This qualification reflects professional accounting job roles in the financial services sector. It can be used to perform a range of accounting tasks for organisations in a range of industries.

Upon completing this course, you will have learnt the skills to apply solutions to a range of often complex problems and analyse and evaluate information from a variety of sources. We will guide you in being able to understand and apply initiatives to manage and evaluate current financial practices and provide guidance to others following appropriate principles and standards.

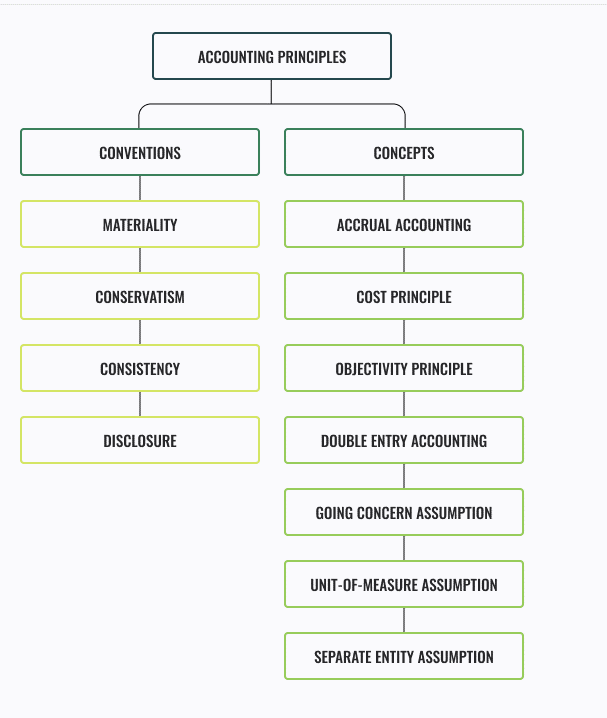

Accounting principles are rules and guidelines that businesses must follow when reporting financial data. They are designed to ensure a business's financial reports are complete, consistent, and comparable.

These principles, which serve as the rules for accounting for financial transactions and preparing financial statements, are known as the Generally Accepted Accounting Principles (GAAP). By Applying these rules, accountants ensure financial statements are reliable and informative for stakeholders.

Accounting principles include accounting concepts and accounting conventions.

Accounting concepts refer to the rules of accounting which are to be followed while recording business transactions and preparing final accounts. Some of the most fundamental accounting concepts are:

1. Accrual accounting: Recording revenue (when a sale is made regardless of when collected) and recording expenses (irrespective of when paid). The key principles of accrual accounting are the following:

- Revenue principle: States that revenue is earned when the sale is made. This is typically when goods or services are provided

- Expense principle: States that an expense occurs when the business uses goods or receives services.

- Matching principle: States that when revenue is recognised, related expenses should be paired with it. This means that expenses are only reported during the period in which the revenue was made to ensure that the profit reported accurately reflects the business's performance in that period.

2. Double-entry accounting: There are always two (2) entries for every transaction. When recording transactions for every credit, a corresponding debit is made.

3. Going concern assumption: Also known as continuity assumption, states that accounting systems assume that a business will continue to operate.

4. Cost principle: States that amounts in the accounting system should be quantified or measured by using historical cost.

5. Objectivity principle: States that accounting measurements and accounting reports should use objective, factual and verifiable data

6. Unit-of-measure assumption: Assumes that a business's domestic currency is the appropriate measure for the business to use in its accounting.

7. Separate entity assumption: States that a business and its owner should be treated separately as far as their financial transactions are concerned

Accounting conventions are practices that are widely accepted and adopted as a guide in the preparation of final accounts. The basic accounting conventions are:

Consistency: This convention requires accounting methods to be consistently applied from one period to the next.

Disclosure: This convention requires a financial statement to be prepared so that they disclose all the material information to users so that users can make a rational decision.

Conservatism: This convention states that a business should not anticipate income and gains but provide for all expenses and losses.

Materiality: This convention states all significant items must be reported in accounting reports. This allows for immaterial amounts to be omitted.

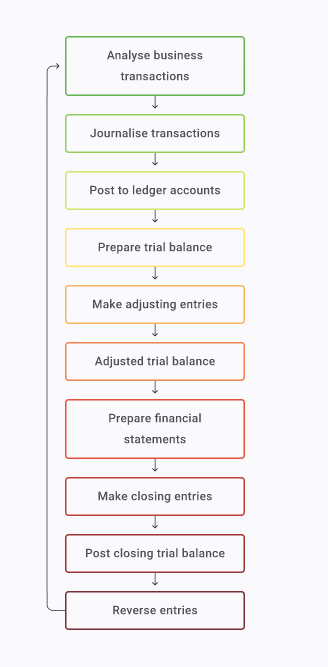

The accounting cycle is a proven method for ensuring all the money earned and spent by a business is accurately recorded. This process identifies errors early on, improves bookkeeping accuracy, and can assist in generating financial reports.

The accounting cycle starts with completing an analysis of all transactions and recording them in the journal. Once recorded in the journal, they are posted to the ledgers, and a Trial Balance is prepared.

The Trial Balance contains a list of all General Ledger accounts. Debit balances are separated from credit balances. It is always prepared on a particular date, e.g., at the end of every month, end of every quarter, etc.

The Trial Balance, adjusting entries, and any additional information for the financial statements are recorded in the worksheet. After the completion of the worksheet, the financial statements are finalised. All adjusting and closing entries are then journalised and posted to the ledger.

To ensure all entries were correctly made, a post-closing Trial Balance is prepared to show the equality of debits and credits, as well as to confirm assets, liabilities, and capital accounts with proper open balances.

The figure below shows the steps in the accounting cycle.

The units in this course can help you prepare for your career journey within Accountancy. If you are inspired by numbers and how they can be used to maximise profit and support the efficiency of businesses, this course will give you the skills and knowledge required. Upon successful completion of this course, your avenues are quite diverse.

Earnings and salary will vary across positions; if you are looking into the earnings of an accountant, you may wish to conduct research to establish that understanding. If you are unsure where to start, click the following link to Seek, and spend some filtering through positions of your choosing to observe some salary profiles within Accounting.

Some of the career opportunities may include (but are not limited to):

- Accountant

- Auditor

- Budget Analyst

- Financial Accountant

- Forensic Accountant

- Government Accountant

- Tax accountant

- Accounts payable and accounts receivable officer

- Payroll accounts officer

Accountants must be mindful of their duties and obligations under legislation. They must comply with the law and the practices of their particular industry. These are often known as standards and are followed to ensure accurate records are kept and any misconducts are avoided.

Australian Accounting Standards

The Australian Accounting Standards Board (AASB) is an Australian Government agency under the Australian Securities and Investments Commission Act 2001. Under that Act, the statutory functions of the AASB are:

- To develop a conceptual framework for the purpose of evaluating proposed standards

- To make accounting standards under section 334 of the Corporations Act 2001

- To formulate accounting standards for other purposes

- To participate in and contribute to the development of a single set of accounting standards for worldwide use

- To advance and promote the main objects of Part 12 of the ASIC Act, which include reducing the cost of capital, enabling Australian entities to compete effectively overseas and maintaining investor confidence in the Australian economy.

Legislations

Careers in Accounting require in depth knowledge of legislation. It is integral you are familiar with the relevant legislation in this role, as much of it sets the foundations for the policies, procedures, code of conduct and practices within the workplace.

The following table outlines some of the relevant legislation you will need to familiarise yourself with as your progress through the course. Click on each of the links to take you directly to the relevant website.

| Tax Agents Services Act |

This defines what constitutes the provision of a BAS Service. It requires anyone providing such a service to be a registered BAS Agent and outlines the required qualifications and experience of registered BAS Agents. This also requires BAS Agents to hold Professional Indemnity insurance and follow a Code of Professional Conduct. |

| Privacy Act |

The Privacy Act regulates how personal information is handled. It defines personal information as: information or an opinion, whether true or not, and whether recorded in a material form or not, about an identified individual, or an individual who is reasonably identified. (Source: Privacy Act) Accountants must ensure creditor, customers, and employees names, contact information, and personal details must be kept private and confidential. Under the Privacy Act, entities must comply with requirements in responding to data breaches. These are outlined under the Notifiable Data Breaches (NDB) scheme. The NDB scheme applies to all agencies and organisations with existing personal information security obligations under the Privacy Act. |

| Corporations Act 2001 | The main law governing business entities (mainly businesses) in Australia is the Corporations Act 2001 (Cth). It governs activities like the creation and management of corporations, the responsibilities of executives and take overs. |

| Criminal Code Act 1995 | Identifies general principles of criminal responsibility under laws of the Commonwealth |

| Freedom of Information Act 1982 | The public rights of access to official documents of the Government of the Commonwealth and of its agencies under the Information Publication Scheme. |