The end of an accounting period is an opportunity to ensure no errors will carry into the next period.

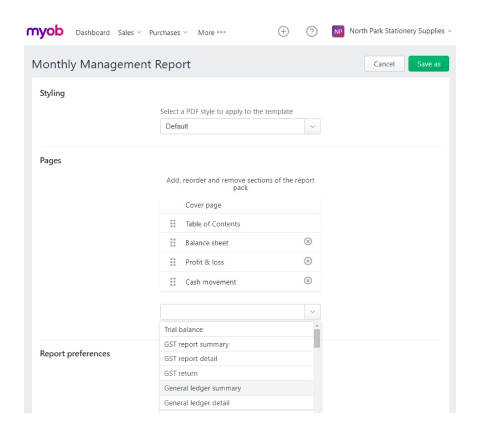

MYOB’s Report packs feature allows you to package reports together so they can easily be run at any time. The default collection to get you started is the Monthly Management Report, which starts with the Financial Statements: Balance sheet, Profit & Loss, and Cash movement. Using the drop-down menu, you can add any additional report you like.

In preparation to prepare the financial documents correctly, an accountant prepares the balance sheet, which reflects the financial position of the business at the end of the reporting period.

The Balance Sheet is the main financial statement that reveals a company's assets, liabilities and shareholders' equity for a given period of time. The other name for the Balance Sheet is Statement of Financial Position. As well as Income Statement, the Balance Sheet is prepared annually, quarterly or monthly. A company's assets, liabilities and shareholders' equity provide all stakeholders (owners, investors, creditors, managers, etc.) the information about what the company owns and owes, as well as the amount contributed by the shareholders. These three parts of the Balance Sheet should meet the following rule or equation:

Assets = Liabilities + Equity

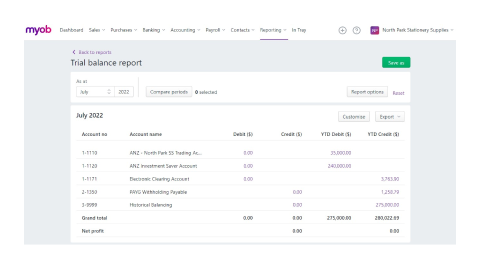

After the general ledger accounts are prepared, the accountant prepares a trial balance.

One of the standard reports in MYOB is a Trial Balance.

Trial balance

The trial balance is a working paper that accountants use as a basis while preparing the balance sheet. It ensures that the account balances are accurately extracted from accounting ledgers and, by doing so, assists the accountant in identifying and rectifying errors.

Watch this video tutorial to help your understanding of Trial Balances.

The trial balance consists of a chart of all closing balances on active (on the debit side) and passive (on the credit side) ledger accounts at a specific date. It is the first step toward the preparation of financial statements. It is usually prepared at the end of an accounting period to assist in drafting financial statements. Ledger balances are segregated into debit balances and credit balances. Asset and expense accounts appear on the debit side of the trial balance, whereas liabilities, capital and income accounts appear on the credit side. Suppose all accounting entries are recorded correctly and all the ledger balances are accurately extracted. In that case, the sum of all debit balances appearing in the trial balance must equal the sum of all credit balances.

The purpose of the trial balance

Creating a trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books per the double-entry concept of accounting. If the trial balance totals do not agree, the differences may be investigated and resolved before financial statements are prepared. Rectifying basic accounting errors can be a much longer task after the financial statements have been prepared because of the changes that would be required to correct the financial statements.

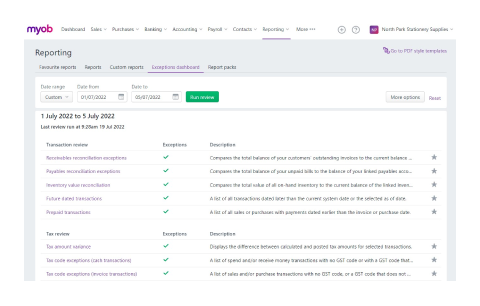

MYOB offers exception reports that check the integrity of your data for a specified date range.

The Income Statement is one of the main financial statements that most companies prepare at the end of the accounting period.

The Income Statement is also called the:

- Profit and Loss Statement (P&L)

- Statement of Operations

- Revenue Statement.

The Income Statement allows the company to define the net profit and show all sources of this profit. The Income Statement is an important source of information for auditors, external and internal investors, creditors, government and other stakeholders of the company. It provides the data for financial analysis of the company’s activity because it measures a company's financial performance over a specific accounting period.

The Income Statement begins with revenues and gains amounts and then considers all expenses, including write-offs, to reach the amount of net profit or loss. The company has net income if the net amount of revenues and gains is bigger than that of expenses and losses. If the final calculated amount of net income is negative, then there is a net loss.

It depends on the complexity of the company’s activity and how the Income Statement looks, but it is a common practice to use pro-formas for creating Income Statements.

The Income Statement provides all information about income and expenses.

- Revenue

- Cost of sales

- Operating expenses

- Depreciation

- Other Expenses

- Earnings before interest and taxes (EBIT)

- Interest Expense

- Interest Income

- Income Tax

- Net Income (Profit) / Net Loss

An accountant may prepare the Income Statement on an annually, monthly, or quarterly basis, which allows managers to control the dynamics of changes to the company’s activity.

Please download and view the example P&L from Freshwater Pty Ltd before continuing.

You can see from the Profit & Loss document that Freshwater has a net profit of $100,440.49. That figure will be carried over into the balance sheet, as shown in the following section.

Revenue refers to all cash inflow from the company’s operational activity during the reporting period.

This may be sales from goods produced or services provided. Revenues from non-operational activity may include rent revenues or revenues from reselling goods. All information about cash inflow the accountant manager retrieves from general ledger accounts.

Expenses include costs of goods sold (COGS), administrative expenses, selling expenses, and general expenses related to the reporting period. Costs of goods sold refers to goods produced and include raw material costs, direct labour costs and other costs directly related to the production process. The difference between Revenues and COGS is called gross profit, which as usual, is also recorded in the Income Statement.

As a part of expenses, depreciation costs reflect the value of fixed assets that contributed to the production of goods during the reporting period. Interest Expenses and Interest Income shows the financial revenues or expenses from borrowing or lending money. Other expenses may include:

- foreign exchange loss

- insurance premiums

- outsourcing costs

- travel hosting expenses

- buildings maintenance and repair work

- studies and research costs

- external personnel charges

- advertising costs

- transportation charges

- the cost of meetings and receptions

- cargo and courier expenses.

After the gross profit is calculated, the manager subtracts all other expenses and depreciation from this number to generate the company’s operating profit or Earnings Before Interest and Taxes (EBIT). EBIT is an intermediate metric between the gross and net profit of the company and is frequently used for calculating different financial ratios.

The next step in preparing the Income Statement is to subtract the interest expenses from operational profit to abstract from the company’s capital structure (not to consider debt capital) and get earnings before taxes.

After subtracting tax expenses, the accountant manager will finally get the net profit. The net profit may be divided between common shareholders or attributed to the company’s development as retained earnings.

The first part of the Balance Sheet is Assets — representing things the company has.

Balance sheet: Assets

As a reminder, Assets include:

- cash

- investments

- accounts receivable

- inventories

- buildings

- land

- machinery

- equipment

- goodwill.

All these types of assets are grouped in the Balance Sheet and usually appear in a specific order.

- Current Assets - accounts receivable, inventories, cash and equivalents that will be used in a period less than one year

- Investments- long-term investments in bonds

- Property, Plant, and Equipment- buildings, land, machinery, equipment

- Intangible Assets- goodwill, copyrights, patents, trademarks, etc.

- Other Assets - other long-term assets

The amounts reported in the asset accounts and on the balance sheet are the company's assets at their original historical cost or actual costs recorded at the time of a transaction.

Balance sheet: Liabilities

The Balance Sheet needs to show the company’s liabilities. Liabilities reflect the obligations of the company to its creditors or suppliers. All liabilities accounts have a credit balance and include the following items: accounts payable, salaries and wages payable, interest payable, income tax payable, accrued expenses payable, notes and bonds payable, other short-term debts, and unearned revenue. As well as assets, the liabilities comprise the current liabilities and long-term liabilities.

The short-term or current liabilities are those payable within one year, such as:

- accounts payable

- salaries and wages payable

- interest payable

- income tax payable

- accrued expenses payable.

Long-term liabilities are to be repaid on a longer-than-one-year term, such as:

- bonds and notes payable

- pension liabilities

- deferred compensation and revenues.

Note, in the case of long-term debt, the principal for the next year will be considered as current liabilities in preparing the Balance Sheet, while the rest will be reported as long-term liabilities.

Balance sheet: Equity

Equity reported on the Balance Sheet represents funds initially contributed by the owners into a business and retained earnings of the company in the following periods. Along with liabilities, equity may be classified as the resources of the company’s assets. If the company is public, shareholders’ equity will be recorded in the Balance Sheet. In contrast, for a sole proprietorship, the owner’s equity will be recorded in the Balance Sheet. The company’s equity may include:

- redeemable preferred stock

- non-redeemable preferred stock

- common stock

- additional paid-in capital

- retained earnings

- other equity.

Balance sheet: Computations

The balance sheet is an essential source of data for calculating many types of ratios, including debt-to-equity ratio, current ratio, working capital ratio, quick ratio, inventory turnover, accounts receivable turnover and others.

Please download and view Freshwater's balance sheet.

If you struggle to understand how the balance sheet works, please discuss your concerns with your peers in the forum.

It is common practice in preparing financial statements to find some errors in the Balance Sheet or the Income Statement. Mistakes may vary, but usually they are:

- omission of transaction

- calculation error

- wrong journal entry (errors of commission, errors of principal)

- error in posting to the general ledger.

To avoid and detect errors, accountants create a report that will help expose these errors before they are carried along further into a reporting cycle and take longer to find and undo. Do you remember what that is?

Did you think of the trial balance? It serves in the identification of accounting mistakes. The double-entry system assumes that there is a related credit entry for every debit entry. This means that if the totals are unequal, some records may be missed or recorded in a journal with a mistake. At the same time, the trial balance may not show any inequality, but errors will exist. For example, if some transaction was missed, then both debit and credit records were not made. Another example may be putting certain transactions into the wrong account

If a calculation error was found, then it is necessary to subtract the smaller total from the bigger total to find the missing amount. After checking each ledger account balance and finding the missing amount, the recalculation of balances is needed.

Some types of mistakes may be corrected in a journal by changing the incorrect entry. This may be done by drawing the line through the wrong record, recording the correction above or below it, or deleting (erasing) it and writing the correct record instead. Suppose the record was already posted into the general ledger and is hard to find. In that case, a suspense account (an account used to store transactions temporarily) is needed to fix the mistake. For this reason, suspense accounts are opened to make the Trial Balance's two sides equal temporarily.

No ledger entry is needed in this case, which looks like the following example.

Consider an example when there is a difference in totals of trial balance like this:

| Debit Total | Credit Total | |

|---|---|---|

| Total of all records | $450,000 | $448,300 |

To achieve equality in the trial balance, we will make an additional record for the credit side.

| Debit Total | Credit Total | |

|---|---|---|

| Total of all records | $450,000 | $448,300 |

| Suspense account | $1,700 |

After it is reasonable to create an account in the trial balance for an amount that has been added. The record will be as follows:

| Debit Total | Credit Total | |

|---|---|---|

| Difference in trial balance | $1,700 |

Note: It should be mentioned that the amount of net income from the Income Statement must be equal to the amount of retained earnings in the Balance Sheet. This must be taken into account while preparing the two statements.

Asking for and providing help

Communicating with other people in the business, and others in the industry ensures that accountants and bookkeepers remain connected to the work they are doing. You may need to collaborate with other colleagues or seek clarification from a stakeholder. When interacting with others, consider the method of communication and ensure it is appropriate for the nature of the topic. You might choose to email an employee with a question about their address for example, but some topics will require discretion and may be best in the confines of a scheduled face-to-face meeting.

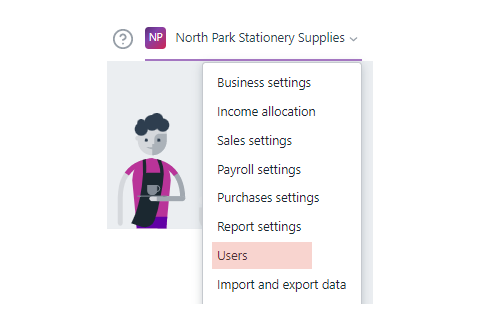

MYOB Users

MYOB offers collaborative features that enable the account to be securely shared. You can invite users for all sorts of reasons, such as advice from an advisor or colleague, someone to assist with data entry, or run reports and pay runs. By assigning roles with permissions, the administrator or owner of the account can control exactly what level of task, and how much information is revealed.

You can read more about Users at the MYOB Help Centre.

Answer the following questions and then complete the activity to prepare for your assessments.

Scenario

Put yourself in the shoes of a bookkeeper or accountant and complete the following tasks.

Before you get started, download this Excel document, Financial Reports and use it to complete the activity. Note the tabs along the bottom for data, templates, and solutions.

- Identify whether each account has a credit or a debit balance by moving the closing balance amount from the general ledger into the correct column, then total the amounts at the bottom of each column so you have a total of credits and debits. Remember that the amounts should be equal to each other.

- Check the tab labelled "Answer Trial Balance" to compare yours against the correct figures. If necessary, update yours so that it is correct before continuing.

- Generate a Profit & Loss statement (in the tab provided) using the balances from the general ledger.

- Generate a balance sheet (in the tab provided) using the balances from the general ledger. Remember, you will need to move the net profit from the P&L into the equity section of the balance sheet.

- Compare your reports to those on the Answer tabs.

- If you found this challenging, please discuss the issues with your peers in the forum.