What is a Business Plan?

A business plan is a written document that describes in detail how a business — usually a startup — defines its objectives and how it is to go about achieving its goals. A business plan lays out a written roadmap for the business from each of a marketing, financial, and operational standpoint. A business plan is a fundamental document that any startup business needs to have in place prior to beginning operations. - www.investopedia.com

What is the purpose of a Business Plan?

Having a business plan;

-

can help you prioritise – it gives your business direction, defines your objectives, maps out strategies to achieve your goals and helps you to manage possible bumps in the road,

-

gives you control over your business – the planning process helps you learn about the different forces and factors that may affect your success. If you're already in business, it helps you to step back and look at what's working and what you can improve on, a good way for companies to keep themselves on target going forward,

-

and is vital to help you get finance – if you're seeking finance for your business, you'll need to show banks and investors why they should invest in your business. The plans are used to attract investment before a company has established a proven track record.

Operating without a business plan is not usually a good idea. In fact, very few companies are able to last very long without one.

The reasons for business planning include;

-

providing analysis of the business.

-

forcing stakeholders to analyse whether the business project is feasible or not.

-

helping to manage the business.

-

serving as a promotion of the business to investors and financiers.

-

assisting business owner to take strategic action.

What are the benefits of Business Planning?

-

The bigger picture: This is one of the key advantages of a business plan. When you plan your business right, you can get a clearer picture of the business as a whole. You can easily connect the dots between strategy and tactics, and everything is easier to work out.

-

Strategic focus: As a startup, you need to create an identity and focus on building that identity. It is usually defined by your target market, and the products and services you are tailoring to match their needs.

-

Set priorities: It’s impossible to do everything at once in a business. When you plan your business, you can order things in terms of their importance and allocate your effort, resources and time in an efficient and strategic manner.

-

Manage change: When you plan your business effectively, you can check your assumptions, track your progress and see new developments right from the beginning, allowing you to adjust accordingly.

-

Forces you to be accountable: When you plan effectively, you set expectations for yourself and a means by which you will be able to track your results. You can constantly review your business plan in terms of what you expect and what eventually happens.

Source: https://smallbusiness.chron.com/

Business plans can be very detailed, such as the more common traditional business plan, or they can be short one page plans, such as lean start up plans where details are provided to stakeholders on request.

There are many types of business planning. These include, feasibility studies, financial, marketing, operational, and strategic planning. The initial process involves developing plans including; start-up, feasibility, internal, operations, strategic, financial, and growth plans.

This analyses the feasibility of a business idea. An assessment of the practicality of a proposed project or system. A feasibility study aims to objectively and rationally uncover the strengths and weaknesses of an existing business or proposed venture.

The use of the feasibility study can;

- Show narrow business alternatives and explore options.

- Allow analysis of the issues and come-up with a solution.

- Mitigate the risks and take precautionary actions.

- Attract equity investments with solid research data.

- Provide quality information for the decision maker.

- Well documented process about a new venture.

Some of the key requirements of a successful feasibility plan are;

- Adequate market research.

- Analysis of data that is real and comparable.

- Discussions with similar venture owners.

- Correct analysis of feasibility financials.

Source: http://businessplanspro.com.au/feasibility-plan

A financial plan is simply an overview of your current business financials and projections for growth. Think of any documents that represent your current monetary situation as a snapshot of the health of your business, and the projections being your future expectations.

The components of a financial plan include;

- Forecasted revenue, or income and expenditure projections.

- Profit and Loss Account.

- Balance Sheet.

- Cash Flow.

- Cost of Goods Sold.

- Annual Maintenance, Repair and Overhaul, and investment budget.

- Asset Depreciation (Depreciation Schedule).

- Tax.

- Inflation.

- Product Price Increase.

- Funding or borrowing requirements.

A marketing plan helps you promote products and services in your business that meet the needs of your target market.

It allows you to;

- Identify your target market and understand how your product or service meets their needs.

- Identify your competitors and what your target customers think about your competitors' strengths and weaknesses.

- Position your brand, products and services so that your target market sees your business as better than, or different from, the competition.

- Set specific, measurable goals and time frames for your marketing activities.

- Map out a strategy to reach your target audience, including the messages, channels and tools you will use.

The operational plan is a description of the systems involved in the day to day running of the business - how you make things happen! This will also cover how goods are produced, what policies and procedures will be followed and how the business will be monitored.

Operational plans should contain;

- clear objectives of the plan.

- activities to be delivered.

- quality standards.

- desired outcomes.

- staffing and resource requirements.

- implementation timetables.

- a process for monitoring progress.

A strategic business plan provides a high-level view of a company’s goals and how it will achieve them, laying out a foundational plan for the entire company.

While the structure of a strategic plan differs from company to company, most include five elements;

- business vision.

- mission statement.

- definition of critical success factors.

- strategies for achieving objectives.

- an implementation schedule.

A start-up plan covers all topics relevant to new venture creation, including;

- company information.

- information on the financial analysis of the business.

- the milestones for implementation.

- the management team.

- the strategy of the business.

- the marketplace.

- the product or service offering of the organisation.

- various forecasts.

Notable among the plan's forecasts are predictions for the sales, profit, loss, cash flow and balance sheet of the company, financial analysis, as well as the monthly projections for the first year.

Any business plan you do not prepare with the intent to show a financial institution, an external investor or any other third party is known as an internal business plan. Internal business plans target a specific audience within the business, for example, a business unit that needs to evaluate a proposed project. Internal plans do not require details about the organisation or the management team.

The plan will describe the company’s current state, including operational costs and profitability, then calculate if and how the business will repay any capital needed for the project. It will provide information about project marketing, hiring and equipment costs. a market analysis illustrating target demographics, market size and the market’s positive effect on the company income.

Some business plans do not concern themselves with the entirety of the business. They are only interested in a part of the business or a specific area of interest. These are called growth plans, new product plans or expansion plans, depending on what they are looking to achieve.

Growth plans or expansion plans are in-depth descriptions of proposed growth and are written for internal or external purposes. If company growth requires new investments or loan applications, a growth plan may include complete descriptions of the company, its management and officers. The plan must provide all company details to satisfy potential investors. This plan should include comprehensive forecasts of sales and expenses for the new venture/product/etc.

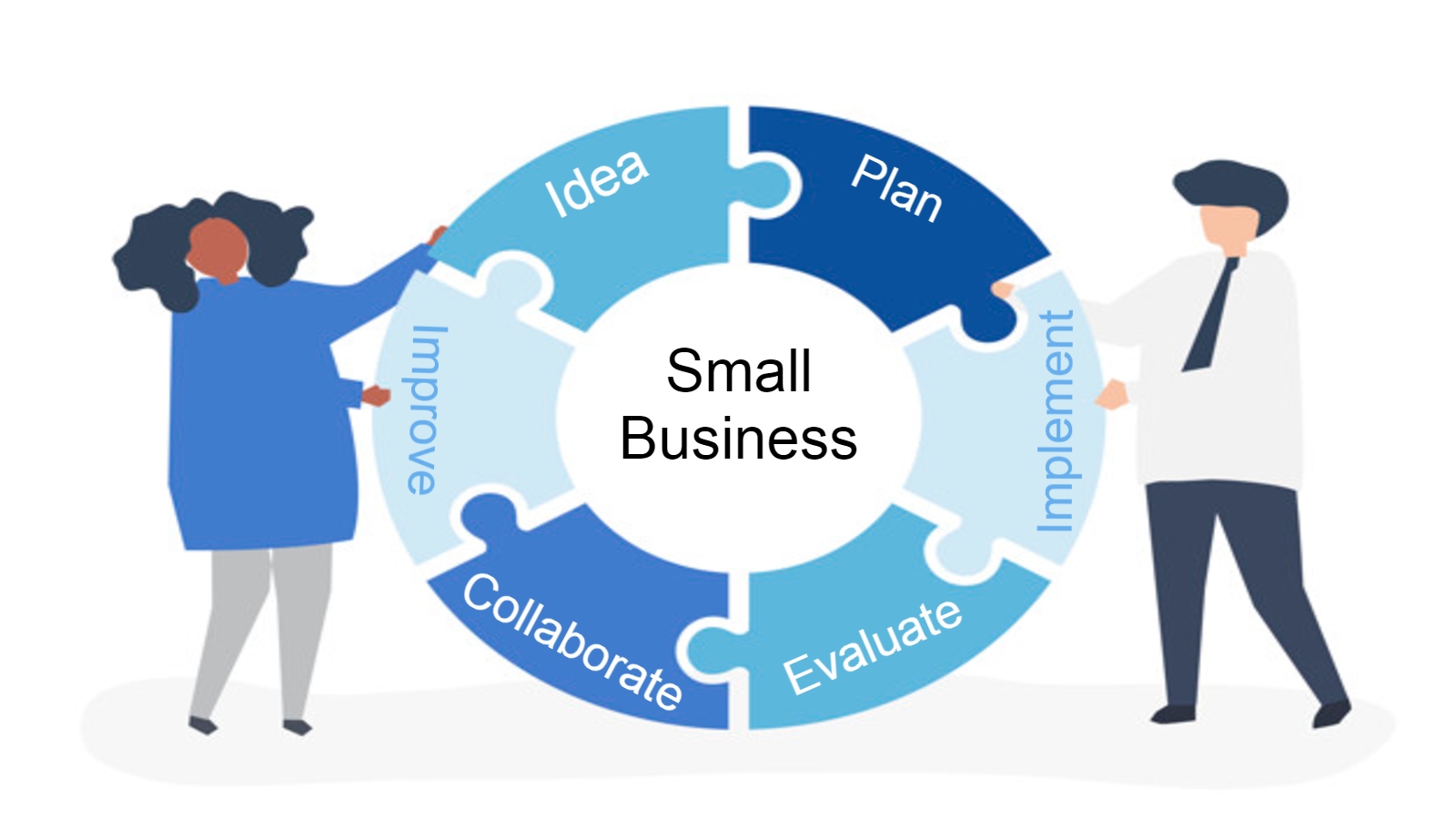

So, you now know that business plans are important, but what is the planning process?

To begin with, you have a great idea! You see a gap in the market, an idea no one has thought of before or simply something you just love doing and you want to make it your business. This is how a small business can start when a seed of an idea expands into reality and becomes a fully functioning and profitable enterprise. To get from dream to operation requires PLANNING.

Your early planning will research the systems and structures which will make your business viable. The planning will assess your idea, measure the outcomes, take into account the inputs and provide a view that encourages you to proceed or not, and all of this within the Australian legislative framework.

Business planning won’t always result in the setup of a small business; it may warn you off commencing a small business based upon the economic climate, the costs to establish and any number of other factors. This makes the planning phase even more important. To make your ideas manageable and to provide the best possible opportunity for success the planning process needs to be documented. You document this process by developing a Business Plan.

Before writing your business plan, honestly evaluate yourself and decide if your business idea has a good chance of success.

- Analyse your business idea - Is your business idea viable? Is there a market for your proposed product or service? Is your business idea worth investing your time and money into?

- Analyse yourself - Are you ready to venture into business? Do you have what it takes to be an entrepreneur? Do you have the skills needed to run your business successfully? Are you ready to put in the hard work?

- Ensure you know if you're running a business or a hobby.

- Prepare yourself for business.

Does your business plan have more than one purpose?

Will you use it internally, or will you involve external parties, such as an investor or bank?

Deciding what your purpose is, can help you develop your plan for the right audience.

If the plan has been developed for third parties, you will need to determine what they’ll be most interested in. Don't assume they’re just interested in the financial part of your business. They’ll be looking at the whole package.

You’ll need to make quite a few decisions about your business including its structure, marketing strategies and finances before you can complete your plan.

Research can help you develop goals and targets, as well as a better understanding of where your business should be heading.

Market analysis - A company needs a good handle of the industry as well as its target market. It will outline who the competition is and how it factors in the industry, along with its strengths and weaknesses. It will also describe the expected consumer demand for what the businesses is selling and how easy or difficult it may be to grab market share from incumbents.

It's important to make sure your research is up-to-date and accurate before presenting to lenders or investors as market conditions can change over time.

nationalindustryinsights.aisc.net.au data on Australian fitness industry including key occupations.

www.franchisehelp.com article on a general analysis of fitness industry cost trends in US market.

www.gminsights.com report on US fitness equipment market.

Lenders and investors need to know your finances are in order and your business is in a strong financial position.

Both lenders and investors will want to know how much money you currently have, how much money you need and how much you expect to make in the near future.

Financial planning - In order to attract the party reading the business plan, the company should include its financial planning and future projections. Financial statements, balance sheets, and other financial information may be included for already-established businesses. New businesses will instead include targets and estimates for the first few years of the business and any potential investors.

Budget - Any good company needs to have a budget in place. This includes costs related to staffing, development, manufacturing, marketing, and any other expenses related to the business.

While a bit of extra funding will help you ensure you’re covered for unexpected costs, be realistic and avoid asking for more than you need.

Summarise the main points of your business plan using as few words as possible.

You want to get to the point but not overlook important facts.

This is also your opportunity to sell yourself, but don't overdo it.

The summary should include details about your business, market, goals, current financial position, how much finance you're seeking and what it will achieve.

If you aren't confident in completing the plan yourself, you can enlist the help of a professional to look through your plan and provide advice.

There are a number of government services available to help you plan, start or grow your business. These services can provide general advice, workshops, seminars and networking events, and can even match you with a mentor or business coach.

Review your plan regularly. As your business changes many of the strategies in your plan will need to change to ensure your business is still heading in the right direction.

Having your plan up to date can keep you focused on where you are heading.

It's a good idea to keep a record of each version of your business plan as they may contain some important historical information as well as your intellectual property.

Having an understanding with third parties when distributing a plan could be enough protection for some businesses. However, others who have innovative business practices or products or services may wish for each person to sign a confidentiality agreement to protect their innovations.

It may also be a good idea to include some words in your plan asking the reader not to disclose the details of your plan.

"When you plan your business’ future, you will generate a list of potential achievements you want it to reach. These are goals. The specific steps you take to get to those achievements are your objectives"- www.smallbusiness.chron.com

Planning for the future for your business includes setting business goals and objectives as a basis for measuring performance. As well as goals and objectives, you need to develop a Mission Statement and a Vision Statement.

-

Vision statement - is a picture of what an organisation wants to achieve over time.

-

Mission statement –is a formal summary of the aims and values of an organisation.

A simple process to follow is to first define your vision, define your mission and then decide your objectives. Include in your objectives what are you going to do and what your goals will be so that they lead to the attainment of your mission and your vision. Write a simple action plan with the smaller actions required to achieve the stated objectives. You could include this much of your planning into a one-page summary or Business Plan statement.

A great way to clarify all of your business goals and objectives is to write a business plan. But how do you go about setting these goals and objectives?

Goals are general statements of what you want to achieve. Some examples of business goals are;

-

To improve profitability.

-

To increase efficiency.

-

To capture a bigger market share.

-

To provide better customer service.

Objectives are specific, quantifiable, time-sensitive statements of what is going to be achieved and when it will be achieved. They are used to measure business performance. Some examples of business objectives are;

-

To earn at least an 8 percent after-tax rate of return on our net investment during the next financial year.

-

To source and roll out new cloud based accounting software by next financial year.

-

To increase market share by 15 percent over the next four years.

-

To grow an email list of 1000 unique subscribers by the end of the financial year.

Other small business goals and objectives could focus on;

-

Customer needs.

-

Family or community benefits (Social).

-

Marketing projections.

-

Financial projections.

-

Systems and processes

-

Lifestyle issues.

-

Proposed size and scale of the business.

-

Specific short, medium, or long-term goals.

-

Social responsibility.

When writing business goals and objectives, follow the SMART acronym for setting business goals;

Specific goals are well-defined and focused. The goal should be clear and detailed enough that you know exactly what you are trying to achieve.

Make it Measurable - Specific goals and objectives provide you with milestones that indicate your progress. You will learn to estimate the time it takes to achieve the results you want. When you are asked to nominate the time it will take to complete a given task you will be able to measure your progress against the goals/objectives you have set.

Be realistic. Goals must be Attainable. There is no point in setting unreachable targets. Make sure you have the resources to achieve the goal, make sure it’s feasible. Check with your industry association to get a handle on realistic growth in your industry to set attainable goals.

If the goal is not Relevant or the team is not particularly concerned about achieving a certain outcome then motivation will slip. Work with the team and customers to determine what is relevant to them and to you.

Set a Timeframe - Objectives must have deadlines if they are to be effective. If you do not have a schedule to work to, your goals/objectives may be pushed aside by the inevitable day-to-day problems. Setting deadlines helps you to estimate your progress and focus on your achievements. Set realistic timeline in which to see real improvement and schedule in reviews at appropriate intervals.

If you're having trouble deciding what your goals and objectives should be, here are some questions you could ask yourself;

- How determined am I to see this succeed?

- Am I willing to invest my own money and work long hours for no pay, sacrificing personal time and lifestyle, maybe for years?

- What's going to happen to me if this venture doesn't work out?

- If it does succeed, how many employees will this company eventually have?

- What will be its annual revenue in a year? Five years?

- What will be its market share in that time frame?

- Will it be a niche marketer, or will it sell a broad spectrum of good and services?

- What are my plans for geographic expansion? Local? National? Global?

- Am I going to be a hands-on manager, or will I delegate a large proportion of tasks to others?

- If I delegate, what sorts of tasks will I share? Sales? Technical? Others?

- How comfortable am I taking direction from others? Could I work with partners or investors who demand input into the company's management?

- Is it going to remain independent and privately owned, or will it eventually be acquired or go public?

Source: http://www.entrepreneur.com/article/38292

The following Fitness Australia PODCAST: Find Your Niche With Zumba’s Maria Teresa Stone, gives an insight into experiences creating a niche business within the fitness industry.

Business plans, even among competitors in the same industry, are rarely identical, but they all tend to have the same basic elements, including an executive summary of the business and a detailed description of the business, its services and/or products. It also states how the business intends to achieve its goals. The plan should include at least an overview of the industry of which the business will be a part, and how it will distinguish itself from its potential competitors.

While it's a good idea to give as much detail as possible, it's also important to be sure the plan is concise so the reader will want to get to the end. All of the information should fit into a 15- to 20-page document. If there are crucial elements of the business plan that take up a lot of space—such as applications for patents—they should be referenced in the main plan and included as appendices or supporting documents.

Source: https://www.investopedia.com/

Elements of a Business Plan

As mentioned above, no two business plans are the same, but they all have the same elements. A business plan is a combination of an executive summary, business profile, marketing plan, growth plan, and a financial plan.

Below are some of the common and key parts of a business plan;

Also called the Executive Summary, this section outlines the company and includes the mission statement along with any information about the company's leadership, employees, operations, and location. It should briefly summarise your more detailed information provided throughout the body of your plan.

Include;

-

Business name - Enter your business name as registered in your state/territory, or your proposed business name.

-

Business structure - Is your business a sole trader, partnership, trust or company?

-

ABN - Enter your Australian business number (ABN).

-

ACN - Enter your Australian Company Number (ACN). Only fill this in if you are a company.

-

Business location - Enter your main business location. Briefly describe the location and space occupied/required.

-

Date established - The date you started trading or date your purchased the business.

-

Business owner(s) - List the names of all business owners.

-

Relevant owner experience - Briefly outline your experience and/or years in the industry and any major achievements/awards.

-

Products/services - What products/services are you selling?

-

Target market - Who are you selling to?

-

Marketing strategy - How do you plan to enter the market? How do you plan to attract customers?

-

Vision statement - The vision statement briefly outlines your future plan for the business.

-

Goals/objectives - What are your short & long term goals?

-

The finances - Briefly outline how much profit you intend on making in a particular timeframe. How much money will you need up-front? Where will you obtain these funds?

This section outlines the company and includes the mission statement along with any information about the company's leadership, employees, operations, and location. It should briefly summarise your more detailed information provided throughout the body of your plan.

-

Registration details - Includes, business name, trading name(s), date and location registered, ABN, business structure, domain names, and licence/permits.

-

Business premises information - Includes, business location, and buy/lease details.

-

Organisational chart - The organisation chart is a quick way of representing your business structure or proposed structure.

-

Management & ownership - Includes, names of owners, details of management & ownership, and experience.

-

Key personnel - Here, you would outline details of current and required staff, recruitment options, training programs, and skill retention strategies.

-

Products and services - Here, the company can outline the products and services it will offer, and may also include pricing, product lifespan, and benefits to the consumer. Other factors that may go into this section include production and manufacturing processes, any patents the company may have, as well as proprietary technology. Any information about product research and development (R&D) can also be included here.

-

Innovation and development - Includes, research & development (R&D)/ innovation activities, and intellectual property strategy.

-

Insurance - Includes, business revenue, business assets, product liability, professional indemnity, public liability insurance, and workers compensation.

-

Risk management - This would be a table listing the potential risks (in order of likelihood) that could impact your business.

-

Operations - Includes the production process, suppliers, plant and equipment table, inventory table, technology (software), trading hours, communication channels, payment types accepted, credit policy, warranties & refunds, quality control, and memberships and affiliations.

-

Legal considerations - For example, consumer law, business law, or specific legislation to your industry.

-

Sustainability plan - This can include, environmental/ resource impacts, community impact and engagement, risks/constraints, strategies, and action plans.

This section should include details of;

-

Market research - Statistical research have you completed to help you analyse your market, such as surveys or questionnaires.

-

Market targets - Outline your planned sales targets. What quantity of products/services do you plan to sell in a planned timeframe?

-

Environmental/industry analysis - Detail the results of regional market research you have performed.

-

Customer demographics - Define who your target customers are and how they behave.

-

Key customers - Identify your key customers.

-

Customer management - Have you introduced customer service standards?

-

S.W.O.T. analysis table - List each of your businesses strengths, weaknesses, opportunities or threats in the table.

-

Your competitors - How do you rate against your competitors?

-

Competitor details table - For each competitor enter; competitor name, established date, size, percentage of market share, unique value to customers, main strengths, and main weaknesses.

-

Advertising and promotional strategy table - what strategies do you have for promoting and advertising your products/services in the next 12 months?

-

Sales and marketing objectives - What sales goals/targets will the team meet, and how?

-

Unique selling position - Why do you have an advantage over your competitors?

-

Sales and distribution channels table - For each channel enter; channel type for e.g. Shopfront, internet, direct mail, export or wholesale, products/services sold via this channel, percentage of sales, advantages of using this channel, challenges you expect to face using this channel.

This includes;

-

Vision statement - The vision statement briefly outlines your future plan for the business. It should state clearly what your overall goals for the business are.

-

Mission statement - What is your business' mission statement i.e. how will you achieve your vision?

-

Goals/objectives - What are your short and long term goals? What activities will you undertake to meet them?

-

Action plan table - What are the business milestones that you need to complete starting from today? When do you expect to complete them? Who is responsible for delivering this milestone?

This section includes; key objectives, financial review, and assumptions.

-

Financial objectives - List your key financial objectives, sales targets or profit targets, also list main financial management goals such as cost reduction targets.

-

Finance required - How much money up-front do you need? Where will you obtain the funds?

-

Assumptions - List your financial assumptions. These can include seasonal adjustments, drought, economy or interest rates etc.

-

Start-up costs for [YEAR] table - The start-up costs table contains a list of costs a typical business may incur in its first year of operation. Fill in Actual or Estimated figures against the items in the table.

-

Balance sheet forecast table - The balance sheet forecast contains a list of assets and liabilities a typical business may have.

-

Profit & loss forecast table - The profit and loss forecast contain a list of profit items and expenses a typical business may have.

-

Expected cash flow table - The Expected cash flow contains a list of incoming and outgoing cash items a typical business may have.

-

Break-even analysis table - Calculations to include here must cover, Total sales needed to break-even, Number of units sold needed to break-even, Percentage of price that is profit.

List all of your attachments here. These may include but not limited to, resumes, inventory list, survey/questionnaire and/or financial documents.

For a copy of a Business Plan template and Guide, refer to How to develop your business plan, and select Download our business plan template.

It is essential to identify the potential risks that could impact your business. Risks can be identified through the Business Planning process and include;

-

Stakeholder feedback including suggestions, concerns and complaints.

-

Consultation.

-

Monitoring of regulatory requirements.

-

Strengths, weaknesses, opportunities and threats (SWOT) analysis.

-

A review of systems and processes in the Operational Plan.

Risks tend to relate to an opportunity, an uncertainty or a hazard.

Opportunity-based risks can be associated with not taking an opportunity and those associated with taking an opportunity that may be ‘risky’. This then is a conscious decision to accept identified risk associated with an opportunity.

Uncertainty-based risk is the risk associated with unknown and unexpected events. Those events that cannot be known, but that can still be planned for, including disaster and inclement weather conditions.

Hazard-based risk is the risk associated with a source of potential harm or a situation with the potential to cause harm. These are often covered by occupational health and safety programs.

Risks associated with your business could also relate to;

• Budgets.

• Personal issues.

• Quality.

• Business risk.

• Management risk.

• Vendor issues.

• Legal issues.

• Political issues.

• Environment risk.

• Weather or natural disasters.

• Technology risks.

• Team skills.

Risk Management is the systematic approach to identifying and assessing risks. These approaches are referred to as risk management strategies or risk assessment strategies.

Areas to consider in your risk management strategies may include;

-

Breach of contract, product liability.

-

Knowledge management.

-

Measures to manage risk including professional indemnity, securing appropriate insurance to cover loss of earnings through sickness/accidents, drought, flood, fire, theft.

-

Security systems to provide physical security of premises, plant, equipment, goods and services.

-

Security of intellectual property

Risk management strategies must include WHS/OHS requirements.

Developing a risk assessment strategy for your business is an important part of the planning process. The steps in the risk assessment process are to;

-

Provide a description of the risk and the potential impact to your business.

-

Determine the likelihood of this risk happening and describe it as either highly unlikely, unlikely, likely, or highly likely.

-

Describe the level of impact it may have on your business, whether it could be high, medium or low.

-

Outline your strategies for minimising or mitigating each potential risk.

You can develop a Risk Assessment Checklist by filling details in under the following headings as per this example;

|

Area |

Issue |

Low Risk |

Medium Risk |

High Risk |

|

Vendor Issue |

The vendor cannot supply and this is a unique product. |

|

|

Yes |

|

|

The vendor increases prices by 10% due to an overseas economic circumstance |

|

Yes |

|

|

Management Risk |

Your manager resigns |

|

|

Yes |

Contingency planning is a component of business continuity, disaster recovery and risk management. A contingency plan describes what you will do to manage situations when they do not go according to plan. It takes into account the effect of uncertain, but possible, events on the achievement of planned objectives. Having a Business Continuity Plan, an Emergency Plan and a Contingency plan can provide alternative courses of action to address possible areas of failure or non-conformance with the Business Plan.

A contingency plan is sometimes referred to as "Plan B," because it can be also used as an alternative for action if expected results fail to materialise. It identifies the chosen strategy for treatment of an identified risk and provides valuable information about the level of risk, the planned strategy, the timeframe and the resources required and who is responsible for ensuring the strategy is implemented. It should also include a budget, appropriate objectives and milestones to measure the achievement of those objectives.

The process of developing a plan involves the convening of a team representing all areas of the organisation. The task of this cross-functional team is to identify;

-

The nature of the extreme situation.

-

The potential risk involved.

-

The likely impact on the business and it's customer base.

-

The costs associated with the plans implementation.

-

Developing a recovery plan.

You can develop a contingency plan by filling details in under the following headings;

-

Risk or Scenario and Risk Level

-

Trigger or Cause

-

Response or Action Required

-

Who to inform?

-

Key responsibility - Who, What

-

Timeline - What, When

The table below provides an example of a simple contingency plan. This plan is for non-conformance (product delivery delay).

|

Contingency Planning - Non Conformance With Business Plan |

|||||||

|

Example 1 – Product delivery delay |

|||||||

|

Scenario |

Trigger |

Response |

Who to inform? |

Key Responsibilities |

Timeline |

||

|

Who |

What |

What |

When |

||||

|

The vendor cannot supply, and this is a unique product. |

Product has not been received as scheduled. |

Ensure the business is not dependent upon one product and that a product mix is established to ensure this will not have a High impact (Risk).

Research alternative products or secure similar designs to replace this product. |

Head of department. |

Head of department. |

Oversee situation.

|

Alert head of department. |

As soon as possible. |

|

Team manager. |

Team manager. |

Maintain contact with team, liaise with department head, assess situation, and offer support.

|

Team manager and team members to be informed of situation and necessary actions. |

Immediately. |

|||

|

Team members. |

Team members. |

Source alternatives, and report challenges / concerns to manager.

|

Assess and redistribute workload according to organisational priorities. |

As soon as possible. |

|||

|

|

|||||||

For more information, refer to How to manage risk.

The benefit of a business plan is that it gives you direction and identifies goals. However, knowing where you want to go does not mean that you are going there. After you create your Business Plan, it is essential that you evaluate it periodically and modify the sections that are not working for your business.

Considerations for when you evaluate your business plan, can include;

Viability and practicality of original plan.

- While starting up your business, there may have been many assumptions you made that do not translate well into the functioning of your business.

- Look for the gap between these assumptions and the reality of your business.

- Make adjustments and corrections to ensure that your business plan is more realistic and in touch with the current and future scenarios of your business.

- Create a Business Action plan based on this evaluation and ensure it works well with your strategies for growth.

Your employees are involved in the details of the running of your business.

- Share your Business plan with them and ask for their feedback.

- This will allow you to gauge how the plan actually impacts the running of your business.

- Ask them questions such as; Do they have suggestions to improve ways to provide better customer service? Do they feel the objectives laid out in the business plan align with the way they currently do their jobs? Do they feel that the correct target audience is being reached? Is there any possible target group that could also be targeted for your business?

Before starting your business, you may have listed out your ideal consumer based on age, income, gender and so on.

- After your business has been running for a period of time, you will need to look at these demographics.

- Check if your assumptions were right. Does this group make up a majority of your customer base?

- Can you find a way to widen your Target Group by enhancing your products or services.

- Getting a good grip on which is the right Target group for your business, will enable you to make better marketing decisions as well as allocate funds in a better, smarter way.

When evaluating your Business Plan, it is important to look at industry trends. Have industry trends changed much since the business plan was last implemented?

- Ensure that you are making the best of current trends that impact your business.

- Examine the ways in which competitors have changed their functioning to accommodate the change in trends.

- How does this impact your products or services?

- This does not mean that it is necessary to mirror competitor moves but rather look at the best way you can better your service and deliver benefits to consumers that your competitors are unable to.

Every month, spend an hour with your accountant or set up a weekly meeting in order to get a clear picture of how your resources are being spent.

- Were the original budget estimates of the plan reasonable or accurate? If not, why not?

- How can cashflow/finances be improved?

- Discover if there are other ways in which your resources can be optimised

- Explore how you can reach more people by concentrating on more marketing channels or focusing on the ones that will reap you better benefits for the money, time and effort spent on them.

It is very important as your business grows and expands to ensure that you are on the right track with your business plan. Make sure that you take the time to evaluate your plan at least every quarter to make sure your business and your business plan is on the path to success.

Source: www.quickbooks.intuit.com