After you have completed this topic, you should have knowledge of:

- Financial reporting

- Reporting and non-reporting entities

- The structure of a Balance Sheet

- Double-entry accounting

- The rules of debits & credits

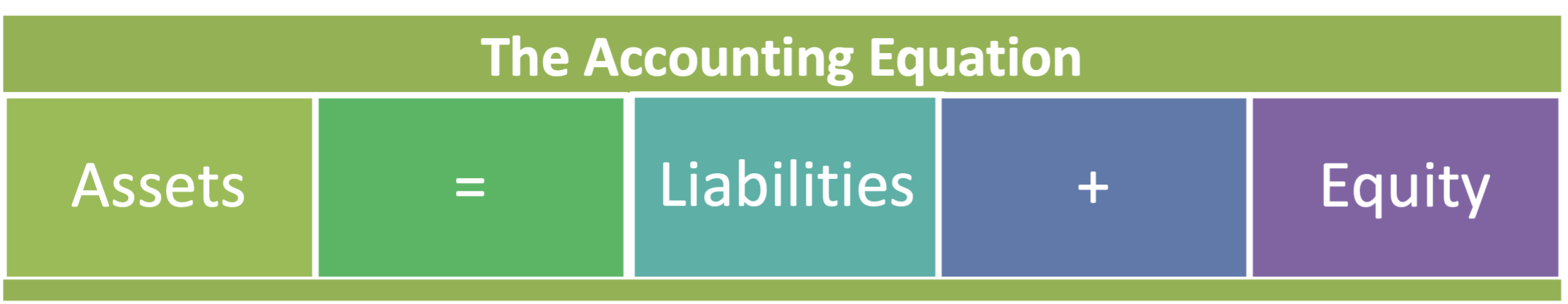

- The Accounting Equation

- Chart of Accounts

- The General Ledger

Financial Reporting

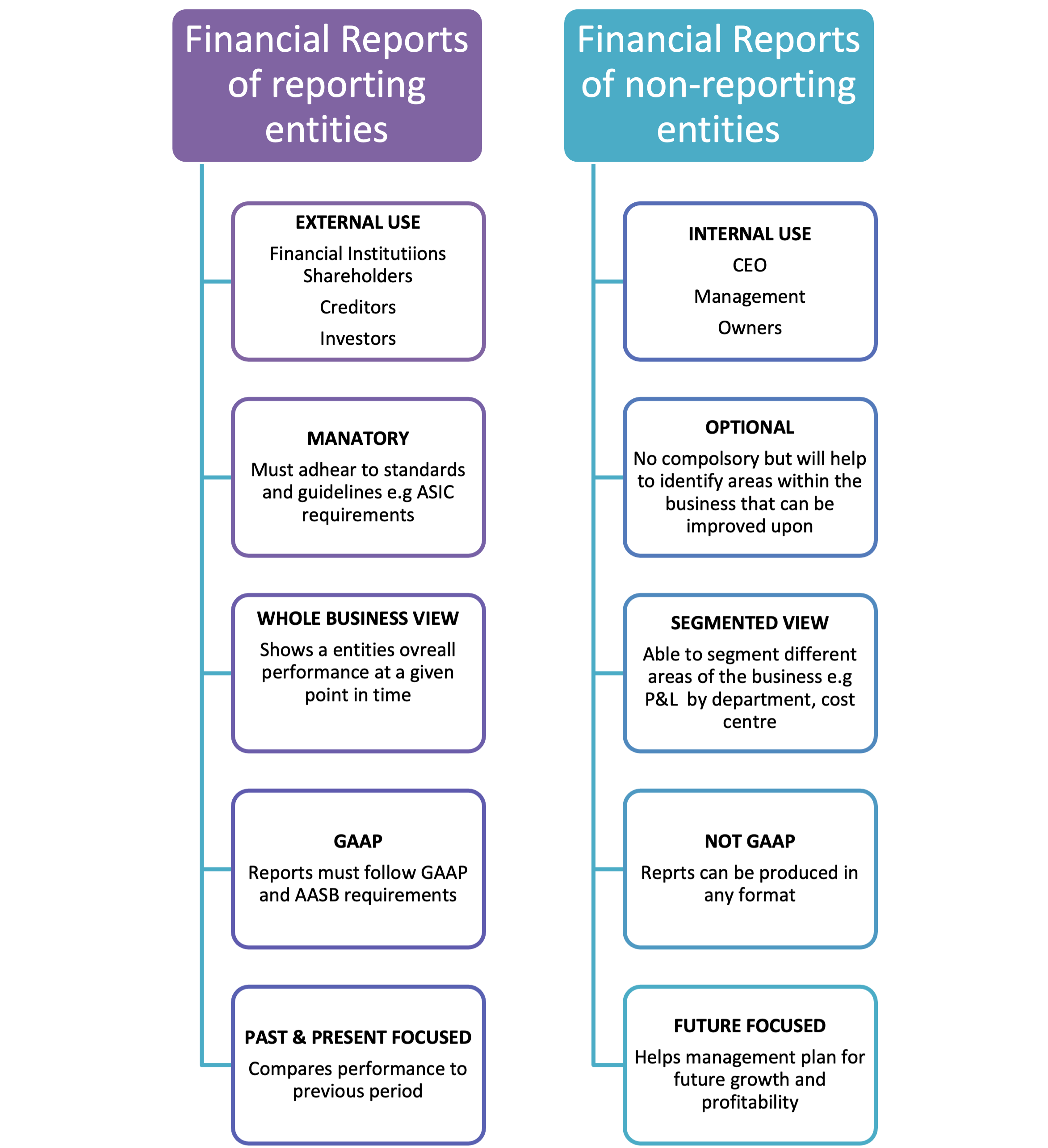

All businesses prepare some form of financial reporting. However, the level of financial reporting that is prepared by a business will depend on whether the business is a non-reporting or reporting entity.

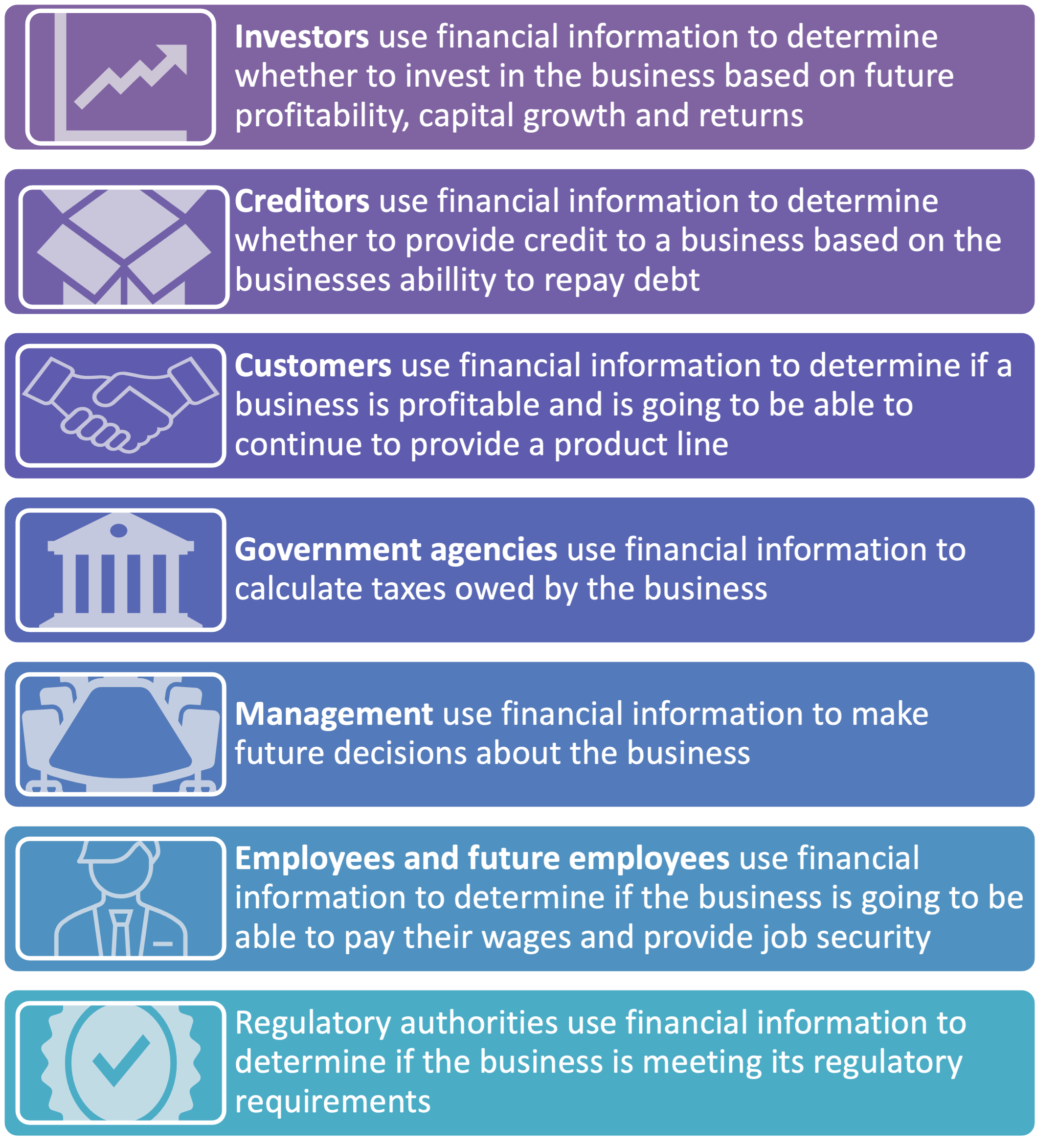

Both internal and external stakeholders use financial reports.

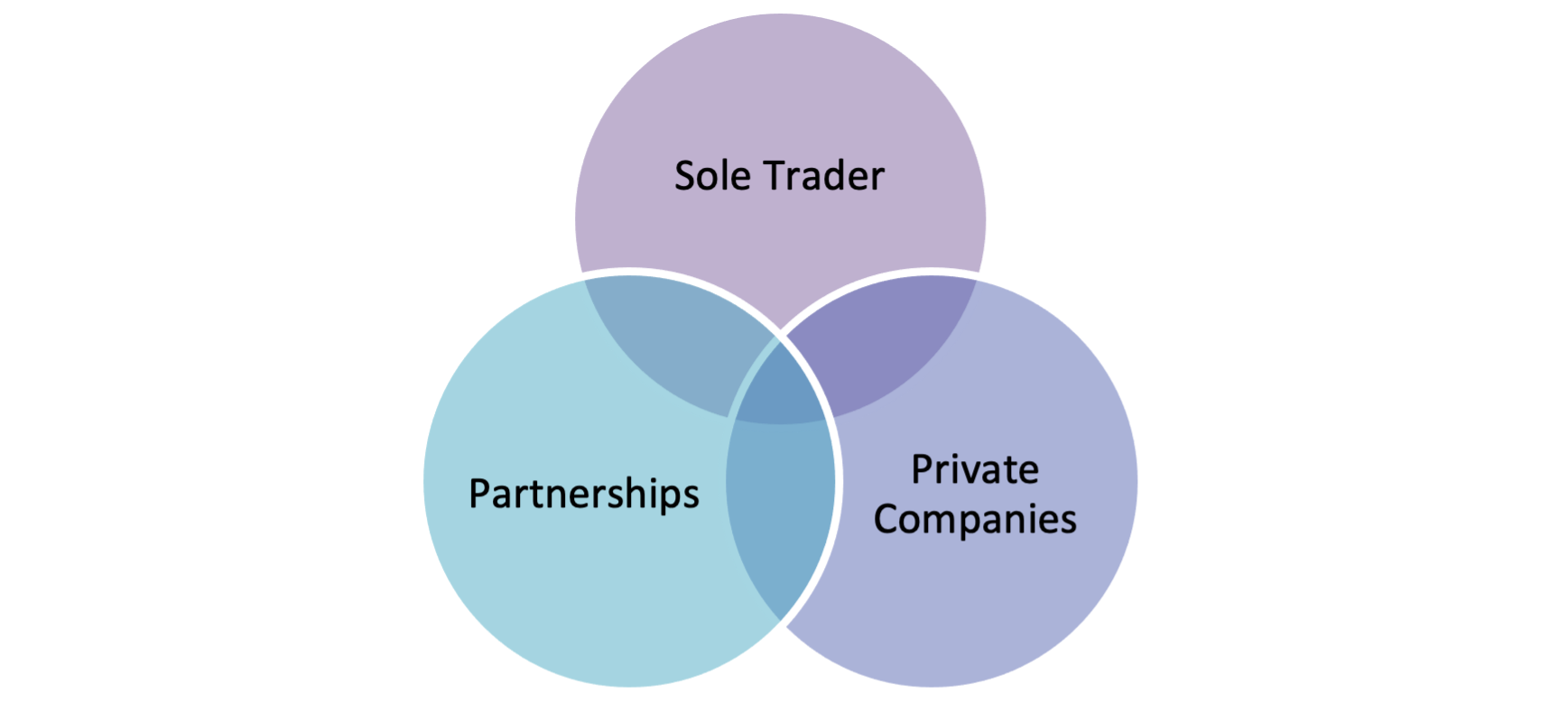

A non-reporting entity is a generally small private business entity that prepares internal financial reports mainly for the owners of the business. Non-reporting entities include:

- sole traders

- partnerships

- and private companies.

Non-reporting entities generally prepare internally focussed financial accounts. They provide insights into how the business is doing, empowering decision-makers to strategise on how to increase operating efficiency and make pertinent decisions to remain competitive.

Financial reports are not mandatory for non-reporting entities, and each business will have different reporting requirements. Reports can include:

- Balance Sheet, also known as the Statement of Financial Position

- Profit & Loss Statement, also known as the Statement of Financial Performance or the Income Statement

- Trial Balance

- Bank Reconciliation Report

- Accounts Payable Aging Report

- Accounts Receivable Aging Report.

A reporting entity is defined in the AASB Conceptual Framework 3.10 as an entity that is required or chooses, to prepare financial statements about the entity that is useful to exist and potential investors, lenders and other creditors in making decisions relating to providing resources to the entity.

Reporting entities may include:

- Public companies listed on the AXS

- Superannuation funds

- Government bodies

Reporting entities must prepare general purpose financial statements that comply with the accounting standards in accordance with the Corporations Act. Companies operating in Australia are required to lodge their financial reports with ASIC, usually at the end of the financial year.

There are four main financial statement reporting entities must prepare:

- Balance Sheet, also known as the Statement of Financial Position

- Profit & Loss Statement, also known as the Statement of Financial Performance or the Income Statement

- Cash flow statement

- Statement of changes in equity.

The diagram below explains the difference between financial reporting and management reporting.

Bookkeepers are often tasked with creating monthly customised management reports and generating draft financial statements. In this module, we will examine in detail three financial reports:

- The Statement of Financial Position, also known as the Balance Sheet

- Profit & Loss

- Trial Balance

- Users of Financial Reports

Throughout this module, we will refer to the:

- Statement of Financial Position as the Balance Sheet

- Statement of Financial Performance as the Profit & Loss Statement

- Trial Balance as the Trial Balance

Accounting entity concept - A business and its owner should be treated separately as far as their financial transactions are concerned.

The accounting entity concept states that for accounting purposes, a business and its owners should be treated as separate entities. The Balance Sheet is prepared based on this premise.

The Balance Sheet presents the financial position of an entity at a given point in time. The elements of a Balance Sheet are Assets, Liabilities and Equity. The relationship between assets, liabilities, and equity can be demonstrated through an equation known as the Accounting Equation.

Balance Sheet Structure

The AASB Conceptual Framework defines an asset as:

‘a present economic resource controlled by the entity as a result of past events’.1

An economic resource is a right that has the potential to produce economic benefits. Examples of rights include:

- rights to receive cash

- rights to receive goods or services

- rights to exchange economic resources with another party on favourable terms.

Assets can be broken down into:

- Current Assets – Assets that are cash or are able to be converted to cash within 1 year. Examples of current assets include:

- Accounts receivable: Accounts receivable is money owed to a business by its customers.

- Inventory: Inventory can describe raw materials used to create a product, items used to deliver a product, or goods to be sold.

- Surplus cash: Surplus cash a business has on a particular date. It may be cash in the cash register, cash in a trading account, petty cash or cash in an investment account.

- Non-Current Assets – Assets that are not expected to be consumed or sold within 1 year. They generally cover large purchases that are investments into the long-term health of the business. Examples of non-current assets include:

- Plant or machinery: Equipment or machinery used to carry out the business's operations.

- Fixtures & fittings: Fixtures and fitting owned by the business. This could include shop fittings, desks, lighting. They are items that contribute to the business's overall value.

- Land & buildings: Land and building the business used for their operations.

- Investments: Investments are portions of money a business invests into other businesses. These count as assets on the business’ balance sheet – they are parts (shares) of other businesses that your company owns.

The AASB Conceptual Framework defines a liability as:

‘a present obligation of the entity to transfer an economic resource as a result of past events

For liability to exist, three criteria must all be satisfied:

- the entity has an obligation

- the obligation is to transfer an economic resource

- the obligation is a present obligation that exists as a result of past events’

Liabilities can be broken down into:

- Current Liabilities – Obligations that need to be paid within 1 year. Examples of current liabilities include:

- Accounts payable: The money a business owes for goods and services they have received but not yet paid for.

- Short term borrowing: Short term borrowing represents lines of credit a business takes out, often to help manage short term cash flow.

- Prepayment liabilities: A prepayment liability is the money a business receives in advance of providing a product or service. Since the product or service hasn’t yet been delivered, this cash hasn’t been earnt yet, making it a liability.

- GST liabilities: GST is the tax the business owes to the government as a result of selling goods or services. A business can report and pay this tax monthly, quarterly or annually. Until it is paid, it is a current liability in the accounts of the business.

- Company tax: Company tax is a percentage of a company’s net profit owed to the government (for 2021-22 and later periods, the rate is 25%). It is paid after the business submits its tax return. Until I had paid it, the owed amount stayed on my balance sheet.

- Non-Current Liabilities – Liabilities that are not classified as current. Examples of non-current liabilities include.

- Loan: Loans are long term borrowing of cash that expands further than a 12 month period. The loan balance does not include interest charged.

- Deferred revenue: This is a payment in advance the business receives for goods or services it will not deliver within 12 months.

Equity can be described as the value of the shareholder's stake in the business.

Equity comprises of two parts:

- Share Capital – The funds invested into a business by the owner or another shareholder.

- Retained Earnings – The accumulated portion of a business’s profits carried over from previous period(s). It is possible for a negative figure to appear here if my business has been making a loss.

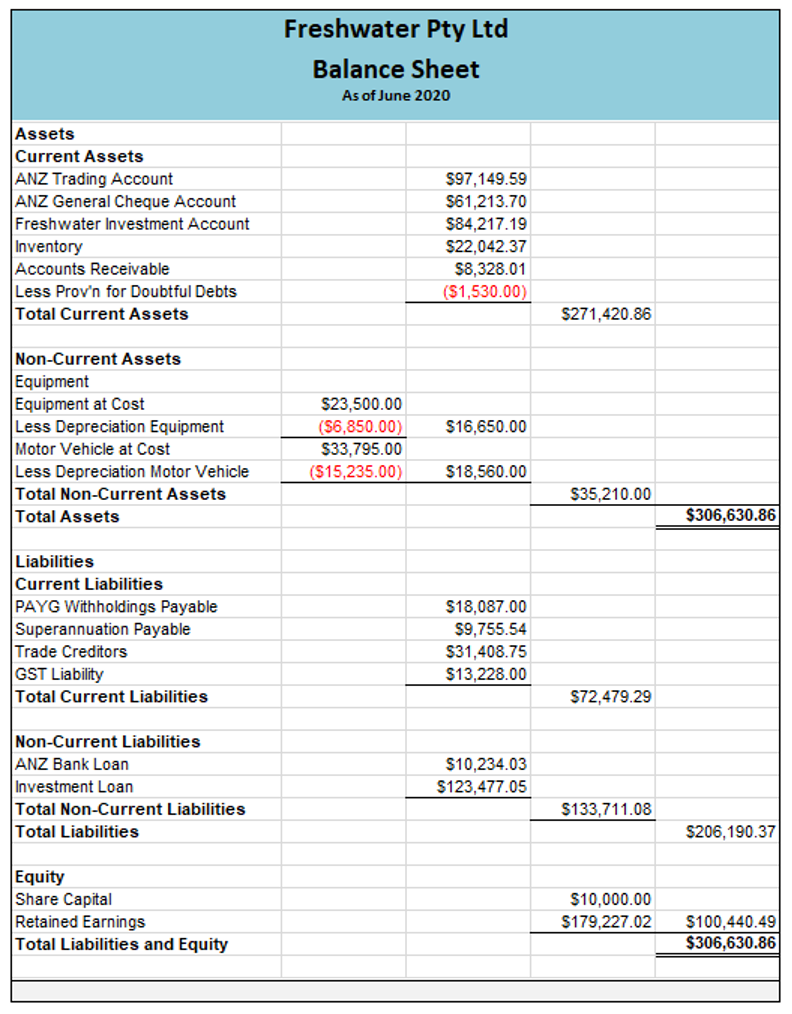

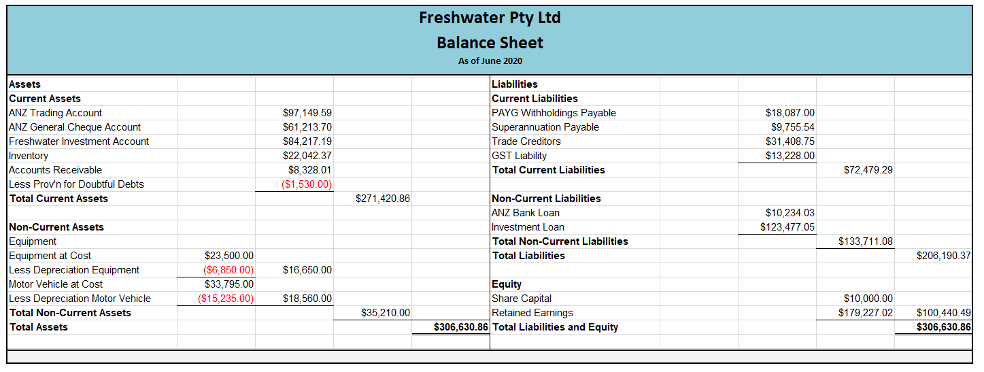

In example (A), the balance sheet below is shown in a vertical format which is the method used in the financial statements of reporting entities. An alternative format is an example (B) horizontal format. This format is more closely aligned to the accounting equation, Assets = Liabilities + Equity.

(Example A)

(Example B)

The video below explains the accounting equation.