As a tax practitioner, you should know the importance of lodging tax returns on time per relevant tax laws. As discussed earlier in the module, lodgement refers to filing statutory requirements with the appropriate authority. It involves filing tax returns with the Australian Taxation Office. One of the most important tax obligations of any organisation is to be able to lodge tax returns on time. A tax return is a formal document where you report all items relevant to a tax assessment. It is filed with the appropriate tax authority to report your income, expenses and other relevant financial information. It shows the basis for computing your taxable income and tax obligations.

Tax collection and withholding mechanism refer to the practice where legal entities collect pay as you go (PAYG) withholding tax amounts for certain payments they make. As discussed in topic 3, this includes payments to employees, other workers, such as contractors, and businesses that do not quote their Australian business number (ABN). This is reported by lodging an annual report to the ATO.

You must submit the relevant tax documentation to the ATO within the timelines stipulated by the ATO. It would be best if you kept the client updated on their current tax obligations. You must also inform them that any advice from the taxation authorities needs to be followed. You are responsible for responding to your clients' tax office enquiries. You must also meet the tax audit requirements, if your clients are subject to one, in a timely manner.

To be able to lodge taxation documentation as per legislative requirements, you need to be aware of the administrative aspects of these taxes. These aspects may include the following:

- Documentation

- Tax collection and withholding mechanisms

- Assessments

- Obligations

- Rulings

- Penalties

- Audits

Anti-avoidance rules are a measure to prevent businesses from benefiting from transactions that:

- Are primarily put in place to reduce, avoid or defer taxes

- Are undertaken to increase refunds or rebates

- Otherwise may not have been considered a reasonable action

You must also be aware of specific and general anti-avoidance tax rules. These are referred to as SAAR and GAAR, respectively.

This topic will cover how to monitor your lodgement due dates for each client. You will also learn basic ways to lodge tax returns and the online platforms you can use for lodging. This topic also briefly discusses the administrative aspects of taxation and the specific and general anti-avoidance tax rules.

In this topic, you will learn how to:

- Submit relevant tax documentation within the timelines

- Advise client of tax obligations

- Respond to tax enquiries and meet taxation audit requirements

The typical workflow for the lodgement of tax returns by tax agents is:

- Prepare the tax return

- Review the tax return to verify completeness and accuracy

- Obtain client and tax agent declaration

- Lodge the tax return

- Receive a confirmation from ATO regarding the status of the lodgment

- Receive a Notice of Assessment from ATO

The first three steps have been covered in the previous topic. This topic will cover the lodgement of the tax returns. It will explain how to submit the relevant tax documentation to the ATO. This submission should be made within the established timelines. It will also explain how to monitor the status of the lodgment.

Lodging tax returns for the applicable tax period may be done by:

- Paper form

Paper tax returns are lodged by mail. ATO informs its taxpayers of the appropriate postal address for the lodgement of paper tax returns through their website. However, it is important to note that lodging tax returns in paper form are not the ideal practice. Electronic lodgements are preferred nowadays because they take less time and effort than paper form lodgements. - Standard business reporting (SBR)-enabled software

Standard business reporting (SBR) is built into the software itself. The Australian Government collaborates with digital service providers to integrate SBR into their products and streamline business-to-government reporting. Each SBR-enabled software functions and operates differently. To see the list of all the SBR-enabled software currently authorised by ATO, you can access the ATO’s product register.

The product register enables you to discover all the relevant services currently offered by each software. Products with practice management functionality usually are the ones that can process electronic lodgements with ATO. - Online services offered by ATO

These services include the following:- myTax

MyTax is a web-based application designed to help individuals and sole traders in their tax compliance processes. It can be accessed through the online service's homepage of ATO or ATO’s mobile application. - Online services for agents

Online services for agents (OSfA) is an online interface developed through the initiative of the Australian Taxation Office. It offers a wide range of services that are all intended to help tax and BAS agents

Some of the services provided through OSfA are the following:- Client management (e.g. add/remove a client)

- Monitor lodgement program status (accessible only by tax agents)

- Access pre-filled, on-demand, and pre-generated reports

- Lodge range of reports and returns

- myTax

To further understand more about the online services offered by ATO refer to Online services for agents user guide

Timely Submission

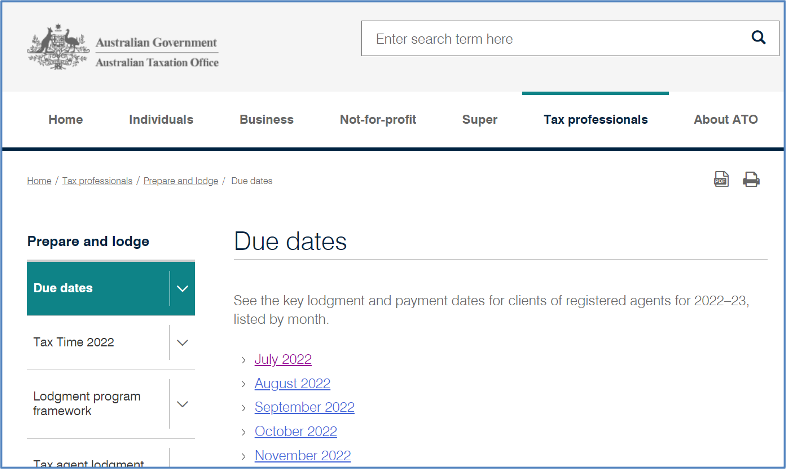

The due dates for lodging tax returns are posted on the official website of the Australian Taxation Office (ATO). Just hover on the ‘Tax professionals’ tab and click on ‘Due dates’. You may check the due dates for lodgements and payments through the left side tab of the ‘Prepare and Lodge’ page.

Sourced from Due dates. © Australian Taxation Office for the Commonwealth of Australia

The due dates posted on the ATO’s website only serve as a general guide. Deadlines for lodgments and payments may still vary on a case-to-case basis.

- Client type

- Lodgment due date

- When the return is lodged

The ATO allows you to lodge or pay on the next business day when a due date falls on a weekend or a public holiday.

Tax Agent and BAS Agent Lodgment Programs are developed to help tax practitioners manage their workload. Through these programs, eligible tax agents and BAS agents can access alternative lodgement due dates for specific returns of particular clients.

To learn more about the lodgement programs available for Tax agents refer to Lodgment program framework.

Taxation authorities are any governmental agencies with legal jurisdiction over taxation matters, including its assessment, determination, collection or imposition. In Australia, the main taxation authority is the Australian Taxation Office. They are the federal government's statutory agency and principal tax collection body. In addition, the State Revenue Offices are the relevant taxation authorities for state taxes like payroll tax and stamp duties.

As discussed in the previous topic, tax obligations refer to the different tax amounts the legal entity is supposed to pay to the government. This includes income tax, GST, capital gains tax, fringe benefits tax, PAYG withholdings, and super. Monetary penalties are fines imposed on legal entities to ensure they pay tax timely and compute tax obligations accurately. Different tax penalties are applicable for tax evasion or delays. Specific penalties levied by the ATO for late and unpaid debts and lodgements and for not maintaining adequate records were covered in Topic 1. This topic provides an overview of the Australian tax laws' penalties regarding legal entities' tax documentation. The kinds of penalties may include:

- Penalties for statements and positions that are not reasonably arguable

- Making false or misleading statements

- Failing to make a statement

- Taking a position that is not reasonable

- Penalties for failure to meet tax obligation under various tax laws

- Keeping or retaining required records

- Retaining and producing required declarations

- Providing access and reasonable facilities to authorised tax officers

- Applying for or cancelling GST registration as required

- Issuing required tax invoices or adjustment notes

- Lodging activity statements

- Paying amounts electronically when required

- Penalties for failure of meeting tax lodgement obligations on time

- Penalties for failure to meet PAYG witholding obligations

To provide advice to your clients that comply with prevailing legislative requirements, you must understand the differences between tax planning, tax evasion and tax avoidance.

- Tax avoidance

These are schemes or arrangements involving practices aimed to minimize one’s tax liability in ways that are still within the law's provisions but no longer within the true intent of the law. Tax avoidance practices can indicate deliberate exploitation of the tax system and can be subject to serious scrutiny by the ATO. - Tax evasion

This is the non-payment of tax that would have been payable if the taxpayer had made complete and correct disclosure of its assessable income and deductions. - Tax planning

This involves the organisation of the taxpayer's affairs or structuring their transactions to minimise tax liability without resorting to tax avoidance measures.

The table below sets out the main difference between tax avoidance, tax evasion and tax planning:

| Practice | Tax Avoidance | Tax Evasion | Tax Planning |

|---|---|---|---|

| Within the letter of the law | ✓ | x | ✓ |

| Within the intent of the law | x | x | ✓ |

Advise Clients

While preparing and administering taxation documentation for your clients, your key responsibilities include advising them of their tax obligations and that the taxation authorities’ advice is to be followed.

As a tax professional, you should be able to properly give insight and advice to your clients on:

- Current tax obligations

This means you must inform your client of their responsibility to provide accurate and complete data required to complete tax reports and returns, lodgement deadlines, tax payment due dates, penalties (if any), etc. It would help if you discussed with them the implications of any updates in taxation laws. - Following advice from taxation authorities

The ATO provides various products that help you understand how the law applies to different legal entities. The advice products of the ATO are binding rulings that are necessary to be complied with by your clients. These rulings were covered earlier in the module. To recap, they may include public, private and oral rulings. They elaborate on the taxpayers' obligations and entitlements under provisions of law. In addition, various state revenue offices also provide public rulings as part of the advice they offer. These revenue rulings may represent their interpretation of particular provisions. They explain the current policies, guidelines and practices of these revenue offices. You are obligated to make your clients understand the necessity of following this advice from the authorities related to taxation. - Tax planning

When you provide tax planning advice to your clients, you must ensure it is tailored to their individual requirements. Taxpayers who can minimise their tax liability within the scope and intent of the tax laws are not penalised. Some examples of the most common tax planning methods in practice are:- Accelerated deductions

- Many entities follow the practice of accelerated deductions towards the end of a financial year. They pay for some expenses before 30 June rather than in July. This way, their taxable income is reduced, lowering their tax liability.

- Delaying income

- Related to the earlier strategy of accelerated deductions is delaying income. Organisations may choose not to invoice their clients in the last quarter of the financial year. This results in an immediate reduction in taxable income. However, based on the expense recognition principle, they can claim the expenses incurred to generate that income before 30 June. This is because expenses can be claimed as a deduction as soon as they have been incurred.

- Negative gearing

- Some entities may opt to employ the negative gearing tax planning method to claim immediate tax deductions while still making a profitable investment in the long run. This method is usually done by purchasing a property that will seem to incur net losses for some periods but is nevertheless expected to generate income in the long term.

- Salary sacrifice arrangement (SSA)

- The composition of an employee’s salary package can be modified in such a way that the tax burden of the employee is reduced to the minimum. This is referred to as a salary sacrifice arrangement.

- Salary sacrifice arrangements – Superannuation contribution. One way to make a salary sacrifice arrangement is to sacrifice a portion of the employee’s gross salary in exchange for increasing the contribution to be made by the employer to the employee’s superannuation fund. An SSA relating to a superannuation contribution will only be deemed effective as of the period if an agreement between the employee and the employer was made before the employee becomes entitled to receive his salary for the period.

- Salary sacrifice arrangements – Fringe benefits Another way to make salary sacrifice arrangements is to increase the proportion of fringe benefits the employee will receive in exchange for sacrificing a portion of the employee’s gross salary. Doing SSA by increasing fringe benefits may only be practical if the salary sacrifice amount also covers the total cost incurred by the employer in providing the fringe benefit. This is to say that the total amount should cover the FBT liability. Implications of doing SSA by increasing fringe benefits are the employer may be liable for FBT and the taxable income of the employee is reduced.

- Accelerated deductions

Learning Exercise

Negative Gearing

Claire Smith plans to purchase a rentable property before the end of the 2021–2022 financial year. The relevant estimates of Claire’s available options are presented in the table below:

| Financial Information | Property A | Property B |

|---|---|---|

| Purchase price | $500,000 | $500,000 |

| Annual rent income | $20,000 | $20,000 |

| Less: Annual levies | $3,650 | $3,650 |

| Annual interest expense on the mortgage | $18,000 | $18,000 |

| Annual cost of capital works | nil | $5,000 |

| Annual net loss | $(1,650) | $(6,650) |

After four years, both properties will sell at $650,000.

Required:

Determine which property will result in a higher cumulative taxable income after four years?

| Capital Gains | Property A | Property B |

|---|---|---|

| Proceeds | $650,000 | $650,000 |

| Purchase price | $500,000 | $500,000 |

| Plus: Cumulative capital works (Annual capital works x 4 years) |

nil | $20,000 |

| Cost base | $500,000 | $520,000 |

| Capital Gain in Year 4 (50% discount on proceeds less cost base) | $75,000 | $65,000 |

| Taxable Income | Property A | Property B |

| Net loss in 4 years (Annual net loss x 4 years) |

$(6,600) | $(26,600) |

| Capital gain in year 4 | $75,000 | $65,000 |

| Taxable Income (Capital gain less net loss) | $68,400 | $38,400 |

Learning Exercise

Salary Sacrifice Arrangements – Superannuation Contribution

The salary package of Leah for the year 2021–2022 is composed of a $180,000 annual salary plus a super guarantee of $17,100 (9.5%). For the next year, Leah and her employer were discussing whether to increase Leah's super contribution by $2,000 via a salary sacrifice arrangement.

Required:

Analyse the probable effect of this salary sacrifice arrangement.

| Leah is a resident taxpayer | ||

| Salary Package | 2021–2022 | 2022–2023 |

| Annual Salary | $180,000 | $178,000 |

| Super Guarantee | $17,100 (9.5% x $180,000) |

$16,910 (9.5% × $178,000) |

| SSA | nil | 2,000 |

| Taxable Income | $180,000 | $178,000 |

| Tax Payable | $54,097 (20,797 + 37% (180,000 - 90,000)) |

$53,357 (20,797 + 37% (178,000 - 90,000)) |

| Medicare Levy | $3,600 (2% × 180,000) |

$3,560 (2% × 178,000) |

| Net Salary (Take Home) | $122,303 | $121,083 |

| Superannuation Fund | 2021–2022 | 2022–2023 |

| Employer’s contribution | $17,100.00 | $18,910.00 (16,910 + 2,000) |

| Less: contributions tax | $2,565.00 (15% × $17,100) |

$2,836.50 (15% × $18,910) |

| Net Total Contribution | $14,535.00 | $16,073.50 |

| Because of the SSA, Leah’s take-home pay will be reduced by $1,220 (i.e.,122,303 - 121,083). However, her total net contribution for her superannuation fund will increase by $1,538.5 (i.e.,14,535 - 16,073.50). | ||

Learning Exercise

Salary Sacrifice Arrangements – Fringe Benefits

Paul’s salary package for the year 2021–2022 comprises a $185,000 annual gross salary plus a super guarantee of $17,575 (9.5% × 185,000). Paul and his employer discussed providing Paul with a fringe benefit for the next year via a salary sacrifice arrangement. Assume that the fringe benefit provided amounted to $2,200 (inclusive of GST) and that the benefit is an exempt fringe benefit.

Required:

Analyse the probable effect of this salary sacrifice arrangement.

| Amount to sacrifice = (2,200/1.1) = 2,000 | ||

| Salary Package | 2021–2022 | 2022–2023 |

| Annual salary | $185,000 | $183,000 |

| Super guarantee (9.5%) | $17,575 | $17,385 |

| Fringe benefit | nil | $2,200 |

| Taxable income | $185,000 | $183,000 |

| Tax payable | $56,347 | $55,447 |

| Medicare levy | $3,700 | $3,660 |

| Net Pay (Take Home) | $124,953 | $123,893 |

| Less: Amount shouldered by the employee if the property was not provided as a fringe benefit | $2,200 | nil |

| Employee’s Disposable Income | $122,753 | $123,893 |

Anti-Avoidance Rules

As a tax practitioner, you are well-placed to identify tax avoidance practices. Understanding anti-avoidance rules is necessary when considering arranging a tax planning scheme for your client. In addition, you must know the applicable laws when preparing the taxation documentation for your clients. This is to ensure the identification of any tax avoidance arrangements that your client may have undertaken. If your client has made such arrangements, you must discuss them with your client and explain the consequences. It is part of your professional code of conduct not to facilitate such arrangements that you are aware of violating Specific anti-avoidance rules (SAAR) and General anti-avoidance rule (GAAR) as stipulated by the ATO. You must explain the rules, consequences and penalties to your client. If the client does not take heed and insists on your preparing and lodging a return despite it contravening ATO rules, you should refuse. ATO has put laws in place to help deter tax avoidance schemes.

General anti-avoidance rule (GAAR)

The general anti-avoidance rule is set out in Part IVA of the Income Tax Assessment Act 1936. GAAR is intended to encompass all possible forms of tax avoidance. The rule is that the Commissioner may cancel a tax benefit that was obtained or would have been obtained from a scheme to which Part IVA applies. The following are some of the conditions that must be satisfied before a taxation authority can invoke GAAR:

- There must be a scheme. This implies there should have been some arrangement, course of action, plan, undertaking, etc.

- There must be a tax benefit. A tax benefit relates to a reduction of tax liability which may be caused by:

- Decrease in assessable income

- increase in allowable deductions

- increase in tax offset.

To further understand general ant-avoidance rules refer to Part IVA: the general anti-avoidance rule for income tax

Specific anti-avoidance rules (SAAR)

There are various specific anti-avoidance rules contained throughout the Australian tax legislation. These provisions are aimed at denying the tax benefits associated with particular types of transactions. Some examples of these rules may include::

| Act | Provision | Explanation of the Rule |

|---|---|---|

| ITAA 1936 | Division 7A | This was inserted by enacting Taxation Laws Amendment Bill 1998 to help overcome issues faced with s.108 of the same Act. This amendment ensures that the amounts lent or paid and loans forgiven by private companies to shareholders or associates are treated as dividends paid by the entity. This ensures they are treated as assessable income of the shareholders or associates under s.44 of ITAA 1936. They will result in debiting the entity’s franking account to discourage such practices. |

| ITAA 1997 | s. 26–35 | Suppose under other provisions of this Act. You deduct payments made or liabilities incurred related to related entities. In that case, your client may only deduct the amount to the extent the Commissioner considers reasonable. |

| s. 26–55 | This section applies a limit on the total amount your client can deduct for the financial year relating to pension, gratuities or retiring allowance payments (s. 25–50); gifts or contributions (Division 30); conservation covenants (Division 31) and personal superannuation contributions (s.290-150). |

If ATO finds out there has been some breach in any of the provisions relating to anti-avoidance rules, ATO may cancel the effect of the tax benefit generated from the scheme.

Anti-Avoidance Rule

Anti-Avoidance Rule ABC company is a partner in the BNM partnership. BNM is renting ABC’s factory for $450,000 a month. If made at arm's length, the rent expense in relation to the factory would only amount to $100,000. Section 26-35 of ITAA 97 disallows deductions for excessive amounts paid to associates. As a consequence of this scheme, ATO may cancel the excessive deductions made by BNM.

Communicating With Your Clients

It is best practice to have established guidelines on how you communicate your responses and advice to your clients. This could be through:

- Direct messaging

Quick questions requiring short answers may be communicated through direct messaging applications or phone calls. If you need to share your advice through direct messaging, you will need a proper template for the letters you send to your client, especially if you are communicating with your client for the first time. - Face-to-face meeting

Communication that requires a comprehensive discussion is best conducted through a face-to-face meeting. Here are some guidelines you may follow when communicating with your client via a face-to-face meeting:- Plan the meeting

Determine the meeting’s agenda. Is it to answer your client's queries, update your client about his current tax obligations, or propose a new tax planning method? In any case, prepare an outline of how the meeting should go. - Set the schedule for the meeting

Having a set schedule for the meeting is one way of demonstrating professionalism in the workplace. It would also be best to confirm with your client his availability for a face-to-face meeting. - Prepare for the meeting

Review the documents that you are going to present to your client. Ensure you are prepared to answer your client's questions about your presentation confidently. - Conduct the meeting with professionalism

While conducting the meeting, establish a strong sense of professionalism by being mindful of how you present yourself, the modulation of your voice, your hand gestures, etc. You must remember to provide an opportunity for two-way communication with your clients by encouraging your clients to ask questions. It would help if you verified with your clients that they understood what you have discussed.

- Plan the meeting

As your client’s authorised tax agent, you must represent your client in all dealings with the taxation authorities. You will need to respond to enquiries by the taxation office and meet all requirements of the tax audit if applicable. These should be done in a timely manner. This implies that you must respond to the queries and meet the tax audit requirements within the timelines prescribed by the relevant authority.

This topic covers different interactions with taxation authorities, including tax office enquiries, taxation reviews and audits. To understand how to respond to tax office enquiries and meet the requirements of a taxation audit, you need to know what assessments and amendments are and how to handle these requests from the ATO.

Assessments and Amendments

Assessment pertains to determining how much the taxpayer's taxable income and tax payable will be for the relevant period. The Australian tax system for corporates and certain entities for income tax purposes is based on a system of self-assessment. Self-assessment means that the taxable entity will undertake the following:

- Calculate their own taxable income

- Calculate their own tax payable

- Initiate request for refund or settles payment

- Self-amend original assessments

Under this system, an assessment is considered to be made when the activity statement is lodged. The activity statement is treated as a notice of assessment (NoA). The ATO will issue no other NoA. There is only one assessment made for a particular tax period. Subsequent activity statements or changes to the activity statements give rise to an amended assessment. If a processing error on a lodged activity statement is corrected, it is an amended assessment. Suppose the activity statement is not lodged when required. In that case, the ATO will assess the taxpayer’s assessable amount based on the information available to them.

Amendments to the lodged tax returns are sometimes done to correct mistakes made in completing the tax returns. Notice of amended assessment will be sent to the taxpayer once the relevant changes were already effected and the taxpayer liability was already updated and finalised. However, take note that the period in which the commissioner may make amendments to the assessments made in the taxpayer’s tax affairs has a time limit.

The table below sets out the time limit for the amendment period:

| Tax Affair | Example of Legal Entity | Time Limit for Amendment Period |

|---|---|---|

| Simple Tax Affairs | Sole traders | Two years from the day NoA was sent |

| Complex Tax Affairs | Companies | Four years from the day NoA was sent |

Tax Office Enquiries, Taxation Reviews and Audits

While entities are required to follow self-assessment, the ATO undertakes ongoing compliance activity to ensure taxpayers meet their tax obligations. They seek fair evidence that helps a reasonable person determine whether a particular taxpayer has paid the right amount of tax. They customise their approach based on the business profile of a taxpayer. The ATO follows a risk-based approach to compliance and audit activities. They focus on taxpayers with a higher likelihood of non-compliance or higher consequences of non-compliance.

The ATO may be drawn to the following behaviors and characteristics:

- Tax or economic performance not comparable to similar enterprises

- Low tax transparency

- Large, one-off or unusual transactions, including wealth transfer

- Aggressive tax planning

- Tax outcomes inconsistent with the intent of the tax law

- Choosing not to comply or regularly taking controversial interpretations of the law without engaging with the ATO

- Lifestyle not supported by after-tax income

- Accessing business assets for tax-free private use

- Poor governance and risk-management systems

Based on What attracts our attention. © Australian Taxation Office for the Commonwealth of Australia

The taxation office’s compliance activities take the form of:

Enquiries

Tax office enquiries include further information, clarifications or supporting/source documentation required by the tax offices relating to your client’s taxation documentation or obligations. These enquiries may arise during regular processing of the taxation documentation lodged by you on behalf of your clients by the taxation office or occasions when the taxation office may have tax enquiries relating to potential compliance issues.

By engaging with you on behalf of your clients, they will attempt to understand and manage these queries and issues. To help resolve these queries and concerns, they may seek necessary information or require further action from you or your clients. Once you have addressed their concerns through the additional information you provide, the tax office will close their enquiries promptly. However, some assessments may need to undergo tax review or audits. The taxation office will engage with you on behalf of your clients on tax reviews and audits.

Reviews

Based on your client’s tax affairs, the taxation authorities may contact you to understand better a specific issue or many issues relating to the client's business. This type of engagement is known as a review. Reviews help the taxation authorities determine if the issues require a more in-depth examination and response. If so, they will thoroughly examine your client's taxation affairs by conducting an audit.

Audits

A taxation audit involves the inspection and examination of the tax affairs of a taxpayer. It is a systematic process of examining taxpayers' tax affairs to ascertain their compliance with relevant tax laws. The taxation authorities can undertake audits if they believe a more in-depth investigation is warranted. Their audit program includes everything from simple reviews of source documents to in-depth examinations of complex agreements and transactions. The majority of audits start with a review. However, if necessary, the ATO may proceed directly to audit without performing a review. This may occur in circumstances involving less sophisticated concerns, where the ATO suspects fraud or evasion, or when a transaction or arrangement is deemed high-risk.

An audit from ATO may be of the following types:

| Type | Purpose |

|---|---|

| Research Audit | It is designed as an exploratory audit |

| Business Audit | ATO conducts an audit of business operations |

| Primary Audit | ATO seeks records that can substantiate information reported in the returns |

| Complex Audit | An audit designed for the largest corporate bodies in Australia |

| Special Audit | An audit designed to deal with serious fraud cases |

The general process of a tax audit involves the following steps:

- ATO arranges a meeting

- ATO discusses the scope of the audit, expectations, and other information relating to the audit to be conducted

- ATO performs the audit

- ATO communicates the outcome of the audit and finalises the outcome in writing

Responding to Enquiries and Meeting Requirements

The best way to handle tax office enquiries is to be calm. The taxation authorities have certain expectations of cooperation from audited entities. It is in your client’s favor for the client and you to cooperate to the best of your abilities.

Here are some guidelines that can assist you in your engagement with the tax officers and taxation authorities.

- In your dealings, be sincere, honest and respectful.

- Inform everyone about anything that could cause the review or audit to be delayed as soon as feasible.

- Ensure the clients produce copies of records and documents, or you should extract information from them, in a comprehensive, accurate and timely manner in response to information requests.

- Offer tax officers with reasonable facilities and help at the premises in case of tax audits.

Providing information and cooperation in a timely manner saves time for both parties. It also facilitates finding the correct outcome of the audit. You should ensure that the tax officers have complete and unrestricted access to buildings, facilities, records and documents.