This week we look at the affordable loss principle, which focuses on the risks associated with trying something new; something which is inherently uncertain. This principle dispels the common perception that entrepreneurs pursue the highest potential (most upside) opportunities, investing whatever it takes in order to chase the biggest return. Instead, we will show that expert entrepreneurs only invest what they can afford to lose.

As part of our case studies, we will then revisit one familiar entrepreneur and meet two new entrepreneurs who exemplify how focusing on only risking what you can afford to lose, can pay off handsomely.

Welcome to Topic 5, Affordable Loss: Understanding the Downside. In this topic, you will cover:

- The affordable loss principle

- Assessing entrepreneurial opportunities

- Affordable loss and bootstrapping

- Affordable loss and stakeholders

- Is affordable loss only valuable when originally launching a venture?

These relate to the Subject Learning Outcomes:

- Recognise the sobering statistic of business failures, while understanding the learning value of such experiences.

- Identify and apply the core principles of effectuation and how they form the basis of the effectual cycle.

- Explain the entrepreneurial bias toward action leads to experience, which in turn increases self-efficacy.

Welcome to your pre-seminar learning tasks for this week. Please ensure you complete these prior to attending your scheduled seminar with your lecturer.

Click on each of the following headings to read more about what is required for each of your pre-seminar learning tasks.

- Read the following chapters of the textbook Read, S, Sarasvathy, S, Dew, N & Wiltbank, R 2016, Effectual Entrepreneurship, Second edition, Routledge.

- Chapter 12-pp. 136-148: The affordable loss principle: Risk little, fail cheap

- Chapter 13- pp. 149-157: Using slack for bootstrap financing.

- Complete this quick knowledge check to see whether you can differentiate effectual and causal thinking based on these scenarios.

Knowledge check

Complete the following six (6) tasks. For each scenario within, select whether you feel it reflects either casual or effectual logic.

Click the arrows to navigate between the tasks.

Read the following academic article:

- Dew, N, Sarasathy, S, Read, S & Wiltbank, R 2009, ‘Affordable loss: Behavioral economic aspects of the plunge decision,’ Strategic Entrepreneurship Journal, 3(2):105-126.

Read and watch the following content.

Affordable loss principle

As we have previously learned, expert entrepreneurs avoid predictions as they are based on too many uncertainties. That means expert entrepreneurs do not focus on the potential upside of an opportunity. Instead, they risk only what they can afford to lose. This is the basis of the affordable loss principle, investing only what you are willing to lose. Watch the following video for a more in-depth overview of the affordable loss principle.

Learning task 1: What is your affordable loss?

The decision as to what we are willing to risk, and lose, tends to be an important personal decision for the entrepreneur. In deciding what YOU can afford to lose and are indeed willing to lose in pursuit of a specific new venture, share your sense of risk in the following poll:

How affordable loss is different to our preconceived notion of chasing the highest return.

The traditional business approach to launching a new venture focuses on market analysis to identify segments that are forecasted to provide the highest returns. The textbook covers this in more detail as part of the discussion on the predictions of net present value. Based on the number of assumptions included in this prediction that tries to quantify the potential return of a venture, we can quickly see that there are so many uncertainties built in, that this becomes more of a guess than a reliable scenario on which we could base our decisions.

Sarasvathy's studies of expert entrepreneurs discovered that they take a very different approach. Instead of focusing on expected returns (based on many uncertainties), expert entrepreneurs considered opportunities based on how much they could afford to lose, in other words, their affordable loss.

Expert entrepreneurs can also increase their chances of success by involving other stakeholders. This then increases the affordable loss by combining it with the affordable loss that the additional stakeholders contribute to the venture, which is specific to each person and their situation.

In this way, the effectuation approach removes the need for any prediction of the outcome, instead, making the venture a truly calculated risk. As the entrepreneur learns and moves forward, they seek to expand the opportunity.

It is important to understand that utilising the affordable loss principle "...does not mean that entrepreneurs choose projects that won’t cost a lot if they fail—or that they do not expect to make a lot of money. It simply acknowledges that uncertain new venture opportunities are difficult to value upfront, whereas the investment of time, money, and other resources is quantifiable, manageable, and controllable" (Society for Effectual Action, n.d.).

Going deeper and never betting the farm - the implications of the affordable loss principle

Is affordable loss just a negative attitude like the adage "glass half empty", or is it actually a positive and empowering idea? Let's hear from effectuation community members answering this question from their perspective. It is important to note that affordable loss is not just financial, pay attention to how this is discussed in the following video.

Virgin Group: from music to airline

A key component of affordable loss is bringing other stakeholders along for the journey. This increases the overall affordable loss of the overall project while not increasing the risk for any individual.

In the words of Sir Richard Branson, famous entrepreneur and founder of Virgin Group, affordable loss is a way of "...protecting from the downside...". In the following video, Sir Richard Branson explains briefly how he, along with his music company, sought to minimise his affordable losses by involving the aeroplane manufacturer Boeing as a stakeholder in starting up his airline venture.

Learning task 2: Have you over-extended?

Sir Richard Branson's example with Boeing demonstrates affordable loss at work for a venture which we now know has become very successful. Sir Richard Branson, however, has certainly had his share of failures. How about you? Have you ever over-extended yourself and got in deeper than you intended?

If you cannot think of an example where you have over-extended yourself in the past, consider a scenario where you might get overinvested and do so in future. Is there something you are very passionate about which is more likely to make you overinvest?

Complete Topic 5: Forum activity 1 by sharing your story with your peers.

You can also navigate to the forum by clicking on 'ENT101 Subject Forum' in the navigation bar for this subject.

Assessing opportunities

Entrepreneurs are known for seeing opportunities before others. In fact, many see multiple opportunities and since they do not have unlimited time, energy, and resources, entrepreneurs must decide which opportunities are worth pursuing.

In order to assess what makes an opportunity attractive, a great place to start is by asking key questions. The following are example questions.

You will notice that questions 1 and 2 use causal logic and focus on the opportunity itself, while questions 3 and 4 use effectual logic and focus on the entrepreneur.

Click on each of the following four example questions to learn more about what information you may seek and obtain to place yourself in the best possible position for a sound decision-making outcome.

This question requires predictions about the future and is based on the idea that the biggest opportunities are linked to those with the biggest returns. This relates to most people being interested in opportunities that will grow over time. As we have learned, in previous topics predictions are fraught with risk, particularly in today's uncertain world.

If you have a relatively predictable market, for instance, for a staple food product such as milk or bread, you can, within reason, comfortably estimate future demand. However, large, and predictable markets usually attract a lot of competition, making these less attractive for entrepreneurs.

At the other end of the spectrum, are markets that do not yet exist. In this instance, it is impossible to make a prediction because the consumers themselves don't know that they need or want a product that does not yet exist (in their mind, at least). In addition, these predictions are based on a whole series of interconnected assumptions making the prediction highly unreliable at best.

Some of the most successful entrepreneurs, Steve Jobs for instance, intuitively understand this, as his own words indicate:

Steve Jobs as quoted by Doolin, 2021.Some people say, ‘Give the customers what they want.’ But that's not my approach. Our job is to figure out what they're going to want before they do. I think Henry Ford once said, "If I'd asked customers what they wanted, they would have told me, 'A faster horse!'" People don't know what they want until you show it to them. That's why I never rely on market research. Our task is to read things that are not yet on the page.

We now know how big the smartphone market is, but when the first iPhone was introduced into the market in 2007, there was no way to predict the size of the opportunity. Only years later, do we have a clear picture of the work and learning that went into developing a product nobody knew they would want. The following video demonstrates the development of the smartphone as a response to Apple considering what the next opportunity would be following the iPod music players.

The iPhone Launch Team video, shown above, gives you a sense of the upfront investment required. The justification for this investment was most likely based on a combination of given factors at that time, including Steve Jobs’ previous successes, but probably also on an estimation of the anticipated future cash flow the iPhone would bring.

As we saw in chapter 12 of the textbook, this calculation of future revenues is called ‘Net present value of future cash flow’ or NPV for short. This was based on many assumptions, such as a prediction of future demand, price assumptions (based on speculated product features and anticipated competitor behaviour), expected delivery costs and the cost margins of each of these inputs; all of which change over time and vary depending on the actions taken by you, as well as the competitors in the marketplace. In short, there are many layers of uncertainty built into the NPV calculation (Read et al. 2016).

As much as the first two questions are about the opportunity itself, the third and fourth questions are about you, the entrepreneur.

Entrepreneurs can make many different types of investments in ventures, including money, time, reputation, knowledge, emotions, and opportunity costs. Money is easy to measure, as is time, whereas other forms of investment such as reputation, knowledge, and emotions, are more difficult to quantify. It is important to understand these types of investments, particularly when we get to the next section, which asks whether you would be willing to lose your investment.

Returning to investments, by committing time to a venture, entrepreneurs are deciding to not invest that time in other things, which is the basis for the concept of opportunity cost. The following short video demonstrates the concept of opportunity cost based on making a specific decision to buy a phone and a gaming console.

The reason opportunity costs are important, is because the entrepreneur needs to decide what to focus on. In addition to more direct investments made by the entrepreneur, it is important to consider the entrepreneur choosing one option over another and the opportunity cost can help do this.

This question is where things get serious for most people. It is about clearly considering what you are willing to lose if the opportunity doesn't work out. Another way of saying this is "gaining the experience (learning) is worth the investment." It assumes that you will be able to use that knowledge in the future. In this way, the knowledge gained from the experience adds to your available means for future ventures.

Everyone has different thresholds as to what is acceptable in terms of loss, hence the poll at the beginning of this topic. For some, investing a week of time is acceptable, but for others (due to the opportunity costs), a week is not a period of time they feel they can afford to lose.

Decisions around what you consider to be an acceptable or unacceptable resource to lose as part of starting a new venture is a highly personal decision and may also change during your life. In other words, at a particular time in your life, you may feel that risking part, or all, of your life savings, is acceptable while at other times you may decide that this is out of bounds.

For some, the potential financial loss is not an acceptable risk, for others, the potential negative impact to their public image or reputation is something they are not willing to risk.

Even money can be seen in different ways. Some people will not touch their savings to start a venture, while others are willing to only use their savings, not the money they have set aside for their normal expenses. This all illustrates that affordable loss is completely subjective.

In all cases, however, the effectual logic principle of affordable loss is exactly that, affordable. You are not putting anything on the line that you do not want to, your life will not end if you lose the investment you decide on, in fact on the contrary, as this quote indicates:

Eric Berne as quoted by Murphy, 2015.A loser doesn’t know what he’ll do if he loses, but talks about what he’ll do if he wins. A winner doesn’t talk about what he’ll do if he wins but knows what he’ll do if he loses.

Affordable loss and stakeholders

Working together with stakeholders (who can bring in their own means and affordable loss) can increase what the entrepreneur is able to achieve. We will look at this in more detail in future topics, however, the following case study shows how Victoria is able to expand what she can achieve by collaborating with various stakeholders in order to develop One World Health.

Case study: OneWorld Health

Victoria Hale, with a PhD in pharmacology and work experience for the US government and a pharmaceutical company, knew how the industry was not pursuing technologies perceived to be unprofitable, despite still being very much needed in some parts of the world.

For Victoria, the affordable loss was her time and her available means included her network in the industry, her reputation, and access to/knowledge of off-patent medications considered worthless to the pharmaceutical industry. Victoria recognised these could be used to treat significant maladies in the developing world.

By seeking out numerous stakeholders and adding their own affordable losses to hers, Victoria went from introducing an antibiotic to treat Black Fever in India, Bangladesh, and Nepal, to treating other maladies and even opening medical clinics with the support of grants from the Bill & Melinda Gates and the Lehman Brothers Foundations.

Watch the following video which features Victoria as she tells her story. We can see how OneWorld Health has grown, by collaborating with other stakeholders and therefore increasing the affordable loss and available means. This enabled Victoria and the OneWorld Health team to produce much needed medicine previously deemed not profitable by major global pharmaceutical companies.

Affordable loss and bootstrapping

Bootstrapping means you do not take on external funding to establish or grow your venture.

The principle of affordable loss centres on managing risk. This means, in simple terms, not investing anything you are not willing to lose. From a borrowing perspective, this means not taking on debt to fund a project with uncertain outcomes as if the project doesn't work out, the debt still needs to be paid. Affordable loss, from an operating perspective, involves a venture using resources it already has and doing what you can with these financial means to grow and thrive. This allows the founders to avoid taking on debt or raising capital from outside investors. This frugal process is called bootstrapping.

As much as being frugal might be seen to be simple 'penny pinching', there are several good reasons to bootstrap. Let us look at some of these below.

Bootstrapping to stimulate creativity

Setting limitations on the amount of money available, as is the case with bootstrapping, forces the entrepreneur to be creative and think of alternative ways of doing things that might not be considered if there were ample funds.

The following short video features venture capitalist and author Guy Kawasaki who discusses his belief that too much money is worse than too little. This is based on the idea that capital is easily wasted and that lack of capital forces more creativity from the venture to find alternative ways of reaching the goal.

Bootstrapping to maintain control

Another benefit of bootstrapping is to maintain control and not be answerable to the demands and expectations of investors or shareholders. Heidi Roizen, venture capitalist and Stanford Lecturer, explains this in the following video.

Learning task 3: Your Own Example of Bootstrapping?

Nowadays, the term ‘bootstrapping’ is usually only used in reference to start-ups or other entrepreneurial ventures.

But we all have had situations where we have had to "pull ourselves up by our bootstraps", in other words, find an alternative way to reach the goal due to a lack of resources.

Complete Topic 5: Forum Activity 2.

Is affordable loss only useful when starting a venture?

Remember Stacy and the Pita Chips venture? We’ll revisit this case study as this is an excellent example of how to use bootstrapping in a venture beyond its initial launch.

With a background in social work and psychology, where they worked with many people in tough financial situations, entrepreneurs Stacy and Mark had a keen awareness of financial risk and how to go about making the most of their available means and only investing within her affordable loss. It is important to note that the affordable loss principle is useful in all stages of venture growth, not just at the beginning. Over time, what usually changes are the available means entrepreneurs have as they develop their ventures and become more experienced and grow their network and other means available to them. Being successful may also allow entrepreneurs to also have a higher affordable loss while maintaining an acceptable level of risk. Notice how this is true in Mark and Stacy's case.

Unexpected demand for chips, not sandwiches!

Although pita chips were intended to be a way of getting people to stay in line and wait for freshly made sandwiches, increasingly customers were just wanting the chips! The demand for the chips was overwhelming and went beyond Mark and Stacy’s capacity to produce them. We will consider the case study from this point in time.

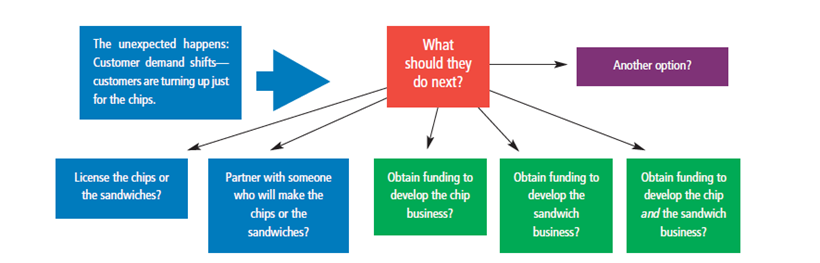

So, Mark and Stacy were faced with a decision of what action to take to address the increased demand in chips versus sandwiches. The chips they served as a snack while people waited for their sandwiches, become so popular that they become the reason customers are turning up. This unexpected shift means that Stacy and Mark need to explore their options. Taking action as an entrepreneur always involves some sort of available means and affordable loss. The following diagram shows the possible next steps for Mark and Stacy when the customer demand shifts.

The following diagram sets out potential options for Mark and Stacy. To meet growing customer demand, they would need to either find partners who could take over production or borrow money to invest in equipment. The options set out in blue require a partner while the options in green require money. Bringing on a partner adds to the available means and enables Stacy and Mark to make the most of the increased demand which pushes them beyond their own ability and resources. When pursuing the next steps that require funding, it is important to remember that this always comes with its own special conditions and restrictions.

It becomes clear that both options, partners, and funding, come with 'strings attached' which can be seen as a type of risk or affordable loss. In other words, both taking on partners and/or funding seemed too risky for Mark and Stacy. This went beyond what Mark and Stacy were willing to risk and lose. When Mark and Stacy considered these options, they were unsure of what to do. To help them make the right decision for them, they asked for advice, conducted research and studied their competitors.

Creative solutions within their affordable loss

After careful consideration, Mark and Stacy stick with the incremental, effectual approach they had taken thus far: and considered an option they did see as fitting within their affordable loss. They avoided long-term financial commitment by finding a short-term (imperfect) solution which brought them a step further in increasing chip production while only risking what they could afford to lose. They found slack capacity (a fully equipped bakery with downtime) to bake their chips and grow their revenue. This meant that they did not need to follow through on the options discussed above which were outside of their affordable loss.

Note that Stacy and Mark also make a commitment to the chips by dropping the sandwiches, it was within their affordable loss to no longer get sandwich revenue. Based on their conversations, they determined that labour associated with sandwiches was significantly higher than chips, making the chips the more profitable alternative.

Wrap-up

Using causal logic, what you invest is dependent on the potential upside of the opportunity, or the predicted returns. Effectual entrepreneurs see this to be too uncertain and too risky, so they only invest what they can afford to lose. This is the affordable loss principle, where we see expert entrepreneurs apply this effectual logic as a way of thinking about risk and consciously investing only what they are willing to lose.

Affordable Loss relates to the concept of bootstrapping, funding venture growth from existing available means. Being frugal might not seem attractive on the surface, but in fact it stimulates creativity, maintains the founder's control, and avoids the dangers of having to meet the expectations of investors.

We revisited Stacy and her pita chips to see how she applies Affordable Loss in several chapters of her story. And we also met Victoria Hale who turned the Affordable Loss of off-patent medications into a health network in the developing world. Expert entrepreneurs are constantly practicing the principle of affordable loss by seeking alternatives to using cash, particularly through co-creation.

Key takeouts

- Expert entrepreneurs are very conscious risk-takers, not overextending themselves, but rather investing only what they are willing to lose.

- Causal logic focuses on the potential upside of an opportunity while effectual logic focuses on the potential downside.

- Affordable loss can take many forms: time, attention, emotional commitment, reputation, money, and knowledge.

- Bootstrapping is a common method of entrepreneurs to fund their growth through their own available means and within their affordable loss.

Welcome to your seminar for this topic. Your lecturer will start a video stream during your scheduled class time. You can access your scheduled class by clicking on ‘Live Sessions’ found within your navigation bar and locating the relevant day/class or by clicking on the following link and then clicking ‘Join’ to enter the class.

Click here to access your seminar.

The learning tasks are listed below. These will be completed during the seminar with your lecturer. Should you be unable to attend, you will be able to watch the recording, which can be found via the following link or by navigating to the class through ‘Live Sessions’ via your navigation bar.

Click here to access the recording. (Please note: this will be available shortly after the live session has ended.)

In-seminar learning tasks

The in-seminar learning tasks identified below will be completed during the scheduled seminar. Your lecturer will guide you through these tasks. Click on each of the following headings to read more about the requirements for each of your in-seminar learning tasks.

During your seminar, click on the link below and download the referenced word document. This is to be completed by yourself, your lecturer will guide you and facilitate a group discussion based on your findings.

Your lecturer will facilitate a class discussion based on the completion of the poll at the start of this topic. Consider the following guiding questions to help reflect on what is important to you personally:

- What resources do you have access to today?

- Which of these would you be willing to risk?

- What if you did not act upon an opportunity, what might you miss out on?

- If you spent lots of time on a new venture, what would that take you away from?

- If a new venture did not succeed and this somehow impacted negatively upon your reputation, what would you see as an acceptable risk and what would not be acceptable to you?

Welcome to your post-seminar learning tasks for this week. Please ensure you complete these after attending your scheduled seminar with your lecturer. Your lecturer will advise you if any of these are to be completed during your consultation session. Click on each of the following headings to read more about the requirements for each of your post-seminar learning tasks.

Following on from the class discussion note down three (3) main takeaways for you personally on affordable loss. Capture your thoughts in your reflective journal. These will assist you in your development of assessment 2.

You can access the reflective journal by clicking on ‘Journal’ in the navigation bar for this subject.

Each week you will have a consultation session, which will be facilitated by your lecturer. You can join in and work with your peers on activities relating to this subject. These session times and activities will be communicated to you by your lecturer each week. Your lecturer will start a video stream during your scheduled class time. You can access your scheduled class by clicking on ‘Live Sessions’ found within your navigation bar and locating the relevant day/class or by clicking on the following link and then clicking 'Join' to enter the class.

Click here to access your consultation session.

Should you be unable to attend, you will be able to watch the recording, which can be found via the following link or by navigating to the class through ‘Live Sessions’ via your navigation bar.

Click here to access the recording. (Please note: this will be available shortly after the live session has ended.)

These are optional readings to deepen your understanding of the topic material:

- Kenton, W 2020, What is Bootstrapping? What it means and how it’s used in investing, Investopedia, https://www.investopedia.com/terms/b/bootstrapping.asp

- Coleman, A 2022, The art of bootstrapping; four entrepreneurs share their secrets, Forbes, https://www.forbes.com/sites/alisoncoleman/2022/03/17/the-art-of-bootstrapping-four-entrepreneurs-share-their-secrets/?sh=1a02f8f3029f

References

- ABC Australia 2021, What is opportunity cost? Streaming video, You Tube, https://youtu.be/7eMjwqO6WnY

- Dew, N, Sarasathy, S, Read, S & Wiltbank, R 2009, ‘Affordable loss: Behavioral economic aspects of the plunge decision,’ Strategic Entrepreneurship Journal, 3(2):105-126.

- Doolin, S 2021, ‘Stop asking users what they want,’ Insight Unlocked, https://insightunlocked.net/2021/04/06/stop-asking-your-users-what-they-want/

- Entrepreneurship.org, 2013 Heidi Roizen- bootstrapping: still a great way to raise money, streaming video, You Tube, https://youtu.be/GLC6VrNVdnA

- iLab Incubator 2019, Affordable loss principle, streaming video, You Tube, https://youtu.be/DchKlxUAG40

- Kawasaki, G 2013, Guy Kawasaki – Funding choices, streaming video, You Tube, https://youtu.be/802manRgmWo

- Kenton, W 2020 ‘Bootstrapping,’ Investopedia, http://www.investopedia.com/terms/b/bootstrap.asp

- Murphy, S 2015, ‘Eric Berne on winners and losers,’ SK Murphy, https://www.skmurphy.com/blog/2015/03/01/eric-berne-on-winners-and-losers/#:~:text=A%20Winner%20Has%20A%20Plan,will%20do%20if%20he%20wins.%E2%80%9D

- Read, S, Sarasvathy, S, Dew, N & Wiltbank, R 2016, Effectual Entrepreneurship, 2nd ed., Routledge.

- Skoll 2009, Institute for OneWorld Health, streaming video, You Tube, https://youtu.be/NVP24_KmJ-g

- Society for Effectual Action, n.d, https://www.effectuation.org/

- Society for Effectual Action, Branson affordable loss, streaming video, You Tube, https://youtu.be/VsRAVj3878U

- Society for Effectual Action 2016, Effectuation, streaming video, You Tube, https://www.youtube.com/watch?v=8_Y_d9ZFhqE&t=230s

- Society for Effectual Action, 2018, Effectuation 101, https://www.effectuation.org/?page_id=207#:~:text=Expert%20entrepreneurs%20believe%20that%20the,or%20finding%20the%20optimal%20opportunity.

- Wall Street Journal 2017, Apple’s secret iPhone launch team: the event that began it all, streaming video, You Tube, https://youtu.be/xxBc1c3uAJw