Revenue streams

Revenue stream pertains to the source of revenue of a business. In the case of a building and construction business, there could be three possible revenue streams: project revenue, service revenue, recurring revenue.

Project Revenue / Contract or Bids

In this revenue stream, revenues are earned through one-time projects. This is the primary revenue stream of businesses engaged in the building and construction industry, whether big or small. Under this revenue stream, it is expected that the revenues earned, and costs incurred for every project will vary since each project will have different contract terms. The revenue from a construction project is recognised in the accounting system based on the percentage of completion method. Here are some examples of how a building and construction business earns through the project revenue stream:

- Construction of commercial buildings

- Construction of public buildings

- Construction of domestic buildings

- Construction of other infrastructures

Service Revenue

Under this revenue stream, the business earns revenue from services provided to clients. You could say that this revenue stream is pretty much similar to project revenue, under the service revenue; however, services are rendered in a short-term basis (e.g., per hour) as compared to project revenue where the recognition of revenue is usually spread over a year or longer. Here are some examples of how a building and construction business could earn through the service revenue stream:

- Maintenance services

- Landscaping services

- Repair services

- Roofing services

- Plumbing service

Passive Revenue

Under this revenue stream, the flow of revenue is considered to be ongoing. As compared to other revenue streams, earning through a recurring revenue would require less effort and resources. Here are some examples of how a building and construction business could earn through recurring revenue stream:

- Renting out equipment

- Dividends earned from owning a stock of other companies

Expenses

Expenses pertain to the costs that you will need to incur in order to generate revenue. The expenses incurred by a business engaged in a building and construction industry would include construction costs and business overhead.

Construction costs

The expenses you incur for a construction project pertains to construction costs. Construction costs include:

Materials

Materials pertain to those items that are to be consumed in the process of building a structure. The total amount of expense incurred for materials should include the purchase price less of discounts, cartage costs, costs for unloading and storage, allowances (e.g., allowances for wastages) and all other costs associated with making the materials ready for use.

Some examples of materials used in a construction project are the following:

- Concrete

- Fibre cement sheeting

- Plasterboard

- Water pipes

Direct Labour

Direct labour costs include the wages and salaries paid to employees of the organisation whose functions can be directly attributed to a particular job or project. Direct labour may include, but is not limited to:

- Wages of builders

- Wages and salaries of other job-site staff

- Subcontractor costs

An overview of the flow of labour costs in a construction project is provided below:

- The number of hours worked by each employee is logged either through an automated tracking system or through a manual system (timecard)

- The hours logged are then recorded to the payroll register where computations are made for salaries and wages

- The data from the payroll register is posted, and employees are paid for their salaries and wages

- The salaries and wages expenses are then recorded to individual job cost sheets

Other direct construction costs

This includes other expenses that were incurred for a specific construction project, but which were not previously included as direct costs incurred for materials and labour. Other direct expenses may include:

- notices, fees, permits, security deposit relating to local authority requirements, water and sewerage authority requirements, Office of Fair Trading requirements, etc

- monetary sums (contingency sums, liquidated damages, security bonds, etc.)

- expenses incurred for hoarding and fences, for scaffolding and gantries, for cleaning and rubbish removal

- hand over expenses – expenses incurred in the process of handing the property over to the owner (e.g., labelling and handing over keys)

- site accommodations - expenses incurred for building a temporary toilet, change rooms, office, etc.

Construction overhead / Indirect Construction Costs

These are construction costs that cannot be practically attributed to one particular project; thus, its total amount is allocated across multiple construction projects. Construction overhead may include:

- rent expense of equipment used in multiple projects

- insurance expense that can be attributed to multiple projects

- salaries expense of project managers, quantity surveyors, architects, etc. who performed tasks for multiple projects

- depreciation expense of equipment used in multiple projects

Business Overhead

Business overhead pertains to the administrative expenses incurred by the office. The business overhead expense includes the following:

- depreciation of the office building

- depreciation of the office equipment

- office utilities (electricity, communication, water, etc.)

- office supplies

- salaries of employees working in the office

- interest on borrowings

- bank charges

- accounting fees

Profit

Profit can be viewed in a business-level and in a project-level. In a business level, profit is the difference between the revenue earned by the business and of the expenses it has incurred for the period. In a project level, profit is viewed as the difference earned from the project and the cost incurred for the project. Here are some of the important things to remember relating to the profitability of a project:

- It is important to remember that in order to at least breakeven, business overhead should be taken into account when pricing a project.

- In order to generate profit, the price you quote for a project should include:

- the mark-up on the construction costs; AND

- the mark-up on the business overhead - The mark up on business overhead represents the amount that must be charged to the project in order to cover business overhead. The manner on how the mark-up for business overhead is calculated varies depending on the choice of the management. Typically, construction companies compute the mark-up for business overhead based on the proportion of the total business overhead with either of the following:

- total labour costs; or

- total sales

- When assessing the profitability of projects, managers would usually compute for the project’s gross profit margin. To get the gross profit of a project, you simply deduct the total construction cost from the contract price. To get the gross profit margin, you simply divide the gross profit of the project by the contract price.

Case Study: Profit

ABC Construction company reports the following information:

| Direct materials | 3,000 |

| Direct labour | 5,000 |

| Other Construction Costs | 7,000 |

| Business Overhead | 2,000 |

| Desired Profit Margin | 25% |

Additional Information:

- The business computes its mark-up on overhead based on the total direct labour costs.

- Project ALT Homes incurred $500 labour costs, $200 material costs and $800 other construction costs.

Required:

- Compute for the mark-up on business overhead for Project ALT Homes.

- How much should be the total contract price in order to obtain the desired margin of 25%?

- How much should be the mark-rate on the construction cost?

Suggested Answer:

- The scenario says that the business computes its business overhead mark-up based on the total direct labour cost hence we first need to divide the total business overhead by the total direct labour costs, and this should equal to 40% (2,000/5,000). To get the required overhead mark-up for Project ALT Homes, you simply multiply the mark-up rate you just computed by the total direct labour cost incurred for the project (40% x $500). Hence, the business overhead mark-up for Project ALT homes should be $200.

- To get the correct total contract price, you just need to divide the total construction cost by 75%. The total contract price for Project ALT Homes should be $2,000 (1,500/75%).

- (2000 – 1,500 – 200 – mark-up on construction cost) = 300. Accordingly, the mark-up rate on the construction cost is 20%.

Project costing

Project costing is the process of accumulating costs to a specific project or job. It refers to the process of identifying which costs are attributable to a specific project. Project costing can be understood in the context of accounting and in the context of project cost estimation.

Project Cost Estimation

Project costing is primarily done to provide estimates useful in different aspects relevant to building and construction projects. In this context, project costs may be classified based on the purpose of developing the estimate:

|

Type of Project Costing |

Purpose |

When it is Performed |

|

Feasibility |

Estimates are used in assessing the financial feasibility of the project |

|

|

Appropriation |

Estimates are used for obtaining project funding. |

|

|

Capital cost or budget |

Estimates are used for budget control |

|

|

Definitive |

Estimates are used to predict costs. |

|

Project Costing in Accounting

In the context of accounting, project costing pertains to the accumulation of actual costs incurred and other costs attributed to the project. The project costs that will be accumulated will be accounted for and will be summarised in the financial reports presented to external stakeholders. Here is an overview of how the accounting department accounts for them:

- The flow of costs for a specific project is tracked and recorded using a Job Cost Sheet. There is a need to be a different Job Cost Sheet for each and every project.

- The cost of material is entered into the Job Cost Sheet upon the issuance of the material to the construction site.

- The direct labour cost is entered into the Job Order Cost Sheet once the pay run is posted.

- Other costs that cannot be directly attributed to a specific project are accounted for by applying an overhead rate.

Overhead allocation

Construction overhead and business overhead cannot be easily attributed to a particular project, and thus, their total costs should be allocated across multiple construction projects.

Why Do We Allocate These Costs?

Knowing how to appropriately allocate these costs is important for budgeting purposes and in determining how much you need to charge for the construction services or supplies you have provided. If you do not allocate the total overhead of the business to each project, you will not be able to accurately determine each project’s profitability

How to allocate these costs

These costs can be allocated with the use of the following methods:

- Rate

- Proportional

Project budget

Project budget is a planning tool that sets out the estimated total costs for each construction project. The data included in the project budget are drawn from the detailed cost estimates made prior to the actual start of construction (i.e., cost estimates made for project bidding or project quoting).

The structure, content, and format of a project budget may vary from one organisation to another. However, for a project budget to effectively serve its purpose, it should include at least the following information:

|

Title |

The title of the project budget should indicate the type of costs being appropriated in the project budget (e.g., project budget for materials, labour, sub-contractor, total project budget). |

|

Project Details |

Project details would include the unique code used to distinguish one project from another, client details, and the location of the project. |

|

Period Covered |

This pertains to the period covered by the budget. It is important for you to know whether the budget is an annual budget, monthly budget or just a weekly budget. |

|

Cost Items |

Items that are assigned with costs in the project budget |

|

Code of Accounts |

Code of accounts is a unique set of numbers used to identify each cost item in the project budget. Codes of accounts help project managers in distinguishing multiple components of a project budget without the need to remember lengthy names or terminologies. |

|

Original Budget |

Original budget pertains to the cost estimates made prior the start of the construction. As discussed, this would typically be based on the detailed cost estimates made for project bidding or project quoting. |

|

Adjustments |

This pertains to any adjustments that have to be made to reflect approved changes in cost estimates (e.g., change orders). |

|

Current Budget |

The current budget is the sum of the original budget and the adjustments. |

Nowadays, project budgets are generated through computer software. Once these projects budgets are approved, the data from the project budgets would then be transposed to the Project Cost Report document. Unlike the Project Budget, Project Cost Report is considered as a living document and thus, updated periodically. The Project Cost Report is updated to reflect the number of costs actually incurred, and resources actually consumed during a period.

|

Project Budget for Equipment (All figures in Thousands) |

||||

|

Project Code: 02360 |

Period Covered: 1 July 2020 – 30 September 2020 |

|||

|

Major Equipment |

||||

|

Description |

Account Code |

Original Budget |

Adjustments |

Current Budget |

|

Compressor |

0020 |

$4,523 |

0 |

$4,523 |

|

Tanks |

0243 |

123 |

0 |

123 |

|

Towers and Reactors |

5320 |

6,412 |

0 |

6,412 |

|

Internals |

4120 |

1,563 |

0 |

1,563 |

|

Heat Exchanges |

2350 |

1,422 |

0 |

1,422 |

|

Pumps and Drivers |

0022 |

2,564 |

0 |

2,564 |

|

Vessels and Drums |

0029 |

1,256 |

0 |

1,256 |

|

Special Equipment |

4765 |

5,235 |

0 |

5,235 |

|

Total Equipment |

23,098 |

0 |

23,098 |

|

In this particular project budget, the costs of the total equipment were itemised, and each item was assigned with their specific account codes. This project budget also includes details about the current budget, adjustments, and the original budget. Organisations who prepare their project budget in the same format as the sample project budget above will also need to prepare project budgets for other construction costs such as for materials, labour, etc.

|

Total Project Budget |

||||

|

Project Name Period Covered |

Wharf Project 20/01/2021 to 15/04/2021 |

|||

|

Category |

Materials |

Sub-Contractor |

Equipment |

Total Cost |

|

Steel Piling |

$240,147 |

$123,759 |

$0 |

363,906 |

|

Tie-rod |

75,565 |

27,856 |

0 |

103,421 |

|

Anchor-wall |

132,273 |

61,759 |

0 |

194,032 |

|

Backfill |

216, 560 |

25,789 |

0 |

242,349 |

|

Coping |

41,678 |

22,165 |

0 |

63,843 |

|

Dredging |

0 |

110,235 |

0 |

110,235 |

|

Fender |

47,226 |

10.231 |

1,674 |

59,131 |

|

Other |

7,560 |

34,165 |

0 |

41,725 |

|

Sub-total |

761,009 |

415,959 |

1,674 |

1,178,642 |

|

Summary Total direct costs Other costs Overhead Total Project Cost |

1,178,642 285,500 146,230 $ 1,610,372 |

|||

The above sample project budget is for the construction of a wharf. Unlike the project budget in the previous example, the above project budget does not present a breakdown for the total cost of materials, labour, and other costs. Instead, the costs for materials, subcontractor, and equipment were aggregated and allocated to each category accordingly.

Progress payments

Due to the long-term nature of construction projects, the project’s total contract price is typically settled in partial payments. These partial payments are referred to as progress payments. The number of progress payments that can be claimed by a contractor is usually based on the progress of the construction project, hence the name.

The figure illustrates how the total contract price can be settled in partial payments. The first payment (the down payment) is paid before the start of construction. Down payment helps the construction project meet start-up costs such as fencing, scaffolding, etc. The succeeding payments then pertain to the progress payments for the construction project.

Contract terms on progress payments

How to progress payments are paid varies depending on the terms of the construction contract. The terms should include the date as to when progress payments can be claimed, the amount of the progress payments that can be claimed, and the conditions before payments can be claimed. These terms are outlined in the Progress Payment Schedule section of the contract (see example below).

Payment Schedule

CLIENT agrees to pay CONTRACTOR the Total Payment specified below for the Services in accordance with the following schedule:

|

Upon execution of the Contract: |

$900 |

|

Upon completion of 50% of the Services: |

$5,100 |

|

Upon execution of the Contract: |

$6,500 |

|

Upon execution of the Contract: |

$13,00 |

CONTRACTOR agrees to provide the CLIENT with a breakdown of all costs (i.e., materials labour) upon the CLIENT’s request. (Figure 4 – Progress Payment Schedule)

The sample progress payment schedule above provides for the details regarding the required advance payment and as well as the amount to be paid upon the completion of the project. The schedule also determines that $5,100 should be paid as progress payment once the construction project is already 50% complete. To determine the percentage of completion of the project, the actual cost incurred to date is usually divided by the total estimated project costs.

Laws on progress payments

The terms of the contract regarding progress payments may vary but, in no case, should these terms be against the provisions of the contract laws of their state or territory.

HARRY COMMENT: maybe the below table would be a good way of showing / differentiate case studies?

|

Case Study: Laws on Progress Payments The total estimated project cost for a proposed project is $8,000. Your project is to develop a residential building in Bunbury, Western Australia. Required: Your client asked you to determine the required down payment for the proposed construction project. Suggested Answer: The required down payment should not be greater than 6.5% of the total contract price. Builders of a home-dwelling in Western Australia are required to adhere to the provisions of the Home Building Contracts Act 1991. As per the Act, home building contracts valued between $7,500 and $500,000 should limit the required down payment to 6.5 % of the total contract price. |

Scheduling

Scheduling is the process of planning how resources should be committed to various tasks over a period of time. Scheduling can be done by preparing a Construction Schedule. Preparing a Construction Schedule will help you:

- Coordinate the delivery time for materials

- Allocate labour hours efficiently

- Anticipate financing needs every period

- In managing payment claims – Most contract terms concerning payment claims require that the progress of the project be determined. Accordingly, the progress of the project can be determined based on the costs incurred to the date of the project.

How to prepare a construction schedule

Here is how you can prepare a Construction Schedule for a building and construction project:

- Prepare and set up the Construction Schedule template.

- Gather information by reviewing the project budget and schedule of progress payments.

- Allocate the expenses and enter all relevant data into the Construction Schedule.

Preparing and setting up the construction schedule template

The first thing to do in preparing a Construction Schedule is to set up the template. Access the Construction Schedule template of your organisation and modify its structure according to the specific requirements of the project.

Here are some of the other things to do when setting up your template:

- Set up the important dates of the construction project (E.g., start date, completion date, etc.). The important dates of a construction project are indicated in the construction contract and other related documents.

- List down the tasks to undertake to complete the project. The cost components in the constructions schedule can be presented in a variety of ways. Ideally, the construction cost should be allocated per task. By breaking down the project into specific tasks, you should be able to easily estimate and identify when certain expenses will be incurred over the life of the project since the sequence of the tasks can be easily determined.

- Choose how you want to allocate project expenses. Label each column heading based on how the project expenses will be allocated — whether it is allocated on a daily, weekly, monthly, quarterly or annual basis. As for most small projects, which are anticipated to be completed in a week, the project expenses would be allocated on a daily basis. If such is the case, the column headings should be labelled as Monday, Wednesday, Tuesday, and so on and so forth, plus their corresponding dates.

- The constructions schedule can also include other details about each task. This may include total allocated labour hours, total units of materials to be used in the construction, name of the supplier, estimated delivery time, productivity rate, etc.

Gathering information

To gather pertinent information for the construction schedule, you will need to review the project budget and schedule of progress payments. The project budget shall tell you the details regarding the costs that will be allocated while the progress payment schedule from the contract should tell you how much of the total contract price should be partially received for each period. Hence, you review the project budget and the progress payment schedule in order to gather the following information:

- the materials, labour, other construction cost associated with each project task

- the quantity of labour and materials needed to complete each project task

- the amount of progress payment that can be claimed upon completing certain tasks

Allocating expenses

After preparing the template and reviewing all related documents, you now need to enter all relevant data into your Construction Schedule. Take the costs of materials, labour, and other expenses that will be incurred for each project task. To determine when these expenses will be incurred, you will have to provide estimates for the start and completion date of each task. To do this, you will need to demonstrate your knowledge in the inner workings of each task, review historical data (i.e. base your estimates on previous projects) and consult with the team and the subcontractors and ask them to provide for their own estimates.

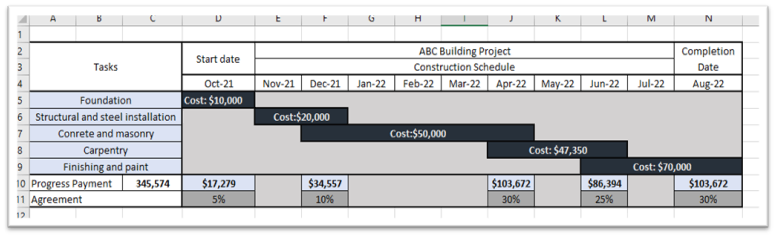

Case Study: Allocating Expenses

After reviewing the project budget and schedule of progress payments, you have gathered the following information for the ABC building project:

|

Project Task |

Duration |

Cost |

Progress Payment Upon Completion of Task |

|

Foundation |

One month |

$10,000 |

$17,279 |

|

Structural steel installation |

Two months |

$20,000 |

$34,557 |

|

Concrete and masonry |

Five months |

$50,000 |

$103,672 |

|

Carpentry |

Three months |

$47,350 |

$86,394 |

|

Finishing and paint |

Three months |

$70,000 |

$103,672 |

Additional information: The project starts on October 10, 2021, and the agreed completion date based on the contract is on August 10, 2022.

Required: Prepare a construction Schedule.

Suggested approach:

This construction schedule was prepared in a spreadsheet format following the structure of a Gantt Chart. Because it is already known that the tasks can be completed in months, the expenses are allocated on a monthly basis. This example simply shows you how data are plotted into the construction schedule template.

Cash flow

Cash flow is the inflow and outflow of cash. The inflow of cash pertains to all cash received by the business for the current period while outflow of cash, on the other hand, pertains to all of the business’s cash disbursements.

Here are some examples of cash inflows and cash outflows:

| Inflow | Outflow |

|

|

Manage Cash Flow

Keeping track of cash flows

Keeping track of cash flows is important in answering questions relevant to the decision making of managers, creditors, and investors. Some of these questions include the following:

- Is the business generating positive cash flows from its operations?

- Will the business be able to meet its obligations with its creditors?

- Where did all the money of the business go during the period?

- Does the business need additional financing?

Cash Flow Status Report

Businesses can keep track of their cash flows by regularly updating a Cash Flow Status Report. Cash Flow Status Report is a living document which contains information about the current inflows and outflows of cash in a specific project. Cash Flow Status Report is typically maintained, updated, and monitored by personnel on-site. Project managers and superintendents are mainly the ones who monitor this type of report because they are the ones who have direct supervisions over the material and labour needs of a project and thus, they need relevant information in determining whether there is a need for additional financing to complete project tasks within the timeframe. Cash Flow Status Report can also help the business in identifying whether progress payments are collected accordingly based on the terms of the contract.

|

Costs 7/02 |

Charges 8,754,516 |

Estimated 65,863,092 |

% Complete 13.292 |

Projected 66,545,263 |

Change 682,171 |

|

Billings 7/01 |

Contract 67,511,602 |

Gross Bill 9,276,621 |

% Billed 13.741 |

Profit 966,339 |

|

|

Payables 7/01 |

Paid 6,719,103 |

Open 1,300,089 |

Retention 391,671 |

Labour 343,653 |

Total 8,754,516 |

|

Receivables 7/02 |

Net Bill 8,761,673 |

Received 7,209,344 |

Retention 514,948 |

Open 2,067,277 |

|

|

Cash Position |

Paid 7,062,756 |

Received 7,209,344 |

Position 146,588 |

Figure 6 - Cash Flow Status Report

Payables: The payables row will provide information on the total payments made to suppliers, and sub-contractors (Paid), current total outstanding balances (Open), the amount not yet paid to sub-contractors as part of the retention terms of their contract agreement (Retention) and the amount paid for labour. It is important to note, however, that the content and structure of a Cash Flow Status Report may vary from one organisation to another. Other companies may have different ways of how they present cash inflows and outflows of the project. Some even have a more comprehensive breakdown of each of its project’s disbursements and receipts.

Receivables: The receivables row contains information about the total amount billed to the clients, the total amount received from the clients, and the amount retained in accordance with the retention terms in the contract agreement. From the example above, you will notice that although the total amount billed is 8,761,673, only 7,2016,344 was actually received in the project. Situations like this could impose risks of not being able to meet project target dates that is why you will have to make sure that you initiate the necessary steps in order to recover the outstanding balances of your clients at the earliest time possible.

Cash Position: Cash Position is the total difference between the cash receipts and cash disbursement of the project for the current period. The cash position balance will tell you exactly whether the project is operating with a negative cash balance or not. The negative balance could indicate that there will be a delay in payments to suppliers, labourer’s, and sub-contractors. Having outstanding balances, ordinarily creates additional expenses for the project, such as interest expense. Some suppliers could also even delay the delivery of materials due to the delay in payments.

Format and Structure of the Cash Flow Status Report

Organisations may employ different tools and templates when keeping track of the cash flows of the project. Some organisations may even refer to such document with names other than ‘Cash Flow Status Report’. The format, structure, and content of such report accordingly vary depending on the policies of the organisation. Nevertheless, any document used to record the incomings and outgoings of a project should at least be able to report the following information:

- Information regarding the incomings including:

- The date when the cash was received

- The amount of cash received

- The payment method

- Information on the source documents related to the cash receipts, including:

- Payment claim reference number

- Receipt reference number

- Information regarding the outgoings including:

- The date when the cash was disbursed

- The amount of cash disbursed

- The payment method

- Information on the source documents related to the cash disbursement including:

- Invoice reference number

- Receipt reference number

Payment claim

A payment claim is a document used to demand and recover payments covered under the security of payment laws of Australia. Each state and territory have their own security of payment laws, but all of which has similar provisions and has the same objective which is to help contractors recover payments from their supply of construction services and construction supplies. According to relevant laws, a payment claim should:

- Identify the related construction work or supplies to which the demand for payment relates to

- Identify the amount of progress payment demanded

- Indicate that the document serves as a payment request

- Include any other information as required by the contract terms

Payment schedule

The client may respond to a payment claim either by paying the amount indicated in the payment claim or by sending a Payment Schedule. A payment schedule should:

- be in writing and is addressed to the claimant

- identify to which payment claim it relates

- indicate the amount of payment proposed to make

- state the reason why the proposed amount is different from the amount indicated in the payment claim

Receipt

A receipt is a type of source document that can serve as a proof of the cash received from a particular transaction. Receipts document the amount of payment received, the date when the payment was received, and other details relevant to the payment transaction. Receipts must always have a corresponding reference number for tracking purposes.

Statement of cashflows

A Statement of Cashflows is a type of financial report used to present information about the cash inflows and outflows of not only a particular project but of the whole business itself. A Statement of Cashflows is one of the mandatory financial reports of a company and is prepared by professional accountants. The information provided in this type of financial report can help managers in determining the necessary measures to undertake to manage cash disbursements and to boost cash receipts. In this report, the information about cashflows is presented according to the types of the cash flow activity in the business. Cashflow activities are basically classified into three: operating activities, investing activities, and financing activities. Most activities relating to construction projects will be under operating activities (e.g., purchase of materials). Loans obtained for construction projects will be under financing activities while a purchase of large equipment for construction projects shall fall under the classification of investing activities.

Pay contractors and suppliers

Payment to Contractors and Suppliers

The specific processes involved in paying contractors and suppliers depends on the policies and procedures of the organisation, but generally, it should involve the following steps:

- Review the invoices sent by the contractor and suppliers.

- Secure payment authorisations.

- Pay contractors and suppliers.

- Secure proof of payment.

Review of invoices sent by the contractors and suppliers.

Upon the receipt of materials from a supplier, an invoice will be received by the business. Sub-contractors will also send an invoice for the payments due once they complete their job. It is important that you first check the accuracy of details indicated in these invoices before finalising any payments to contractors and suppliers. Ensure that you only pay the amount that is rightfully due and demandable. In your review, check for the following details:

- the amount claimed by the contractor and suppliers; to determine whether the payment is due and demandable, you will need to check two things:

- The contract or any form of agreement that the business had with that supplier or sub-contractor – This agreement will help you determine the payment terms. Checking this agreement is especially essential when reviewing the invoices sent by a sub-contractor since sub-contractors are paid based on the contract terms. On the other hand, payment for supplies shall only be due and demandable once the materials are received unless there is an agreement indicating otherwise.

- Any proof that those supplies have been received or the services have been rendered – To determine whether materials were already received, you will need to check their respective receiving reports. The receiving report shall tell you information about the materials received, including information about their quality and quantity. To know whether the sub-contractor/s have rendered their services based on the contract terms, you can physically check the site or ask personnel on the site to take pictures of the work of the sub-contractors and ask them to send these to you.

- the payment terms:

- Will you get discounts if you pay early?

- When is the due date for the payment?

- What are the available payment methods?

Secure authorisations for payments

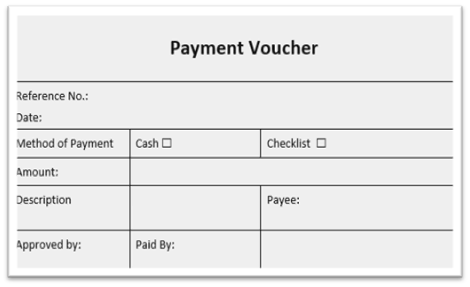

Before the actual payments can be made, it is best practice to first secure authorisations for the disbursements. To observe this practice, most businesses employ a system called the voucher system. A voucher system is simply a set of procedures employed by the organisation intended to regulate the approval of cash disbursements. It can help the business mitigate the risks of fraudulent and erroneous cash withdrawals.

The procedures involved in the voucher system may include the following:

- A payment voucher is filled out. A payment voucher, also known as disbursement voucher, is an internal document used to request approval of cash disbursement. A payment voucher is filled out once it was ascertained that the payments are due and demandable. Since a payment voucher is an internal document, its format and structure vary in every business. However, for convenience purposes, the document should be properly labelled to identify that such is a payment voucher.

- Attachments are stapled to the payment voucher. These attachments include an invoice, a receiving report, and the proof that services were rendered.

- The payment voucher, together with its attachments, is submitted to authorising personnel for approval.

Pay suppliers and contractors

After the payment is authorised, you may now pay the invoices using the payment method indicated in the payment terms (if any) or using the payment method required by the organisation’s policies and procedures. Here are some reminders when making the payment:

- Review the payment terms or the policies and procedures of the organisation. Should you have any clarification with the policies and procedures of the organisation, enquire with the policymaker or with the personnel in charge of enforcing the policy.

- There can be different procedures and instructions to follow for every method of payment. For instance, if you are making a payment through an online transfer, you will need to follow the instruction of the bank or financial institution which will process the online transfer.

- When paying the invoices, make sure that you are prepared, and you have the following with you:

- Copies of the related source documents including the invoices and payment vouchers

- Record of the necessary payment details (e.g., bank details)

- Cash, debit card, credit card, etc. (if not paying through electronic transfer)

IMPORTANT: If you are going to pay physical cash, make sure to keep it secured, especially if you will be travelling.

Secure proof of payment

After paying, secure a receipt or any kind of proof payment for the disbursements made. Ensure that the receipt indicates the correct details about the payments and that it has the following information:

- The receiver of the payment

- The amount paid

- The date of the payment

- The reference number of the receipt

- The description of the transaction

Importance of Managing Receipt of Revenue

Managing the receipt of revenue is integral to the success of every project. You have to ensure that the business is able to receive the payments according to the terms of the contract.

Having an effective management of revenue will help the business:

- in improving cashflows

- in avoiding the need to increase construction loan

- in avoiding delay in the project schedule and temporary shutdown

- in preventing issues with the claims of the sub-contractors, suppliers, and other creditors

Ways of Managing Receipt of Revenue

To properly manage the receipt of revenue of the business, you will need to know how to:

- properly process invoicing of clients

- keep track of progress payments

Invoicing

Invoicing is the process of sending an invoice to a client for services rendered or for supplies provided. An invoice is basically a document used to demand payment from clients. In general, it should indicate the amount payable by the client and the description of the transaction (i.e., the services or supplies provided). Here are some important things to remember when invoicing the clients of the business:

- If you are a project manager, you will have to ensure that the invoices you issue to the clients follow the format required by the contract terms and the policies of the project.

- Make sure to be mindful of the contract terms and take note of the conditions regarding when the business can demand payment. This is important because any delay in invoicing creates problems in the contractor’s cashflows.

- After invoices are issued to the client, the accounting department records the transaction in their accounting system by crediting a ‘Progress Payment’ account and by debiting an ‘Accounts Receivable’ account by the amount indicated in its related invoice. Once these invoices are settled by the client and the progress payments are collected, the accounting department then debit a ‘Cash’ account and credit an ‘Account Receivable’ by the amount equal to the payment received.

- There are essentially five ways to send invoices to clients:

- Via post mail

- Through email

- Through e-invoicing

- Through a printable web page

- In person

Types of invoices

The two most common types of invoice include:

- Regular invoice – Regular invoice is issued by businesses who are not GST registered.

- Tax invoice – A tax invoice should only be issued by a GST registered business. It is used primarily to indicate the amount of GST charged on the goods or services provided by the seller. A tax invoice is required before a GST credit can be claimed. According to ATO, a tax invoice made for a sale of more than $1,000 should include the following information:

- information that the document is intended to be a tax invoice, e.g., the document is titled ‘Tax Invoice’

- the business’s identity as the seller, such as its business name or trading name.

- the date when the invoice was issued

- the business’ Australian business number

- a brief list of the goods and services provided, including quantity (e.g., hours worked) and the price

- the total goods and services tax (GST) amount payable

- the extent to which each sale includes GST

Invoices and payment claims

An invoice, regardless of its type, can serve as a payment claim as long as it includes information required by relevant security of payment laws. However, a document labelled as a ‘payment claim’ may not be considered as a valid tax invoice if such document fails to provide information that such is intended to be a tax invoice.

Processing payment claims and invoices

The manner of how the business demand payments from its client depend on its internal policies and procedures. There are businesses who would process a separate document for a payment claim and a separate document for an invoice, and there are also businesses who would just issue a tax invoice to serve as a payment claim.

Demanding payments with payment claims and invoices

If the business demands payment by processing separate documents for payment claims and invoices, the normal procedures will involve the following:

- The business sends out a payment claim.

- The client reviews the payment claim.

- The business receives either a payment schedule or a Recipient Created Tax Invoice.

- If the client disagrees with the amount indicated in the payment claim, they will have to send the business a payment schedule. However, if they approve of the amount indicated in the payment claim, the business will receive a type of invoice known as a Recipient-Created Tax Invoice (RCTI). An RCTI is a special type of invoice that can be used if the payor intends to issue the invoice himself. Payments from the clients will also be received upon the issuance of this RCTI.

Demanding payments by issuing invoices that also serve as payment claims

Here is how you can properly issue invoices to the clients of the business:

- Review the contract agreement in conjunction with the security of payment Act relevant in the state or territory where the business operates. Determine whether there are terms in the agreement that dictates the required format, structure, and content of the invoice.

- Prepare the template of the invoice according to the policies of the organisation and the terms of the contract.

- Gather your estimates and complete the required fields in the invoice template. The information indicated in the invoice should include the following:

- Information on how the progress payment is computed. It is important to note, however, that the computation for the progress payment should be based on the terms of the contract and should be supported with relevant source documents.

- Essential data to be included in a valid invoice (See the previous discussion).

- Make sure that all necessary attachments are attached to the invoice. For instance, if the contract states that the invoice must be accompanied by a detailed cost summary, then such cost summary must be included when you send out the invoice.

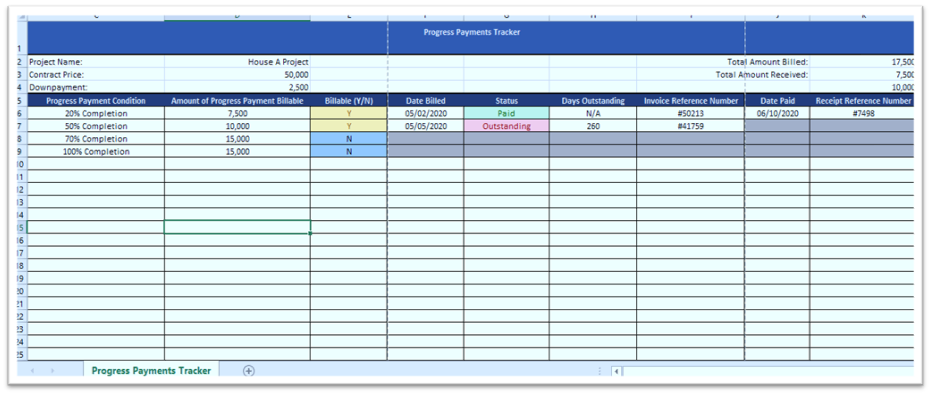

Keeping track of progress payments

There are different tools that the business can utilise in tracking the progress payments of a building and construction project. Most construction management software, nowadays, has a feature that lets its user monitor the current outstanding balances of the clients, their paid balances, etc.

Importance of Keeping Track of Progress Payments

It is important to keep track of the progress payments in every project in order to determine:

- whether the invoices are immediately sent to the clients once payments become due and demandable

- whether there are outstanding debts that need to be resolved

- the amount of cash expected to be received in a given period

Developing your own tracker

If your organisation does not employ any tools for keeping track of progress payments, you can opt to develop your own tracker using a spreadsheet. You can follow the simple guide below when developing your own progress payment tracker:

- Choose software that enables users to create spreadsheets.

- Add columns and rows for the following information:

- total contract price

- the amount of progress payment that can be claimed as stated in the contract

- the status of the progress payment (i.e., whether paid, outstanding, or not yet demandable)

- the date when the progress payment was billed

- the date when the progress payment was received

- the reference number of the payment claim and receipts

- the number of outstanding balances

- the number of total progress payments paid

- The amount paid as a down payment

The sample progress payment tracker above was prepared using Microsoft Excel. The first part of the tracker provides fields for the project name, total contract price, required down payment, the total amount billed, and the total amount of progress payments received as of the period. The columns are properly labelled according to what information is being required in each column. For instance, the first column labelled as ‘Payment Conditions’ requires the personnel who is managing the tracker to review the contract and determine what the conditions are before the progress payments can be claimed against the client.

Recovering outstanding debts

Business.gov.au identifies six steps on how a business can recover its outstanding debts:

- Review the terms of the contract

- Send a reminder

- Send a letter of demand

- Get legal help with the dispute resolution

- Get assistance from a debt collection agency

- Get legal assistance and explore possible legal actions to undertake

Payment methods

Giving your clients different payment options can ease the recovery of outstanding debts. The advantages and disadvantages of different payment methods are provided below to help you assess which payment method would be the most appropriate to your clients and to the business.

|

Payment Method |

Advantage |

Disadvantage |

|

Credit Card |

|

|

|

Direct Debit |

|

|

|

Cheque |

|

|

|

Cash |

|

|

Monitoring the financial health of the business

You should be able to perform a financial health check of the business by analysing different financial ratios and sales calculations including the following:

- Sales calculations

- Profit ratio

- Liquidity ratio

- Finance ratio

Sales calculations

You perform a sales calculation if you want to analyse how your business is doing in terms of revenue generation. Examples of sale calculations include the following:

Break-even Point

Break-even point (BEP) in dollars determines the number of dollar sales in which the business’s total revenue would equal its total costs. BEP is calculated using the following formula:

Break-even point in dollars = Total Fixed Costs ÷ Contribution Margin Ratio

If the total sales of the business are greater than its Break-even Point in dollars, the business would be currently operating at a profit. However, if the total sales of the business would be less than the Break-even Point in Dollars, it would mean that the business is currently operating at a loss.

Gross Profit Margin

Gross Profit Margin indicates the proportion of gross profit with sales in percentage. Margin can be calculated using the following formula:

Margin = (Gross Profit ÷ Sales) x 100.

If the current margin is lower than the target margin for the period, the business would then be considered as underperforming and vice-versa.

Case Study: Sales Calculations

You have gathered the following information for the current period:

Contribution Margin Ratio 0.20

Total Fixed Costs $35,000

Current Total Sales $189,000

Current Gross Profit $72,000

Required:

- How much sales should the business be able to generate in order to break-even?

- Compute for the gross profit margin.

- Is the business generating enough sales in order to earn a profit?

Suggested answers:

- Break-even sales in dollars = $35,000 ÷ 0.20 = $175,000

- Gross profit margin = ($72,000 ÷ $189,000) x 100 = 38.10%

- Yes. Evidently, the business is operating in a profit since the current total sales of the business is greater than its break-even sales in dollars. Furthermore, it has also been calculated that for every dollar sale, the business earns 0.3810 cents.

Financial ratios

Financial ratios indicate the relationship that exists between two numbers which are both relevant to the financials of the business. However, it is important to note that it is not enough that you merely know how these financial ratios are computed. The most important thing that you have to be knowledgeable about is how these financial ratios can be analysed so that you can assess the current financial health of the business.

Financial ratio analysis

To be able to make use of your financial ratio computations for your assessment of the business’s current financial health, you must compare these financial ratio computations to either of the following:

- to the respective financial ratios from the previous period (historical data)

- to the respective financial ratios of other organisations in the same industry (Building and Construction)

Profit ratio

You compute for a profit ratio when you want to analyse how profitable the business is in relation to other aspects of the business like sales, equity, etc. Examples of profit ratios include the following:

Gross Profit Ratio

The gross profit ratio measures the percentage of gross profit earned for every dollar sale. Gross profit ratio is calculated using the following formula:

Gross profit ratio = (Revenue – Cost of Goods Services) ÷ Sales

The higher the gross profit ratio is, the better. For instance, if the gross profit ratio last year is 0.35, then the gross profit ratio of the business for the current period should be at least equal or higher than 0.35. If the business’s current gross profit ratio happens to be lower than the last period, then this can be a bad indication of the business’s current financial health.

Return on Equity Ratio (ROE)

This ratio measures the rate of return on the resources provided by the owners of the business. Return on Equity Ratio (ROE) is calculated is using the following formula:

ROE = Net Income ÷ Average Ordinary Equity

This ratio practically indicates the profit that the investors of the business earn for every dollar of their investment. Accordingly, the higher the Return on Equity is, the better.

Liquidity ratio

You compute for liquidity ratios when you want to assess the current ability of the business to settle its short-term obligations. Examples of liquidity ratios include:

Current Ratio

The current ratio measures the business’s ability to pay short-term obligations with all of its current assets.

Current ratio = Current Assets ÷ Current Liabilities

A current ratio of more than 1.0 is good. If the current ratio of the business is more than 1.0, then that means that the current assets of the business is more than its current liabilities. Evidently, this also means that the business has enough cash or enough assets that are easily convertible to cash, to settle its current obligations.

Quick ratio

The quick ratio measures the business’s ability to pay short-term obligations with its quick assets.

Quick ratio = Quick Assets ÷ Current Liabilities

As you can see, the only difference between the current ratio and the quick ratio is their numerator. In quick ratio, your numerator shall be quick assets. Quick assets include all current assets except inventories. Inventories are excluded from the computation of quick assets because it is not as liquid as the other current assets. Unlike the other current assets, inventories still need to undergo the manufacturing cycle before it can be sold to consumers and be turned into cash. Accordingly, the analysis of quick ratio is the same with how you analyse current ratio — a quick ratio of more than 1.0 is good.

Financing ratio

You compute for financing ratios when you want to analyse how much of your assets are financed by obtaining debt and how much is financed through equity. Examples of financing ratios include:

|

Financing ratio |

What is being measured |

Formula |

Analysis |

|

Debt-to-Equity Ratio |

This ratio measures the riskiness of the business’s capital structure. |

Debt-to-Equity Ratio = Quick Assets ÷ Current Liabilities |

A high Debt-to-Equity ratio indicates that the riskiness of the business’s capital structure is high. |

|

Loan-to-Value Ratio (LVR) |

This ratio helps lenders work out if they can get the loan amount back if the business stops making payments |

Loan-to-Value Ratio = (loan amount/property or asset value) x 100 |

The lower the LVR, the better. |

Options to improve financial position of the business

There are different ways on how you can improve the financial position of the business:

Recover outstanding debts

This option must be implemented if there is a number of receivables of the business which are already passed due dates.

Reduce expenses

If the actual costs are higher than the budgeted cost of the business, you might need to start planning on how to reduce your expenses. Here are some examples of how you can reduce the expenses of the company:

- Switch to an insurance company that provides for a better policy

- Use energy-efficient equipment

- Build good relationships with your suppliers to be able to negotiate better deals

- Hire multitasking companies

- Avail of purchase discounts

Sell assets

Selling unused assets may improve the business’s financial position by reducing the storage costs related to the unused asset and by turning long-term assets to highly liquid assets such as cash and receivable.

Increase prices

The price increase would be necessary to improve the business’s financial position when there is a hike in construction costs like materials, labour, and equipment.

Consolidate debts

Debt consolidation is the process of combining different outstanding debts into one loan. Consolidation of debts can help the business in improving the financial position of the business by:

- Allowing the business to settle multiple loans into one single transaction

- Obtaining arrangements from financial institutions that offer a lower interest rate

- Obtaining arrangements with payment terms that are often more manageable

Track cash flow

The business can track its cash flows by:

- preparing and updating the Cash Flow Status Report

- conducting period cash counts

- monitoring bank statements

- preparing a Statement of Cashflows

Rearrange expenses

Rearrangement of expense relates to the manner of arranging payment terms and the manner of incurring expenses. Some examples of how you can rearrange your expenses include:

- Paying large expenses in periodic payments

- The schedule for the purchase of materials is aligned with the schedule of progress payments to ensure that the business has sufficient cash to pay the suppliers

Improve cashflow

Some examples of how you can improve the cash flow of the business include:

|

How to Improve Cashflow |

Effect |

|

Lease Assets |

Decrease cash outflow |

|

Provide easy payment options to clients |

Increase cash inflow |

|

Order Just-in-Time |

Decrease in cash outflow |

|

Offering discounts for early payment |

Increase cash inflow |

|

Use interest-bearing bank accounts for any surplus cash |

Increase cash inflow |

Recommendation report

To formally introduce said options to the business, you may prepare a document called Recommendation Report. Your recommendation reports should:

- Provide an executive summary (i.e., explain the purpose of the report)

- Justify the purpose of the report and introduce the issue that your recommendations intend to resolve.

- Present the recommendations in a clear and precise manner which means that you need to be able to explain how those options can be implemented by the business.

- Explain how your recommendations can resolve the problem presented (i.e., how it can improve the financial position of the business)

- Provide for a conclusion. Your conclusion must state the best option among the alternatives you have presented in the report and provide a basis for your conclusion.

Business records

Business record pertains to any type of document containing an information about a particular business transaction. Business records may include meeting minutes, contract agreements, accounting books, accounting source documents, etc. Keeping business records is especially important if you are a contractor and you want to tax deductions for the payments that you make to your sub-contractors and suppliers.

Here are some examples of the type of records that you must keep in relation to the payments that you make to sub-contractors and suppliers:

- contracts or written agreements

- invoices issued and received

- records of the amounts paid

- records of reimbursement made to contractors

- payment summaries or income statements issued

- records of superannuation payments (if applicable)

- voluntary requests made by a contractor if tax amounts from payments are to be withheld

- records of tax withheld from payments when a supplier does not quote their ABN

Importance of keeping business records for taxation purposes

Keeping business records is integral for taxation purposes for the following reasons:

- to provide written evidence of income and expenses

- to help the business’s tax agent in preparing tax return

- to ensure that the business will be able to claim all your entitlements

- to prove the information you provided in your tax return

- to reduce the risk of tax audits and adjustments

- to improve communication with ATO

- to resolve issues relating to disputed assessments or adjustments

- to avoid exposure to penalties (failing to meet your record-keeping obligation would be equivalent to 20 penalty units)

How long do you need to keep business records

Here is an outline regarding how long an entity must keep its business records:

|

Based on What Law |

How Long |

|

Taxation Laws |

Five years |

|

Corporations Act 2001 |

Seven years |

|

Fair Work Act |

Seven years |

Five recordkeeping rules

ATO has set out five recordkeeping rules which you must take note of:

- You need to keep all records related to starting, running, changing, and selling or closing your business.

- Your records should be generated and stored in a way that protects the information from being altered or damaged. Accordingly, it important to secure access controls to your recordkeeping system.

- You need to keep most records for five years. The retention period shall start from the time you have obtained the record or completed the transaction, whichever comes later. IMPORTANT: There are some tax laws that specifically dictate when the retention period for a particular record should start. For instance, under the FBT law, FBT records should be retained for five years starting from the date the FBT return was lodged.

- You need to be able to provide the records whenever obliged by ATO. Accordingly, when you are asked by ATO to provide such records, that means you must also provide all the information required to gain access of such records including encryption keys, passwords, file location, etc. IMPORTANT: It is best practice to have your documents in an easily accessible format and have them properly labelled as well.

- Your records must be in English or can be easily converted to English.

Maintaining and saving financial records

Each organisation may implement different measures in maintaining financial records as long as it is consistent with the five recordkeeping rules and with other relevant regulations. Here are some examples of measures that can be implemented when maintaining and saving financial records:

- Generate copies of all source documents such as receipts, invoices, contracts etc. To do this, you can either, scan the documents and save the soft copies in a secure folder in your computer, or make copies of the document and keep them in a filing cabinet with reliable access controls.

- Properly label each document according to their purpose. Preferably, the name of the document should be located in the upper part of the document for easy identification.

- Number your documents. Ideally, every document must have a reference number. A reference number is a unique set of numbers that can be used to identify documents and differentiate one document from another.

- Attach together all those documents that relate to a specific transaction. For instance, after a transaction with a supplier, the business should attach together all documents that relate to that transaction including the purchase order sent by the business to the supplier, the invoice sent by the supplier, the payment voucher, and the receipt obtain after paying the supplier. This way, the business can easily trace the flow of the transaction.

- Organise the documents into files and according to their category. Preferably, you should create a separate file for each client. Each file shall contain all of the documents that must be kept in relation to your transaction with that client. However, if you are keeping these files in physical storage, do not forget to organise the files alphabetically for easy access.

- Implement access controls. All financial records must be kept in secure storage. When keeping records in a filing cabinet, make sure that only authorised personnel can access that filing cabinet. If the business maintains digital copies of financial records, the folders where the documents are stored should be secured with pin codes.

- Protect your files from possible damages and losses. Make sure to generate back-up copies for your digitally stored documents. For files kept in physical storage, ensure that the storage is located in an area safe from floods, fire, theft, etc.