Applying common law principles

As introduced in an earlier section, Australian common law is based on the common law from England and the United Kingdom, English common law applies to Australian contract law. The four elements in forming a legally binding contract are under common law. Therefore, to apply common law principles means to make sure that all elements are present when creating a contract:

- Agreement:

- Offer: You must explicitly provide an offer that you will accept to be bound on the contract terms should the other party accept it. Whether in writing or through words, you should express the offer to the other party.

- Acceptance: Accepting the contract means there is expression and proof of the other party agreeing to be bound by the contract terms. As stated, there must be proof (e.g. a signature on the contract) that the offer has been accepted.

- Consideration: You must provide something of value to the other party (such as monetary payment) for fulfilling terms in a contract. The value of consideration must be reasonably proportionate with the nature and intensity of a condition.

- Capacity: Make sure that all parties involved have the capacity to enter into a contractual agreement. Therefore, those who do not have the capacity (such as minors, people with mental incapacity, and people under the influence of alcohol or drugs) should not partake in an agreement; otherwise, contracting with them would most likely void the contract may lead to legal consequences.

- Intention: You and the other parties should provide evidence in the contract to create legal relations. Since construction contracts are considered commercial agreements, they will automatically be legally binding and involves different businesses and commercial companies.

Applying laws, regulations and legislation

Although the common law regulates contracts in Australia, there still are statute laws (laws created by legislators) that enforce legal requirements on construction contracts. These must be complied with as well as the common law, as they provide specific provision and potential sanctions.

Security of payment legislation

Security of payment pertains to the certainty that a building contractor will receive proper payment as outlined in the construction contract. The security of payment legislation of the different states and territories can help resolve payment disputes of contractors through adjudication. Adjudication protects contractors with regards to their payments but has strict requirements on applications and timeframes. As legal requirements, you need to adhere to the conditions of the security of payment so that your contracts can be eligible for the security of payment.

The map below provides the legislation and relevant regulatory body on the Security of Payment across Australia.

Fair trading legislation

Fair trading legislation covers fair business negotiation and agreements, including contracts. As one who engages in business agreements through construction contract, you must comply with the legal requirements outlined in the legislation. This table shows the relevant, fair trading legislation and regulatory body administering the legislation to assist you. Make sure you review the legislation.

Once the contract agreements have been reviewed, agreed upon and signed, you then apply the contract agreement and must meet all of its conditions throughout the construction. This is important as non-compliance is a contract breach and may lead to contract termination, or worse, legal action and consequence. Thus, properly complying with the contract is a must.

You may also refer to the contract agreement as instructions on conducting yourself at the construction site and other related workplaces, dealing with the other involved party, handling monetary aspects of the project, etc. In essence, construction contracts are followed as written.

Conversely, what is not included in the contract will almost always be unimportant. Therefore, you may not do a task that is not within your agreed terms or ask the other party for clarity. Remember, stay within your agreement as accurately as possible to avoid dealing with disputes.

As it should be, you will see terms and conditions with a definition section in the contract. In noting its every word, you can identify and clarify statements that will make it clearer for you to apply certain conditions in your situation.

Specific parts of the contract you should particularly comply with are the following:

| Parts of contract | Description |

|---|---|

| Contract price | Check the total contract price indicated to know the total amount needed for the project. Also, check if there are clauses following the computation of the price, such as disclaimers of contract price exclusion (e.g. contract price does not include cost the owner will pay to a third party) or that the contract price can change based on other terms of the contract. |

| Payment schedule | You must also be wary of the payment schedule of the project when paying through progress payment. You must be aware of when to transact payment as stated on the contract. Remember also that usually, after a stage has been completed, a percentage of the contract price is paid. |

| Construction period, start dates and practical completion | Confirm the building period, or how long it takes for your team to construct the building and when the project will commence (usually days or weeks after acquiring a building approval or permit). Check for terms and clauses on the extension of time and damages when practical completion is not reached without reasonable grounds. Also, check what constitutes practical completion as this will vary per project and per contract. |

| Statutory compliance | As contracts are legally binding, review specific legislation and legal requirements found in the contract, as you need to comply with them contractually and legally strictly. Even though sometimes statutory compliance is implied (meaning it does not explicitly appear in the contract), a term or clause on legislative compliance would suggest it is considered important and a priority by the other party. |

| Construction standard and codes | Although the Building Code of Australia should automatically be applied to the construction project (therefore, compliance is a must), several codes of practice can also be mentioned as guidelines or even standards to be followed. Make sure that, when they are required, you review the standards and codes to meet compliance properly. |

| Documentation | Contracts would also require specific documents as proof of compliance. Documents such as building permits, invoices, notices, reports, etc., provide evidence of adherence to the contract and the local jurisdiction. |

| Dispute resolution | In case of disputes in the contract or the project, contracts most likely contain methods and contacts on dispute resolution, such as writing a notice, conducting meetings, contacting relevant third parties (legal counsel or regulatory authority) if necessary. |

Construction insurances are essential for the safety of your workers, protection for your project, and compliance with legal requirements. Carrying out construction without one or an outdated or expired one is subject to legal action. Therefore, you must take the time to confirm all necessary insurance are current or updated. You should also find out if they are currently applied and covered by the insurance; otherwise, the insurance will not cover your workers even if they have one.

Here are some ways you can check and confirm the different insurances:

- Acquire information: First off, you should get as much information as you can on the insurances the building, subcontractors, and workers possess, such as policy number, insurance company, insurance scheme or coverage, insurance agent, period of coverage, contact details etc.

- Verify insurance: Once you have acquired relevant information, you should now verify the information:

- Research online: You should first look up the information online to ensure that details are not made up and even match what you have. You may also check regulatory registers to confirm that the insurance company exists and is operating legally in Australia and get additional information.

- Contact insurance agent or company: If you have the contact details of the insurance agent or company, you should contact them appropriately. This will help you verify if the agent is working under said insurance company and if the agent knows a particular worker or subcontractor. You can also contact the insurance company themselves to confirm the information you have and if the insurance policy is currently insuring the building, worker, or subcontractor in question.

- Request a certificate of insurance: A certificate of insurance provides relevant information on an insurance policy of a particular person or group of people. Requesting and acquiring a certificate of insurance provides proof of the insurance either a building, subcontractor or worker has. Check information thoroughly if it matches the information you have, and contact the insurance company again if there are discrepancies.

In doing these steps, you can be confident that your building, subcontractors, and workers are aptly insured for the duration of the contract and project, helping you comply with legal requirements as discussed.

Aside from the Fair Work legislation, employers must also be aware of payment and superannuation schemes. It is essential to be aware and have the confidence brought by understanding the fundamentals of payroll systems and employer obligations.

Even if payroll systems are outsourced, the employer must still ensure that obligations are met and the taxes and social security are accurately filed. This is not only for your compliance but to make sure that everyone is paid their due. You should also know what information should be given to the payroll provider and what their responsibilities to you are.

Payroll systems

The Pay as You Go (PAYG) system used in Australia was introduced in an earlier section. It is used to pay income tax and payroll taxes for the employer based on the rates of each state, and this is paid to the Australian Tax Office. The number of employees and the kind of industry the work falls in affect the flexibility and efficiency of the payroll system. Businesses must know the complexities and possible issues to ensure that the staff is paid accordingly, as making the wrong payments can result in bankruptcy or criminal charges.

Australian payroll tax is calculated based on hours worked and the income generated while working. Payroll taxes vary depending on the state and territories. If you are employed in more than one business, your tax paid in one job may not necessarily be the same as the second one.

PAYG withholding is a system for withholding amounts from payments you make to employees and businesses so they can meet their end-of-year tax liabilities. You always have withholding obligations if you:

- Have employees.

- Have other workers, such as contractors, and you enter into voluntary agreements to withhold amounts from payments you make to them, or

- Make payments to businesses that do not quote their Australian Business Number (ABN).

If you make payments subject to withholding, you must:

- Register for PAYG withholding.

- Withhold amounts from wages and other payments.

- Lodge activity statements and make payments

- Provide payment summaries to employees and other payees.

- Provide with a PAYG withholding payment summary annual report.

There are a number of ways to register PAYG withholding. You must apply for registration by the day on which you are first required to withhold an amount from a payment. Your withholding obligations vary depending on whether your worker is an employee or a contractor. Other factors that can affect the amount you withhold include an employee’s Higher Education Loan Program (HELP) or Financial Supplements debts and eligibility for tax offsets. You need to report and pay amounts withheld and lodge activity statements.

Paying payroll taxes

Payroll taxes are assessed by businesses on the income they pay or will pay to their employees. This depends on the laws based on the state or territory the business is in or where the employees work. Some areas of administrative payroll tax were made consistent by states and territories. Income to an employee can be wages for hours worked, commission on sales made, bonuses, or allowances.

Companies must correctly apply the tax rates based on the specific metrics of computation. In Australia, the employer pays the payroll tax on behalf of the employee by withholding part of the salary after each salary period.

At the end of each year, the employee may claim the tax back if they did not meet a specified threshold or pay more if the tax withheld is insufficient.

Below are the practice guidelines for issuing electronic payslips.

Employers should:

- Give electronic payslips to each worker, such as via email or into an electronic personal account (employers should not simply store them on a database).

- Issue electronic payslips in an easily printable format.

- Issue electronic payslips to employees securely and confidentially.

- Ensure that employees can access and print their electronic payslips in private (e.g. it would be inappropriate to issue an electronic payslip to an employee who doesn’t have access to a computer terminal to privately read and print their payslip).

Fringe Benefits Tax

Fringe Benefits Tax (FBT) are non-cash benefits for employees while they are employed. These may include private health insurance, company car, a loan or other item that aids the employees in doing their jobs. This is a way for employers to attract potential employees to work for their company. Fringe Benefits Tax must be paid to the ATO. Before this, an FBT must first be registered before they are offered to workers.

Payslip

Your payslip must contain details of the payments, deductions, and superannuation contributions for each pay period. Payslips must include the employer’s name, employer’s ABN (if any), employee’s name, date of payment, pay period, gross and net amount of payment, and any loadings, monetary allowances, bonuses, incentive-based payments, penalty rates, or other separately identifiable entitlement paid.

What deductions may be made from an employee’s pay?

Under the Fair Work Act 2009, an employer is allowed to make a deduction from an employee’s pay if one of the following applies:

- The employee has authorised the deduction in writing (which must specify the amount), and the deduction is principally for the employee’s benefit.

- The employee authorises the deduction in accordance with an enterprise agreement and other industrial instruments (e.g. an award or agreement made under the former Workplace Relations Act 1996).

- The deduction is authorised by or under a modern award or order of the Fair Work Commission.

- The deduction is authorised by or under a law or an order of a court.

- Deductions commonly authorised include income tax deductions, superannuation or health insurance contributions, and trade union dues.

Goods and Services Tax (GST)

The Goods and Services Tax (GST) is a broad-based tax of 10 per cent on the sale of most goods and services in Australia. You need to register for GST if:

- Your company has a GST turnover (gross income minus GST) of $75,000 or more.

- When you start a new business and expect your turnover to reach the GST threshold in the first year of operation.

- You own an international business importing services and digital products to Australian customers and make more than $75,000.

- You provide taxi or limousine services in exchange for a fare as part of your enterprise.

- You want to claim fuel tax credits for your business.

If you do not fit into any of the aforementioned categories, you may still register for a GST. However, if you do register, you have to stay registered for at least 12 months. Excluded from GST are food products, a few education courses, a few medical, health and care products and services. GST-free sales do not include GST in the price, but tax credits may still be claimed for the GST included in purchase prices made to purchase the GST-free sales.

It is good to register even if your turnover has not reached $75,000 yet since registering for the GST has its benefits, as well. Such advantages are the following:

- Claiming GST credits for any GST you have paid on goods and services.

- Eliminating the risk of upsetting clients with an unexpected increase in prices.

- Eliminates the cascading effect of taxes.

- The unorganised sector is regulated with the GST.

GST registration

Once you have decided on the benefits of the GST and the need to comply, if you fall into any of the three categories requiring registration, then you may register through the following:

- Online via Australian Taxation Office (ATO)’s Business Portal.

- By calling 13 28 66.

- Through your registered tax or BAS agent.

It is crucial to possess an Australian Business Number (ABN) since it will be your GST registration number. You will also need to complete your application using the same form used in the ABN application and other tax registrations.

Claiming GST credits

You have to be registered for GST to claim GST credit. You may claim GST credit if the following conditions apply to you:

- You use your purchase solely or partly for your business.

- The GST is included in the purchase price of the good or service.

- You paid or will need to pay for the item.

- You are issued a tax invoice (for purchases over $82.50).

On the other hand, you cannot claim a GST credit if:

- You do not have a tax invoice.

- Your purchase does not have GST in the price.

- Your purchase is an input-taxed supply.

- Your purchase is for private use.

- It is for staff salaries.

- It is for motor vehicles above a certain price.

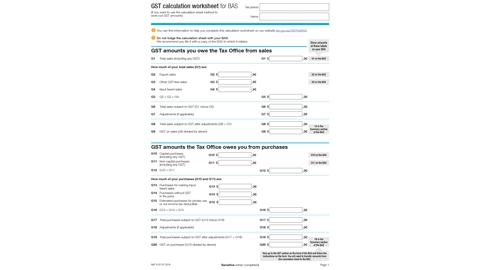

Provided below is a sample GST Calculation sheet if you want to use the worksheet method in computing for GST, which you can access through the Australian Taxation Office website.