Transactions are divided into two categories: Cash and Non-cash. Depending on the nature of the transactions one type may dominate over the other. For example, people tend to use cash for low-value items (under $50) whereas high-value items such as equipment or medical services are normally processed via non-cash methods. Non-cash payment options include EFTPOS (eg. debit and credit cards, smartphone mobile wallets), Gift vouchers, Buy now pay later schemes (eg. After Pay, Zip Pay), PayPal and less commonly cheques.

Individual workplaces will have their own specific policies and procedures relating to the processing of financial transactions, however below are some basic steps regarding cash payments:

-

Communicate clearly with the customer and advise them of the total cost for the goods and services.

-

Receive the cash from your customer and confirm the amount tendered. Note: Your workplace may have a policy whereby you have to confirm with a colleague or supervisor if a customer uses a large note for payment.

-

Input or record the amount tendered into the Point of Sale (POS) terminal.

-

Open the cash drawer and put tendered money inside.

-

If change is required gather the necessary coins and notes that equal the required amount. Note: Refer to the section below relating to providing change.

-

Close the cash drawer.

-

Provide the customer with the relevant change, counting it out loud back to them.

-

Provide the customer with a tax invoice receipt, unless they indicate they do not wish to receive one.

Cash transactions normally require the provision of change to the customer. To calculate change you simply need to extract the amount an item cost from the amount that has been tendered. Most point of sale systems will automatically calculate the change value. However, you need to know how to count back the change as you provide it to the customer, this reassures the customer and helps to ensure you keep your cash draw balanced.

Counting back the change means you are verbally communicating how each item of money contributes to the change amount until it reaches the total amount that the customer provided in the first instance.

If an item cost $67 and the customer paid with a $100 note you need to subtract $67 from $100 to get $33. The change is likely to be made up of a $20 note, a $10 note, a $2 coin and a $1 coin, although some variations may apply.

Starting with the smallest valued coin, hand it to the customer and verbally add the amount onto the item cost, repeat with each coin/note until you reach the amount tendered.

For example:

-

$1 makes $68.

-

$2 makes $70.

-

$10 makes $80.

-

$20 makes $100.

Precautions should be taken into consideration when dealing with cash. Small and medium-sized businesses are targeted more often in robberies because they usually have less security in place.

Steps that can be taken to minimise security issues are:

-

Keeping cash levels low, supervisor to move excess cash to a safe.

-

Encourage electronic payments EFTPOS / Credit Card payments.

-

Only open the cash drawer when in use.

-

Position cash drawer away from the main entrance.

-

Counting cash takings and float out of sight, preferably in a private room.

-

Install security cameras.

-

Utilise a security company (armoured vehicle) for the transportation of cash to the bank.

The most common type of non-cash transaction is EFTPOS which stands for Electronic Funds Transfer at Point of Sale.

Customers will have a card which may be a debit or credit or a combination (dual purpose) of both, or they may use their mobile phone and pay via a mobile wallet (eg. Google Pay or Apple Pay). Transactions are divided into three main types Cheque, Savings or Credit depending on the type of card and the type of account the customer holds with their financial institution.

Contactless payment can be processed via EFTPOS machines for transactions under $100, otherwise, the customer must enter their Personal Identification Number (PIN). Likewise, if your workplace allows cash withdrawals from a Cheque or Savings account the customer must enter their PIN rather than utilise the contactless method. For security purposes, customers are no longer required to sign for purchases that are paid via credit card, microchip technology embedded in the card is used for identification rather than a signature.

The following video shows how to process non-cash EFTPOS transactions.

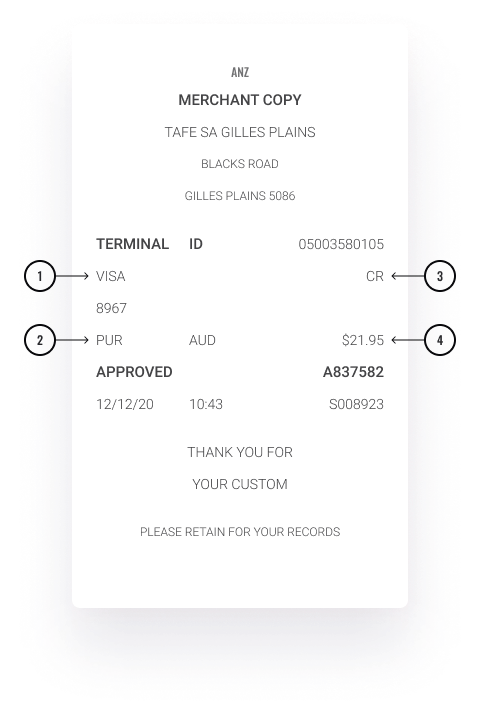

EFTPOS transactions will produce an additional receipt, specific to the card transaction. Note: This receipt is not a tax invoice.

- This indicates the account type

- This indicates the transaction type

- PUR: purchase

- REF: refund

- This indicates the type of transaction

- CR: credit

- SAV: savings account

- CHQ: cheque account

- This indicates the transaction amount

When selling a gift voucher to a customer, there will likely be an item in the Point Of Sale menu such as 'gift voucher', each voucher will have a unique identifying number or barcode that may need to be entered or scanned. You will be prompted to enter the value that the customer wishes to assign to the voucher, handwrite this amount onto the voucher and complete other required information such as date of purchase or the name of the customer. The transaction is then processed using either Cash or Non-cash methods.

Your workplace may issue gift vouchers quite frequently, especially if they are a specific retail establishment like a pet store. Therefore, gift vouchers may come in the form of actual cards with pre-assigned monetary values (eg. $20, $50, $100) and they may also have activation codes that are required to be entered at the time of redemption.

When redeemed, a gift voucher is tendered as the payment method. The unique number or barcode will likely be entered or scanned and assigned to this particular transaction. Your workplace may require you to keep the actual gift voucher in the cash drawer and count it up as part of the non-cash reconciliation process.

The law requires that most gift cards or vouchers have a mandatory minimum expiry period of three years, beginning from the date a gift card is sold to a customer. Businesses can choose to have longer expiry periods or have a no-expiry period if they wish.

A lay-by agreement allows a customer to buy a product and pay for it in two or more instalments before taking it home. It is often used to purchase high-value items. A written agreement stating all the necessary terms and conditions must be provided to the customer, and signed by them, prior to a lay-by arrangement being setup. Customers may be required to pay a set-up fee and may be charged a cancellation fee if they choose to cancel the lay-by agreement.

An increasingly popular alternative to lay-by is Buy Now, Pay Later services such as Afterpay or Zip Money. These services involve the customer establishing a credit account with the service provider to a specific value, these funds can then be used to purchase items at any store that allows Buy Now, Pay Later transactions. The retailer receives payment immediately from the service provider and the customer then makes regular repayments (and potentially pays interest or fees) to pay the balance off (similar to a credit card).

Your workplace may have a refund policy, which will outline the terms and conditions they offer to customers regarding the repair, replacement, refund or exchange of goods and services that were sold by the business.

Repairs - Will usually involve the products being returned to the manufacturer in accordance with any warranty that was provided as part of the purchase.

Replacement - Allows the customer to select or be provided with another product identical to the original.

Refund - The product is returned to the store and the customer receives their money back.

Exchange - Allows the customer to swap the product for another item. The new product can be for less, equal or more than the original amount. If the amount was less then the difference is refunded to the customer. If the amount is more then the customer pays the additional amount.

Stores are not allowed to display signs that state 'no refunds' or 'no refunds or exchanges on sale items', however, they don't have to offer a refund or exchange simply because a customer has changed their mind.

Most businesses will require the original tax invoice receipt as proof of purchase before processing any repair, replacement, refund or exchange. If the customer paid for the original purchase using EFTPOS they may require the original card that was used for the transaction so that the refund can be deposited back into the same account.