Identifying the requirements of the business

It is important that you know how to identify the requirements of the business in order to ensure that the business complies with its obligation to relevant stakeholders like the Australian Taxation Office (ATO), Australian Securities & Investment Commission (ASIC), to its shareholders, creditors, and other regulatory authorities. You should be able to identify the requirements of the business by understanding relevant legislation, regulations, contract terms, information gathered from internal assessments, etc.

These requirements include:

- required businesses registrations

- required licensures

- the requirement to lodge and pay taxes

- insurance requirements

- operational requirements of the business

Identify legislation and regulations relevant to a building and construction business

Difference between legislation and a regulation

Legislation

Legislation is the general term used to refer to a set of laws enacted by the Parliament. A piece of legislation is also often referred to as an Act. Acts can either be a principal Act or an amending Act. When principal Acts and amending Acts are compiled, they are referred to as consolidated Acts. Legislation could also be classified either as federal law or a local law (See below).

|

Federal Law |

Local Law |

|

Federal laws cover all of Australia. |

Local laws shall only apply to a particular state or territory. |

|

Federal laws can be accessed online through the Federal Register of Legislation. |

Local laws can be accessed online through the website of each state or territory. |

Regulations

Regulations often contain the specific provisions on how certain legislation should be applied. Accordingly, to help you identify what regulations apply to the business, you must first identify the application of the legislation to which the regulation relates.

Regulations are classified under the term, subordinate legislation. Subordinate legislation, which is also known as delegated legislation, pertains to the set of laws promulgated under the delegated authority of the Parliament. Subordinate legislation can be in the form of regulations, rules, and industry codes.

Importance of identifying building and construction legislation and regulations

It is important to identify which laws and regulations are applicable to the business so that the business can:

start and conduct a business in a state or territory legally

ensure that the continues smooth operations

protect its reputation and integrity

continue their good relationship with stakeholders

avoid penalties

Identifying legislations and regulations

To properly identify the legislation and regulations relevant to the business, you must consider:

- your organisation’s business structure, whether it is:

- a sole proprietorship

- a partnership

- a corporation

- the industry where your organisation is engaged in (Building and Construction)

- the state or territory where your organisation is registered to operate

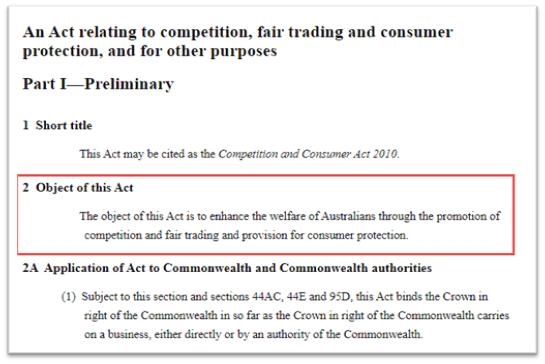

- the object of the legislation – The object of legislation outlines the purpose of the legislation. Most legislation has a specific section for that provides for the object of the legislation which is usually located at the beginning of the legislation. Likewise, the purpose of legislation can also be implied from its provisions.

Some of the laws relevant to a building and construction business are identified below:

|

Legislation |

Business Structure to which it Applies |

|

Competition and Consumer Act 2010 |

All business structures |

|

Australian Consumer Law |

All business structures |

|

Corporations Act of 2001 |

Corporate bodies |

|

Partnership laws in each state or territory (e.g., Partnership Act 1892 of NSW) |

Partnership |

|

Building and construction laws in each state or territory (e.g., Queensland Building and Construction Commission Act 1991) |

All business structures |

|

Security of payment laws in each state or territory (e.g. Building and Construction Industry Security of Payment Act 1999 of New South Wales) |

All business structures |

|

Income Tax Assessment Act 1936 |

All business structures |

|

Income Tax Assessment Act 1997 |

All business structures |

|

A New Tax System Act 1999 |

All business structures |

|

Fringe Benefits Tax Assessment Act 1986 |

All business structures |

|

Payroll Tax Laws in each state or territory (e.g., Payroll Tax Act 2007 of Victoria) |

All business structures |

Competition and Consumer Act

The object of this Act is to enhance the welfare of Australians through the promotion of competition, fair trading, and consumer protection. Here are some important provisions set out in this Act:

- Prohibition of cartel provisions – As per the Competition and Consumer Act 2010, all businesses, including businesses engaged in the construction industry, are prohibited from entering into agreements that relate to cartel provisions. The cartel provisions are outlined in Section 45AA of the Competition and Consumer Act 2010, and it includes the following:

- Provision for price-fixing

- Provision for restricting outputs in the production and supply chain

- Provision for allocating customers, suppliers, or territories

- Provision for bid-rigging

- Contravention of industry codes – Based on the provisions of the Competition and Consumer Act 2010, an infringement notice shall be issued to persons who have allegedly contravened a civil penalty provision of the industry code relevant to their businesses. (e.g., National Construction Code).

Australian Consumer Law (ACL)

Australian Consumer Law is one of the schedules attached to the Competition of Consumer Act. Here are some of the important things to remember about the Australian Consumer Law:

- Under ACL, builders are classified as suppliers.

- Under ACL, there are three guarantees that must be guaranteed by builders in relation to the services they provide to their consumers:

- Services must be provided with due care

- Services provided must be fit for any specified purpose

- Where a contract does not specify a timeframe for the services, must be carried out within a ‘reasonable time’

Identify business requirements of a building and construction business

Business requirements

The primary requirements of business include:

- Licensing

- Tax registrations

- Lodgement and payment of taxes

- Lodgement of other external reports

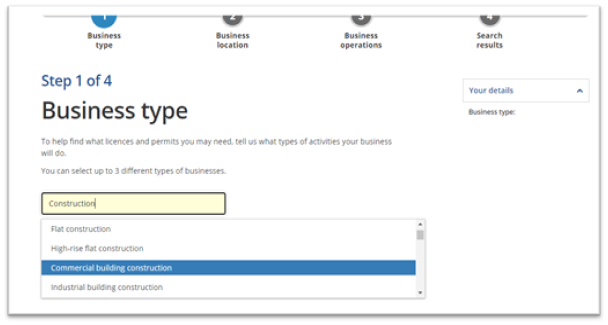

Identifying required registrations, permits, and licenses

With Australian Business Licence and Information Service (ABLIS) accessible in business.gov.au, the business will now be able to know its registration requirements by simply answering a series of questions about the business and its operations. To access the service, you just need to:

- Access this link on the ABLIS website

- Click on ‘Guided search’

- Follow through the guide. The guide is just a series of questions about the business and its operations. The information you provide will help ABLIS in identifying the required registrations of the business.

Tax registrations

Discussed below are some of the most relevant tax registrations for a business:

- Tax File Number (TFN) – All types of business, except sole traders, are required to register for a Tax file number. A TFN is a unique nine-digit number used by ATO to facilitate file tracking and data matching.

- Australian Business Number (ABN) – the ABN is an 11-digit number used to identify a business. Not all business transactions require an ABN. Here are some of the uses of an ABN:

- The business wants to identify the business using a unique set of numbers when ordering or when invoicing

- The business does not want others to withhold 47% of their payments to the business

- The business needs to register for GST and other types of taxes

- The business wants to apply for an Australian domain name

- Australian Company Number (ACN) – Business receive their own ACN upon registering as a company. All companies are mandated to register for an ACN. Companies are also required to have ACN before they can register for an ABN.

- Registration for Goods and Services Tax – The business is required to register for a GST if its GST turnover amounts to $75,000 or more. Nevertheless, the business may voluntarily register for GST if it intends to claim for fuel tax and GST credits.

- Registration for Pay as You Go (PAYG) withholding – The business must register for PAYG if the business makes payments to:

- employees

- contractors to whom the business had a voluntary agreement with

- other businesses that do not quote their ABN

- Registration for Payroll Tax – The business must register for payroll if the salaries and wages by the business to its employees exceeded the tax-free threshold set out in the state or territory where the business pays the wages and salaries.

- Registration for Fringe benefits tax (FBT) – The business will be required to register for FBT if it plans to provide fringe benefits to its employees.

Identify operational requirements for a building and construction business

Operational Requirements

Operational requirements pertain to those requirements that concern the inner workings of the business and by which must be satisfied in the conduct of the business’s normal operations (i.e., providing construction services or supplies). It is the process of identifying all the resources needed to complete a project initiated by the business.

Here are some of the important things to remember when asked to identify operational requirements:

- Review the contract. It is essential that you review the contract agreement and know if there are terms that might require the business to procure materials from a particular supplier, employ a specific number of construction labourers, employ a specific sub-contractor, etc. Accordingly, you will have to review all relevant documents attached to the contract such as schedule of costs, foundation data, Bill of Quantities, the scope of work, drawings, and other sets of plans and specifications. Here are some of the things to look out for in the contract when identifying operational requirements:

- The location of the project site

- The plan and specifications (e.g., drawings, required quality of materials, nominated sub-contractor, etc.)

- Understand the processes involved in the construction work. You would not possibly be able to identify the operational requirements of a project if you do not understand the processes involved in the project itself.

- Various specifications in the contract may be subject to certain regulations. Make sure to practice due diligence and refresh your knowledge of all applicable laws, codes, standards, and regulations.

- Consult with other professionals in the same field. To have an accurate estimate of the operational requirements of the project, it would be best if you rely on the expertise of a qualified quantity surveyor. The quantity surveyor, together with cost engineers, is the one tasked to prepare cost estimates during the tendering stage of a project.

The example below will help you understand the things to consider in identifying the operational requirements of a project.

Case Study: Identify Operational Requirements

The project is to construct a building in a designated bushfire-prone area. The contract agreement includes the installation of laminate flooring.

Required: Based solely on the above information, identify the operational requirements of the project.

Suggested answers:

The operational requirements of this project may include:

- Materials for the construction of the building

- Accredited bushfire consultant

- Materials to be suggested by the bushfire consultant (e.g. fire-resistant materials for construction)

- Laminate glue for the laminate flooring

- Other tools used for laminate flooring

- Laminate flooring

As discussed, you must review the contract terms thoroughly and be knowledgeable of different laws and regulations that may apply. In this example, for instance, you must have known that there are certain regulatory requirements that must be complied with when you are constructing a building in a bushfire prone area. Accordingly, additional resources may be required in order to comply with the said legal requirements, and this may include the hiring of an accredited bushfire consultant.

Update knowledge of the current trends in the building and construction industry

Economic Trends

An economic trend indicates the current direction by which indicators of the economy tend to incline in general. There are a number of indicators that can be analysed when determining the current situation of the economy. Some of which includes the following:

- Gross Domestic Product (GDP) – It is the current value of all the final goods and services produced within a particular geographic boundary for a specific period of time, normally a year.

- Terms of Trade (TOT) – It is a ratio that reflects the proportion of the number of units of exports with the number of units of imports in the country.

- GDP Price Index – It serves as a measure of price inflation of the goods and services accounted for in the GDP.

- Index of Industrial Production (IIP) – It indicates the growth rate in different industries for a specific period of time.

- Wage Price Index – It indicates the growth rate in the price of labour in the Australian market.

Watch the videos below to learn more about the basic principles of the economy and economic indicators.

Identifying economic trends in an industry level

Most of the economic indicators discussed preciously, however, are only usually analysed in a per country level, and there are only a few indicators analysed in an industry level. Among those, few include the Index of Industrial Production and the Wage Price Index. Here are the trends for industrial production and wage price index in 2020:

|

Economic Indicator |

Economic Trend |

|

Index of Industrial Production |

The growth rate from 20 June to 20 September in terms of production in the Construction Industry is 2.2%. The growth is said to be driven by an increase in the demand from domestic households, but it was also partly offset by a reduced in investments in heavy and civil engineering construction projects. |

|

Wage Price Index |

The annual change in the original and total hourly rates of pay, excluding bonuses in the construction industry increased by -0.9%. |

Industry trends

Industry trend pertains to the current business patterns that occur in a specific industry. While the discussion for economic trends is focused on the changes in prices and production, the discussion for industry trends, on the other hand, will be focused on the current trends relating to the 'inner workings’ of the businesses engaged in a specific industry. The following are considered as industry trends:

- The trend in technology – Trends in technology usually relates to how businesses take advantage of the current developments in technology. Examples of trends in technology are the following:

- use of technology to market and deliver services online

- use of new technology to generate sustainable energy and reduce energy consumption (e.g., solar panels)

- Customer service trend – Trends in customer service may relate to how businesses in a specific industry provide assistance to their current and potential clients. Examples of trends in customer service may include:

- providing automated customer service

- providing customer service in different platforms (e.g. Facebook, Twitter, Gmail)

- The trend in terms of market size – Market size pertains to the number of potential consumers in the industry. If there was a decrease in the current market size, the business could expect that obtaining new clients will be more difficult than usual.

- Trends in managing the finances of a business – There could be a lot of aspects that can relate to the trends in finance. Some may include changes in required financial reporting, new financial models, new financial strategies, etc.

Importance of remaining up to date with economic and industry trends

Remaining up to date with economic and industry trends is important in the business in so many ways. Businesses are only able to thrive in the long term by being flexible with the demands of changing times. By remaining up to date with economic and industry trends, you can help the business:

- in maintaining its competitive advantage in the market

- anticipate shortcomings and risks

- plan set of measures to mitigate risks

- identify new opportunities for the business

Key Government Sources for Industry Information

The industry information that you gather must come from reliable sources such as different government bodies. Fortunately, many government bodies recognise their responsibility in providing the public useful industry information and continue to upload reliable resources on their official websites. You may check the website of the following government bodies when gathering industry information:

|

Government Body |

About the Government Body |

Link to Their Resources |

|

Australian Building and Construction Commission |

The objective of the Australian Building and Construction Commission is to ensure that the building and construction industry continues to be fair, efficient, and productive. |

|

|

Department of Industry, Science, Energy and Resources |

The Department of Industry, Science, Energy and Resources intends to promote economic growth and job creation in Australia. |

Department of Industry, Science, Energy and Resources website |

|

Australian Bureau of Statistics |

The Australian Bureau of Statistics is the national statistical agency in Australia that provides statistical information on matters concerning the economy, social issues, environment, population and the like. |

It is important for you to know that in order to properly execute your role in managing the finances of a construction business, you will have to liaise with the experts from other specialised fields such as:

- Project Cost Estimation

- Taxation

- Payroll

- Accounting/Financial Reporting/Bookkeeping

- Legal

Project Cost Estimation

Quantity surveyors are the ones considered to be experts in the field of project cost estimation. Quantity surveyors specialise in providing reliable cost estimates useful in determining depreciation for tax purposes, and replacement costs for insurance purposes. They are usually the ones who have the required skills and knowledge to provide accurate and detailed cost summaries. You can definitely ask for their assistance every time you need to prepare a construction schedule.

Taxation

Tax professionals are considered experts in the field of taxation and they can help you ensure that the business complies with the provisions of different tax legislation and with the regulations of the Australian Taxation Office (ATO). Tax professionals specialise in the following:

- working out the business entitlements under relevant tax laws

- working out the business’s taxable income

- preparing tax returns

- lodging tax returns

- representing the business in its dealings with the Australian Taxation Office (ATO)

- identifying the obligations of the business with ATO

Payroll

Professionals who specialise in this business area can help the business do the following:

- process payroll transactions (pay run)

- collect and gather payroll data

- perform calculations related to net pay, PAYG withholding, superannuation contributions

- resolve payroll discrepancies

- pay employees in a timely manner

- remit PAYG withholdings

- submit required payroll reports to regulatory authorities

Accounting, financial reporting and bookkeeping

Professionals practising in the field of accounting can help the business comply with its record-keeping and reporting obligations to regulatory bodies such as the Australian Securities and Investments Commission (ASIC), Australian Securities Exchange (ASX), and as well as with Australian Taxation Office (ATO). Accountants specialise in the following:

- bookkeeping

- financial statements preparation

- financial statements analysis

- financial management reports preparation

- lodgement of financial reports

- conducting business audits

Legal

Most large companies have a separate department that would be tasked to deal with legal matters. Professionals working in this department can help the business with the following:

- interpret the terms of the contract, insurance policies, loan agreements, etc.

- provide advice regarding the legal options of the business in terms of recovering debts of the clients

- represent the business and coordinate in meetings involving legal matters

- help the business in monitoring legal compliance of the business

- prepare contracts and other legal documents

Business systems for managing financial requirements

In the context of this chapter, ‘system’ is defined as a set of policies and procedures adhered to in performing a particular function (e.g., accounting system). Accordingly, we define the terms policies and procedure as follows:

- policies – the principles or rules that must be adhered to by the individuals within the organisation

- procedure – the mandatory way of doing something

One should be able to effectively establish a system for managing business finances by developing different sets of policies and procedures. You may develop a different set of policies and procedures for different aspects of business finance. For instance, you can develop sets of policies and procedures for payroll, taxation, accounting, treasury, etc.

Establishing a system

To effectively establish a system in the organisation, one must:

Develop a set of policies and procedures

- Prepare the ‘Policies and Procedures’ template. Most organisations follow a standardised format for this document. A standardised format is followed to ensure that the document is easy to read and is simple to understand.

- Include an introduction for your document. Your introduction must be able to identify the purpose and scope of the document. Explain why such a document exists and to whom it may apply. For example, ‘This document sets out the policies and procedures that must be adhered by individuals performing payroll functions.’

- Define the terms used in the document. To ensure that the provisions of the document are understood correctly, you must be certain with how you interpret the words in the document. If you intend to limit the definition of a certain term, then you must do so by providing a section for ‘Definition of Terms’

Communicate the policies and procedures to the organisation

To ensure that the policies and procedures you have developed will be established into the business, you must make sure that you effectively communicate the content of the document. You must conduct a meeting and do the following:

- discuss the content of the document. To be able to discuss the document with competence, you must do the following preparations prior the meeting:

- Review the document.

- Make an outline of your presentation. Determine how you want to start and close your presentation.

- encourage the audience to ask questions about the policies and procedures discussed

- verify with the audience if they understood what you have discussed

- answer the queries of the audience with confidence and in a straightforward manner. To be able to this, you must do the following measures prior the meeting as a preparation

- review the document

- ask experts from other fields for clarifications and assistance

- prepare and take note of possible questions so that you can prepare for the answers ahead of time

Monitor the implementation of said policies and procedures

To monitor whether the policies and procedures you have developed are being implemented, you will need to observe current processes, inspect documents, and enquire with all relevant personnel. Make sure that you record the results of your monitoring procedures for documentation.

Criteria in developing policies and procedures

The policies and procedures you establish must meet the following criteria:

- The policies and procedures must be feasible. Given the current resources of the organisation. For example, you should not develop a policy that requires the business to use a sophisticated payroll software if the business itself cannot currently afford such additional expenditure.

- The policies and procedures must be in line with the organisation’s vision and mission.

- The policies and procedures must be consistent with relevant laws and regulations. The laws and regulations set out by relevant authorities must always be complied with and shall not be countervailed by the mere implementation of internal policies and procedures.

- The policies and procedures must be presented in a clear language. To ensure that the employees understand the document correctly, you must construct the provisions in simple sentences and in an assertive manner. Do not provide an avenue for doubt or grey area.

- The policies and procedures can effectively help in managing the finances of the business.

Enquiring with other professionals

During this whole process, it is important that you enquire with the professionals from other fields such as accounting, taxation, payroll, etc. These professionals will help you understand the needs of the business and the requirements of each function. You may enquire about the following:

- the different steps involved in a particular process (e.g., payroll processing)

- what policies and procedures should be implemented

- the current issues encountered in the process which must then be addressed in the policies and procedure document you will develop

Business programs for remaining up to date and compliant with industry and business changes

Program defined

The term ‘program’ in the context of this chapter is basically just a set of activities aimed to achieve defined long-term goals (e.g., total quality management program). This means that you need to plan the activities that must be performed in order to achieve a certain goal. In this section, however, your focus is only to establish programs (i.e., activities/ways) on how the business can remain up to date with industry changes and how the business can remain compliant with business changes.

The establishment of a business program involves a similar process as the one discussed in developing policies and procedures. It involves:

- the development of the set of measures to undertake

- the communication of the set of measures

- the monitoring of the implementation of set measures

Industry changes and business changes

In the context of this Learner Guide, ‘industry changes’ pertain to the changes released by non-regulatory authorities that pose relevance to businesses engaged in the building and construction industry, while ‘business changes’ shall pertain to those changes released by regulatory authorities which modify existing business requirements and/or creates additional obligations for the business.

Measures you can observe to remain up-to-date with industry changes

Here are some of the measures that you can observe to remain up-to-date with industry changes:

|

Measures |

Resources Needed in Undertaking Such Measures |

|

Avail of the email subscription of different regulatory authorities and organisations |

|

|

Adopt an RSS feed reader system |

|

|

Regular preparation of summary reports about the update |

|

Remaining up-to-date with the current industry changes will help you do the following:

- remain at par with your competitors

- plan ahead based on the anticipated changes reported by different organisations

- gather information relevant in performing a risk assessment

- gain knowledge on the latest advancements in the industry

Measures you can observe to remain compliant with business changes

Here are some of the measures that you can observe to remain compliant with business changes:

|

Measures |

Resources Needed in Undertaking Such Measures |

|

Avail of the email subscription of different regulatory authorities and organisations |

|

|

Adopt an RSS feed reader system |

|

|

Prepare a summary report and analysis about the update. Typically, this type of report shall include an analysis on the cost and benefit of the changes in business regulations. |

|

|

Create a checklist from the changes and assess whether the updates are currently being integrated into the system and practices of the organisation. |

|

Remaining compliant with the current business changes will help you do the following:

- avoid penalties imposed by regulatory authorities

- maintain good standing with stakeholders

- eliminate the risks associated with non-compliance

Risk assessment

Risk assessment is the process of evaluating the extent and degree by which certain events (risks) could potentially harm a business and its financial health. Risk assessment is crucial in fulfilling your role and in planning the necessary actions to undertake as you manage the finances of a building and construction business. Risk assessment, however, is just one aspect of the risk management process. Evidently, before you can actually assess the risks, you must first be able to identify what risks can be associated in conducting the business.

Presented below are the essential steps involved in a risk management process:

Risk assessment and contingency planning

Risk assessment is an important aspect of contingency planning. Contingency planning is performed in every project to ensure that unforeseeable expenses necessary for the proper completion of the project are covered in the tender sum. Conducting a risk assessment is important because it helps you provide an estimate of how much cost should be allocated for contingency purposes. Generally, the estimate for contingency sum should account for:

- Costs to be incurred for possible wastages and/or additional labour and material needs due to errors in design plans

- Costs to be incurred for possible wastages and/or additional labour and material needs due to errors in cost estimations

- Foreign currency fluctuations – Projects that procure materials and equipment from overseas should be cautious of foreign currency fluctuations especially if these will be purchased on an account because the amount paid on these accounts will increase if the value of Australian dollar falls. For instance, if you promise to pay a supplier of material for 12,000 Hong Kong dollars when the exchange rate was 1 HKD = 0.17 AUD, but only settled the amount when the exchange rate was 1 HKD = 0.70 AUD, then you incur a loss by paying 6,360 AUS (12,000-(0.70-0.17) more than originally accounted for. Accordingly, these probable foreign currency fluctuations should be accounted for in the estimate of the contingency sum. In any case, project managers should enquire with the professionals from the finance department to ensure that the risks associated with such fluctuations will be properly managed.

Performing the risk assessment

The following are the basic steps that you can follow when conducting a risk assessment:

- Prepare the risk assessment report template

- Set out the risk ratings and identify parameters on how risks will be assessed

- Identify the adverse outcome/events and analyse the likelihood of its occurrence

- Identify the consequence of such adverse outcomes and assess their impact on the business

- Provide explanations for your assessments

Financial risks

There are different types of risks that you must identify when managing a business, but to limit the scope of this section, only financial risks are discussed. Financial risks pertain to those events that can pose adverse effects to the business’s funds or current cash balance. The table below presents the most common types of financial risks, the outcome associated with each risk, and the consequence for the happening of each respective outcomes.

|

Financial Risk |

Adverse Outcome/Event |

Adverse Consequence |

|

Liquidity Risk |

The risk that the cash balance of the business will not be sufficient to settle current financial obligations. |

|

|

Credit Risk |

The risk that the business will not be able to recover a number of bad debts. |

lowers cash balance |

|

Interest Rate Risk |

The current decrease or increase in interest rates unfavourably affects the business. |

lowers cash balance |

|

Foreign Exchange Risk |

The current decrease or increase in receivable or payable, respectively, due to currency fluctuations. |

lowers cash balance |

Likelihood and severity

There are two things that you should essentially be able to assess in the process, and these are the following:

- the likelihood of an outcome/event occurring

- the severity of the consequence associated with the outcome

Likelihood indicates the probability of an outcome from happening while severity indicates how serious the consequence is. It is important to be able to assess these things in order to know how rigorous your approach should be in managing the business’s finances.

Types of analysis performed in the risk assessment

There are two types of analysis involved in a risk assessment:

Quantitative

In quantitative analysis, you base your risk assessment on facts and tangible data. Mathematical calculations are often factored in, and various quantitative techniques are employed in your risk assessment. Quantitative techniques can be as simple as performing basic calculations such as computing for some financial ratios. For instance, you should be able to assess the likelihood of liquidity risk by computing for the current ratio. If the current ratio of the business is lower than the market average, it could be assessed that the liquidity risk is high since a low current ratio also means that the current asset of the business is lower than its current liabilities. On the other hand, there could be other quantitative techniques that can be complex, and which may require an actuary. Actuaries are professionals who use mathematics and statistics in estimating risks. Some of the quantitative techniques they perform involve, probability analysis, expected value of perfect information, sensitivity analysis, trend analysis, Monte Carlo technique, etc.

Qualitative

On the other hand, the quantitative analysis does not rely on tangible data. Instead, you base your risk assessment on information that cannot be easily summarised in mathematical figures. When doing qualitative analysis, you must be able to provide explanations as to how you were able to come up with your assessment. In qualitative analysis, your assessment could be based on:

- Brainstorming

- Series of interviews

- Professional judgment

- Experience/historical data

- Current analysis of the environment

- Delphi Technique – involves a structured interview of a group of individuals who are experts in a particular subject area

Since you are not expected to have the same knowledge and skills as an actuary, you may employ simple computations (as discussed) and qualitative analysis in your assessment.

Example Risk Assessment Report / Likelihood

For this example, a qualitative assessment was performed to assess the likelihood of each risk. Each assessment has a corresponding explanation which provides the basis for each assessment. As you can observe, the explanations are barely based on the current environment and circumstances of the business. This is what it means to perform a qualitative assessment of risks.

|

Financial Risks |

Adverse Outcomes |

Risk Ratings / Likelihood |

Explanation |

|

Liquidity Risks |

The business cannot pay its current obligations. |

Possible |

The business is planning to purchase a long-term asset in full cash payment. |

|

Credit Risks |

The business cannot recover its current receivables. |

Rare |

All of the clients of the business are established and have good credit ratings. |

|

Foreign Exchange Risks |

The business needs to expend more cash for the supplies purchased in Hongkong dollars. |

Almost Certain |

The country’s currency value continues to decrease as the inflation rate increases. |

|

Descriptor |

Definition |

|

Rare |

Far from occurring |

|

Unlikely |

May occur at least once over the life of the business |

|

Possible |

Might occur at least once a year |

|

Moderate |

Might occur every quarter |

|

Almost Certain |

Prone to occur every month |

Example Risk Assessment Report | Severity

In this section of the risk assessment report, the adverse consequence of each outcome explained previously was identified. The impact of each consequence is assessed with the assumption that the occurrence of each of the consequences is almost certain. Accordingly, the impact of each consequence is assessed based on the current circumstances of the business.

|

Financial Risks |

Adverse Consequence |

Risk Ratings / Severity |

Explanation |

|

Liquidity Risks |

Because the business cannot pay its current obligations, the business will have to continue paying for interest decreases the current cash balance of the business |

Moderate |

The loan agreement provides for a very low-interest rate, and thus, such interest payments will not be able to decrease the current cash balance by more than ten per cent. |

|

Credit Risks |

Due to the failure to recover debts, a decrease in the anticipated cash balance can be ascertained |

Major |

Our current receivables comprise a large portion of the business’s total assets. Failure to recover such will definitely have a major impact on our current cash balance. |

|

Foreign Exchange Risks |

Due to the decrease in the country’s currency value, the amount of cash that has to be disbursed will increase |

Major |

A lot of the smaterials used by the business in the construction are imported from other countries. |

|

Descriptor |

Definition |

|

Insignificant |

No financial impact |

|

Minor |

Decreases anticipated cash flow by one per cent or less |

|

Moderate |

Decreases anticipated cash flow by two per cent to ten per cent |

|

Major |

Decreases anticipated cash flow by ten per cent to fifteen per cent |

|

Severe |

Decreases anticipated cash flow by more than fifteen per cent |

Financial management functions

Many small to medium construction businesses delegate all financial management functions to their home office accounting department. Large construction firms, on the other hand, would most likely have a separate jobsite financial management team. The goal of the job site financial management team is to ensure that every project remains profitable, and there is sufficient cash to support the project’s ongoing operations.

This job site financial management team typically would have the following functions:

- review project budget

- review progress payments

- manage cash flow

- manage payments to suppliers and contractors

- monitor financial condition

- provide recommendations on how to improve the financial condition

- maintain financial records

It is important to remember that your obligations and responsibilities in managing the business’s finances are specified in your job description. If you need further clarification, discuss and clarify your concerns with the person whom you will be reporting to.

Obligations and responsibilities

In the context of this Learner Guide, obligation shall pertain to your duty to the external stakeholders (taxing authorities, local authorities, etc.), while responsibility will be your duty to your organisation. It is important that you know how to interpret your obligations and responsibilities in order to understand how to competently execute these obligations and responsibilities. To properly interpret these obligations and responsibilities, you must identify the required knowledge that you must possess and the tasks that you will be obliged to do in line with these obligations and responsibilities.

Obligations

There are corresponding tasks that you must do for every obligation you have in managing business finances:

|

Obligation |

What You Must Do |

|

Ensure that the business lodges tax reports on time (tax returns, activity statements, etc.) |

|

|

Ensure that the business is compliant with the recordkeeping requirements set out in relevant tax laws |

|

Responsibilities

To be able to perform your responsibilities in the organisation, you must have knowledge on:

|

Responsibilities |

Required Knowledge |

|

Monitor the financial health of the business |

Knowledge of the calculation and analysis of different financial ratios |

|

Review business finances against project budgets |

Knowledge on how to analyse cost variances |

|

Introduce options to improve the financial position of the business |

|

|

Prepare construction schedule |

|

|

Keep track of the cash flows |

|

|

Review insurance covers |

|