In this topic, we focus on the financial aspects of setting up and running your own business, along with the financial obligation of employees. You will learn:

- The difference between income and expenses along with how to calculate these

- Determining and preparing for income tax payments

- Understanding provisional tax

- Claiming for home office and related expenses

- The requirements of financial record keeping.

Terminology and vocabulary reference guide

As an allied health professional, you need to be familiar with terms associated with basic exercise principles and use the terms correctly (and confidently) with clients, your colleagues, and other allied health professionals. You will be introduced to many terms and definitions. Add any unfamiliar terms to your own vocabulary reference guide.

Activities

There are several practical activities in the topic and an end of topic automated quiz. These are not part of your assessment but will provide practical experience that will help you in your work and help you prepare for your formal assessment.

When tackling finances in a business, it is important to have a clear understanding of the terms involved. Business income refers to the amount of money that is gained over a period of time. This is determined by and initially reflected in the gross sales (income received before any expenses or taxes are calculated) that are made. However, be careful to not think of this as the profit the business is making as this does not yet take into consideration deductions such as taxes and expenses which has occurred within the business.

Some key areas that are essential focuses of the business finances include.

Income sources

- Business expenses

- Personal expenses.

Let us have a closer look at these paying, close attention to some examples.

Income sources

It is good to get in the frame of mind in knowing what types of expenses the business will incur to ensure you are making sufficient income to cover these expenses, in order to earn an honest salary. Some common business expenses in the fitness industry may include the following:

- Gym rent

- Marketing/website

- Accident compensation levies

- Phone expenses

- Registration of Exercise Professionals/insurance

- Entertainment

- General travel

- Achieving/maintaining CPD points

- Upskilling travel and accommodation

- Uniform.

Personal expenses

Other than general business expenses, there are a few personal expenses you may need to also take into account. Check with your accountant if some of these may be tax-deductible.

Here are a few examples of personal expenses:

- Travel and petrol

- Meals

- Clothing such as gym bra, gym shorts/pants and shoes (to name a few)

- Gym equipment.

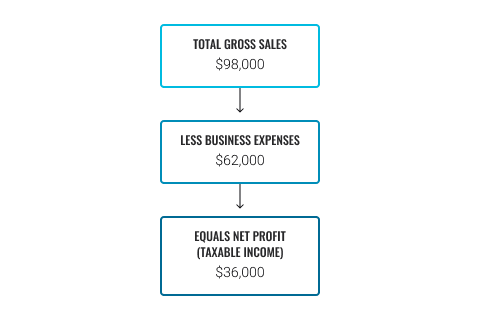

There is a percentage of tax that needs to be paid depending on the income you are making in the business for the year, with the percentage gradually increasing as your income increases. The following illustration demonstrates how to calculate the net profit, note this is the portion in which income tax will be assessed, known as the taxable income.

At the end of a financial year, anyone who is self-employed or earning an income from a business will be required to complete a tax return (IR3), this does not apply to those who are employees.

You can use the New Zealand tax rates mentioned in the following table to guide you to which tax rate applies to you.

| Taxable income | Tax rate |

|---|---|

| $0 - $14,000 | 10.5% |

| $14,001 - $48,000 | 17.5% |

| $48,001 - $70,000 | 30.0% |

| $70,001 and above | 33.0% |

Company tax rate: 28% flat rate

Provisional tax is a way of paying your income tax as you go. In other words, your taxes will be paid throughout the year in instalments rather than at the end of the financial tax year. Provisional taxes will apply to you when your residual income tax (RIT) is more than $2,500.

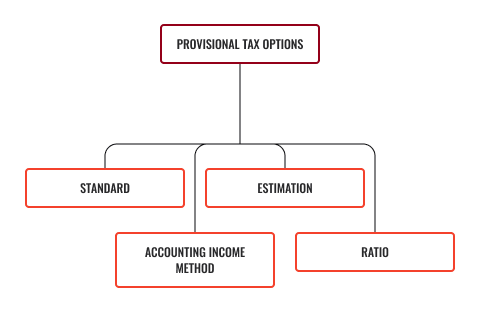

There are four options available to determine the provisional tax.

Learn more on each of these options and which might apply to you at the following website of Inland Revenue.

Provisional tax calculation

It is important to ensure the tax return is filed on time i.e., by the time the next new financial year begins, i.e., after 1st April each year.

The tax amount will be based on the taxable income, less the residual portion. Using the examples above, taxable income is $36,000 less $2,500 = $33,500

Provisional tax would then be calculated as $33,500, with the addition of 5%, this would total = $35,175 which would then be paid over three instalments, resulting in three payments of $11,725.

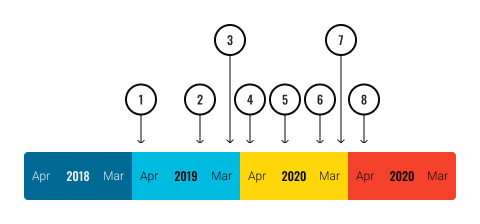

Provisional tax standard due dates:

- 28/8/18 - $1,862

- 15/1/19 - $1,862

- Tax bill for 2018 is due 7/2/2019

- 7/5/19 - $1,862

- 28/8/19

- 15/1/20

- Tax bill for 2019 is due 7/2/2020

- 7/5/20

The following video explains residual income tax in more detail.

The following image demonstrates the portion of your home, representing the dedicated workspace, which is thereby claimable for tax purposes. This may include:

- The garage – is used as a training location for clients

- Indoor gym space

- Home office space.

You cannot claim against your entire home, only the spaces dedicated for work purposes. See the following illustration as an example.

Home office (floor area calculation)

Office space used ÷ total home area

6m2 ÷ 100m2 = 6%

A part of running your own business is keeping a record of the income and expenses for tax purposes. Is advised to review the Archives and Records Association of New Zealand who outlines the Record-Keeping Legislation for both paper and electronic-based documentation along with other various types of documentation such as financial records. The Securities Act 1978 states all records of an accounting nature should be kept for a minimum of seven years. Some records you need to keep include, but not limited to:

- Proof of income (bank statements, invoices, etc)

- Proof of expenses (receipts, invoices, emails, etc).

It is advised to discuss this further with your accountant in order to ensure you are collating all vital information to safeguard yourself and appropriately prepare in the event you are called for audit.

In this topic, we focused on the financial aspects of setting up and running your own business, along with the financial obligation of employees. You learnt:

- The difference between income and expenses along with how to calculate these

- Determining and preparing for income tax payments

- Understanding provisional tax

- Claiming for home office and related expense

- The requirements of financial record keeping.