hours worked. This feature can be used to track hours for hourly-paid employees or for tracking project-based time entries.

- To enable timesheets, go to Payroll Settings and make sure the time tracking options are configured properly.

-

Xero Me Mobile App:

- Employees can submit their timesheets via the Xero Me mobile app. This app allows employees to enter work hours, request leave, and view their payslips directly from their mobile devices.

- The app is integrated with Xero’s payroll system, which means that once timesheets are submitted, managers can approve them, and they will automatically be reflected in the pay run.

-

Approval and Payroll Processing:

- Once timesheets are submitted via the app or desktop, they are sent to payroll administrators for approval.

- Approved timesheets are directly integrated into the payroll, ensuring that employees are paid based on their submitted hours.

-

Project Tracking:

- Xero also offers a Projects feature, which allows businesses to track time spent on specific tasks or projects. Employees can log their hours against projects, and the data can be used for billing or project cost management.

- Project managers can easily view timesheet data in Xero to track project hours and expenses efficiently.

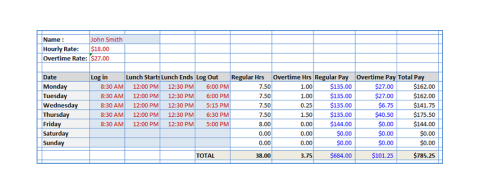

If you are attached to old-school ways of doing things or are working without a payroll system, a spreadsheet will be the next best thing. The example below shows a medium level of complexity in terms of separating overtime that has been worked and calculating gross wages. With moderate spreadsheet skills, worksheets can be created to provide data that could be inputted into a manual or computerised payment system to pay employees, store required data and create reports.

Running payroll can feel stressful, as it affects all employees simultaneously and is highly important for each recipient.

Answer these questions and see how much you already know about payday.

If you didn't do well, no worries – we'll go over everything in more detail.

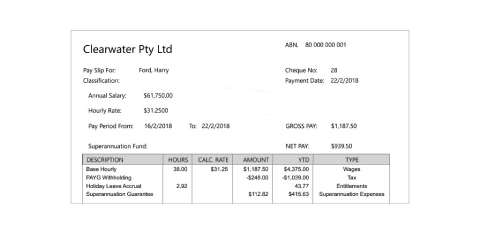

This is an example of part of a pay slip generated by MYOB Business for their example employee, Harry Ford.

The pay run is about more than just paying employees

Creating a pay run involves three activities:

- Transferring the correct amount of pay to your employees using a bank file (.ABA) uploaded to your bank for processing.

- Reporting to the ATO on or before payday

- Giving your employees their pay slips within one working day of their payday.

To minimise pay run errors and enjoy a seamless payday, ensure you have completed the following set-up tasks before starting a pay run.

- Payroll details settings: set default super fund, complete General payroll information and edit your e-mail message for sending pay slips.

- Employee records and details are current and complete.

- Bank account details have been entered for each employee.

- Pay items have been created and assigned.

- STP - Your system is connected to the ATO for Single Touch Payroll reporting.

Creating a Pay Run in MYOB:

-

Navigate to Payroll:

- Log into MYOB, and from the dashboard, click on the Payroll tab in the left-hand menu.

-

Start a New Pay Run:

- Click on Create Pay Run. You’ll need to choose the pay period you’re processing, such as weekly, fortnightly, or monthly, depending on your pay cycle.

- Select the Pay Date and the Period Start and End Dates.

-

Select Employees:

- MYOB will show a list of employees assigned to that pay period. You can select individual employees or all employees to include in the pay run.

- You can enter each employee’s hours worked (if applicable) or confirm the wages and salary details for salaried employees.

-

Review and Adjust:

- Before finalizing the pay run, review the details for each employee, such as wages, tax, superannuation, and deductions.

- If necessary, make adjustments to items like overtime, leave, or other allowances and deductions.

-

Submit Pay Run:

- Once everything is confirmed, click Record Pay. MYOB will then record the payment.

- You can either pay employees via electronic payment by preparing a bank file (ABA file) or process payment manually.

-

STP Reporting:

- After recording the pay run, MYOB will prompt you to submit the payroll data to the Australian Taxation Office (ATO) via Single Touch Payroll (STP). Submit the STP report if applicable.

Creating a Pay Run in Xero:

-

Navigate to Payroll:

- Log into Xero, and from the dashboard, click on Payroll in the left-hand menu.

-

Start a New Pay Run:

- In the payroll section, click New Pay Run.

- Choose the pay period (weekly, fortnightly, or monthly) and the Pay Date.

- Select the Period Start and End Dates for the pay run.

-

Select Employees:

- Xero will automatically select all employees set up for that pay period. You can deselect any employees not included in this pay run or adjust their pay details if needed.

-

Enter Hours and Adjustments:

- For hourly employees, enter the number of hours worked. For salaried employees, Xero will auto-calculate their salary for the period.

- You can also add any allowances, bonuses, leave taken, or deductions directly in the pay run window.

-

Review Pay Run:

- Xero will display a summary of the pay run, including wages, taxes, superannuation, and any deductions.

- Review this information carefully, and if any changes are needed, adjust the pay items accordingly.

-

Submit Pay Run:

- Once confirmed, click Post Pay Run. This records the payment.

- You can then download the payment file to upload to your bank, or pay manually.

-

STP Reporting:

- Similar to MYOB, Xero also integrates Single Touch Payroll (STP). Once the pay run is posted, Xero will prompt you to file the STP data directly with the ATO.

How to fix incorrect pays

Fixing Incorrect Pays in MYOB

-

Reverse a Pay:

- In MYOB, to correct a mistake in a pay run, you first need to reverse the incorrect pay.

- Navigate to Payroll > Transaction Journal.

- Select the incorrect pay run and click Reverse. This will create a reversal entry, nullifying the original payment. MYOB will adjust the employee’s leave balances and pay records accordingly.

-

Reprocess the Pay:

- After reversing the pay, you can process the correct payment.

- Go to Payroll > Process Payroll and run a new pay run for the employee, ensuring that all amounts, hours, and deductions are correct.

-

Correct STP Submission:

- If the incorrect pay was already submitted to the ATO via Single Touch Payroll (STP), the reversal will also reverse the submission.

- Once the correct pay is processed, MYOB will submit the updated STP report, correcting the ATO records.

Fixing Incorrect Pays in Xero

-

Void or Adjust a Pay Run:

- In Xero, you can fix an incorrect pay by either voiding the pay run or making adjustments to it.

- To void a pay run, go to Payroll > Pay Runs and find the incorrect pay run.

- Click on the pay run and select Void Pay Run to remove it from the records. After voiding, Xero will automatically adjust the employee’s pay history and balances.

-

Make Adjustments:

- If you don’t want to void the entire pay run, you can open the specific pay run and make the necessary changes (e.g., hours worked, salary, deductions).

- Xero allows you to adjust pay items directly from the pay run window.

-

STP Adjustments:

- If the pay run has already been reported to the ATO via STP, you will need to correct the STP submission after making the adjustments.

- Once the incorrect pay has been voided or corrected, Xero will prompt you to resubmit the updated STP data to the ATO.

How changing a pay affects STP

With STP, employees' year-to-date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, it will be updated with the ATO the next time a pay run is completed.

How to delete a payroll electronic payment transaction

Deleting a Payroll Electronic Payment Transaction in MYOB:

-

Go to the Electronic Payments Section:

- In MYOB, navigate to the Banking menu, and then select Prepare Electronic Payments.

-

Locate the Transaction:

- Find the payroll electronic payment transaction that you want to delete. This section lists all payroll transactions that have been processed but not yet paid.

-

Delete the Payment:

- Select the transaction and click Delete. This will remove the payment from the electronic payments section, but the original payroll transaction will remain in the employee’s pay history.

- If the payment has already been included in an ABA file and uploaded to the bank, you’ll need to reverse the payroll transaction instead.

-

Reverse the Payroll Transaction (If Needed):

- If the electronic payment has already been processed by your bank, you cannot delete the transaction in MYOB. Instead, go to Payroll > Transaction Journal, locate the payroll transaction, and reverse it. This will update both the payroll record and electronic payments.

-

Resubmit Payments:

- After deleting or reversing the incorrect transaction, you can reprocess the payroll or electronic payments as needed.

Deleting a Payroll Electronic Payment Transaction in Xero:

-

Go to the Bank Account:

- In Xero, go to Accounting > Bank Accounts and select the bank account where the electronic payment was recorded.

-

Find the Transaction:

- Locate the payroll electronic payment transaction in the bank account transaction list.

-

Delete or Remove the Payment:

- Click on the payment transaction to open it.

- In the transaction window, click the Options button and choose Remove & Redo. This will delete the payment and allow you to reprocess the transaction, but the payroll record will remain intact.

-

Update the Payroll Record (If Needed):

- If the electronic payment has already been processed by the bank, you'll need to void the original pay run or make adjustments instead of deleting the electronic payment.

-

Reconcile Transactions:

- After deleting or adjusting the transaction, ensure your bank reconciliation is updated correctly by either processing the correct payroll or electronic payment.

When an employee leaves the business, several things must be done to manage the change. All of the activities at this point involve paying the employee’s final wages and salary and paying out their annual leave balances. It is advisable to make two separate payments for those items to keep communication clear about what has been paid and why. An Early Termination Payment (ETP) may also be required, which would be the third payment.

Depending on the employee's workplace agreement and their reason for leaving, there may also be other payments you'll need to finalise, such as:

- unused long service leave

- redundancy

A note about Rules, tax and other complexities

Final pays can get complicated, and no two are exactly the same, so we recommend consulting with an accounting advisor about the specifics of a final pay. To learn about tax on final pays, see this ATO information. For the rules, calculators and other final pay resources, check the Fair Work website.

MYOB

-

Prepare for Final Pay:

- In MYOB, start by checking the employee's leave balances, entitlements, and any outstanding amounts (such as unpaid wages, bonuses, or deductions).

- Go to Payroll > Employees and review the employee’s details, including leave entitlements (Annual Leave, Long Service Leave, etc.).

-

Process Final Pay:

- In the Payroll section, click on Process Payroll and select the employee who is being terminated.

- Adjust the pay for the final pay run by including:

- Any accrued Annual Leave or Long Service Leave.

- Any unused entitlements or termination benefits (e.g., redundancy payments or notice pay).

- To ensure that leave is paid out correctly, go to the Entitlements section in the pay run and enter the correct leave payout amounts.

-

Termination Date:

- Once the final pay run is processed, record the employee’s termination date.

- Go to Payroll > Employees, select the employee, and enter their termination date in the Employment Details section.

-

Submit STP Finalization:

- After processing the final pay, ensure the termination is reported to the ATO via Single Touch Payroll (STP).

- In the Payroll Reporting Centre, submit the STP report for the final pay. Mark the employee as finalized for the financial year to notify the ATO that they won’t receive any further payment.

Xero

-

Prepare the Final Pay:

- In Xero, go to Payroll > Employees and review the employee’s leave balances and any outstanding payments.

- Ensure you calculate any accrued leave (Annual Leave, Personal Leave) and include any termination payments (e.g., redundancy, payment in lieu of notice, etc.).

-

Process Final Pay Run:

- Go to Payroll > Pay Runs and create a new pay run for the employee.

- Adjust the pay to account for the final payment, including:

- Accrued leave payouts.

- Any additional benefits or deductions related to the termination.

-

Record Termination:

- In the employee’s profile, go to Employment and enter the termination date.

- This will officially mark the employee as terminated and prevent them from being included in future pay runs.

-

STP Reporting:

- After processing the final pay, Xero will prompt you to update Single Touch Payroll (STP).

- Go to Payroll > Single Touch Payroll and submit the final STP report, marking the employee as finalized for the financial year. This tells the ATO that the employee’s payments for the year are complete.

Prevent super from accruing on unused leave payments

In MYOB:

-

Access Payroll Categories:

- In MYOB, go to the Payroll section and click on Payroll Categories.

-

Edit the Leave Category:

- Go to Wages in Payroll Categories and find the wage category used for unused leave (e.g., Unused Annual Leave or Unused Long Service Leave).

-

Unlink Superannuation:

- Click on the wage category, and in the settings for that wage item, there will be an option to set whether superannuation accrues on this payment.

- Untick the option that says Include in Superannuation Calculations. This will ensure that super is not calculated on any unused leave payouts.

-

Save Changes:

- Once the change is made, save the settings. Now, when you process final or termination pays with unused leave, superannuation will not accrue on those amounts.

In Xero:

-

Access Pay Items:

- Go to Payroll > Pay Items in Xero.

-

Edit Unused Leave Pay Items:

- In the Earnings section of Pay Items, find the unused leave pay item (e.g., Unused Annual Leave).

-

Modify Superannuation Settings:

- Open the unused leave pay item and ensure that the option Exclude from Superannuation Guarantee Calculations is ticked. This setting ensures that the pay item will not accrue superannuation.

-

Save Changes:

- Save your changes. Now, when unused leave payments are made, super will not accrue on these payments.

Deactivate Employees

MYOB

-

Go to the Employees Section:

- In MYOB, navigate to Payroll > Employees.

-

Select the Employee:

- Find and select the employee you wish to deactivate from the employee list.

-

Terminate the Employee:

- In the employee’s record, click on the Employment Details tab.

- Enter a termination date in the Termination Date field. This action will stop the employee from being included in future pay runs.

-

Mark as Inactive:

- Once a termination date is set, the employee is effectively inactive. MYOB removes them from future pay runs but keeps their record for compliance and reporting purposes.

Xero

-

Go to Payroll Settings:

- In Xero, navigate to Payroll > Employees.

-

Select the Employee:

- Find and click on the employee that needs to be deactivated.

-

Terminate Employment:

- In the employee’s profile, go to the Employment section.

- Scroll down to the End Date or Termination Date field and enter the employee’s final day of employment.

- Once the end date is entered, the employee will no longer appear in future pay runs.

-

Deactivate the Employee:

- After entering the termination date, the employee is considered inactive in Xero. They will remain in the system for record-keeping, but they won't be included in future payrolls.

Creating the ETP taxable and non-taxable earning

MYOB

-

Go to Payroll Categories:

- In MYOB, navigate to Payroll > Payroll Categories.

-

Create New ETP Wage Categories:

- Under the Wages tab, click New to create a new wage category for ETP - Taxable and another one for ETP - Non-Taxable.

-

Set Up ETP Taxable Earnings:

- Name the wage category ETP Taxable Component.

- Select the correct ATO Reporting Category (which is usually “ETP – Taxable Component”).

- Define how it will be calculated (either as a fixed amount or percentage).

- Link the wage category to the correct accounts (such as wage expense and super liability).

-

Set Up ETP Non-Taxable Earnings:

- Create another wage category and name it ETP Non-Taxable Component.

- In the ATO Reporting Category, select ETP - Tax Free Component.

- Set up the payment calculation and link it to the appropriate accounts, similar to the taxable category.

-

Assign to Employees:

- Once the wage categories are created, assign the relevant ETP categories to the employee being terminated through their Payroll Details.

-

Process the Final Pay:

- When processing the final pay, include both the ETP Taxable and ETP Non-Taxable components to ensure the correct amounts are paid and reported.

-

STP Reporting:

- MYOB will automatically report these amounts to the ATO via Single Touch Payroll (STP) when you finalize the pay run.

Xero

-

Go to Pay Items:

- In Xero, navigate to Payroll > Pay Items.

-

Create ETP Taxable Earnings:

- Under the Earnings section, click Add to create a new pay item.

- Name the item ETP - Taxable Component and select ETP - Taxable Component as the ATO Reporting Category.

- Define whether it’s a fixed amount or calculated based on a percentage.

-

Create ETP Non-Taxable Earnings:

- Similarly, create another pay item named ETP - Non-Taxable Component.

- Choose ETP - Tax Free Component as the ATO Reporting Category and set up the calculation method.

-

Assign to Employee:

- When you’re preparing the employee’s final pay, add both the ETP Taxable and ETP Non-Taxable components under their pay template.

-

STP Reporting:

- Xero will include these amounts in the STP submission to the ATO during the pay run finalization.

Creating the ETP tax-withheld deduction

MYOB

-

Go to Payroll Categories:

- In MYOB, navigate to Payroll > Payroll Categories.

-

Create a New Deduction:

- Under the Deductions tab, click New to create a new deduction category for ETP Tax Withheld.

-

Configure the Deduction:

- Name the deduction category ETP Tax Withheld.

- Set the calculation basis as a percentage or fixed amount based on the tax that should be withheld from the ETP.

- For example, you can calculate the tax rate based on ATO ETP tax withholding rates, depending on whether the employee’s ETP is within or above the tax-free threshold.

-

Link to Liability Account:

- Link the deduction to the appropriate liability account where tax withheld amounts are tracked.

-

Assign to Employee:

- When processing a termination payment, assign the ETP Tax Withheld deduction to the employee’s pay run to ensure the correct tax is withheld.

-

STP Reporting:

- MYOB will automatically report this deduction to the ATO via Single Touch Payroll (STP) along with the ETP components.

Xero

-

Go to Pay Items:

- In Xero, navigate to Payroll > Pay Items.

-

Create a Deduction for ETP Tax:

- Under the Deductions section, click Add to create a new deduction pay item.

-

Configure Deduction Settings:

- Name the deduction ETP Tax Withheld.

- Set the deduction as a Fixed Amount or Percentage based on the required withholding rate for the employee’s ETP.

- Use the appropriate tax withholding rates as per ATO guidelines, depending on whether the ETP is within the tax-free threshold or above.

-

Link to Employee’s Pay:

- When processing the employee’s final pay run, apply the ETP Tax Withheld deduction to ensure the correct tax is withheld.

-

STP Reporting:

- Xero will automatically report this deduction to the ATO through Single Touch Payroll (STP) along with the ETP earnings components.

Superannuation on ETPs

Generally, ETPs don't attract superannuation, but this will depend on the ETP you're paying. To get clarification, check with your accounting advisor or speak to the ATO. The ATO also has a page showing a List of payments that are ordinary time earnings.

If an ETP does not attract superannuation, you'll need to prevent super from calculating on the ETP pay items you've just created.

Prevent Superannuation from Calculating on an ETP in MYOB:

-

Access Payroll Categories:

- Go to Payroll > Payroll Categories.

-

Edit or Create ETP Wage Category:

- Under the Wages section, locate the wage category for the ETP payment (or create a new one if needed).

- For example, if you have categories such as ETP Taxable Component or ETP Tax-Free Component, select those.

-

Unlink Superannuation from ETP:

- Open the wage category and ensure that the option Include in Superannuation Calculations is unticked.

- This will prevent superannuation from calculating on the ETP payment when processing it.

-

Save and Apply:

- Once you've made the changes, save the category. Super will no longer be calculated on this wage type when the ETP is processed.

Process an ETP in MYOB:

-

Prepare Final Pay:

- Start a pay run for the terminating employee by going to Payroll > Process Payroll.

- Select the employee and set the termination date in their Employee Card.

-

Add ETP Components:

- In the pay run, select the appropriate ETP Wage Categories (e.g., ETP Taxable, ETP Tax-Free). Ensure that all applicable components such as accrued leave, redundancy pay, and other entitlements are included.

-

Check Tax Withheld:

- Make sure the correct ETP tax-withheld deduction is applied. ETP payments are subject to different tax rates depending on the employee's age and the amount of the payment, so ensure the tax is calculated accurately.

-

Process and Submit:

- Finalize the pay run and ensure the STP report is correctly submitted to the ATO, marking it as the employee’s final payment.

Prevent Superannuation from Calculating on an ETP in Xero:

-

Go to Pay Items:

- In Xero, go to Payroll > Pay Items.

-

Edit ETP Pay Items:

- Under the Earnings section, find the pay item for ETP payments (e.g., ETP Taxable or ETP Tax-Free).

-

Exclude Superannuation:

- Open the ETP pay item and ensure the box for Exclude from Superannuation Guarantee Calculations is ticked.

- This ensures that no super is calculated on these payments.

-

Save and Apply:

- Once the changes are saved, the super won’t be calculated on ETP payments during the pay run.

Process an ETP in Xero:

-

Prepare Final Pay:

- In Xero, go to Payroll > Pay Runs and create a new pay run for the terminating employee.

- Make sure their termination date is set in the employee’s profile under the Employment tab.

-

Add ETP Components:

- In the pay run, add the ETP Taxable and ETP Non-Taxable components using the appropriate pay items.

- Ensure any applicable tax and unused leave are included as part of the final payment.

-

Check ETP Tax Withholding:

- Ensure the correct ETP tax-withheld deduction is applied based on the ATO’s guidelines for ETP payments. Xero allows you to adjust the tax component as needed.

-

Finalize the Pay Run and Submit STP:

- Complete the pay run and submit the final payment via STP to the ATO, marking it as the final payment for that employee.

Some reporting is done at the end of every pay period or month. The ATO uses the financial year for Payroll Reporting.

End-of-year Payroll Reporting

In years past, you may have heard this was a complicated activity, but using Single Touch Payroll with MYOB or Xero makes this task easy and quick, as long as you have maintained a clean payroll system by rooting out and fixing errors as they occur.

Essentially, the ATA wants to know how much you have paid each employee over the financial year period of July 1 of the previous year to June 30 of the current year. Each time your pay run goes through the STP process, year-to-date payment totals are included, so for the most part, this task has already been completed. Employees can go to their MyGov account to see their total pay at any time throughout the year.

You now need to let the ATA know there won't be any more payments from the business before the end of the year, which is called finalising. Once that is done, employees have the right to prefill and lodge their tax returns at myGov.

You may have heard of the terms PAYG Payment summaries and EMPDUPE files, but those administrative tasks have been replaced with end-of-year reporting that happens automatically using STP. Payment summaries do provide the business with useful information, but are not required at the end of the payroll year.

Important Dates

- Determining when to finalise is based on the payment date.

- Pay date prior to and including June 30 →Include payment in current year.

- Pay date after July 1 → Do not include this pay until next year.

- Before 30 June: Pay Superannuation Guarantee Contributions (SGC) so that the payments are received by 30 June to qualify for a tax deduction.

- Before 14 July: Finalise payroll information to keep your employees and the ATO happy.

If an employee leaves the business during the year, you can finalise their payroll information at any time. Just make sure it's done before 14 July. - Extension: A business may apply for an extended date directly with the ATO.

Before you finalise

There are a few tasks that need your attention before you finalise your payroll with Single Touch Payroll (STP). Getting them done will mean a smoother end of the payroll year.

- Finish entering all of your pays for June.

- Fix any incorrect pays by:

- adjusting the employee's next pay, or

- recording a separate pay for the adjustment, or

- delete or reverse the pay and start again.

- Check that all pay runs sent during the payroll year have been accepted by the ATO.

- Ensure you have already notified the ATO of any terminated employees within Single Touch Payroll reporting.

- Check the Year-to-Date (YTD) verification report to ensure that reported totals for all employees for this payroll year are correct.

Checking the YTD Verification Report in MYOB:

-

Go to Payroll Reporting:

- In MYOB, navigate to Payroll > Payroll Reporting Centre.

- This section houses all your payroll reporting data, including Single Touch Payroll (STP) submissions.

-

Select YTD Verification:

- Once in the Payroll Reporting Centre, click on the EOFY Finalisation tab.

- Here, you’ll see the Year-to-Date (YTD) verification report. This report shows the total gross payments, tax withheld, superannuation, and other payroll-related amounts submitted to the ATO via STP.

-

Review YTD Totals:

- Review the totals for each employee and cross-check them with your payroll records to ensure that all amounts are accurate.

- If any discrepancies are found, you can make adjustments before completing the finalisation process for the financial year.

-

Generate and Download:

- You can download the YTD verification report for further analysis or as a record of the year-to-date payroll totals.

-

EOFY Finalization:

- If the YTD totals are accurate, you can proceed with finalising the STP for the year and submit the final report to the ATO.

Checking the YTD Verification Report in Xero:

-

Go to Payroll Reports:

- In Xero, navigate to Payroll > Single Touch Payroll.

-

View YTD Report:

- From the STP section, select the EOFY Report or YTD Verification Report.

- The report will display the year-to-date totals for gross wages, PAYG tax withheld, and superannuation for all employees.

-

Verify the YTD Data:

- Review the totals against your payroll data to ensure accuracy. You can compare these figures with the employees’ payroll summaries to identify any discrepancies.

- If adjustments are needed, you can update the pay records before finalising the report.

-

Download the Report:

- Xero allows you to download the YTD report as a PDF or CSV file for further review or record-keeping.

-

EOFY Finalisation:

- After verifying the YTD data, proceed with EOFY finalisation in Xero by submitting the final STP report to the ATO.

What to do if the YTD verification report is incorrect

- The culprit is often ATO reporting categories

- Make sure all payroll categories have been assigned the correct ATO reporting category.

- If you make changes to the ATO reporting categories, remember to process a 0$ pay to update your STP details for the affected employee.

What gets reported when

Reported with pay runs

- Gross payment - this amount is reduced by any salary sacrifice amounts and pre-tax deductions or wages

- PAYG withholding

- Superannuation Guarantee Contributions (SGC)

- Reportable Employer Superannuation Contributions (RESC)

- Employment Termination Payments (ETP)

Reported at finalisation

- Reportable Fringe Benefits Amounts (RFBA)

- RFBA that is exempt from Fringe Benefits Tax under section 57A

Find out more about RFBA from the ATO: Fringe benefits tax - ATO guide for employers.

Changing a pay after finalising Single Touch Payroll

Changing a Pay After Finalising STP in MYOB

-

Reverse the Incorrect Pay:

- In MYOB, you cannot directly amend an incorrect pay after submitting the STP report. Instead, you need to reverse the pay.

- Navigate to Payroll > Transaction Journal, find the pay that needs correction, and click Reverse. This creates a reversing entry that nullifies the original pay.

-

Process the Correct Pay:

- After reversing the incorrect pay, go to Payroll > Process Payroll and enter the correct pay details.

- Process the corrected payroll as you normally would.

-

Update STP:

- Once you’ve processed the correct pay, go to the Payroll Reporting Centre and review your STP submissions.

- MYOB automatically includes the corrected pay in your next STP submission, so the ATO will be updated with the correct information in the next report.

-

Finalisation Check:

- If the error was made during the EOFY finalisation, you may need to resubmit the finalization report for that employee, making sure corrected data is included.

Changing a Pay After Finalising STP in Xero

-

Void or Reverse the Pay Run:

- In Xero, if a pay run has been finalised and reported via STP, you cannot amend it directly. You will need to either void or reverse the pay.

- Go to Payroll > Pay Runs, find the relevant pay run and select the option to Void Pay Run. This will undo the pay run and remove it from the payroll history.

-

Reprocess the Pay:

- After voiding or reversing the pay run, create a new pay run with the correct details.

- Adjust the pay items as needed to ensure the finalisation of the employee’s wages, taxes, and superannuation contributions are accurate.

-

Update STP Submission:

- Once you process the correct pay, Xero will automatically update the STP submission.

- Go to Payroll > Single Touch Payroll to ensure that the next submission includes the corrected pay run data. Xero will submit the updated information to the ATO automatically.

-

Resubmit EOFY Finalization (If Applicable):

- If the error occurred during an EOFY finalisation, navigate to Payroll > Single Touch Paroll, and submit the corrected year-end finalisation for the employee. Ensure the correct data is included in the final submission to the ATO.

Key Points:

- MYOB and Xero require you to reverse or void incorrect pay runs rather than amending them directly after STP submission.

- Both systems will automatically update the STP submission in the next report once the correction is made.

- If the error occurs during EOFY finalisation, you'll need to resubmit the finalization report after making corrections

Business Activity Statements (BAS) - An Overview

All businesses that have employees and/or are registered for GST need to lodge a BAS. The completed form provides information to the government about tax liabilities so if that expense has not been planned for, this time of year can bring with it some stress.

Any anxiety associated with BAS time can be more easily managed when you fully understand what activity statements are, when and if they need to be lodged and when they need to be paid by. If you have a system in place that prepares you for BAS time, the “red tape” process can actually be positive for you and your business.

What are activity statements?

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time.

There are two types of activity statements:

- an instalment activity statement (IAS)

- a business activity statement (BAS).

What is an Instalment Activity Statement (IAS)?

The IAS is the simpler of the two forms and is only issued quarterly.

On the IAS, the ATO tells you what your GST instalment amount is and where applicable what your PAYG instalment amount is.

If you are using MYOB, there is no need to print any reports or make any calculations. However, there certainly are benefits if you can accurately calculate your liability which will be explained in more detail shortly.

If the ATO considers you to be eligible for the IAS system, you will have the option to take advantage of this easier method on your September BAS — the first BAS of the financial year. If you elect this option, for each of the next three quarters you will simply be sent an amount that needs to be paid to the ATO.

Instalment activity statement (IAS):

A form similar to the BAS but without GST and some other taxes. Businesses that are not registered for GST, and individuals who are required to pay PAYG instalments or PAYG withholding (such as self-funded retirees), use this form to pay PAYG.

If you feel the instalments advised are too much or not enough to cover your liabilities, you may be able to vary the amounts. Alternatively, you may be in a position to wait until the end of the year and pay in one lump. In these situations, any adjustments for GST will be calculated when your annual GST return is lodged and any adjustments on PAYG will result in an amount payable or refundable when your income tax return is lodged.

If you’re paying the amount shown on the form, you do not need to physically lodge anything with the ATO. However, if you wish to vary the amount shown, you will need to lodge the form by the due date.

| Quarter | Due date |

|---|---|

| July – September | 28 October |

| October – December | 28 February |

| January – March | 28 April |

| April – June | 28 July |

What is a Business Activity Statement (BAS)?

Business Activity Statement (BAS) is a government form that all businesses must lodge to the Australian Tax Office (ATO). Like the IAS, it’s a summary of all the business taxes you have paid or will pay to the government during a specific period.

Most Australian businesses will lodge their BAS monthly, quarterly or annually.

What to include in a BAS

A BAS involves a bit more detail. They can include some or all of the following payments.

- Goods and services tax (GST)*

- Pay as you go (PAYG) income tax instalment*

- Pay as you go (PAYG) tax withheld

- Fringe benefits tax (FBT) instalment

- Luxury car tax (LCT)

- Wine equalisation tax (WET)

- Fuel tax credits

*Only those marked by an asterisk are included on the IAS.

BAS are issued by the ATO either monthly or quarterly. A form needs to be lodged with the ATO and payment made to the ATO by the due dates as follows:

- For monthly BAS: within 21 days of the end of the month on the form

- For quarterly BAS: as above for IAS.

BAS form examples

Download this example BAS and review the fields required. You will need to submit the PAYG withholding and instalments.

Download this BAS form for businesses that pay Fringe benefits (FBT) instalments. View instructions for completing each of the fields in this form.

Each business needs the BAS form that matches their financial requirements. This page indicates which form is required depending on what the business needs to report.

Fringe Benefit Tax (FBT)

The ATO does not notify employers of how much FBT is due. Each employer must calculate their FBT liability every FBT year (which runs from 1 April to 31 March). The FBT rate may vary from year to year.

The ATO provides instructions on how to lodge an FBT return. If a business has paid FBT of $3,000 or more for the previous FBT year it must make FTB instalment payments on BAS and complete the specific fields relating to FBT. These were published for the 2022 financial year.

This website will help you calculate your Fringe Benefit Tax amount.

| Step | Instruction |

|---|---|

| 1 | Determine what type of fringe benefits you provide. |

| 2 | Work out the taxable value of each fringe benefit you provide to each employee. The rules for calculating the taxable value of a fringe benefit vary according to the type of benefit. |

| 3 | Work out the total taxable value of all the fringe benefits you provide for which you can claim a GST credit. |

| 4 | Work out the total taxable value of all those benefits for which you cannot claim a GST credit, for example, supplies you made that were either GST free or input taxed. |

| 5 |

Work out the grossed-up taxable value of the benefits by multiplying the total taxable value of all the fringe benefits you can claim a GST credit for (from step 3) by the type 1 (higher) gross-up rate. 'Grossing-up' means increasing the taxable value of benefits you provide to reflect the gross salary employees would have to earn at the highest marginal tax rate (including Medicare levy) to buy the benefits after paying tax. |

| 6 | Work out the grossed-up taxable amount by multiplying the total taxable value of all the fringe benefits you cannot claim a GST credit for (from step 4) by the type 2 (lower) gross-up rate. |

| 7 | Add the grossed-up amounts from steps 5 and 6. This is your total fringe benefits taxable amount. |

| 8 | Multiply the total fringe benefits taxable amount (from step 7) by the FBT rate to get the total FBT amount you are liable to pay. |

How do IAS and BAS help your business?

IASs and BASs can help you keep an eye on your business finances.

Since you need to track your income and expenses to be able to calculate your GST and other liabilities on your BAS, it makes sense to stay on top of it and track it consistently.

Waiting until the end of the quarter turns it into a much bigger job than it needs to be. It also means that there would be only four occasions yearly to make observations or small adjustments – such as setting aside the correct amount of money for the payment.

How to prepare and lodge your BAS

- Get everything up to date

Make sure that the system you are using is up to date. If that's MYOB, make sure all information is up to date and all bank feeds (if you use them) are imported, allocated and bank reconciliations done. - Print off your report

At the end of the week or month, print off the reports you'll need to prepare your BAS. Now you have an estimate of what you would have to pay should your BAS be due right now. - Check your bank balance

Ideally, you should have enough money in your business bank account to cover it. (This account could also be used to set aside employee obligations such as superannuation guarantee.) - Lodge online or via tax agent

You can lodge your BAS online through MyGov or through a registered tax agent. If you have an accountant or bookkeeper, this is a task that they can take care of for you.

READ: Top 10 common GST mistakes in BAS reports you’re probably making.

How to use MYOB to lodge a BAS

The help centre at MYOB provides detailed instructions on how to prepare and lodge your BAS or IAS.

Routine reports

The frequency and types of reports needed to monitor payroll activity, and ensure the payroll transaction history matches what actually happened, will be different for every business and depends on how often they report to the ATO and pay Super Guarantee. Diligence around reporting and reconciling differences will ensure that problems don't compound at the end of the year. Performing these reporting tasks in accordance with a solid Payroll Policy will ensure your business stays in compliance with legislative and management deadlines.

Routine reports for reconciliation

| Report Name | Frequency | Depending on... | Purpose |

|---|---|---|---|

| Payroll summary | Weekly, Fortnightly, or Monthly | pay frequency. | Summarised view of Payroll activities. |

| Payroll activity | Weekly, Fortnightly, or Monthly | pay frequency. | Detailed view of Payroll activities. |

| Payroll pay item transactions | Monthly or Quarterly | whether they report monthly (IAS) or quarterly (BAS) to the ATO. | Monitoring pay items to prevent errors from compounding. |

| Accrual by fund (detail) | Monthly, Quarterly, or Yearly | whether they pay Superannuation Guarantee monthly or quarterly. |

Monitoring and reporting superannuation contributions. |